I know I’m a few months late, but I recently read Jeremy Grantham’s Waiting for the Last Dance where he claims that U.S. stocks are in a “fully-fledged epic bubble.” He states:

I expect once again for my bubble call to meet my modest definition of success: at some future date, whenever that may be, it will have paid for you to have ducked from midsummer of 2020.

Grantham has drawn his line in the sand. Midsummer 2020 is the point at which prices for U.S. stocks got too high. But he doesn’t stop there. He even goes on to bash anyone who is still bullish:

Their best policy is clear and simple: always be extremely bullish. It is good for business and intellectually undemanding.

Well since I am one of these intellectually undemanding, extremely bullish individuals, let’s run the numbers to see just how brave Mr. Grantham’s prediction actually is.

Based on his words, Grantham is predicting that U.S. stocks will be below where they were in the summer of 2020 at “some future date”. When Grantham penned this prediction (January 5, 2021), the Dow was at 30,200. The lowest the Dow got during the summer 2020 was about 25,100 (17% lower than 30,200).

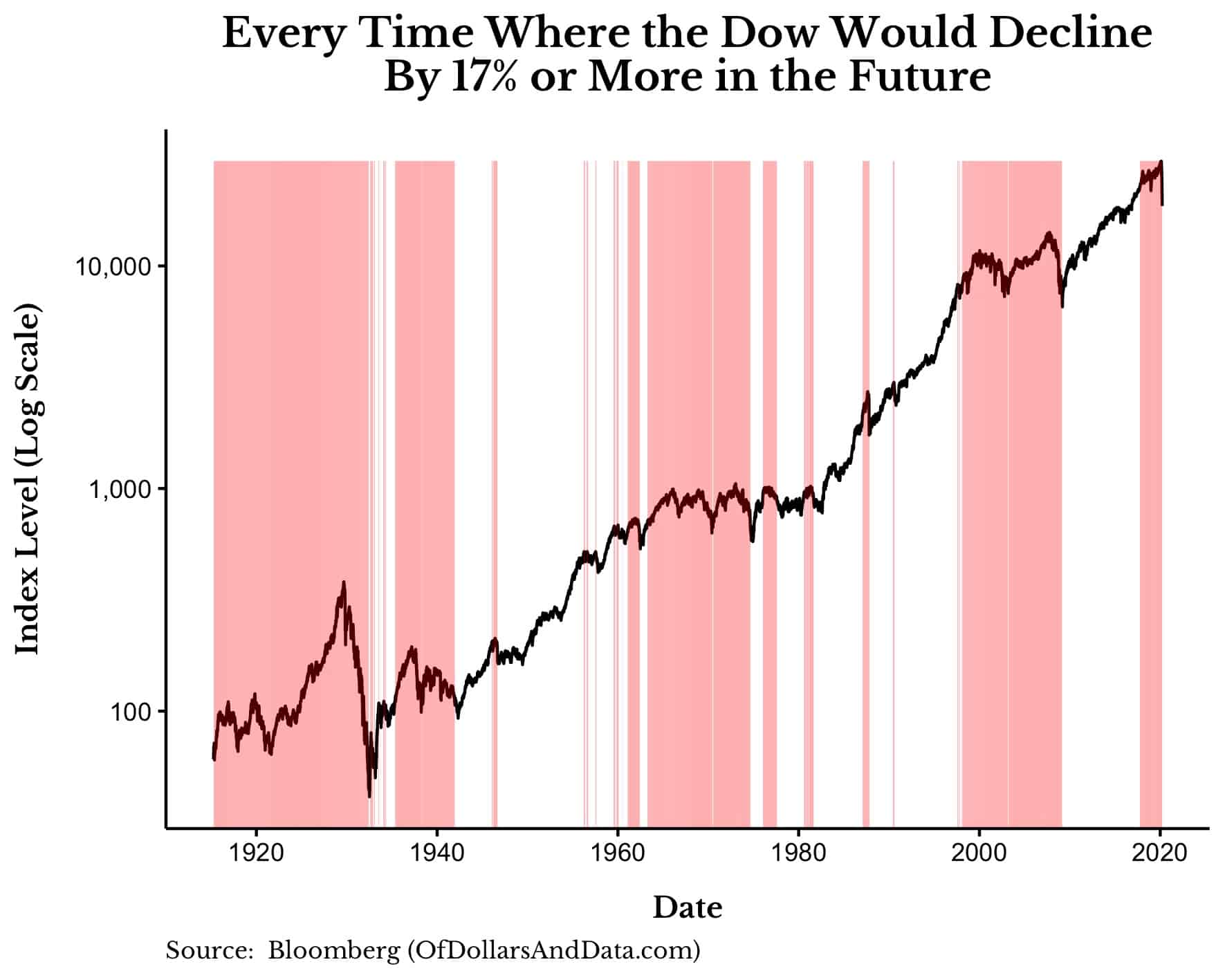

This means that Grantham was calling for at least a 17% (or larger) correction at some point in the future. If we picked a random trading day since 1915, what’s the probability that the Dow would be down 17% (or more) at some point in its future?

53%.

Grantham’s prediction is no better than a coin flip. How’s that for intellectually demanding?

In all seriousness though, how can you take a prediction like this seriously when it’s more likely to be right than wrong, no matter when it was made?

If Grantham had made this prediction on January 5, 2020 or January 5, 1970 for that matter, he is more likely to have been right than wrong. The chart below illustrates this by highlighting every trading day (in red) in which the Dow would have be down by 17% (or more) in its future:

As you can see, making a call like this isn’t that outrageous in the context of history. That’s why I don’t believe Grantham took much intellectual risk when he penned Waiting for the Last Dance two months ago.

But guess what? If the market crashes by 30% or more, he can claim he called it. But, my issue with this is that he has been calling bubble for the last decade. Therefore, it’s only a matter of time until he is “proven” right.

For example, in November 2010 he stressed the importance of holding cash when he said:

It buys you the right to buy the U.S. market if the S&P drops from 1,220 today to 900, which is what we think is fair value.

Since then the S&P 500 is up 335% (not including dividends). In 2014, Grantham provided this two-year outlook:

And then around the election or soon after, the market bubble will burst, as bubbles always do, and will revert to its trend value, around half of its peak or worse, depending on what new ammunition the Fed can dig up.

