Peter Attia, a physician and longevity expert, has a talk on increasing your lifespan where he proposes an incredible thought experiment to his audience (see 16:49):

I would be willing to bet that not one of you, if you were offered every dollar of Warren Buffett’s fortune, would trade places with him right now…And I would also bet, by the way, that Buffett would be willing to be 20 years old again if he was broke.

Consider his thought experiment for one moment. Imagine having Buffett’s wealth, fame, and status as the greatest investor on Earth. You can go anywhere you please, meet anyone you want, and buy anything that can be sold. However, you’re now 87 years old. Would you make the trade? I know it sounds cryptic, but almost all of you wouldn’t.

Attia’s thought experiment got me thinking deeper about another seemingly unrelated question I have been asked by a few friends:

Nick, why don’t you monetize your blog?

I used to respond to this question with, “I am trying to grow my audience,” or “It isn’t worth what little money I would make,” but I recently realized I was wrong. I was thinking about this question incorrectly. I am charging for this blog, but not with money. I am charging you the one thing you cannot replenish, the one thing Warren Buffett can’t buy, the most important asset in the world—your time.

Think of it this way: Each week you get 10,000 minutes to live your life (it’s actually 10,080 minutes, but let’s round for simplicity). If these 10,000 minutes represent 100% of your week, then each minute is 1 basis point (i.e. one hundredth of a percent). If you sleep 7 hours a night that’s 2,940 minutes or ~30% of your week.

If you work 40 hours, that’s another 2,400 minutes or 24% gone. Therefore, if you spend 5 minutes reading one of my posts, that’s 5 basis points of your week that you are allocating to me. I know that doesn’t sound like much, but when you consider the endless amount of content competing for your attention, it’s amazing.

This is why I happily spend ~10 hours a week (6% of my week) writing a 5 minute post that thousands of people will read. It’s why I read 40+ books a year to find diverse ideas to relate back to your finances. It’s why I view writing to you as a privilege, an exorbitant privilege, as Barry Ritholtz once said.

In a world where so many people think they are owed something, I have to remind myself that I am owed nothing. I have to fight, scratch, and claw for your precious attention. And I will. I will scour the Earth for the most intriguing things I can share with you week after week after week. And yes, while my post quality will vary, my goal is to never waste your most important asset.

And trust me that time is your most important asset. Why? Because you will never get a second more than what you already have. Yes, I could discuss the importance of time when it comes to starting early or compounding, but I know you already know that. Time is important primarily because of its scarcity.

Consider this thought experiment and you will see why:

Imagine working extremely hard for years at the neglect of your family so you can earn more money. Let’s say your plan works and you get that promotion you always craved. Now you can take your extra money and invest it. However, a few years later, a downturn strikes and you sell in a panic for a minor loss.

In this thought experiment it sucks that you lost money, but, in theory, you can earn it back later. You can work a few extra years before retiring, but you can’t go back and see your children as children again. You can’t attend that friend’s wedding or mourn a relative with your loved ones twice.

As Epsilon Theory’s Ben Hunt stated, “Always go to the funeral.” The fact is that money will come and go in your life, many times as a result of good and bad luck, but your time is only here now, so don’t squander it.

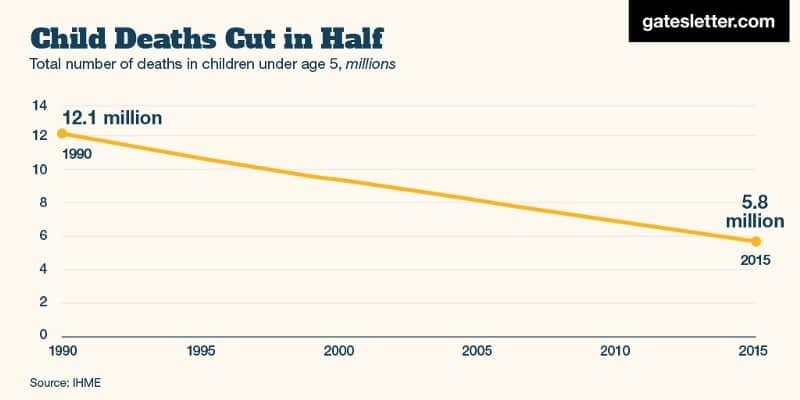

And don’t start believing that there isn’t enough time to do what you want in life. That idea is self-defeating. If anything, our society is creating more time for more people than ever before. Just consider this beautiful graphic, which I have discussed before, from the Bill and Melinda Gates Foundation:

Look at all of those children we saved and all of that human time we created! All of those lives, billions of hours collectively, would have been wiped from existence but for modern medical knowledge. This explains why the death of a child is so tragic compared to the death of a centenarian: the child never had a shot at life, but the 100 year old did.

Nevertheless, 5.8 million children died in 2015. Children who never got to fully live, love, or dream big. Children who never had their time, so whatever you do, don’t waste yours…

Knowing When To Trade

The key to changing your worldview on time is knowing when to trade it for money. Obviously, if you don’t have much money, you don’t have many options for trading, but as you gain wealth, this tradeoff will become more relevant.

The traditional way to think about when to trade your money for your time has been to pay for anything that is below your hourly wage. This explains how one could justify paying for a cleaning or laundry service. I generally agree with this, but it can be expanded.

You should also trade your money for anything that you would regret missing on your deathbed. If you can imagine yourself regretting skipping an event in your final days of life, then you should trade money for it today.

This worldview is something I only adopted recently, but it has made my decision-making process so much easier when it comes to tradeoffs like these. For example, I would probably spend money to visit a good friend, but I wouldn’t spend money to have a nice car. I will (hopefully) remember seeing my friend on my deathbed, but the car? No chance.

Lastly, I do technically monetize this blog through Amazon affiliate links (i.e. if you buy a book I link, then I get a small percentage). However, the goal was not strictly monetization (I’ve made ~$1 per hour worked on this blog), but tracking which books readers bought the most.

With that being said, if you really like issues of time and time travel, I highly recommend the fiction book Replay by Ken Grimwood. Please just trust me and DO NOT READ THE SYNOPSIS. Go in blind and you will thank me later for it.

I also recommend the films Memento, Primer, The Butterfly Effect, and Twelve Monkeys for other takes on time travel (sorry it’s my favorite genre). Until next time, don’t forget where you spend your basis points each week and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 81. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data