There is a great line that comes from George Goodman’s The Money Game (note that Goodman went by the pseudonym Adam Smith):

The first thing you have to know is yourself. A man who knows himself can step outside himself and watch his own reactions like an observer.

Knowing yourself as an investor will be far more important for your long term results than even the most perfect portfolio. Why? Investing is primarily a behavioral exercise, not an analytical one. Despite all of the “data” that Of Dollars And Data prides itself on displaying, behavior beats analytics in the investment world. To demonstrate the importance of this, I am going to tell you a personal story about my history with one asset in particular: gold.

I used to hold 5% of my net worth in gold, but after examining the data and questioning myself, I realized I had to get out. Why was I in gold to begin with? There is some evidence that gold can play an important role in a portfolio due to its lower correlation with equities and bonds. When the S&P 500 goes zig, gold generally goes zag. As a result, there is a small rebalancing bonus that you could have earned, historically, by holding some gold. I have written about this previously here, and Jake from EconomPicData described the idea of the rebalancing bonus with volatile assets beautifully here.

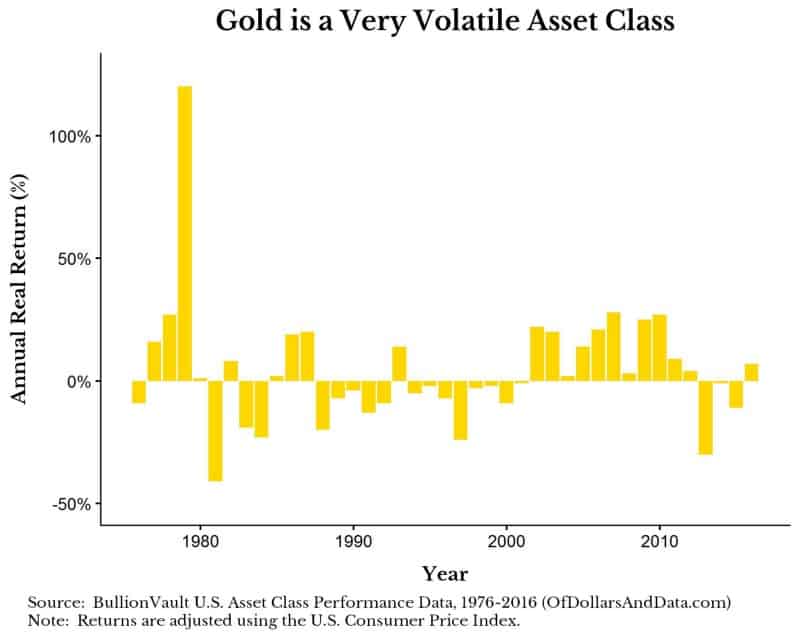

However, though it plays well in a portfolio, gold is a very volatile asset by itself. For example, consider it’s real returns by year:

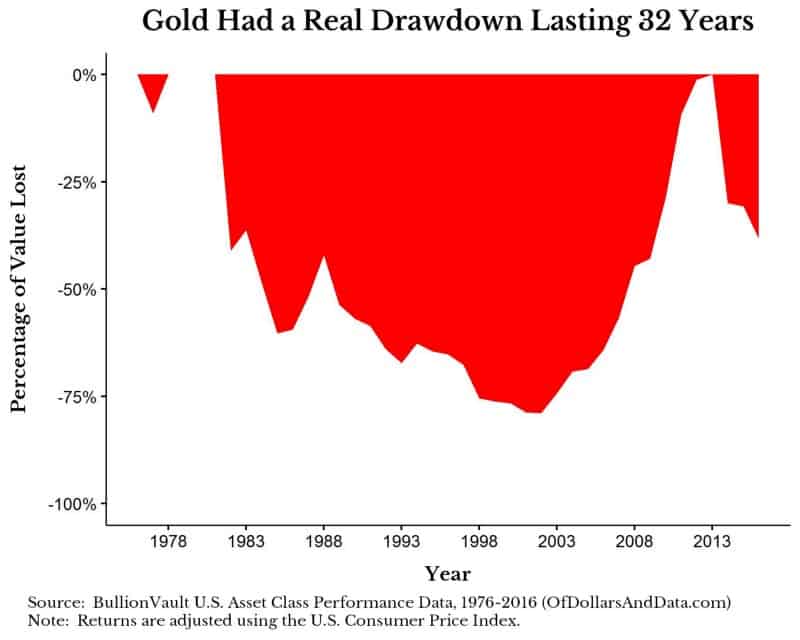

The highest one year real return for gold since 1976 is 120% and the lowest is -41%. More importantly, you will notice that gold can have long stretches of negative returns. To be exact, from 1981 it took ~32 years before gold was back at its all time high, adjusted for inflation:

And that is why I had to get out of gold as a long term investment. I saw this chart and said, “Nope.” Can you imagine having 5% of your net worth in an asset while watching it drop by 75% in value over the course of multiple decades?

I realized I could not and I sold last week, thankfully, at a profit. The fact that I have gone back and forth on gold a few times over the last few years illustrates why I shouldn’t own anything this volatile. I have accepted my nature as an investor and will ignore gold as a long term investment for the rest of my life — rebalancing bonus be damned.

Ironically, Michael Batnick, my favorite investment writer, recently put 10% of his net worth into gold as short term investment based on pricing trends. Gold is currently down ~25% from its 2013 high. Will it recover to its 2013 high and beyond, or will the drawdown continue for another few decades?

I have no idea, however, I don’t have the same investing discipline as Michael and I know this. My decision to abandon gold could either work out in my favor, or be an expensive mistake. But, I’m okay with that.

How to Know Your Investing Self Better

The problem with trying to know your investing self is that you have so few data points to go on. Large market drawdowns happen rarely, and some investors, myself included, have never experienced anything of this magnitude. Despite the difficulty in determining how you will react to a 30%, 40%, or 50%+ decline in equity markets, there are likely clues in your behavior. For example, consider the following questions:

- Do comments about the stock market from your friends/colleagues make you want to check my portfolio?

- If you lost $X (where X is 50% of your equity allocation), would you feel okay still owning stocks? Note this has to be done in actual $ terms not in percentage terms. Losing 50% sounds bad, but losing $500,000 sounds far worse. Always convert to dollars when thinking about losses.

- What kind of event would have to occur for you to sell (i.e. full fledged nuclear war, super volcano eruption, etc.)? This sounds extreme, but it may get you thinking about how you would feel so you can admit if you have a selling point.

- Are there any assets that you could never own based on their volatility?

Despite all of the questions above, it will still be difficult to know your investing self. Or, as Fred Schwed once said:

Like all of life’s rich emotional experiences, the full flavor of losing money cannot be conveyed by literature.

While investing with real money may be the only way to actually understand your investment nature, I don’t recommend doing anything that could ruin you financially. However, taking a small percentage of your portfolio and putting it into more volatile assets may be worth the investment, even if you incur small losses.

The knowledge you gain from this exercise could save you far more in the future. Best of luck in finding your true investment self and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 38. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data