As riots erupt across America following the murder of George Floyd, race relations have once again taken center stage in the United States. Though there is a lot of focus on the social inequalities occurring in the U.S., we should also take a deeper look at the economic inequalities as well.

Because it is my belief that many of the social issues experienced by people of color throughout America would be greatly mitigated if they had more economic power. Before we get to that discussion, let’s examine the size of the racial wealth gap to see where things stand currently.

How Big is the Racial Wealth Gap?

To figure out just how stark wealth inequality is by race, I will be using the net worth data provided by the Survey of Consumer Finances (“SCF”). As a quick refresher, net worth is defined as:

Net Worth = Assets – Liabilities

Where assets are everything that you own (i.e. house, car, bank accounts, securities, rental properties, etc.) while liabilities are everything that you owe to others (i.e. credit card debt, student loan debt, mortgage, etc.)

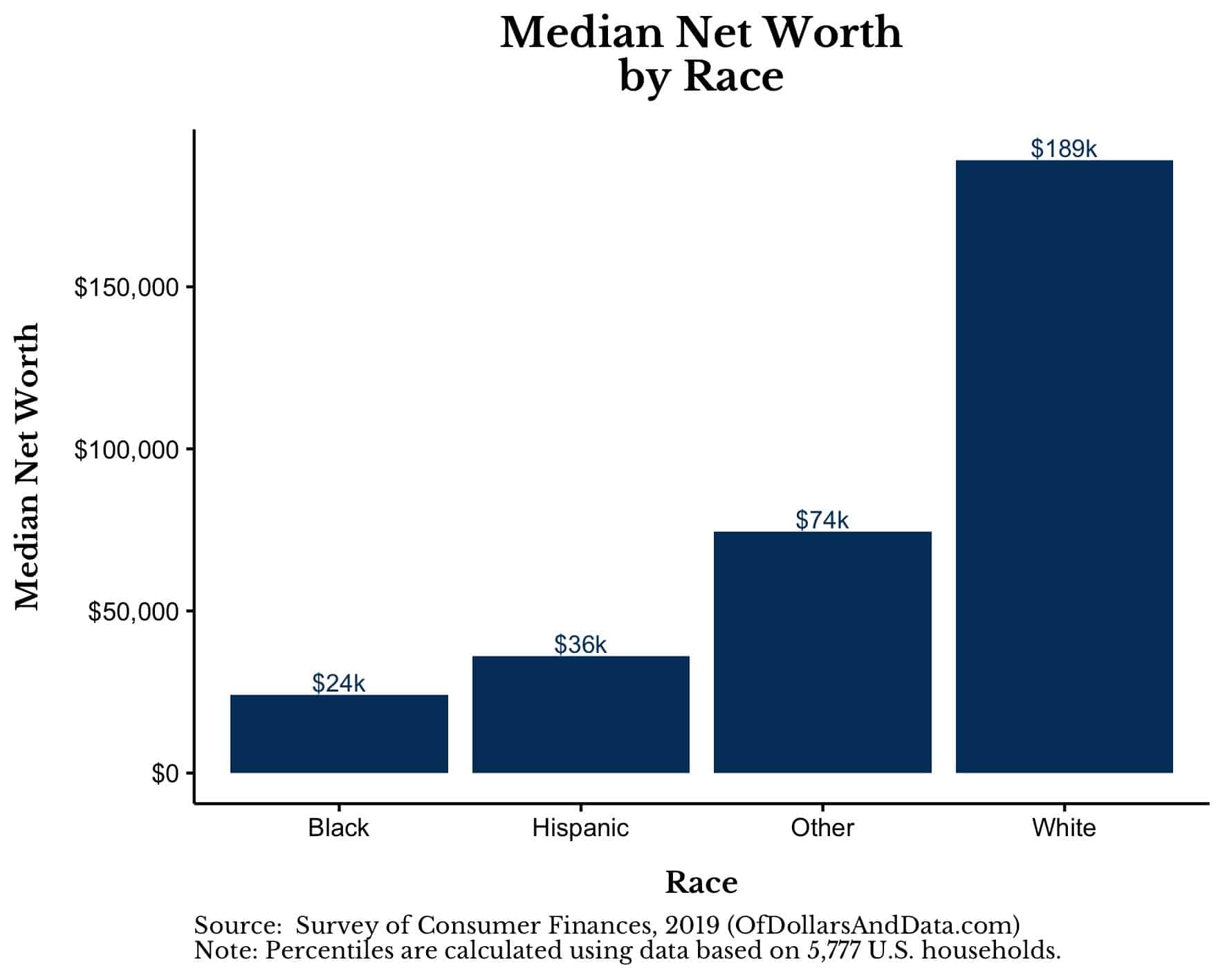

When we look at the median net worth by race we can see that racial wealth gap between White households and Black households was a factor of eight in 2019:

It might be hard to believe, but the typical White household has eight times as much wealth ($189,000) as the typical Black household ($24,000) in the U.S.

I say “typical” because the median measures the middle household within a particular group. In comparison to the average, the median is a far more useful metric because it excludes the effects of outliers (i.e. superrich households that are mostly White).

But if you are a good little statistician then you might argue that this comparison isn’t fair because it doesn’t adjust for so many other factors that influence wealth accumulation.

For example, if we know that Black households generally have lower educational attainment than White households, then the racial wealth gap might just be illustrating the influence of education on acquiring wealth and not the influence of race itself.

I have previously discussed the impact of education on net worth generally, but will controlling for education fix the racial wealth gap?

Does Education Fix the Gap?

