Almost two years ago, I wrote a post about some regrets I had early in my career. As I stated:

While many of my friends went off to big tech firms (i.e. Facebook, Amazon, Uber, etc.) and got that sweet, sweet equity compensation, I worked at the same consulting firm for six years where I was paid generously, but had no such upside. I didn’t realize how much I was missing out until it was a bit too late.

But, after the brutal selloff across the tech sector this year, I’m starting to have second thoughts.

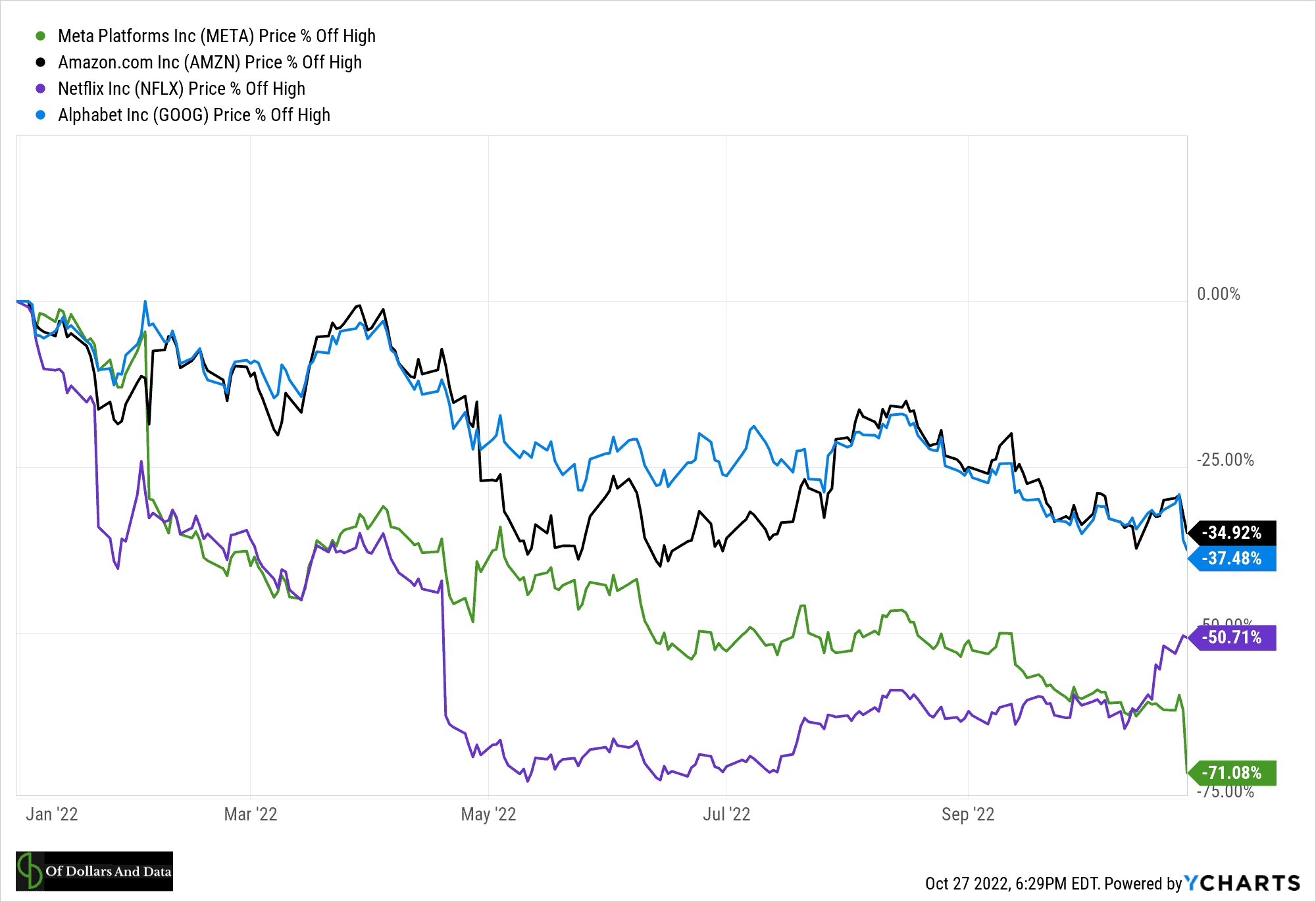

For some context, four out of five of the FAANG stocks (Meta, Amazon, Netflix, and Alphabet) are down 35%-71% in 2022, while the S&P 500 is down only 21%:

