Last week, President Biden announced a policy that would forgive $10,000 in student loan debt for those individuals earning less than $125,000 per year with an additional $10,000 in forgiveness for low-income students (i.e. those who received a Pell grant while in college). Following the announcement, there was a discussion of student loans and the efficacy of a loan forgiveness program. To add to this discussion, I decided to dig into the data on student loans and who would be most impacted by Biden’s recent policy proposal.

To start, let’s first examine how much student loan debt is actually out there.

How Much Student Loan Debt is There?

According to the most recent estimates, there’s $1.75 trillion in student loan debt across more than 43 million borrowers. This means that roughly 1 in 6 adults in the U.S. (17%) have student loan debt, with the average balance being around $41,000.

Who is this debt owed to? Mostly the U.S. government. According to the office of Federal Student Aid, $1.62 trillion, or 93% of all student loan debt, is federal student loans. The remaining $131 billion (7%) is owed to private lenders, according to this Q3 2021 report from MeasureOne. Therefore, for all practical purposes, the student loan problem is a federal loan problem.

This is why Biden’s policy proposal could have such a big impact on the student loan market—its biggest creditor is considering a huge write-off. How much of a write-off are we talking about? Current estimates suggest that Biden’s forgiveness program would cost around $300 billion, or about $2,300 per U.S. household. Though this burden would not be shared equally across all households, it provides some context for the cost of the program.

Now that we have looked at how big the student loan market is and how much Biden’s proposal might cost, let’s review who holds most of the student loan debt.

Who Does Most of the Borrowing?

When it comes to student loan debt, total borrowing is split basically 50/50 between undergraduate and graduate programs. However, after adjusting for population size, it’s graduate students that have the highest debt loads. As summarized in this review from the Brookings Institute:

About 75% of student loan borrowers took loans to go to two- or four-year colleges; they account for about half of all student loan debt outstanding. The remaining 25% of borrowers went to graduate school; they account for the other half of the debt outstanding.

This means that, on a per capita basis, the typical graduate student has roughly twice as much debt as the typical undergraduate student. And since we know that the average public university student borrows $32,880 to attain a bachelor’s degree, we can infer that the average graduate student borrows about double this (~$66,000) to obtain their graduate degree.