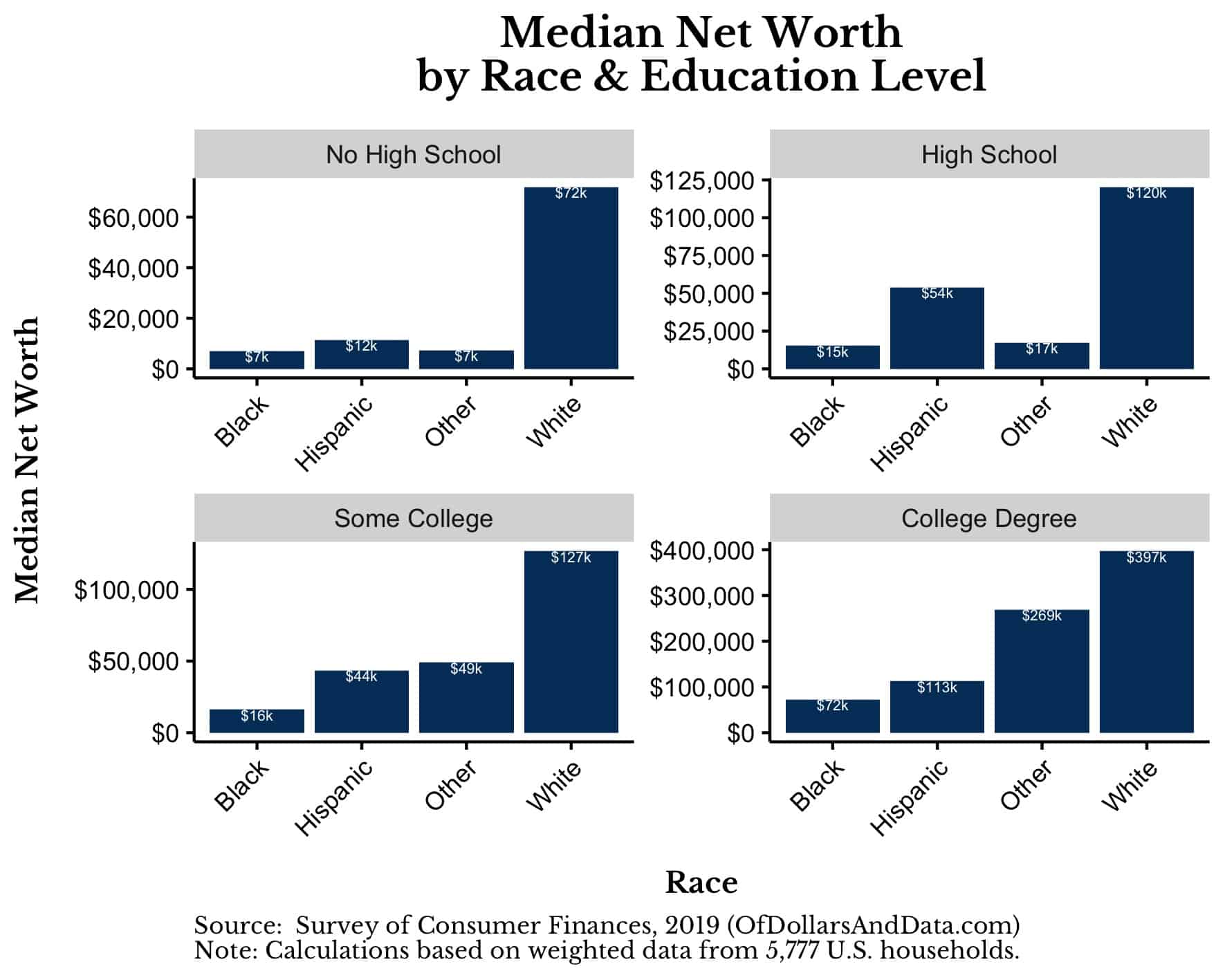

Unfortunately, even when we control for a household’s education level, the wealth gap still exists between White and non-White households. In fact, the median Black household with a college degree has a net worth similar to the median White household without a high school diploma.

Yes, you read that right. A college degree barely gets a Black household past where a White household is with no high school education.

You can see this more clearly in the plot below which breaks out the median net worth by race and education level (note: the y-axis varies in each subplot to emphasize the difference between races rather than the differences in educational attainment):

As you can see, the typical Black household with a college degree has a net worth of $72,000 while the typical White household with no high school diploma also has a net worth of $72,000. Of the thousands of charts that I have produced on this blog, this one might be the most shocking. Unfortunately, this finding may just be the tip of the wealth gap iceberg.

A report from the Federal Reserve Bank of Boston found that U.S. born Black households in Boston only had a median net worth of $8 compared to $12,000 for Caribbean-born Black households and $247,500 for White households in the same area. Once again, you did read that correctly…$8 compared to $247,500!

More importantly though, the gap found between U.S. born Black households and foreign-born Black households in Boston suggests that the Black net worth data from the SCF (the image above) might be slightly skewed upward because of foreign-born Black households in the U.S.

This implies that, as bad as wealth inequality is for Black households in the U.S. generally, it is likely worse for those U.S. born Black households.

However, I don’t want you to interpret the above data as “education does nothing to close the racial wealth gap.” This isn’t true.

Remember earlier when I said that the median net worth of White households ($189,000) was eight times that of the median net worth of Black households ($24,000)? Well, among the college-educated, White households only have a median net worth about six times greater than Black households ($397,000 vs. $72,000).

This is some evidence that a college degree can help to reduce the racial wealth gap, but it isn’t enough to fully explain it away.

Does Controlling for Income Help?

