Vernon Lamberg had been dead for 8 to 10 hours by the time they found his body in a hotel room in Wautoma, Wisconsin, two hours northwest of Milwaukee. Five days earlier he had started his Monday like any other. However, on that Monday, Lamberg would suffer a trauma so devastating that it would eventually lead him to take his own life—it was October 19, 1987.

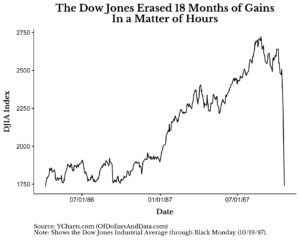

For those of you that aren’t familiar, October 19, 1987 (“Black Monday”) was the greatest single day decline in stock market history with the Dow Jones Industrial Average dropping 22.6%. Over $500 billion in wealth was wiped out on that day as the Dow closed at 1,738, a level not seen since April 7, 1986, roughly 18 months prior. Visually, the single day drop is almost unbelievable:

Vernon Lamberg had personally lost over half a million dollars and became a broken man as a result of the crash. However, it wasn’t the monetary losses that broke him, it was something deeper than that. A few days after Lamberg’s death his son stated in an interview:

He didn’t take his life because of the money…it was a personal shame that he couldn’t handle.

Lamberg wasn’t the only one to take his life because of Black Monday either. Arthur Kane, 53, was a longtime visitor to the Merrill Lynch offices in Miami when a week after the crash he went into the branch and opened fire, killing one and wounding another Merrill employee before taking his own life.

With these tragic events, a question lingers: what causes financial post-traumatic stress disorder (PTSD)?

The answer to this lies in an incredible book I read recently called The Evil Hours: A Biography of Post-Traumatic Stress Disorder by David J. Morris. Morris writes:

In short, the more helpless the patient felt, the more likely he was to be traumatized, a finding that essentially remains unchanged to this day.

While both Lamberg and Kane felt helpless as a result of the crash, this doesn’t fully explain why they reacted so strongly. In fact, if you watch these traders discuss their reaction to Black Monday you will see that they also felt helpless at the end of that historic Monday. So, what really separates a normal event from a traumatic one for most people? Morris explains:

“The experience of trauma is context-dependent,” meaning its essence lies in the subjective experience of the victim; in other words their story as they tell it to themselves.

These two ingredients: helplessness and the story we tell ourselves about an event are the two most important factors when determining whether someone experiences trauma. In Lamberg’s case, it is clear that he had convinced himself that he was a failure after the crash, while Kane had become convinced that the brokers at Merrill were to blame. Their trauma existed in the story, or the memory, that they told themselves about the crash. As Morris states:

Normal, nontraumatic memories are owned and integrated into the ongoing story of the self. These are, in a sense, like domesticated animals, amenable to control, traceable. In contrast, the traumatic memory stands apart, like a feral dog, snarling, wild, and unpredictable. This is in part what the psychoanalyst I interviewed meant when he said that, “trauma destroys the fabric of time.”

This is why the term “the evil hours” is so relevant for financial markets, because we replay traumatic market moments in our head over and over again and they can come to define how we invest in the future. For example, one study conducted after 2008 found that 93% of financial advisors experienced symptoms consist with PTSD with many becoming increasingly skeptical of buy and hold investing.

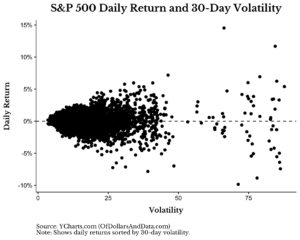

However, there is another interpretation of “the evil hours” as not just the hours we replay in our minds after we live through financial trauma, but also the hours during which markets actually decline. Historically large daily declines (and gains) tend to occur around the same time (i.e. when market volatility is high). Just watch how the average daily positive and negative returns increase in magnitude with higher market volatility:

We can get an even clearer picture of this if we put volatility on the x-axis and the daily return on the y-axis:

The far right side of this plot is where “the evil hours” reside. They wreak havoc on us psychologically while they are happening and then, if we become traumatized, we relive them again and again as they scare us away from markets. You might think I am exaggerating, but consider how many people you have heard about that never got back into the markets after 2008. They are traumatized and still waiting until it is “safe” again. While financial PTSD is a lifelong battle for many of us, there is a way to fight back…

How to Deal With Financial PTSD

Despite all of the dramatic statistics and stories I have told about financial PTSD, these worries tend to be exaggerated. For example, you have probably heard of the individuals on Wall Street who leapt to their own demise after the crash of 1929, but these stories are mostly myth. In fact, there is no evidence that suicides go up as a result of financial crises. Taking extreme action as a result of financial trauma is the exception, not the rule.

So how should you deal with financial PTSD if you show symptoms of anxiety, self-doubt, or sleeping problems? Redefine the story you tell yourself. While it’s true that you cannot change your helplessness in the market (you don’t control the market after all), you can control how you think about its aftermath. You can be like Vernon Lamberg and consider yourself a failure, or you can realize that market volatility is a part of the investment process and large crashes will happen from time to time. This is the game we are playing.

So if you have some form of financial PTSD from 2008, or 2000, or some other time, remember that life goes on and that most markets eventually recover from their declines (this is the story I tell and the evidence supports it). With that being said I wish you the best when you eventually face the evil hours.

Lastly, if you want to read some horrifyingly good writing, I highly recommend The Evil Hours. As proof of how great of a writer Morris is, I will leave you with one of my favorite passages from the book:

One unit I was with north of Fallujah had lost a guy who was killed while using a Port-a-John in the middle of the night. He’d gone out to take a ***, and out of nowhere, a single mortar round came in and ended him. It was the only incoming they had taken in days. How do you go about telling a guy who is alive only because he didn’t use the ***ter at the wrong time that he ought to go back home, go to school, get married and mortgaged, have kids, and commit to the world when he knows for a fact that nothing in this world is real except chance? That his continued existence, his dreams, his plans, his hopes for the future are the product of invisible, ever-changing odds, odds that could shift and turn on him at any moment? What place did human reason have in this world really, after you’d seen what war could do to it? The lesson taught by war was clear: to be human is to be small, powerless, and subject to the forces of randomness.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 77. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data