Last week Financial Twitter experienced a firestorm of controversy about what it means to be financially independent. First Codie Sanchez claimed that $20M wasn’t enough for “true financial freedom”:

The next day Paul Millerd took a view at the opposite end of the spectrum after stating that $25,000 in savings, a retirement account, and a job that you enjoy is all you need for financial freedom:

So who is right? Is $25k + good employment enough for financial freedom? Or is even $20M not sufficient in today’s day and age?

Unfortunately, for most people, the answer is somewhere in the middle. Can you be financially free with only $25k and a great job? Yes, if you don’t get unlucky. All it takes is one bad break and there goes your financial stability.

For example, my cousin sells custom woodwork and did so for years without issue. He always had consistent demand from clients. However, as lumber prices started surging in 2021, he had to put his entire business on hold. None of his clients wanted to pay more than what they were used to paying despite the fact that lumber prices had doubled.

This a perfect example where $25,000 plus a job you love doesn’t guarantee financial independence. Unforeseen circumstances such as job loss, health issues, or other major life events can derail any such plans.

On the flip side, there are individuals whose lifestyles are so lavish that even $20 million wouldn’t be enough to sustain them. Based on the 2019 Survey of Consumer Finances, having $20 million would have put you in the top 0.4% of U.S. households. This means that you were wealthier than 996 out of every 1,000 American households. If you still struggle with money despite this level of wealth, then you might want to reevaluate your lifestyle.

Thankfully, most of us have a definition of financial independence that falls between Paul’s ($25k + job) and Codie’s ($20M). So what’s the right amount? I can’t provide a single answer that will work for everyone, but I do have a framework that can help you think about this.

The Spending Framework for Financial Independence

When it comes to figuring out how much you will need to be financially independent, we only need to know two things: (1) your annual spending and (2) how many years you need to spend for. Once we know these two things, we can estimate how much you will need to be financially free.

For example, consider someone who wants to retire at 65 while spending $50,000 a year for 30 years. Note that $50,000 is what the middle income U.S. household spends annually according to the 2019 Consumer Expenditure Survey. Assuming that this person has no other income in retirement, we can calculate their financial need using the 4% rule. The 4% rule assumes that you deplete your assets by 4% annually for 30 years. Taking $50,000 and dividing by 4% (or multiplying by 25) and you get $1.25 million. That’s what they would need for financial independence at age 65 for 30 years.

However, if we change our assumptions a bit, we can lower this number considerably. For example, if we assume that they will receive $1,500 a month ($18,000 a year) from Social Security and $500 a month ($6,000 a year) doing freelance work they love, then they only need to cover the remaining $26,000 annually to be financially free. Using the 4% rule, this means they now only require $650,000 for financial independence instead of the $1.25 million in the original scenario. Their ability to generate income in retirement reduced their required financial assets considerably.

But what about someone who isn’t near retirement? If you wanted to be financially free starting at 35 instead of 65, then you would require an additional three decades worth of spending. All else equal, we can cautiously assume that if the time horizon is doubled, then the amount needed should double as well. So if you need $1.25 million for 30 years, you will need $2.5 million for 60 years. However, this would be very conservative since in the original scenario ($1.25 million for 30 years) the required rate of return was only 1.22%.

If you use a financial calculator, you will find that the amount required for 60 years of financial independence when spending $50,000 a year while earning 1.22% is only $2.1 million (slightly lower than $2.5 million). Either way, you can see that the amount required for financial independence may not be as large as you initially imagined, especially if you have other guaranteed sources of income (hobby, Social Security, etc.)

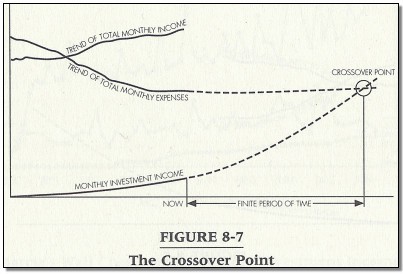

Of course, not everyone will feel financially independent while spending down their assets. As a result, they may only be comfortable if the income from their assets matches (or exceeds) their spending. If this sounds appealing to you, then the amount of assets you need to be financially independent is called your crossover point.

The Crossover Point

In the book Your Money or Your Life, Vicki Robin defines the Crossover Point as the point “where your money investment incomes exceeds your monthly expenses.” Robin refers to this as the Crossover Point because it is the point at which your investment income literally crosses over your expenses and allows you to reach financial independence. The image below from her book illustrates this well, with the Crossover Point circled on the right side:

To find your crossover point you only need two pieces of information: (1) your annual spending and (2) your annual expected rate of return on your investments. Mathematically, using these two pieces of information you can calculate your Crossover Point as:

Crossover Point = Annual spending / Expected rate of return on your investments

Therefore, if you have annual spending of $50,000 and you think your investments can provide you a 5% rate of return each year, then your Crossover Point would be $1 million. This means that $1 million earning 5% per year generates $50,000 in income. If you assumed an annual rate of return of 4%, your crossover point would be $1.25 million, which is identical to what the 4% rule would suggest for this level of spending.

Putting it All Together

Now that we have examined a few ways of calculating financial independence, let’s do a step-by-step walkthrough of how you can find how much you might need:

- Find your expected annual spending going forward. As a reminder, for middle income in the U.S. this is about $50,000 a year and for the top 20% of income earners this is $120,000 a year. I’m assuming you will be in this range.

- Reduce your spending by any guaranteed income you have coming in. If you can make $10,000 a year without issue or you have Social Security income of $24,000 a year, then subtract this from your expected future annual spending. We will call this your Annual Excess Spending.

- Divide your Annual Excess Spending by a reasonable rate of return. If you can earn 5% a year without issue, divide by 0.05, however, I would recommend a more conservative estimate like 4% or even less (given where bond yields are today).

What you get from dividing the number in (2) by (3) is your crossover point and should be close to the amount of money you need to have invested for financial independence. I will do this below for 3 spending levels ($10k, $50k, $100k):

- At $10,000 in annual excess spending, you will need $200k – $500k

- At $50,000 in annual excess spending, you will need $1M – $2.5M

- At $100,000 in annual excess spending, you will need $2M – $5M

While this exercise isn’t perfect, the figures above should be in the ballpark for the level of spending mentioned. However, the exact figures aren’t what’s important here. It’s the range of those figures that really speaks volumes.

From the calculations above we can conclude that the most important factor for reaching financial independence isn’t your rate of return, but your spending. Technically, every person reading this post could be financially independent tomorrow if they lowered their spending enough (and had no outstanding debt). Of course, this isn’t realistic, but you get my point.

Spending determines everything when it comes to reaching financial independence. Therefore, if you can find ways to be happy while spending less, you already own one of the most valuable assets in the world.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 247. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data