If I gave you $100, would that change your life? What about $100,000? How about $100 million? Your answer will depend on many things including age, family situation, and your current net worth. More importantly though, how you change your behavior after receiving such money can tell you a lot about your current financial standing.

Stewart Butterfield expanded on this idea when he discussed what he called the “Three Levels of Wealth.” My colleague, Ben Carlson, beautifully summarized the three levels of wealth as:

- Level 1. I’m not stressed out about debt: People who no longer have to worry about their credit card debt or student loans.

- Level 2. I don’t care what stuff costs in restaurants: How much you spend on a particular meal isn’t impacted by your finances.

- Level 3. I don’t care what a vacation costs: People who don’t care how expensive the hotel is or which flight they go on.

What’s interesting about thinking about wealth in levels is that you realize that certain sums of money won’t necessarily improve your life in any noticeable way. For example, for the average person at level two (above), an extra $10,000 probably wouldn’t move them to level three.

Frankly, $10,000 isn’t enough to free someone from considering the cost of lodging and transportation for the rest of their life. However, that same $10,000 given to the average person at level one may get them to level two.

This perfectly illustrates how wealth is, and always will be, a relative measure. Or as Jay Z once proclaimed:

What’s fifty grand to a mother****er like me? Can you please remind me?

While $50,000 may change your life, it wouldn’t even register for Jay. But the question is: just how trivial was “fifty grand” to Jay Z at the time those lyrics were written (2011)? If we use Jay Z’s estimated net worth of $450 million in 2011, this means that $50,000 represented 0.01% (1 basis point) of his fortune.

This data point might seem random, but 0.01% is a good proxy for what constitutes a trivial amount of money for any level of wealth. For example, if you had a net worth of $10,000, paying $1 more (or 0.01% more) for something shouldn’t affect your finances in the slightest.