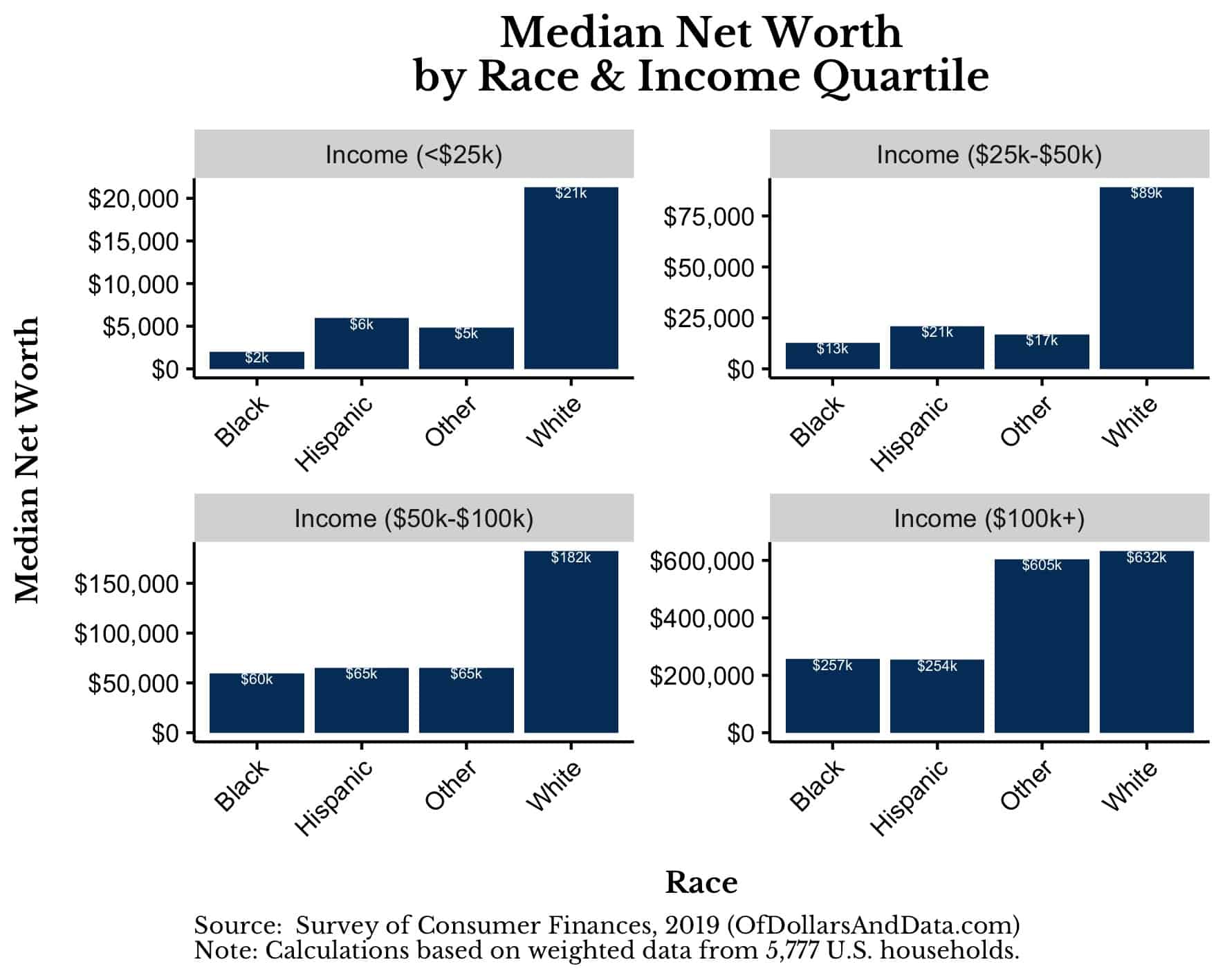

In the prior section, we tried to adjust for the racial wealth gap by controlling for the education level of a household. However, we don’t really care about the education level of households, but how that education affects a household’s income. Therefore, it probably makes more sense to adjust for income directly by bucketing households into income groups and then comparing their wealth.

Using the 2016 SCF data, the four income quartiles I found were <$25,000, $25,000 to $50,000, $50,000 to $100,000, and $100,000+. This means that 1/4 of U.S. households have an income <$25,000, 1/4 have an income of $25,000 to $50,000, and so forth.

After bucketing household income in this way and then looking at the median net worth by race, the wealth gap closes considerably more:

As you can see, the median net worth of White households is now only three to four times more than the median net worth for Black households in the higher income groups. Controlling for income directly has shrunk the racial wealth gap from a factor of eight to a factor of three to four.

However, the gap still isn’t close to zero, so something else is going on.

What Else Could Explain the Racial Wealth Gap?

As someone who has written about investing every week for the past few years, I understand the effects of compounding on systems. And when I look at the racial wealth gap, all I see is centuries worth of negative compounding at work.

I see discriminatory acts both large and small that have added up over decades and decades to leave the typical Black household in the U.S. at a far worse starting point than the typical White household.

For example, say someone is prevented from buying a home in a certain area because of their race. Imagine how that might affect the quality of their children’s education and their children’s lifetime income. As I have written about before, even a small change in initial conditions can affect where you end up in life. And that is just one racist act one time.

What if instead of losing a better education, those children lost a parent? Imagine how much worse off they would be without the economic support of their mother or father. You run this logic over and over and it’s easy to see how the racial wealth gap can come about.

It’s not just one disadvantage one time. It is the cumulative effect of discrimination that negatively compounds on individuals, their communities, and, ultimately, their ability to build wealth.