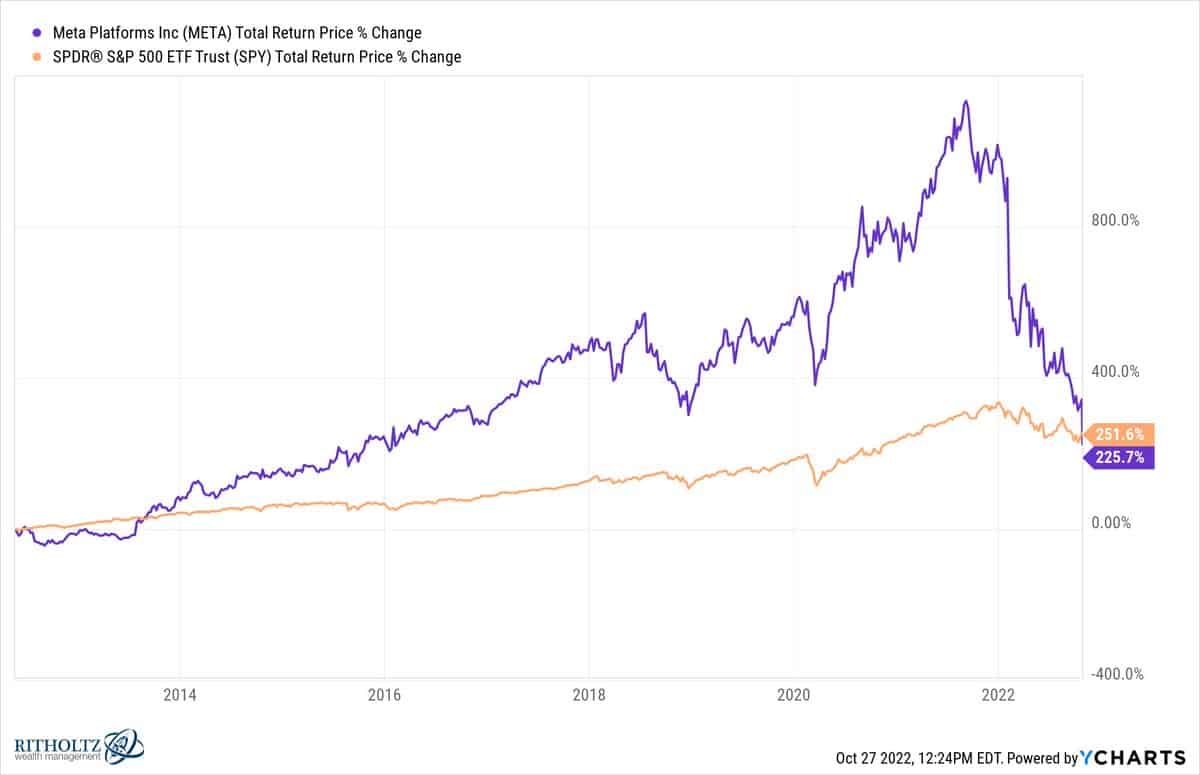

In fact, Meta is down so bad that it’s underperformed the S&P 500 since its IPO on a total return basis (props to Ben Carlson for this find):

When I see charts like this, it makes it easier to think back and rationalize my early career choices. I can tell myself that not joining a big tech firm was the right move after all. But, the more I think about it, the more I realize that this kind of thinking is an illusion.

Because we can’t see how else my decision could’ve turned out. We can’t see the world where big tech continues its upward trajectory in 2022 and beyond. We also can’t see the world where big tech crashed in 2015 and I got laid off. We can only see how things turned out in this version of the world. And while we can imagine many different ways in which history could’ve unfolded, at the end of the day we don’t live in those alternate realities. We live in this one.

Because of this, we too often end up judging our decisions by their outcomes rather than by the processes we used to make them. This is what Annie Duke calls resulting, and it can lead to all sorts of problems when trying to judge your previous choices. One area where I’ve struggled in this regard is with my investments into Bitcoin. For example, in March 2019 I wrote:

My biggest investment blunder so far is buying 1 Bitcoin at $7,500. I still own it despite its price being cut nearly in half. I don’t know if this is a mistake yet, but time will tell.

Nearly three years later I sold half my Bitcoin at $52,000. By chance my greatest investment “mistake” turned into my greatest investment ever. However, with Bitcoin currently trading at a little over $20,000 a coin, not selling it all at $52,000 seems foolish in hindsight. Was it foolish to keep half? What about investing in Bitcoin in the first place?

The truth is that I bought Bitcoin because optimal portfolio theory suggested a 2% allocation and I sold it because I needed to rebalance. My process for both of these decisions remains sound. However, if Bitcoin had never broken out above my original purchase price of $7,500 a coin, would these processes still seem rational? I’m not so sure. Why?

Because the present defines the past. How we view yesterday is determined by what is happening today. Something that seemed trivial years ago can suddenly have meaning and something that was once important can instantly lose its significance.

Our decisions are no different. In a time when many investors are facing significant losses, it can be easy to question your investment choices over the past year. I know it all too well. If you recall, I lost $2,800 earlier this year investing in altcoins and recently liquidated two individual tech stocks that cost me another 1% of my investable assets. While it’s logical to regret these speculative bets today, a part of me also knows that if the tech bubble had continued into 2022, I’d be singing a different tune.

This is why re-evaluating your investment choices in a down year can be so tough. Because you are going to debate whether your choices made any sense to begin with. When bonds are having their worst year since 1931, you might question why you ever owned bonds in the first place. When international stocks are still underperforming U.S. stocks, you might reevaluate your foreign equity allocation altogether. And so forth.

