If I had to convince my 22 year-old self to save more money, here is what I would say:

Go big, then stop.

This phrase might not mean anything to you yet, but in a few moments it will.

What I’m talking about is a savings philosophy so effective that it can put your future finances on easy mode. It can help you to build wealth for decades while you literally do nothing. It may just be the lowest effort way to set yourself up for a nice retirement. How does it work?

You save as much as you can as early as you can, then you stop saving altogether (if you want). Go big, then stop.

Why is this strategy so effective? There are two reasons:

- Money invested earlier in time typically grows more than money invested later in time.

- Compounding money is easier than saving money.

The first point is mathematical. If we assume that markets compound by some positive rate each year (on average), then money invested earlier will grow to more than money invested later.

The second point, however, is behavioral. It takes all sorts of willpower and planning to save money throughout your life. However, when it comes to compounding your money, it takes almost no effort at all. All you have to do is wait and the market does the hard work for you.

For these two reasons, this strategy is an excellent way to build wealth early and set yourself up for an easier financial future. I have used this strategy over the last nine years and so far it has worked wonders.

Of course, saving a lot of money early in your career isn’t easy, especially if you have low income. However, if you are able to find a way to save during the first decade of your career, it will pay off in big ways and I can prove it.

Starting Early vs. Starting Late

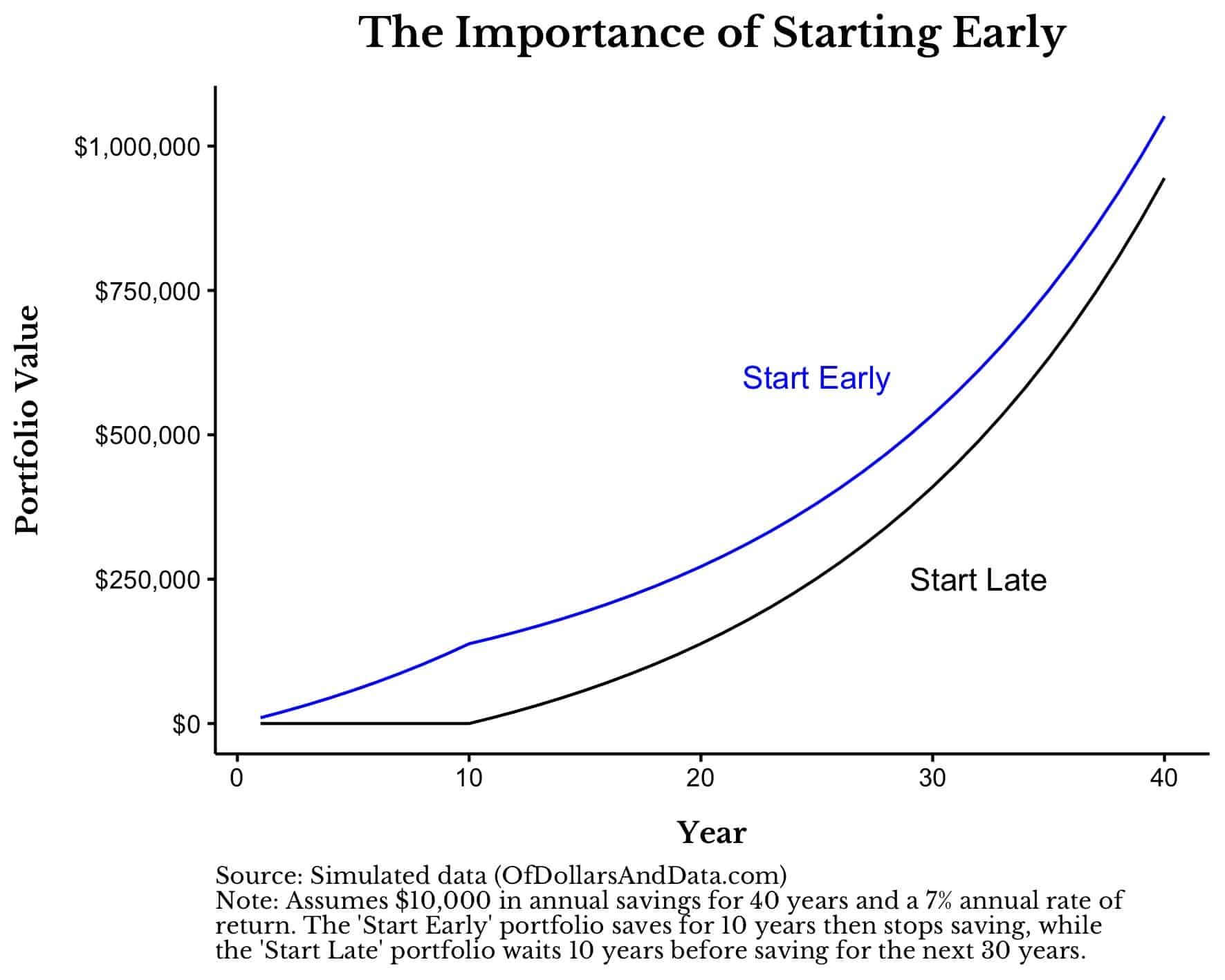

Imagine two people who decide to follow different savings strategies. One commits to saving for the first 10 years of their career and then never saving again (“Start Early”), while the other says they will wait 10 years but then save every year for the next 30 years (“Start Late”). Assuming that they both save $10,000 a year (while saving) and earn 7% on their money, who ends up with more wealth after 40 years?

As the chart below shows, Start Early is the undeniable winner:

To reiterate, “Start Early” only saves $10,000 a year for the first 10 years, then stops saving money altogether. The increase in the Start Early portfolio after year 10 is completely due to compounding and not additional savings.

This simple example illustrates the power of saving early when compared to saving later. This is true mathematically but especially behaviorally. Remember, the “Start Early” saver only requires 10 years of disciplined savings compared to 30 years of disciplined savings for the “Start Late” saver. That’s so much less effort and financial worry simply because you started earlier than someone else.

However, this strategy only works when you can get a 7% annual return (or better). If the annual return were a little lower, then the “Start Late” saver would end up with more money than “Start Early” saver using the same assumptions above. Why?

Because the larger your annual return, the more costly it is to delay your savings.