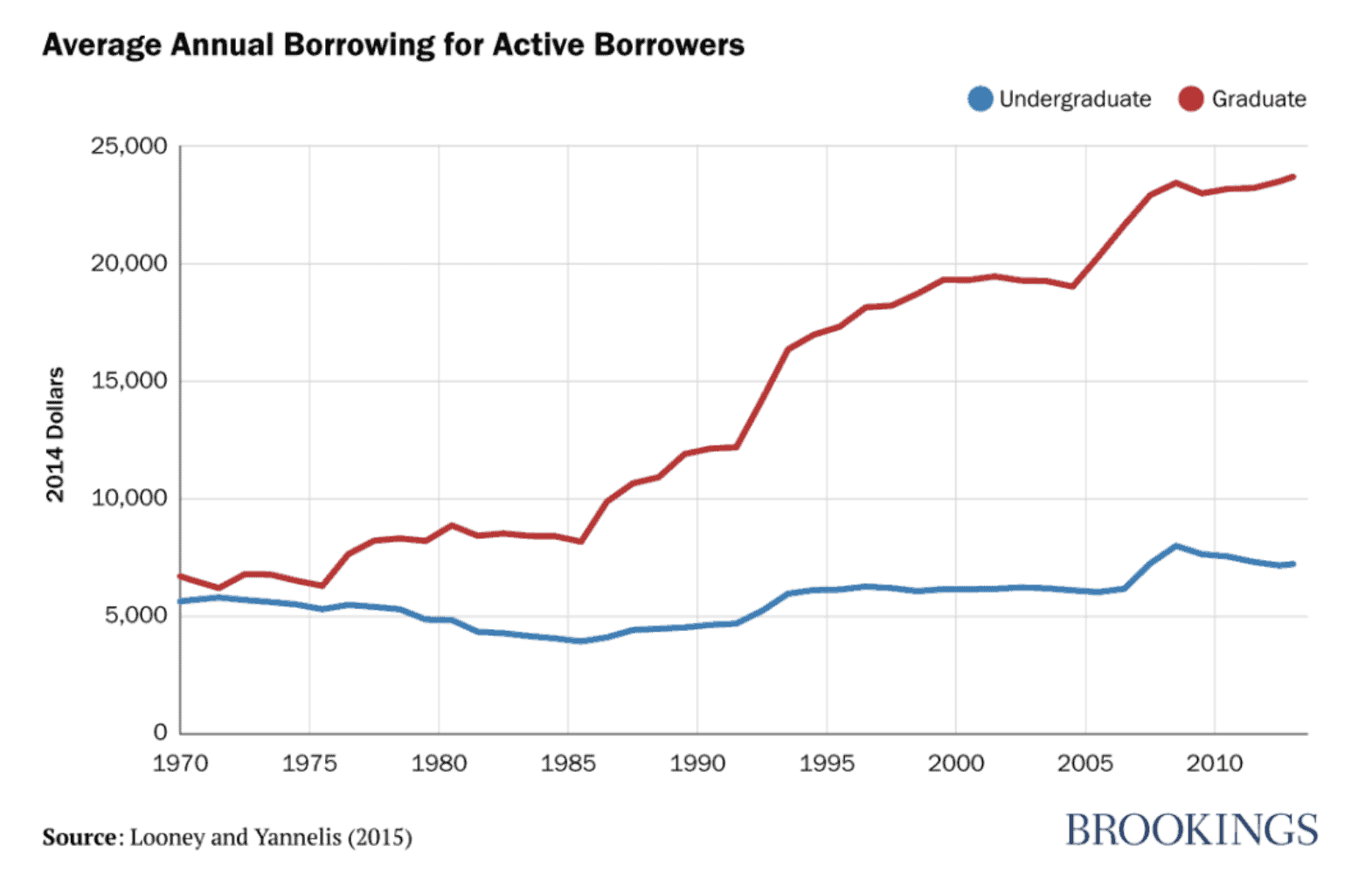

Looking at the trend of average annual borrowing by undergraduate and graduate borrowers, you can see why this is the case:

Even after adjusting for inflation, graduate school has gotten increasingly expensive and has led to far more annual borrowing than at the undergraduate level. As a result, graduate debt loads have gone up significantly over the past few decades.