But, whatever you’re thinking right now, you have to realize that you’re being biased by current events. The present is redefining your past. Sometimes this is necessary so that you don’t make the same mistakes again in the future. However, sometimes, the present can teach you the wrong lessons. Differentiating between the two (i.e. signal vs. noise) is the hard part. This is why I have a love/hate relationship with this quote supposedly said by John Maynard Keynes:

When the facts change, I change my mind. What do you do, sir?

The problem with this quote is that the facts are always changing. This is especially true in financial markets. Prices fluctuate. Earnings get released. Rates go up and down. How do you know which facts you should pay attention to and which you should ignore? It’s not easy. Let me demonstrate this with another example.

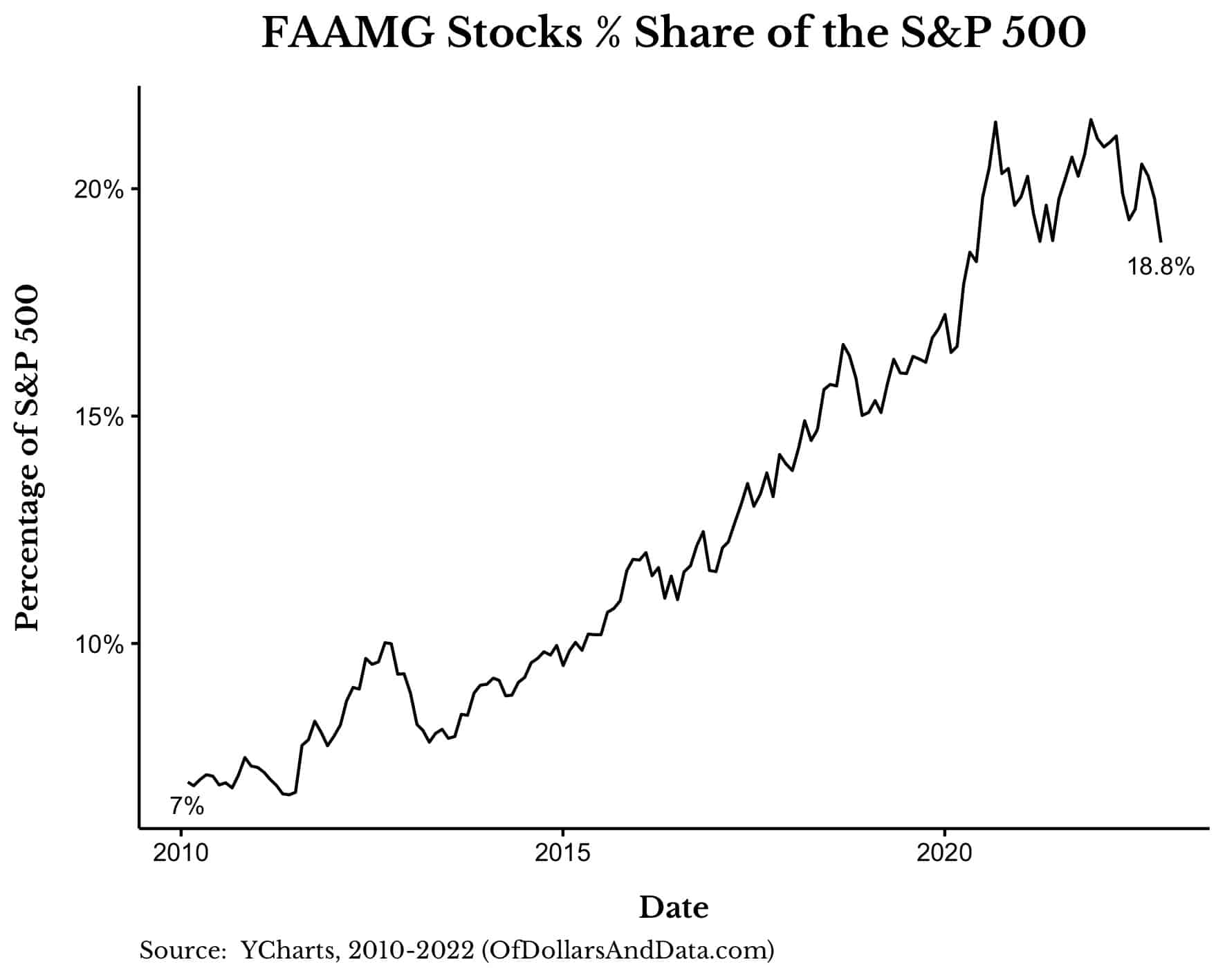

I started this post by discussing how badly big tech has been doing this year and implied that I had made the right choice by avoiding the industry altogether. But that’s not the full story. Because, despite the recent pullback, big tech still represents a larger share of the U.S. stock market today than when I first wrote about its dominance in January 2020:

So, which is it? Is big tech dying or just in a temporary lull? Was I right to avoid the industry and chase my dreams? Or should I have joined the mass exodus to Silicon Valley when I had the chance?

I’ll never know the answers to these questions. I’ll never know if I made the “right” choice. The truth is, you won’t either. And that’s okay. Because the present only defines the past…if you let it.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 319. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data