Why Delaying Savings Hurts You Financially

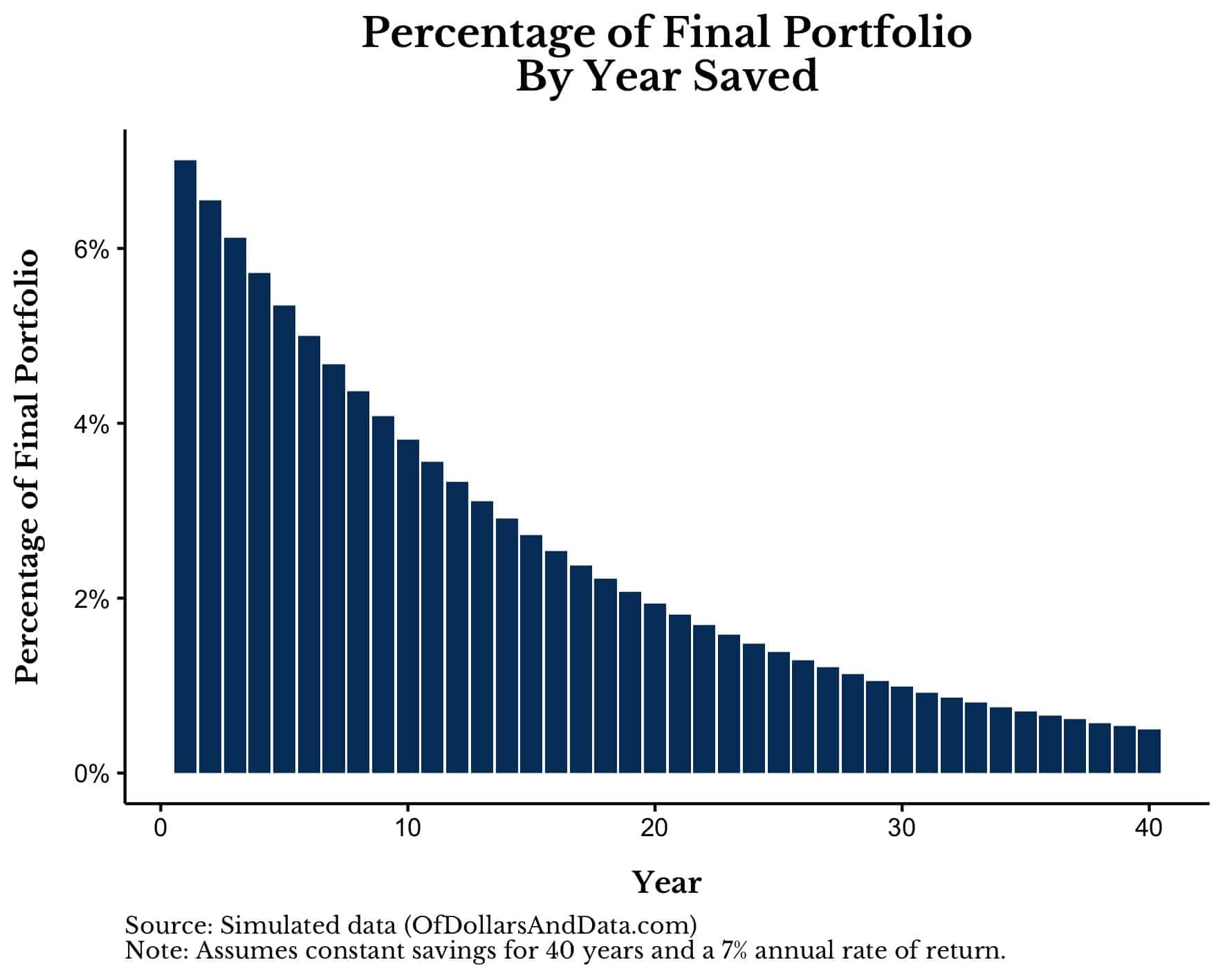

To illustrate why delaying savings can be so harmful to your finances, let’s imagine someone who invests $10,000 a year for 40 years while earning 7% a year. At the end of the 40 years they will have roughly $2 million in their portfolio though they have only invested $400,000 ($10,000 * 40) in total. The rest of their portfolio value came from investment growth.

However, every investment they made didn’t grow to the same amount! In fact, their first $10,000 contribution eventually grew to $140,000 (or 7% of the final portfolio value) despite only being 2.5% (1/40th) of the contributions.

You can see this more clearly in the image below showing the total percentage that each annual contribution makes to the final portfolio:

As you can see, earlier investments end up contributing more to the final portfolio than later investments. This is why the investment in year one ends up being 7% of the final total while the investment in year 20 only ends up being about 2% of the final total.