At that point he claimed that an S&P 500 level of 2,250 would be “100% overvalued.” Six years have passed and the S&P 500 is nearing 4,000 (over 75% above 2,250).

Yes, I am dunking on Grantham, but he shot first. It’s easy to call people “intellectually undemanding” when they don’t agree with you. However, sometimes the intellectually undemanding answer is the best answer.

This idea reminds me of when I used to play Starcraft 2 in my early twenties. For the uninitiated, Starcraft 2 is a real-time strategy game where your goal is to collect resources, build an army, and kill off your opponent.

When I first started playing Starcraft 2 I was very bad at it. I spent too much time focusing on the wrong things and almost always lost as a result. But then I learned about a strategy called “Mass Marines” and everything changed.

The strategy worked as follows: Build a worker. Collect resources. Build marines. Repeat. That’s it. You don’t have to worry about trying to outfox your opponent. You don’t have to worry about getting a more advanced army. You just have to keep building marines.

While this is a boring way to play the game in the long-term, it’s a great way to learn it. And by following this simple strategy, I started to win a lot more. Of course, a strategy like this would never work against a more advanced player, but against novices (like me), it was an easy way to get better.

The same idea is true in investing. There are people who spend lots of time trying to call a bubble when they would be far better off investing according to one simple idea—stocks go up. Does this mean that stocks never go down or that bubbles never occur? Of course not.

While U.S. stocks have never lost money over any 20 year period, nothing guarantees that this will be true in the future. If the next century had an unlucky decade or two for U.S. stocks, I wouldn’t be surprised. The same is true for bubbles. They happen frequently and can be devastating. But since no one knows if (or when) they might occur, there is little to be done about it.

This is why believing that “stocks go up” can seem both foolish and genius at the same time. It’s like this IQ meme on repeat:

Believing that stocks go up (and investing accordingly) is probably better than constantly trying to predict the fair value of the entire stock market.

While I have been a bit critical of Grantham in this piece, as my colleague Michael Batnick pointed out, at least he has been honest about getting things wrong in recent years. As he stated in this Barron’s piece from 2016:

For bubble historians eager to see pins used on bubbles and spoiled by the prevalence of bubbles in the last 30 years, it is tempting to see them too often.

Obviously Grantham understands the problem of calling bubbles too frequently. Despite this, he is once again calling his shot. Maybe he will be right this time. Maybe not.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 233. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data