This week I want to talk about how much the investing world has changed over the last century and how these changes may reduce your future expected returns. My argument is that because it is now easier, cheaper, and less risky for the average person to invest, a reduction in future returns is warranted. Lower future expected returns will have large implications for investors with longer time horizons (i.e. millennials like myself), however, there are ways to counteract this. In order to explain my thinking, let’s go back to a different time.

Imagine being an average person in 1900–1970 who wanted to invest. During this time, the investment industry had the following qualities:

Less information

Before the advent of the internet, most investors had relatively little access to information. For example, SEC filings weren’t available online until the mid 1990s and there was no Google to find information instantly. In his interview on Masters of Business with Barry Ritholtz, Charles Ellis describes how he used to have to go down to the NYSE to look up company filings and do calculations by hand using a slide rule. This gave a huge natural advantage to those who were in New York and could access this information easily.

If you are still skeptical about the value of information in the past, hear me out. In The Snowball: Warren Buffett and the Business of Life, the author describes how Warren Buffett cut a deal with the local distributor of the Wall Street Journal so that the next day’s paper would be delivered to Buffett’s house around midnight the day before it was released. Therefore, almost every single day for decades, Warren Buffett got the news before almost any other investor. Do you think this had no positive impact on his returns?

Fewer competitors

The number of people that have joined the investment industry in the last few decades is staggering. As Charles Ellis stated in his Masters of Business interview:

“If you go back 50 years, there might have been 5,000 people involved in investing. Now there are at least 1 million people.”

Lack of diversification

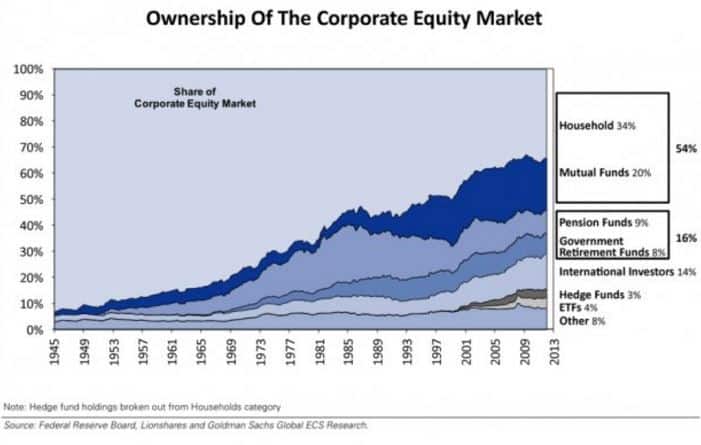

Though mutual funds were invented in the mid 1920s, most investors did not start using them until the 1980s and 1990s, the same time that fees started increasing. As a chart from this Business Insider article illustrates, mutual funds have increased their total stock market ownership dramatically in the last few decades:

Though I do not have data on the typical number of stocks owned by households in the 1940s–1970s, I would assume that households were not as diversified as a modern index/mutual fund. This means that it seems likely that a larger number of investors have become more diversified in the last few decades.

Does this surprise us? Should we have expected investors in the 1940s–1970s to be diversified when there was little information on the topic? For example, Harry Markowitz, who won the Nobel Prize in Economics for his work on portfolio optimization, did not publicize his ideas until the 1950s, and index funds weren’t created until the 1970s. A Random Walk Down Wall Street, one of the first books to champion index funds, wasn’t published until 1973. Despite the publication, Burton Malkiel, the book’s author, described how hard it was to get people to buy index funds initially:

“Sometimes I used to joke that Jack Bogle and I were about the only people I knew who owned index funds. It was very, very slow to catch on.”

Increased risk

Because many investors were not using index/mutual funds, they had to deal with the psychological trauma and increased risk of holding individual stocks. Even owning a handful of individual stocks could not provide the same safety as a diversified index/mutual fund. For example, I have previously cited a paper by Hendrik Bessembinder that illustrates that more than half of all stocks deliver negative lifetime returns and only 42.1% of stocks have a holding period return that exceeds that of one-month T-bills.