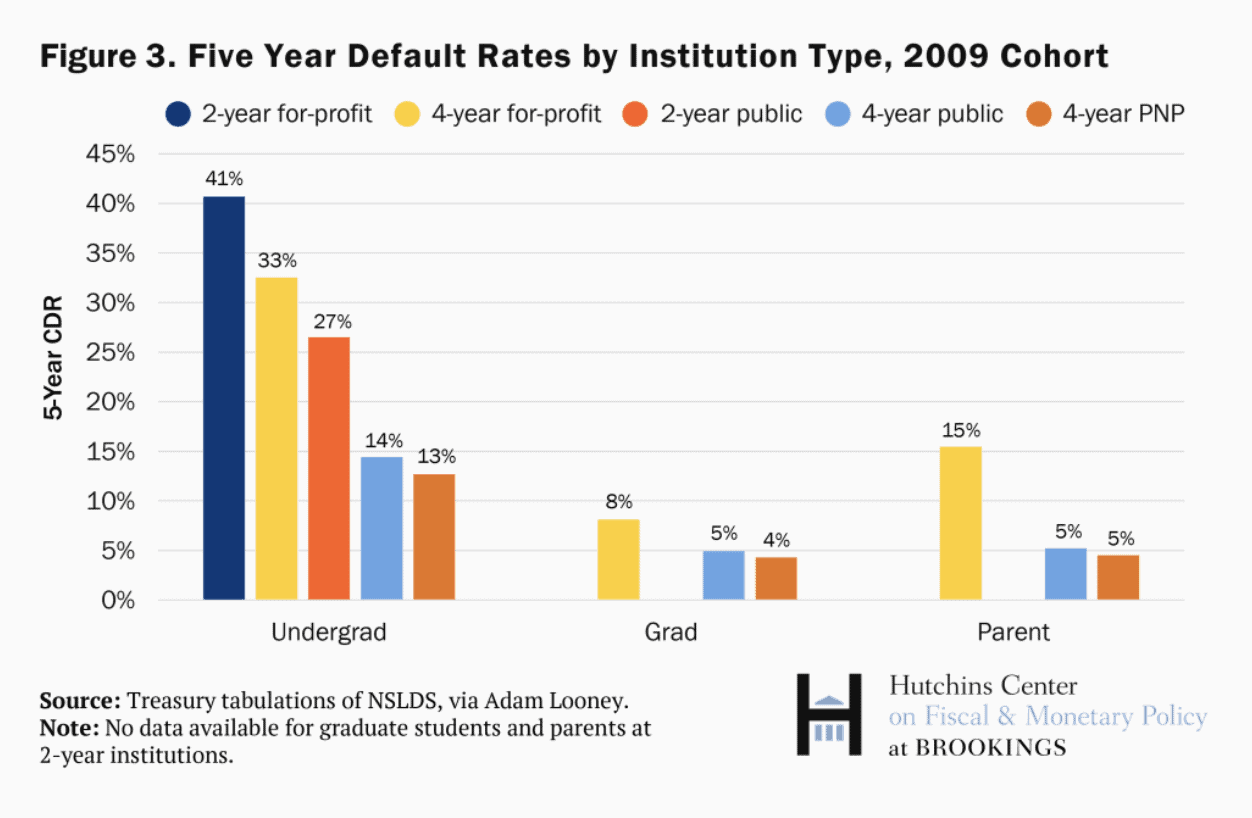

Despite this, graduate students have the lowest default rates among all student borrowers. Who has the highest default rates?Undergraduates who attended for-profit institutions:

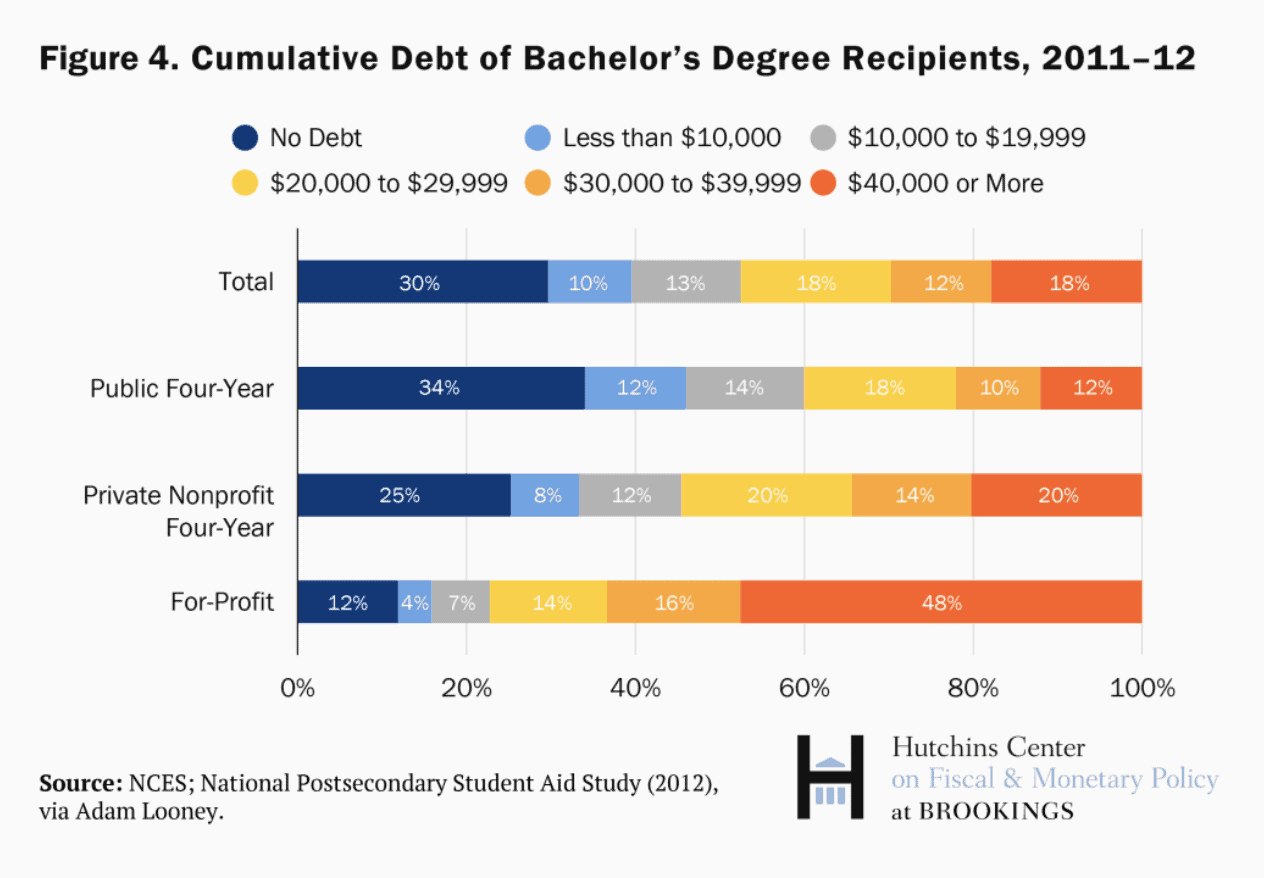

It’s not completely clear why undergraduates at for-profit institutions have the highest default rates, but debt load may be a factor. According to Kadija Yilla and David Wessel, nearly half of all undergraduate borrowers at for-profit institutions hold $40,000 or more in student loan debt. However, this is not the norm. As you can see in the chart below, the vast majority of undergraduate borrowers hold less than $40,000 in loan debt:

This implies that a small number of borrowers hold a disproportionate share of the total student loan debt. And this is exactly what we see in the data. According to Sandy Baum at The Urban Institute, only 6% of borrowers have over $100,000 in student loans, yet these borrowers account for 35% of the total student loan debt.

From these figures it is clear that those with the highest debt loads are typically graduates and undergraduates at for-profit institutions. Now that we have a better of understanding of who holds all the student loan debt, let’s get a better understanding of who Biden’s loan forgiveness program would impact the most.

Who Does Biden’s Plan Impact the Most?

Before we can dig into who Biden’s plan impacts, we need to first figure out who it does not impact. The plan claims that any individual making more than $125,000 per year or any household making more than $250,000 per year would not be eligible for loan forgiveness. But how many households is this?

After analyzing the 2019 Survey of Consumer Finances, I discovered that only the top 5% of households with student loans would be excluded based on their income. But what is the other 95% like? Do they have higher incomes and wealth than those without student loans? Yes and no. Let me explain.

The problem with comparing those with student debt to those without student debt is education status. As I have discussed before, both age and education status are positively correlated with income and wealth. Therefore, to truly compare those with student debt to those without student debt we need to separate those who have a college degree from those who don’t.

After doing so, we would find the following:

- Those with student loan debt and a college degree (or some college) are generally doing worse than those without student loan debt and a college degree.

- Those with student loan debt and a college degree (or some college) are generally doing better than those without student loan debt and without a college degree.