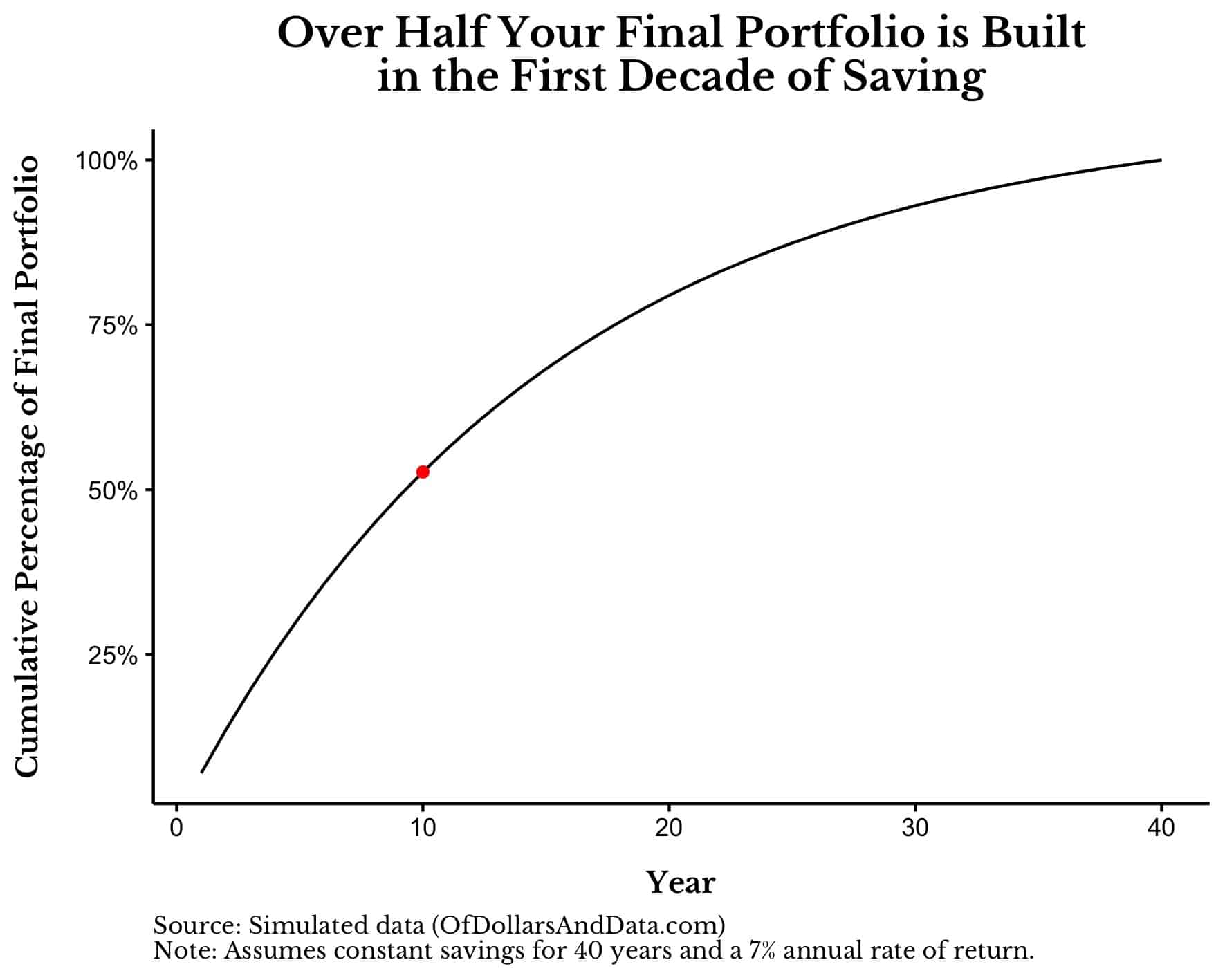

But, a more important point is lurking just beneath the surface. Because if we were to add these bars up over time and show the cumulative total of the final portfolio by year, we would find something remarkable.

Not only does the first year contribute 7% to the final total, but the first 10 years of contributions make up over half of the final portfolio value!

You can see this more clearly in the chart below showing the cumulative percentage of the final portfolio based on number of years saved:

What this means is that by year 10 (see red dot above), over half of your final portfolio value is already baked in. Why? Because the future compounding of these first 10 years of investments is greater than the compounding on the next 30 years of investments. It might seem crazy, but it’s true.

This means that if you save well enough in your first 10 years, your last 30 years of savings matter far less. Of course, these three decades will contribute to your final portfolio value, but technically they contribute less than the first 10 years do (under the assumptions above). This is why “Go Big, Then Stop” can be such an effective way to think about savings, especially as a young person.

However, if you don’t want to follow “Go Big, Then Stop”, we can calculate exactly how much more you would need to save in order to stay on track in the future.

How Much Will Delaying Cost You?

Let’s say that you want to enjoy the first decade of your career and you don’t want to worry about savings. That’s completely fine and reasonable. But, how much will this cost you in the long run?