The fact is that almost all individuals picking stocks would have experienced higher risk than if they had diversified adequately. However, in the past, diversification was less well understood, it was more expensive to do manually, and there were fewer diversified options available. Cheap index and mutual funds have fundamentally changed all of that, and investors should expect lower returns as a result of taking less risk.

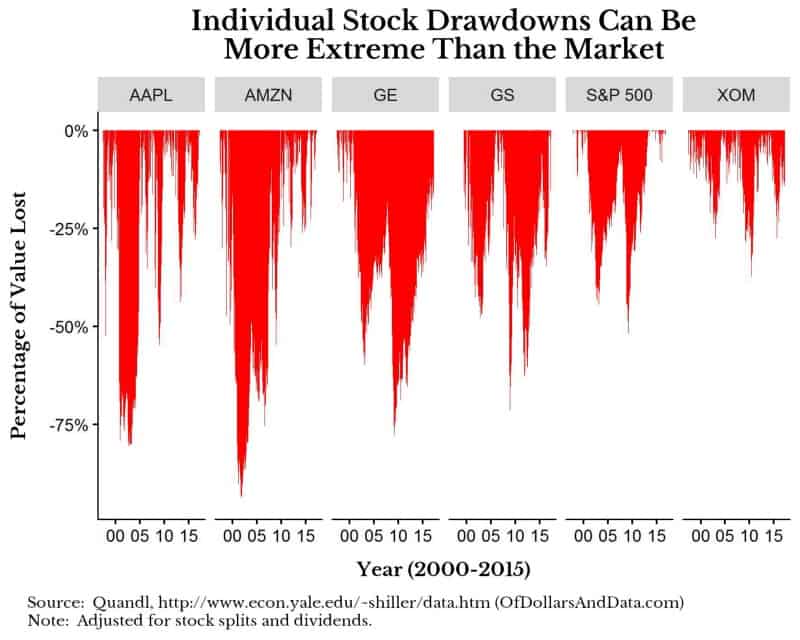

Think of it this way: When you hold the S&P 500 (i.e. in an index fund) you are diversified and have some belief that America as a whole will not fail. However, when it comes to individual companies, the price fluctuations can be more extreme and the fear of failure is real.

To visualize the psychological aspect of this, let’s look at the drawdowns for the S&P 500 and a handful of stocks that have done well historically (Apple, Amazon, GE, Goldman Sachs, and Exxon Mobil):

Besides Exxon (“XOM”), all of the other stocks pictured had drawdowns that were greater than or equal to the S&P 500. This illustrates how even winning stocks can lose enough value (temporarily) that you may doubt your stock picking ability. But this leads me to ask a few questions:

What would you do to avoid this psychological trauma? Would you be willing to give up a few percentage points in expected return to have less risk through diversification?

I would and I am guessing many other investors would as well.

I wish this post was fully my idea, but it isn’t. I re-framed this idea based on a post by the blogger who goes by Jesse Livermore. His blog post is arguably the most important thing I have read this year because of how much it changed my thinking on the future of investment returns. The post is quite complex, but worth the read if this really interests you. In addition, Ben Carlson and Meb Faber have also discussed how future expected returns in the U.S. should be lower based on current valuations.

What To Do About Lower Future Returns?

If I am completely wrong and U.S. stocks provide 6–8% inflation-adjusted returns over the next few decades (as they have historically), then you and I will be rich and we can laugh about my ignorance over an expensive meal and fine wine. However, if you think I might be right about future returns being lower, this could imply a few things:

- Your future savings rate will be far more important than it was in the past. If U.S. stocks return lower, you might need to make this up with more savings. This also implies that higher incomes will be more valuable in the future, as higher incomes make it easier to save more.

- For the same savings rate, having a larger international stock exposure may help, but not necessarily. I still think the U.S. is the best game in town for structural/cultural reasons, however, international stock markets currently seem much cheaper than the U.S., but who knows?

Regardless of whether future returns are lower, I would much rather have today’s investing environment than the one of the past. Investing has become so much easier because of indexing and the average investor is far better off as a result. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 23. Any and all code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data