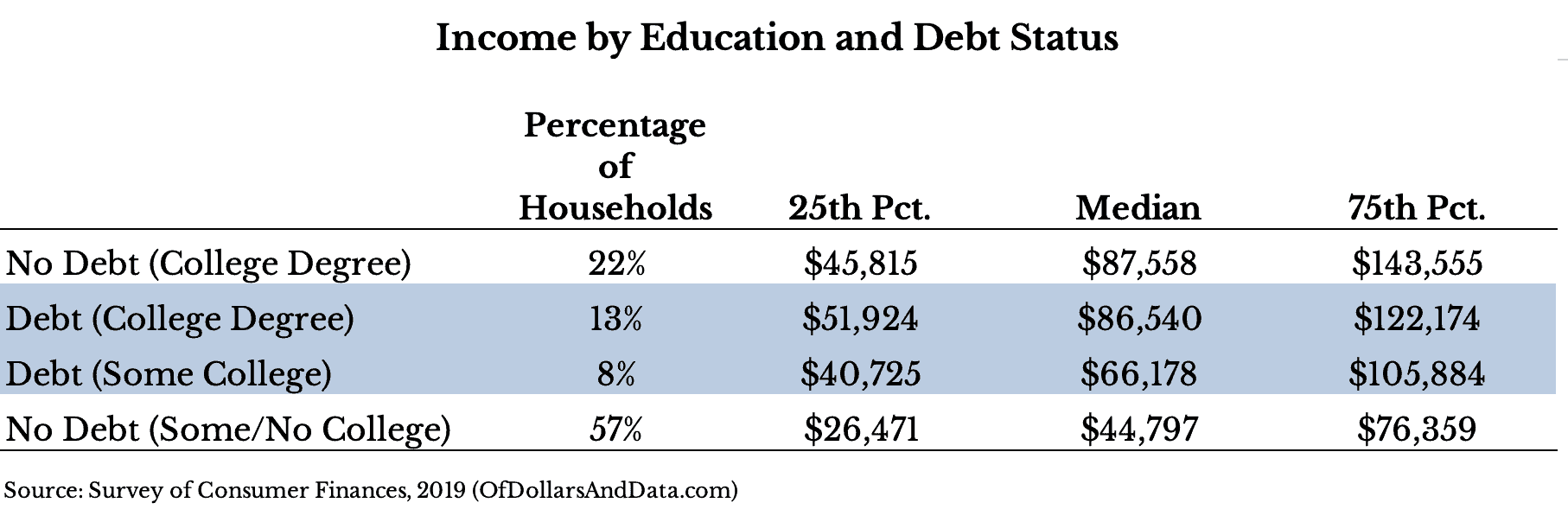

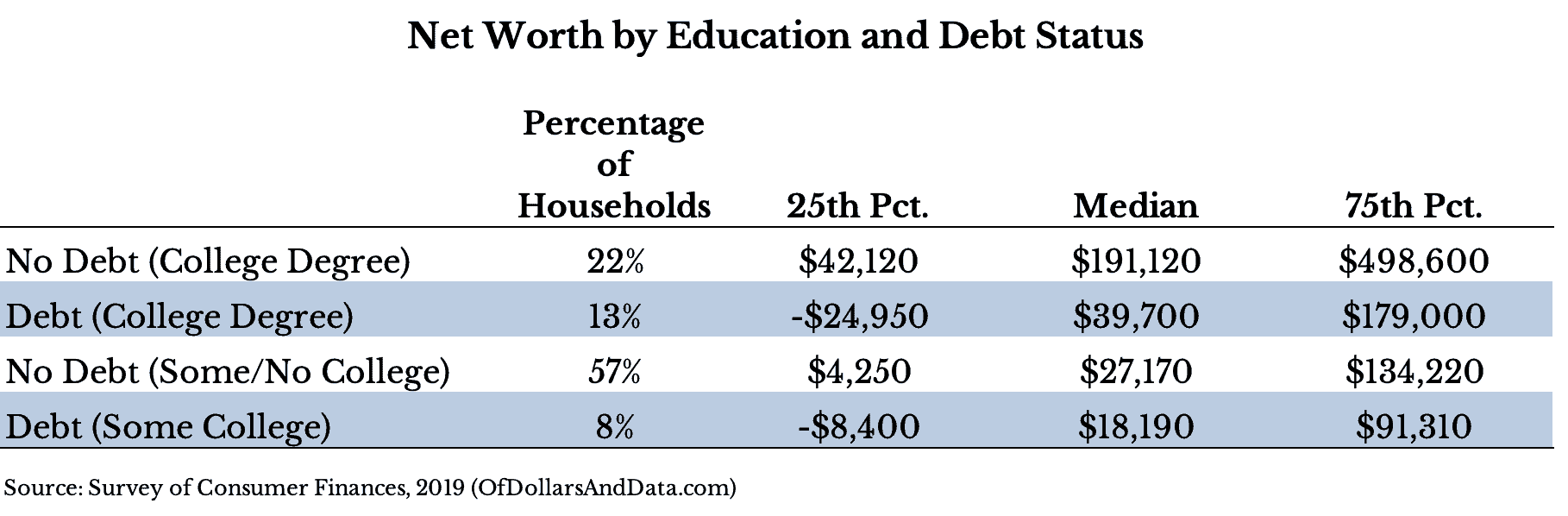

Below I have illustrated this by creating a table showing the 25th, 50th (median), and 75th percentile of household income by both education and debt status using data from the 2019 Survey of Consumer Finances. I made sure to exclude any households with incomes greater than $250,000 and any households over the age of 55 (to ensure that we are examining similar household cohorts). In addition, I’ve sorted the table by median income and highlighted (in blue) the two groups that would benefit from Biden’s loan forgiveness program:

As you can see, this proposed policy is somewhat regressive given that it would benefit households that already have higher incomes than the vast majority of U.S. households. However, income isn’t the whole story.

If we look at net worth, which includes student loan debt, then the proposed policy is somewhat less regressive. Once again, the blue rows highlight those households that would benefit from Biden’s program:

When examining net worth, Biden’s program would definitely help those on the lower end of the wealth spectrum that are struggling. Nevertheless, those with student loans and a college degree are, for the most part, doing better than those with no debt and no college degree. So, once again, the policy comes off as benefiting many of those who are already doing better than the vast majority of U.S. households.

Don’t just take my word for it though. This article from the Brookings Institute came to a similar conclusion using a completely different data source:

Measured appropriately, student debt is concentrated among high-wealth households and loan forgiveness is regressive whether measured by income, educational attainment, or wealth.

Setting this aside, why are we trying to cancel student loan debt in the first place? Is it all that bad?

Of course, we’ve heard the horror stories of individuals with six figures of student debt and no way out. However, as we saw above, these struggling borrowers represent a small part of the student loan market.