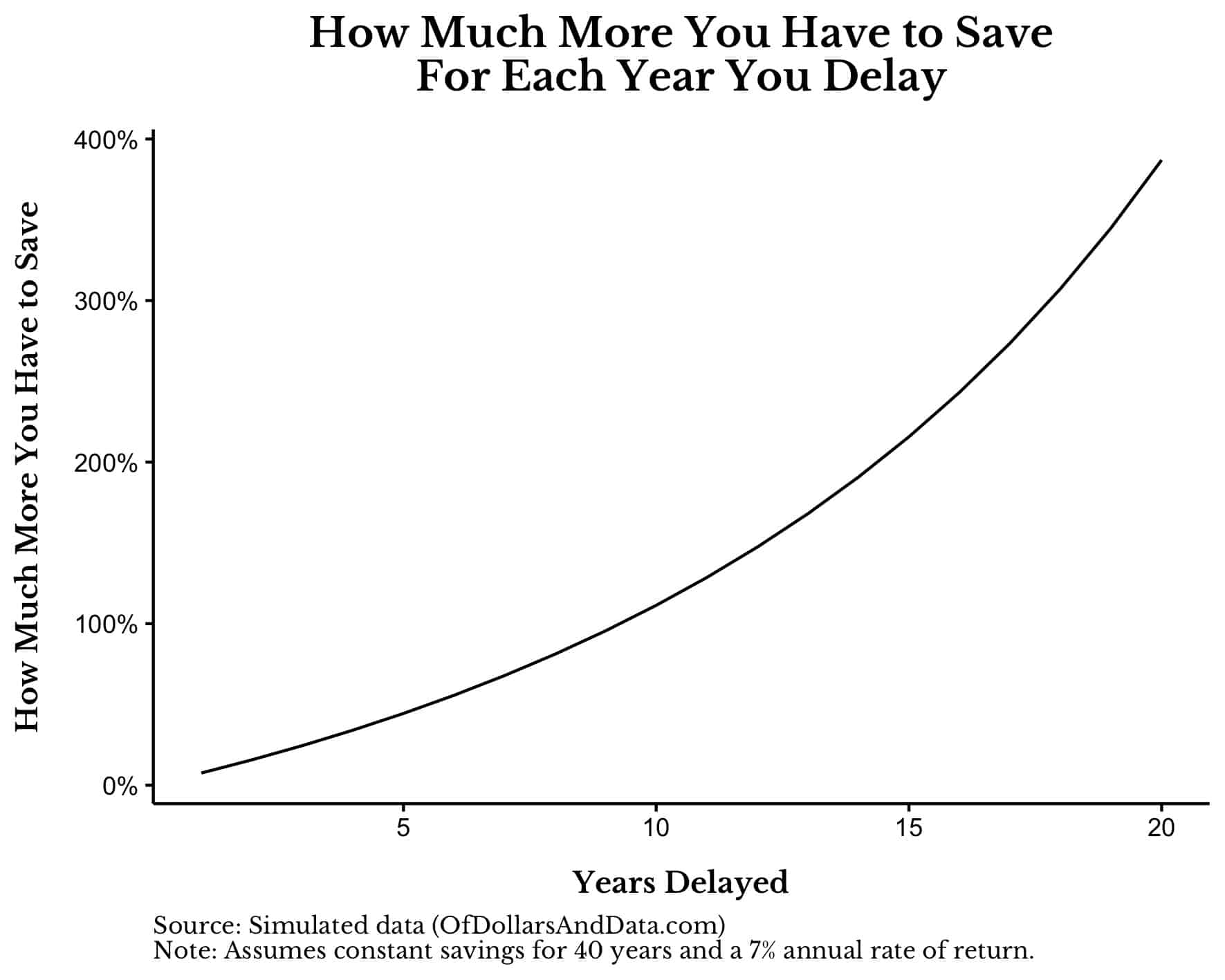

Assuming you can earn a 7% return (and want to retire on the same schedule), then you will have to save approximately double (100% more) of what you would have saved initially.

So if you decide to take $5,000 a year in your 20s and use it on vacations instead of savings, be prepared to save $10,000 a year in your 30s to make up for it (all else equal). And what if you delay more? Then the required savings to stay on track goes up exponentially.

As the chart below shows, by the time you delay your savings for 20 years, you need to save 400% more (fives times more) than if you had never delayed your savings at all:

If this chart isn’t intuitive, let’s use an example to explain what it is showing. If we assume that you could reach your financial goals by saving $5,000 a year for 40 years, then delaying your savings for 10 years would mean saving roughly $10,000 a year (~100% more) for 30 years to reach the same financial goal. And if you delayed your savings for 20 years, you would need to save about $25,000 a year (~400% more) for 20 years instead.

Note that this has nothing to do with the exact amount that you save, only the relative amount. So if you needed to save $50,000 a year to reach your financial goals, then a 10 year delay would mean that you would need to save $100,000 a year (100% more) to stay on track. Therefore, once you calculate roughly how much you need to save to reach your financial goals, this chart can tell you how much more you would need to save in the future if you decide to delay those savings (assuming a 7% rate of return).

This chart also explains why those who delay their savings have to go above and beyond later in life to catch up. It is the exponential cost of delayed savings that can hurt in the long run. However, as bad as delaying your savings can be, sometimes not delaying your savings can be far worse.

