I used to think that those that ran hedge funds got rich because of their incredible returns. Then I heard about the 2 and 20 fee structure that most hedge funds charged. The typical hedge fund fee structure (historically) is 2% of assets under management and 20% of all positive returns.

Therefore, if you gave a hedge fund $1 million and they got a 10% return on it, their total take in fees would be:

[$1 million * 0.02] + [($1 million * 0.1) * 0.2] = $20,000 + $20,000 = $40,000.

This represents $20,000 for managing your money and $20,000 for their positive performance (i.e. the $100,000 they earned with your money). Despite their $40,000 fee, you would end up $60,000 richer than before you met them. Good deal, right?

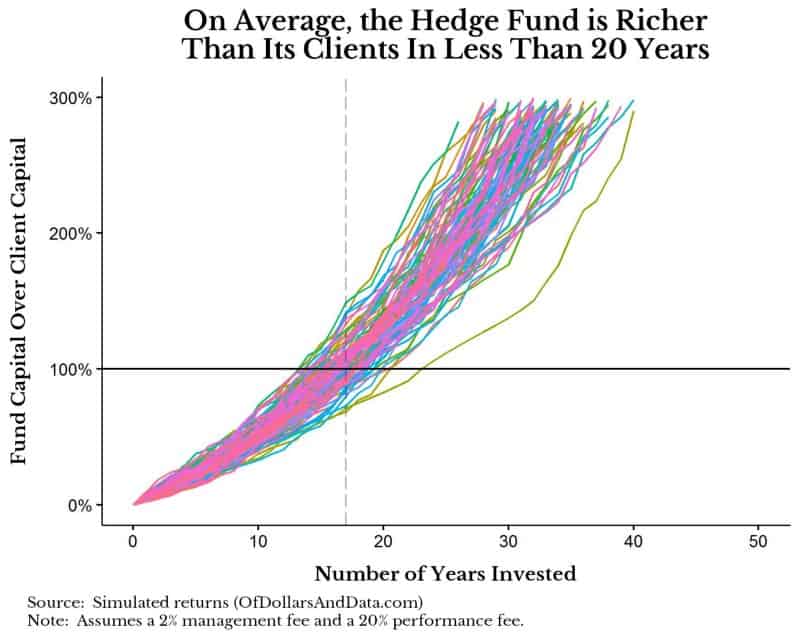

However, what if I told you that in less than 20 years the hedge fund would have more money than you (regardless of the size of your initial investment). Shocking, but true.

I created a simulation model in R that illustrates this (program is here). It assumes that the hedge fund will receive a market return each year (~10% average with a 20% standard deviation) and reinvest all fees it gets along with its clients’ money.

After running 10,000 simulations of this model, the average amount of time before the hedge fund’s capital exceeds the client capital is about 17 years. You can see the hedge fund’s capital as a percentage of the client capital for the first 100 simulations here:

The horizontal black line represents the point at which the hedge fund has as much money as its clients. The dashed gray vertical line is the point where the hedge fund, on average, would have more capital than its clients.

You can see that most of the 100 simulations cross the 100% line before the 20 year mark. The luckiest hedge fund is richer than its clients within 13 years and the unluckiest within 23 years.

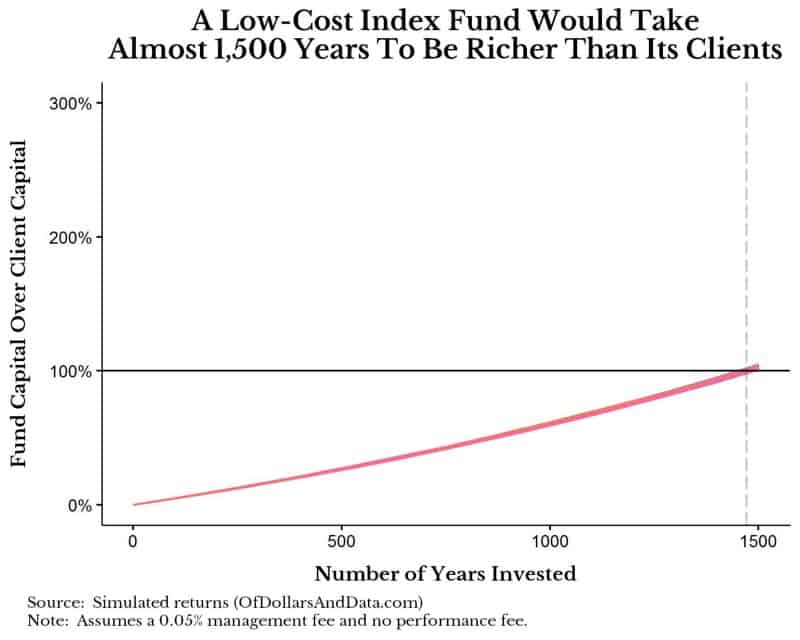

Now, compare this to a lower cost ETF/index fund option (see plot below). If the client were to purchase an S&P 500 ETF/index fund from Vanguard or Charles Schwab with an annual expense ratio of 5 basis points (0.05%), the time it would take for the fund to have more capital than its client is almost 1,500 years!

Remember, this is the exact same simulation as above, but with lower fees.

The stark contrast between the hedge fund fee structure and a low cost ETF should illustrate how extractive the 2 and 20 hedge fund fee structure is for investors. This is true even when the hedge fund has a watermark (a performance benchmark it must hit before it gets a performance fee) or whether the hedge fund can outperform the market.

I ran sensitivities on both of these factors and they made little difference. No matter what initial capital you give the hedge fund to start with, the hedge fund will become richer than you since its real talent is transferring your wealth into its coffers.

The good news is it seems that investors have caught on to this fact as hedge funds saw increased outflows in 2016 even as they dropped their fees. However, the current fee averages (1.4% management and 17% performance) don’t change the math enough to make much of a difference.

With these fees, a hedge fund would have more capital than its client within 22 years instead of 17. These are both a far cry from the ~1,500 years that would be required by a low cost index fund/ETF.

How You Can Get Rich (Hint: Pay Lower Fees)

The moral of the story is that fees matter, a lot. When it comes to investing, a little more in fees can go a long way (for those charging them). So though 2% might sound small now, within a short time frame it can add up very quickly.

I recommend keeping your average fees below 0.1% across your portfolio. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 01. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data