It was December 5, 1914 and Sir Ernest Henry Shackleton set out to be the first person to travel by land across Antarctica. Or, at least, that was the plan. Shackleton and his 27 man crew figured they could brave the Wedell Sea and land at Vahsel Bay while another ship headed to the opposite side of Antarctica at McMurdo Sound in the Ross Sea. This second team would place food stores along their path and meet Shackleton near the south pole before doubling back to McMurdo. If everything went as expected, Shackelton’s journey across the continent would have looked like this:

However, none of this happened. Shackleton’s boat, Endurance, never made it out of the Wedell Sea. A few months into their journey, ice floes descended upon the hull of their ship from every direction. As this frozen iron maiden closed upon the Endurance, Shackleton and his crew were forced to abandon ship and face the elements. Their goal to venture across Antartica was ruined as they now had to improvise in hopes of ensuring their survival. As the famous phrase goes:

Man plans, God laughs

In Endurance: Shackleton’s Incredible Voyage, Alfred Lansing illustrates how, despite Shackleton’s meticulous preparations, Mother Nature had plans of her own. It was a classic case of expectation versus reality.

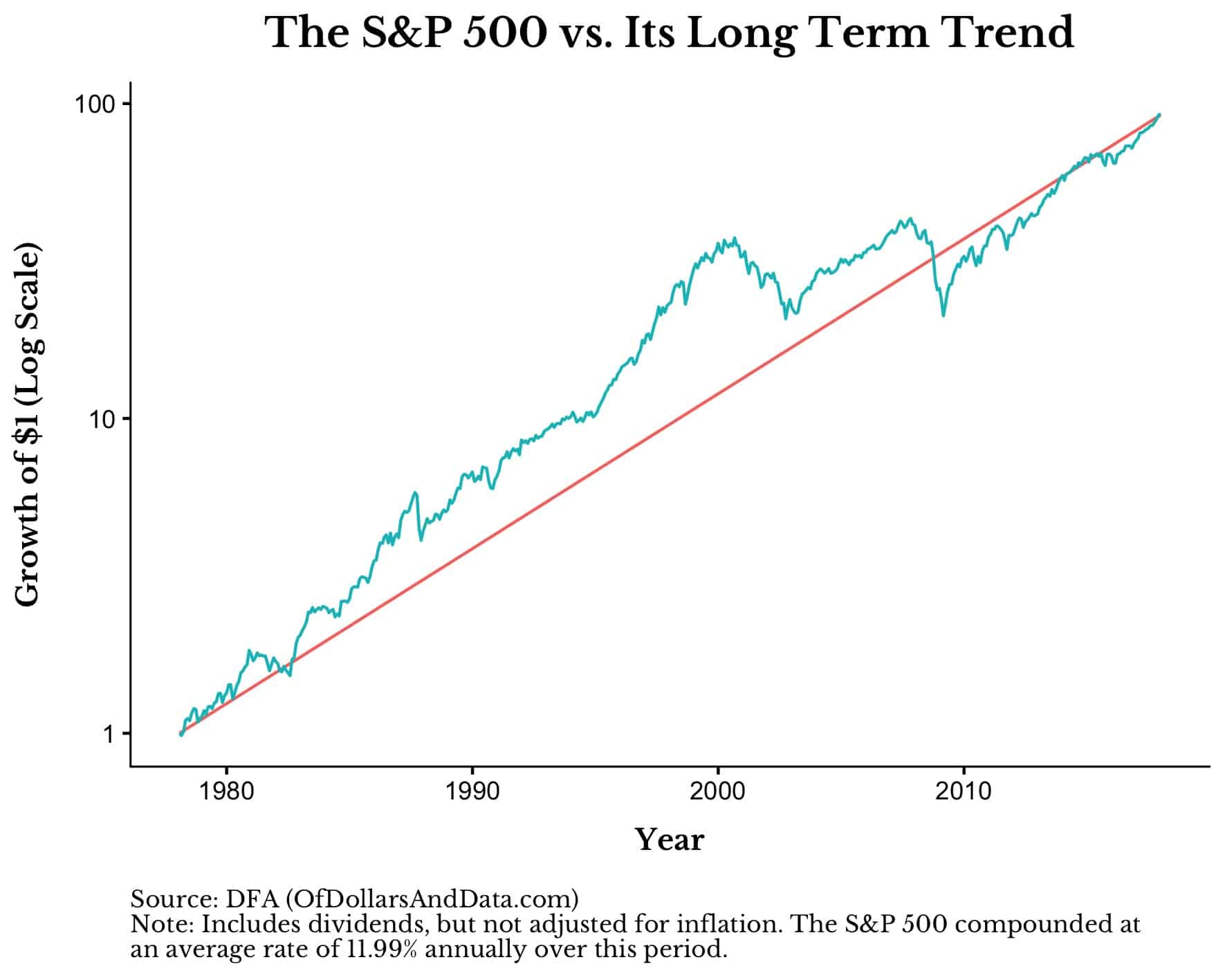

The same can be said of investing. We like to simulate (and plan for) the future with smooth, average rates of return, but the market is chaotic and almost never behaves like its “average” self. For example, over the last 40 years (1978-2017), the S&P 500 had a return of 12% a year (includes dividends, but not adjusted for inflation). If we were to plot the average growth rate over this period with how the market actually performed on top of it, it would look something like this:

Over this time period, the S&P 500 spent 78% of all months above its long term growth rate. Additionally, in its best month the S&P 500 was 300% higher than its long term average and in its worst month it was 37% lower than its long term average. Expectation and reality diverge quite often.

Or, consider the most infamous day in stock market history—October 19, 1987. On that day the Dow Jones dropped 22.6%, which would be a 20 standard deviation event (assuming a normal distribution). In theory, an event of this magnitude should occur once every 1.453^86 years. This number is bigger than the estimate of all of the photons ever produced by all the stars in the universe. We would have to simulate (or re-run) all 14 billion years of our universe:

10,378,571,428,571,400 * 10^60

times before we saw a drop that rivaled the one in 1987. Sorry for story topping you Michael Batnick.

Think about if you had to model the stock market on October 18, 1987 (the day before the crash). The worst one day decline for the Dow at that point in time was -13.5% on October 28, 1929. With that information, how could you ever plan for what would occur on the following day? You couldn’t. As Fischer Black, the economist and creator of the Black-Scholes option pricing model, famously said:

The market appears a lot more efficient on the banks of the Charles River than it does on the banks of the Hudson

You might think that I am implying that there is nothing we can do to plan for the unexpected, but this is far from the truth. Yes, we will all face financial events (both positive and negative) that we did not expect through the years, but this doesn’t mean we are doomed. Just as Shackleton changed tack when thrown off course, you too can follow some basic rules to survive when financial plans go awry:

Have sufficient “rations”

Just like Shackleton, if things go bad, you need to make sure you have ample rations to last you through the tough times. Yes, I know you have heard about the emergency fund 1000x before, but most people I ask about this don’t truly know how much they spend each month or how much emergency cash they might actually need. Track it and find the amount that allows you to sleep well at night.

Re-evaluate your plan and make needed changes

Maybe you no longer can afford that 5-star vacation or you can’t do the home improvements you wanted on schedule, but you can re-assess and make necessary changes. If Shackleton and his men had tried to fight their way across Antartica instead of accepting their reality, it is unlikely we would know their tale today.

Don’t give up

I know it is cliche, but a positive mental attitude during the worst of times can really help when things look the bleakest. Don’t forget that people who are less capable than you faced far worse odds and still made it through.

Of Order and Chaos

As humans we seek the ordered, the linear, and the smooth, but the world gives us the chaotic, the curved, and the jagged. This dichotomy is as old as history itself—order versus chaos. While we all hope that the world will conform to our expectations, as I have said before, “the truth is usually far messier.”

So don’t be drowned by negativity when things don’t go as planned. Don’t be upset if you didn’t achieve your childhood dreams or if some piece of your life isn’t what you hoped. This is the natural state of the universe (entropy is always increasing). Sometimes you win. Sometimes you lose. The important thing is to not get consumed by the chaos when it inevitably comes.

Honestly, I wasn’t sure how to end this post. I considered telling you the story of the man who attempted to cross the world’s largest desert, but failed. But, you already know that story. His name was Sir Ernest Henry Shackleton and the world’s largest desert isn’t the Sahara. It’s Antarctica. Sometimes reality differs from our expectations.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 103. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data