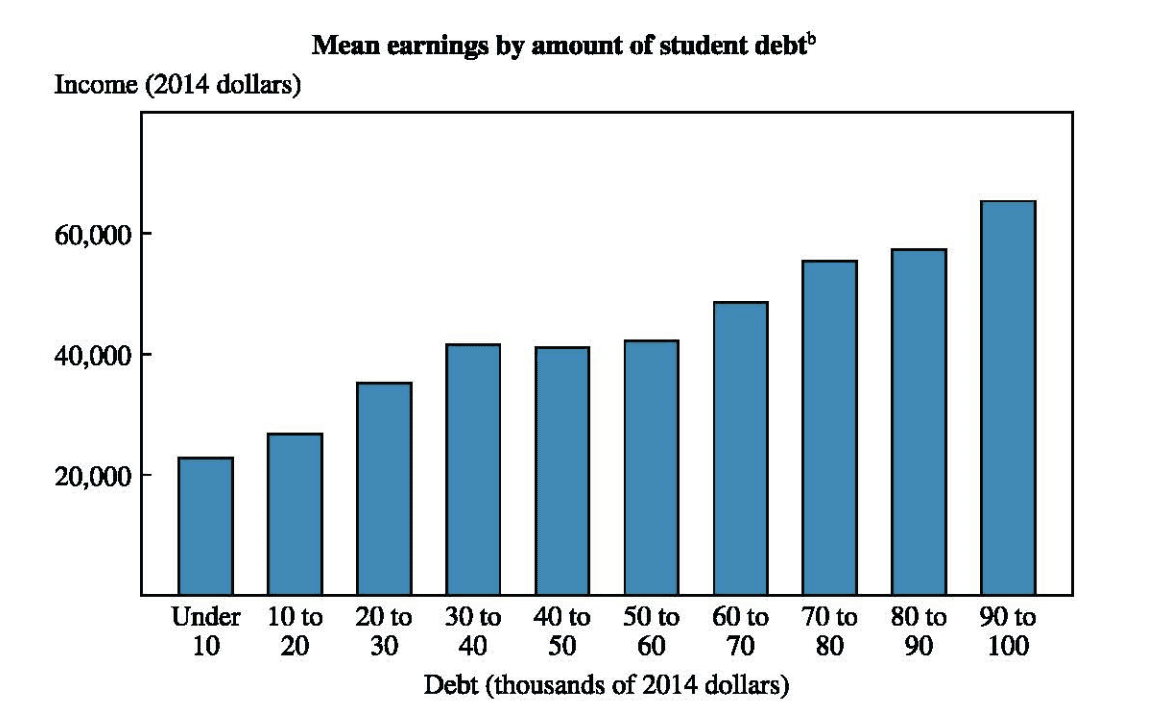

Most individuals with debt tend to be getting their money’s worth. As this research illustrates, those with higher debt loads earn more than those with lower debt loads:

This suggests that most individuals see a return on their student loans in the form of a higher paying career. I’ve checked other data sources and found the same thing–those with more student loan debt typically have higher incomes. This is partially explained by professional schools (i.e. law, medicine, etc.) that require high borrowing now for (hopefully) higher income later.

Nevertheless, for those that are struggling with student debt, is there a better solution than Biden’s proposal?

Is There A Better Solution?

I’m no political expert, but if I had to come up with a policy to help those most negatively impacted by student loan debt, the policy would be simple—let them declare bankruptcy. Let them wipe their debt clean.

Yes, this would have huge repercussions on the student loan market going forward, but it would also provide major relief to those who need it most. Mike Solana took this idea a bit further when he suggested that we also make repayment of student loans 100% tax deductible and abolish federal educational loans in the process.

If those idea sound too extreme, then why not give every American (yes every American) an educational tax credit that they can use throughout their lifetime against any prior or future educational debt (up to a limit).

So, if the limit is $10,000 across your lifetime and you paid off $8,000 of student loans in 2021, then you could reduce your 2021 federal tax owed by $8,000. You would still have $2,000 in credit left to use before you hit your lifetime limit. Therefore, if you paid off another $5,000 in student loans in 2022, you could reduce your federal tax owed in 2022 by $2,000 (since you hit the $10,000 lifetime limit).

I prefer this idea because it applies to everyone equally and can also be used retroactively. It’s also much fairer than a one-time forgiveness program. However, the biggest downside to such a proposal is how incredibly expensive it would be.

Regardless of how you might feel about these ideas, there are many good discussions to be had about how to fix the student loan problem. I can only hope that, despite the complexities involved, we find a solution that works for everyone. Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 310. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data