For example, when slavery ended in 1863, most Black families had no economic base to start from. And whatever economic base they were offered, in terms of free land, was typically taken back years later. It’s hard to compound wealth when you don’t have any in the first place. Researchers at the Federal Reserve Bank of Cleveland came to a similar conclusion when they studied the racial wealth gap as well. After analyzing prior studies that looked at the gap, the researchers stated:

Because the relationships between observable characteristics and wealth are estimated over short periods of time in those studies, they are likely underestimating the importance of initial conditions and income disparities for future wealth.

And guess what? The SCF net worth data supports this assertion as well. Let me explain.

So far we have broken out net worth by race, education, and income, but we haven’t looked at anything that involves time’s impact on wealth accumulation. We technically don’t have the ability to follow each of the households in the SCF data over time, but we do have the age of each household.

So what if we try to compare young White households to similarly situated young Black households and then see how these households do in the future?

Basically, the idea is to control for similar levels of starting wealth between Black and White households and see if this is predictive of future wealth.

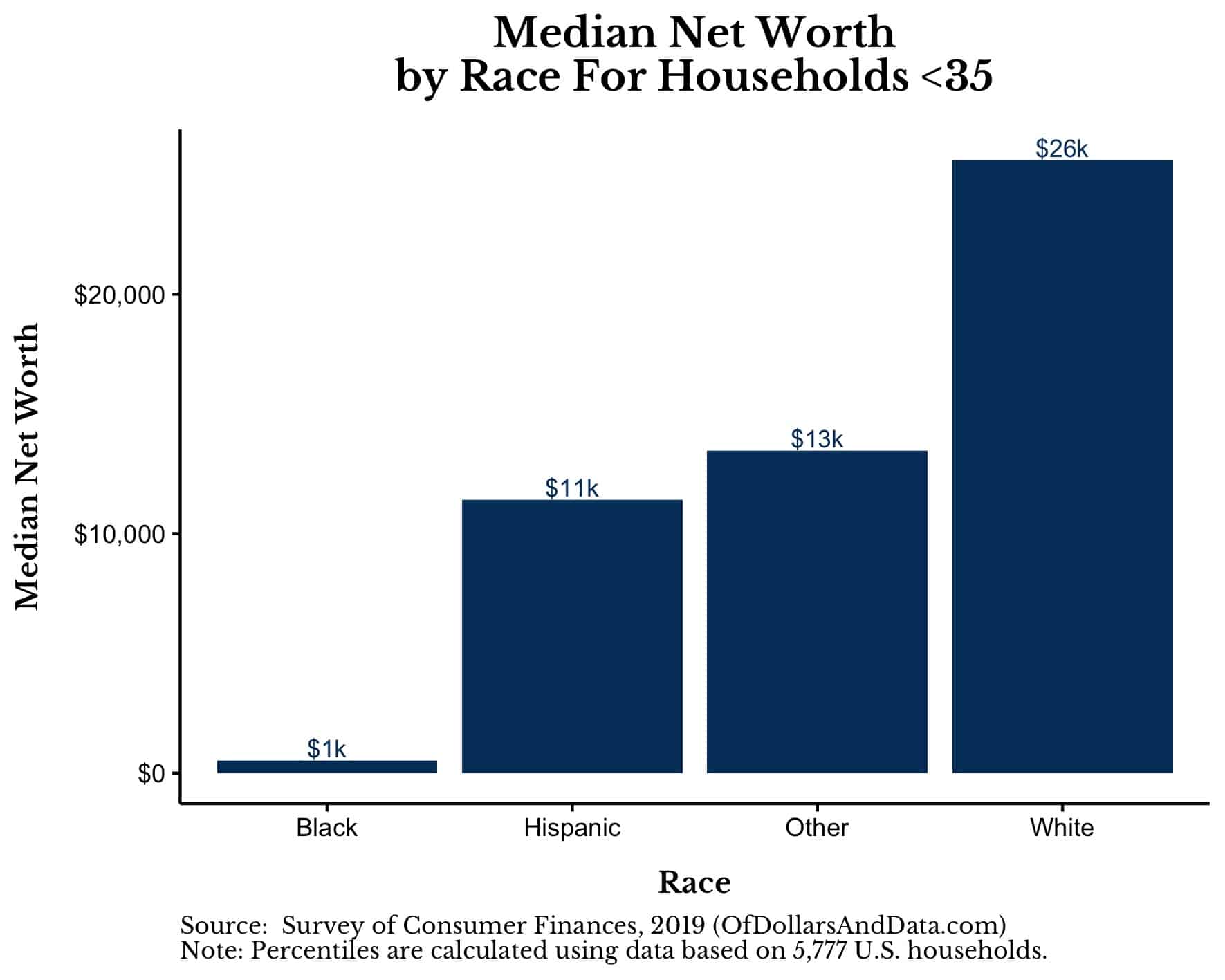

Below is a plot of the median net worth of all U.S. households under age 35 by race:

As you can see, Black households under 35 have a median net worth of $1,000 compared to $26,000 for their White counterparts.

If you wanted to find a Black household under 35 comparable to the median White household under 35, the Black household would need to be at the 82nd percentile (~$24,000). This means that a Black household under age 35 has to be in the top 18% to have similar wealth to a typical White household under age 35.

Okay, now here is where the trick occurs. Imagine these households (the median White and the 82nd percentile Black) three decades in the future when they are age 65-74.

Of course, we don’t have future net worth data, but we do have net worth data for the median White and 82nd percentile Black households aged 65-74 today. And this data shows that the median net worth of a White household aged 65-74 is $360,000 while the 82nd percentile net worth of a Black household 65-74 is $259,000.

$360,000 vs. $259,000! That’s the closest we have been to “closing” the racial gap thus far. And we were only able to do it because we controlled for initial conditions (i.e. starting wealth).

Note that this doesn’t imply that a cash transfer to young Black households by itself will fix this problem. Because it isn’t the money alone that makes these households better off, but the underlying factors that allowed them to accumulate that money in the first place.