When “Go Big, Then Stop” Goes Wrong

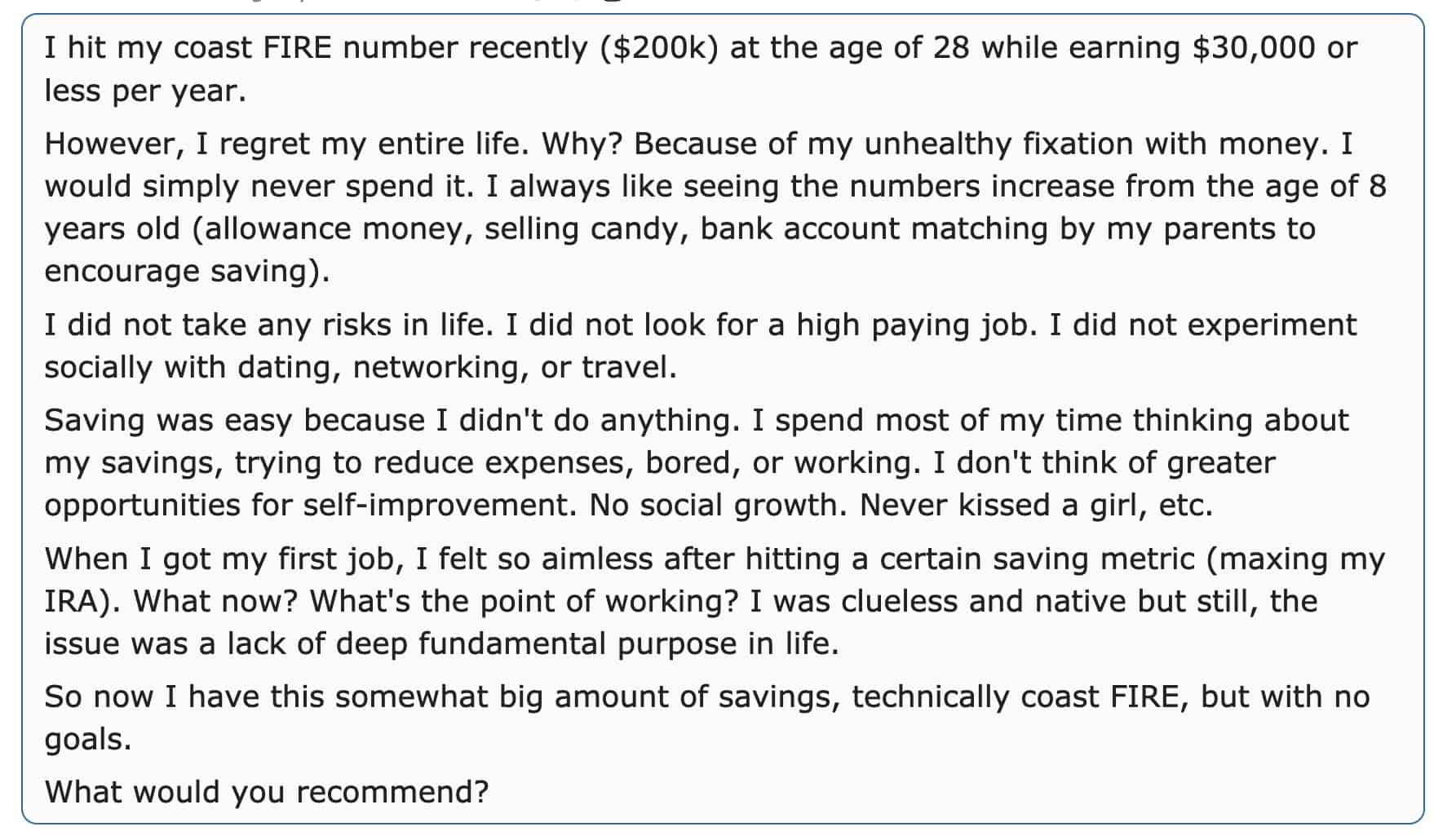

Despite the effectiveness of the saving strategy highlighted in this post, some people can take early savings too far. Just consider this post from a regretful Redditor who focused too much on saving instead of living throughout his 20s:

Finding the right balance between saving and enjoying life will never be an easy task. This is why I wouldn’t recommend “Go Big, Then Stop” for everyone. Some people will find this strategy too stressful and will miss too many lifetime opportunities trying to pursue it.

I only know this because I followed this strategy a little too much when I was younger. Because I was fortunate enough to have a high income in my early twenties, I saved lots for retirement and maxed out my 401(k) almost every year. I have since come to regret these actions slightly (see here) knowing what I know now. Yes, I understand how tone deaf and privileged this sounds, but I’m just trying to help out anyone who might be in a similar position.

The best advice I can give is to find what works for you and worry a little less about your finances. After all, it’s just money.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 252. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data