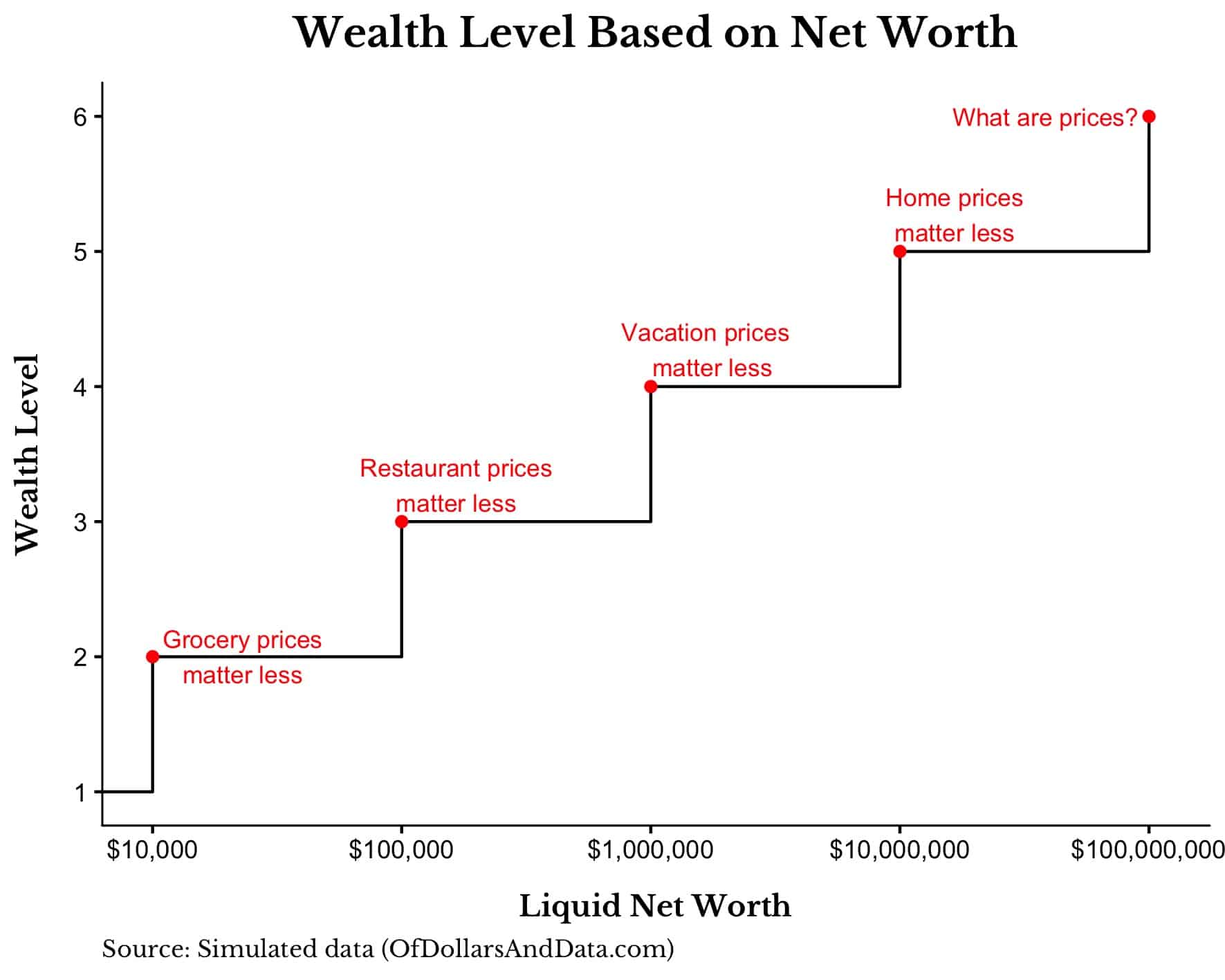

We can use this 0.01% threshold as a guide to then re-think Butterfield’s “Three Levels of Wealth” to include other lifestyle adjustments:

- Level 1. Paycheck-to-paycheck: You are conscious of every dollar you spend. This includes people with crippling debt.

- Level 2. Grocery freedom: How much specific grocery items cost don’t impact your finances.

- Level 3. Restaurant freedom: You eat what you want at restaurants regardless of the cost.

- Level 4. Travel freedom: You travel when you want, how you want, and stay where you want.

- Level 5. House freedom: You can afford your dream home.

- Level 6. Philanthropic freedom: You can give away money that has a profound impact on others.

Due to the diversity of life circumstances, it can be difficult to put an exact dollar amount on each of the above wealth levels. For example, a single 21 year-old with $1 million is very different than a 65 year-old retired couple with $1 million.

However, if we use the 0.01% threshold as a guide, a working-age adult could use the following amounts to determine their wealth level (note: the x-axis is a log scale):

I choose these specific levels because, for each category, the marginal spending decision represents about 0.01% of the net worth level shown. Let me explain.

Let’s say you are at the grocery store and you are deciding whether to purchase a dozen eggs for $1.99 or a dozen cage-free eggs for $2.99.

If your net worth was $1,000, this single choice (paying $1 extra for cage-free eggs) could have a slight impact on your finances as it would represent 0.1% of your total assets. However, if you were worth $10,000 (or more) the decision to spend $1 more would likely be trivial to your finances since it represents less than 0.01% of your wealth.

Nevertheless, we can extend this thinking to more expensive spending categories as well. For example, imagine you are in a restaurant where you are deciding between a burger for $15 and salmon for $25. If your net worth > $100,000 then the $10 difference is trivial (<0.01% of net worth). If you continue to scale this logic upward you will see that the marginal impact of a single decision within each level of wealth could be as follows:

- Level 1. Paycheck-to-paycheck: $0-$0.99 per decision

- Level 2. Grocery freedom: $1-$9 per decision

- Level 3. Restaurant freedom: $10-$99 per decision

- Level 4. Travel freedom: $100-$999 per decision

- Level 5. House freedom: $1,000-$9,999 per decision

- Level 6. Philanthropic freedom: $10,000+ per decision.

When you view wealth in this way, it looks more like steps than a smooth, ever-increasing line. This is because most people in the same level of wealth consume in much the same way. If you are in level 3, you don’t fly private and you only fly first class if you are lucky enough to get upgraded. If you are in level 1, you rarely fly.

More importantly though, the best way to climb the wealth ladder is to spend money according to your level. If you are in level 1 and you book a vacation without caring about the costs (level 4), then you won’t progress further up the ladder. Until you have the money to spend frivolously within a level, you have to be strict about your spending in that level. Get this right and you have a far better chance of progressing up the ladder.

Personally, I know what it feels like to go from level 1 when I graduated college to level 2 within a year or so of working to hitting level 3 only more recently. Though today I might opt for a good ribeye when eating out, I will still move my schedule around to find the absolute cheapest direct flights when traveling home for the holidays.

For example, this year I booked red eyes back from California to NYC on Thanksgiving night and on Christmas night because they were so much less expensive than flying back on the weekends. I am spending my money according to my level and this allows me to enjoy my life while continuing to grow my wealth.

Lastly, you might argue that you shouldn’t increase your consumption with your net worth, but I would counter that some lifestyle creep can be highly rewarding in terms of maximizing your leisure time and long-term life satisfaction. In other words, there is a lot more to life than saving money. Live a little.

The Steps Only Get Larger

The idea for this blog post came out of a conversation I had with a friend who recently sold his company for seven figures. Now that he is technically a millionaire, we got to discussing how much his life was going to change as a result.

Our exchange revealed that his day-to-day experience wouldn’t be all that different. While he might travel a bit more, or upgrade for more legroom when he flies, he was going to keep the same apartment, the same job, and the same basically everything else. The money will just provide some extra optionality.

The most important thing I learned from thinking about all of this is that it takes a giant step in wealth to fundamentally alter how we live our lives. And the steps only get larger as we go higher up the wealth scale. So think about whether that step is worth it. Whether the juice is worth the squeeze. Until next time, thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 155. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data