For example, these young households may have higher income, a stronger support network, or better financial habits. I don’t know. However, by controlling for starting wealth, you pick up those things that are predictive of future wealth.

Regardless, this thought experiment misses the point. Because the actual wealth gap between a typical Black household and a typical White household is a factor of eight. We shouldn’t have to adjust for education or income to explain it away. This, in itself, is defeat.

Instead, we should ask ourselves why there is a massive gap in education and income between Black households and White households in the first place. This is where we must start.

Is There a Solution?

At this point it should be evident that economic inequality is as big of an issue as social inequality for Black households in the U.S. And, as I suggested at the beginning of this piece, if we want to reduce social inequality, we must reduce economic inequality.

Don’t believe me? Consider what Martin Luther King Jr. said on the Tonight Show in February 1968:

The economic problem is probably the most serious problem confronting the Negro community, and, I might say, the most serious problem confronting poor people generally.

Why did he say this? Probably because he recognized the utmost importance of money in our society.

Money drives the world. Everyone understands it and it is the primary tool that we can use to affect change. Whether that means starting a business, helping the needy, or supporting politicians that champion our causes, money is at the center of it all.

As Chamath Palihapitiya, founder and CEO of Social Capital, explained:

Get the fuckin’ money. I’m serious…Get it. It is going to be made. It is going to be allocated. And you have a moral imperative to make sure that, if you have a point of that matters and you wanna reflect it, you get it.

I’m gonna go get it. Other people are gonna go get it. Then it will be about a competition of views…In the absence of capital you’re irrelevant. With capital, you’re powerful. And then you decide.

And I couldn’t agree more. Of course “get the fuckin’ money” is easier said than done. So how might we ensure that everyone has a fairer chance of getting it?

Improve the initial conditions of those who are the worst off in society.

Does that mean a basic income? More social safety nets for all? Higher investment in early childhood education?

I don’t know. But we need to even the playing field for as many people as possible as early as possible. We need true equality of opportunity not just the image of equality of opportunity.

Because this isn’t really about black or white. It’s about being who we say we are. Who we’ve said we were for so long.

And if we are the United States of America, where everyone is supposed to have a somewhat similar chance of making it, then we should prove it. We should put our money where our mouth is, and finally make the American dream into a reality…for everyone.

Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 188. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data