He described the sensation as “a thousand knives” being driven into his body. He knew cold, but not like this. Charles Herbert Lightoller was treading 28 degree water (-2 Celsius) as he watched the Titanic slowly sink into the ocean. Though he managed to climb aboard an overturned lifeboat and live to tell the tale, 1,517 others weren’t so lucky.

Experts claim that a human can survive in waters just below freezing for 15 to 30 minutes. Within half an hour you get hypothermia and die. Case closed. That’s biology. However, Charles Joughin, a baker aboard the Titanic, managed to survive for 4 hours in these waters before being rescued. How did he withstand over 200 minutes in the icy North Atlantic while most didn’t last much more than 15? Giles Milton retells the story in When Hitler Took Cocaine and Lenin Lost His Brain:

Charles Joughin, realized that he, as a member of the crew, would not be given a place in a lifeboat. As the ship began listing at an alarming angle, he decided to drink himself into oblivion.

That’s right. Joughin drank himself into the history books by finishing not one, but two bottles of whiskey as the Titanic descended into its watery grave. What does this tell us? Were the medical experts wrong? Or was Joughin just an outlier, an anomaly, an exception to the rule?

I tell this story because I frequently see individuals within the investment community who use exceptions to argue against general financial principles. One of the simplest principles, which I discussed recently, is:

You can’t have more reward without taking on more risk.

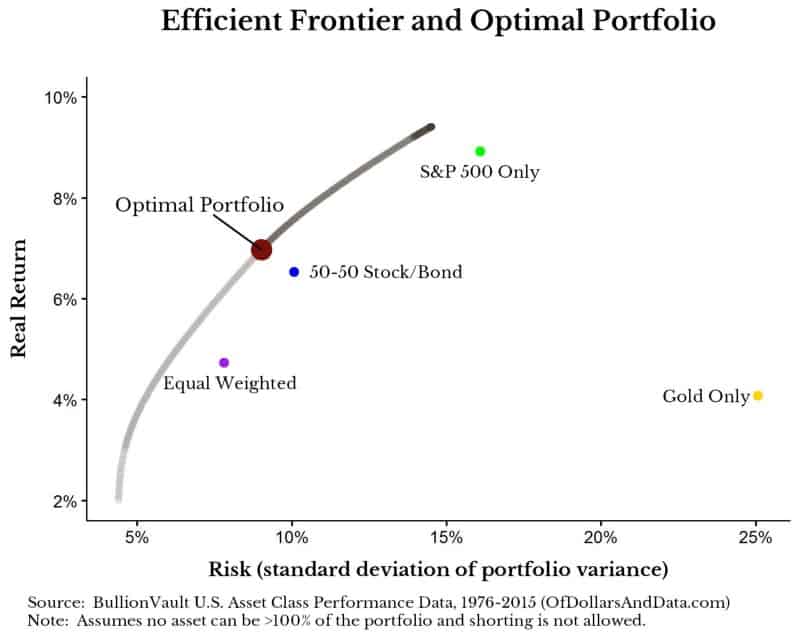

Are there exceptions to this? Of course. Just look at gold as a long term asset class. It has lots of risk with little reward:

We could have the same return as gold for far less risk by creating a diversified portfolio. Technically, you can have the same return with less risk for all of portfolios above (besides the optimal one). So, yes it is possible, but this completely misses the point of my argument. When I discuss risk and reward, I am talking about large shifts in portfolio outcomes, not marginal ones. Looking at the image above, you can see this clearly if you compare the 50-50 stock/bond portfolio to the 100% stock one. To get the increased return of the 100% stock portfolio, you have to take more risk.

However, even within a 100% stock portfolio you can get more return for less risk. How? As Lawrence Hamtil pointed out, just invest in a subset of its sectors:

But, why should we stop here? Why not just find the single stock with the best risk-adjusted returns and put all of our money into that? You can see that doing this would be ridiculous, but it gets at my bigger point. The existence of exceptions do not invalidate a good investment rule.

Why does this matter to you? Because you shouldn’t let your investments be defined by exceptions. I see this all the time in our community when someone is arguing for a particular strategy that has outperformed the market for some number of years. Just look at this tweet where someone claimed you can get a lot of reward with far less risk by investing in real estate (I’ve made the Tweeter anonymous to not start a Twitter war):

Even if we ignore the effects of leverage (which we shouldn’t), how do I know if this is truly a better risk-adjusted performance or if it is luck? Just because there is some mutual fund X or some hedge fund Y or some asset class Z that has beaten the S&P 500, this doesn’t mean that a passive approach is flawed. If anything, since finding those exceptions (and doing it consistently) are so difficult, it actually provides more evidence for sticking to an investment strategy not based on exceptions.

So how do you prevent yourself from falling victim to exception-based investing? Always think about investing with the average result in mind (i.e. the base rate).

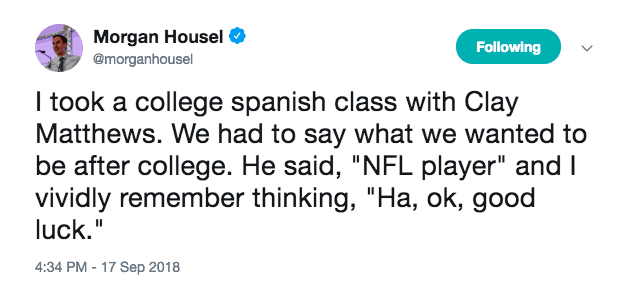

Morgan Housel demonstrated this incredibly well with a recent tweet about one of his college classmates who made it to the NFL:

Just because Morgan was wrong about the outcome (i.e. Clay Matthews is in the NFL), this doesn’t imply that his thinking was wrong. Morgan’s base rate is “most people don’t make it to the NFL” so he assumed anyone he met would never make it. Yes, he forgot he was at USC (a football “powerhouse” at the time), but it illustrates how he uses the base rate to think about outcomes, which is the correct approach when deciding how to invest. Remember, it is the average result you should care about. As I have said before:

Don’t pray for alpha. Pray for beta.

Most Swans Are White

The reason exception-based investing, as I call it, is so in fashion now is because people have become enamored with the idea of black swans. As Morgan said, and I agree, we have clung a little too close to Taleb. Everything is an exception now. Everyone is a contrarian. We are all waiting for the next crash. This kind of thinking is bad for us because we are getting away from base rates. We are getting away from what happens on average in favor of what happens rarely. Just consider the following “black swan” events:

- Patriots beat Falcons in Super Bowl LI.

- Bitcoin.

Are these as rare as we think? Maybe the Patriots won because they are the most winningest NFL franchise of the last two decades. Maybe Bitcoin’s meteoric price rise is the same thing we have seen from various asset bubbles throughout history. We are forgetting the base rates in both cases. The base rate for playing against the Patriots since the early 2000s is YOU LOSE. The base rate for price manias for some asset class is that they happen quite often. Last year it was crypto and this year it is cannabis.

Yes, black swans exist, but, like the actual bird, never forget: most swans are white. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 92. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data