You have probably heard the phrase before:

Start saving early.

The logic goes that the earlier you start saving and investing, the more time you will have to compound your money, and the more successful you will be as an investor. I agree with this wholeheartedly, however, I think this advice misses the bigger point as to why investing early matters. Investing early matters not solely due to the amount of time for compounding, but because saving money is hard while compounding money is easy. This is a behavioral argument, not a mathematical argument, for why you should start early.

Investing early (i.e. in your 20s) is crucial because you have fewer liabilities that squeeze your budget. The dynamics of investing in your 20s has changed a lot recently with the student loan burden placed upon many college graduates. However, I still believe it is somewhat easier to save some money before you have a mortgage, kids, sick parents, or other major liabilities. Every year that you delay investing you will either need to work one extra year, or save more than you would have saved in prior years, in order to catch up. These are the cruel mathematics of investing later in life.

To illustrate this, let’s run a simulation. Imagine you save money for 40 years from age 25 to 65 and then retire. In each year you save the same amount of money and have it compound annually at some constant rate. The question is:

How much more would you have to save each year going forward if you delayed investment by 1 year (i.e. started at age 26)? By 10 years? How about 20 years?

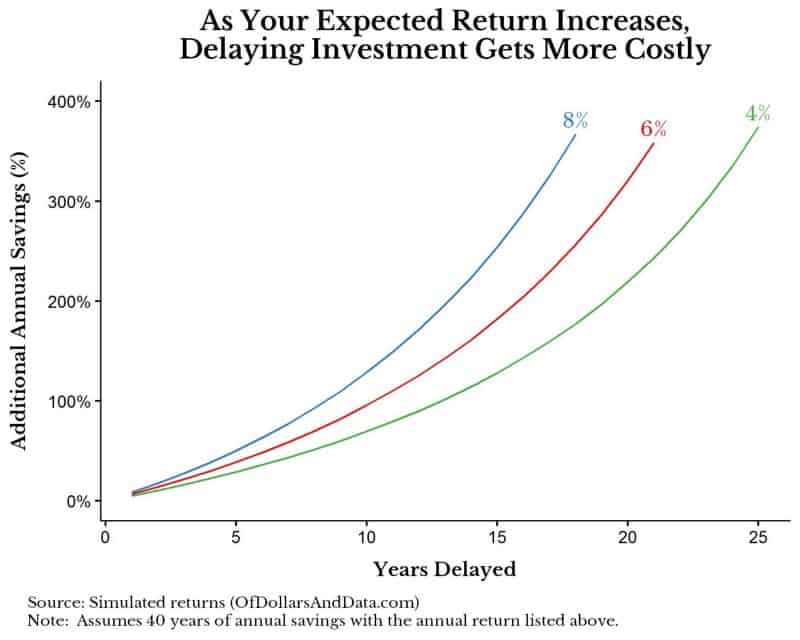

This question requires that we solve some financial formulas, but I have done this for you. The plot you will see below shows the number of years delayed on the x-axis and the amount of additional savings needed, as a percentage, on the y-axis. The additional savings represent the amount of additional money needed to catch up to your original savings plan so that you would end up with the same amount of money for retirement. There are three lines representing three different expected returns going forward (4%, 6%, and 8%). You should notice two things on this plot:

- The higher your expected return, the more costly it is to delay investing. Therefore, if you need a high return to reach your financial goals, don’t delay.

- There is an exponential impact to each additional year you delay investing. Therefore, delaying 1 extra year from 20 years to 21 years is worse than delaying 1 extra year from 2 years to 3 years. This is why those who start late have a very difficult time catching up.

As you can see, the cost of delaying gets exponential with time. If we assume that you originally planned to save $5,000 a year for 40 years, here is how delaying would affect you:

- Delaying 5 years (i.e. starting at age 30) would require 30–50% more money saved annually until your retirement at 65. Therefore, you would need to save $6,500-$7,500 a year for 35 years.

- Delaying 8-12 years would require you to double what you save annually (i.e. $10,000 for ~30 years).

- Delaying 25 years would be catastrophic as you would need to save 5 times more (i.e. $25,000 annually for 15 years), and that is just for the 4% rate. If you expect a higher return, the additional savings required are far higher (i.e. off the chart in this case).

Moral of the story: Father Time is unforgiving to those who wait.

This brings me back to my original point. Since saving money is not easy, you need to start as early as possible because it will likely only get harder as you add more liabilities later on. I think this argument is even more true today as median incomes are stagnant, while education, healthcare, and housing costs are rising. Additionally, I agree that individuals with lower incomes or large debt loads may find it difficult, if not impossible, to save money. Unfortunately, I do not have an easy answer to this problem. I recommend raising your income, possibly through learning programming, but this is easier said than done.

The second part of my original argument is self-evident: compounding is easy. You don’t have to do much work for your money to compound and make more money. This is why, by starting early, you do the harder work up front so that the easier work (compounding) can be done later.

You Can Make Saving Easier Too

Despite the cruel mathematics of delaying investment, you can make saving easier with a few simple tricks:

- Automating your savings (don’t worry about your spending given you have already set aside money to invest)

- Investing your raises (avoid lifestyle creep and invest the difference)

- Save money on big ticket items (I don’t think small items move the dial enough, but shopping around for a cheaper home or car helps a lot)

If all this fails, work a few extra years. Ever year you delay savings you can make up with working an additional year without having to save extra. I enjoy working and can’t see myself retiring, so this is a great solution for people who feel the same way.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 19. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data