There have been five mass extinctions in Earth’s history. They occurred 444, 375, 251, 202, and 66 million years ago. You already know about the most recent extinction that took out the dinosaurs. Remember the asteroid? Perfect. But, what you probably don’t know is just how bad the asteroid impact was. Thankfully, The Ends of The World by Peter Brannen does it justice:

What they mean is a rock larger than Mount Everest hit planet Earth traveling twenty times faster than a bullet. This is so fast that it would have traversed the distance from cruising altitude of a 747 to the ground in 0.3 seconds. The asteroid itself was so large that, even at the moment of impact, the top of it might have still towered more than a mile above the cruising altitude of a 747. In its nearly instantaneous descent, it compressed the air below it so violently that it briefly became several times hotter than the surface of the sun.

In the aftermath it was estimated that 75% of all species went extinct and more than 99.9999% of all organisms on Earth died. As grim as this seems, the extinction at the end of the Cretaceous is not even the worst mass extinction in Earth’s history. The Permian mass extinction, which occurred 251 million years ago, eliminated 96% of all species and killed virtually all living things.

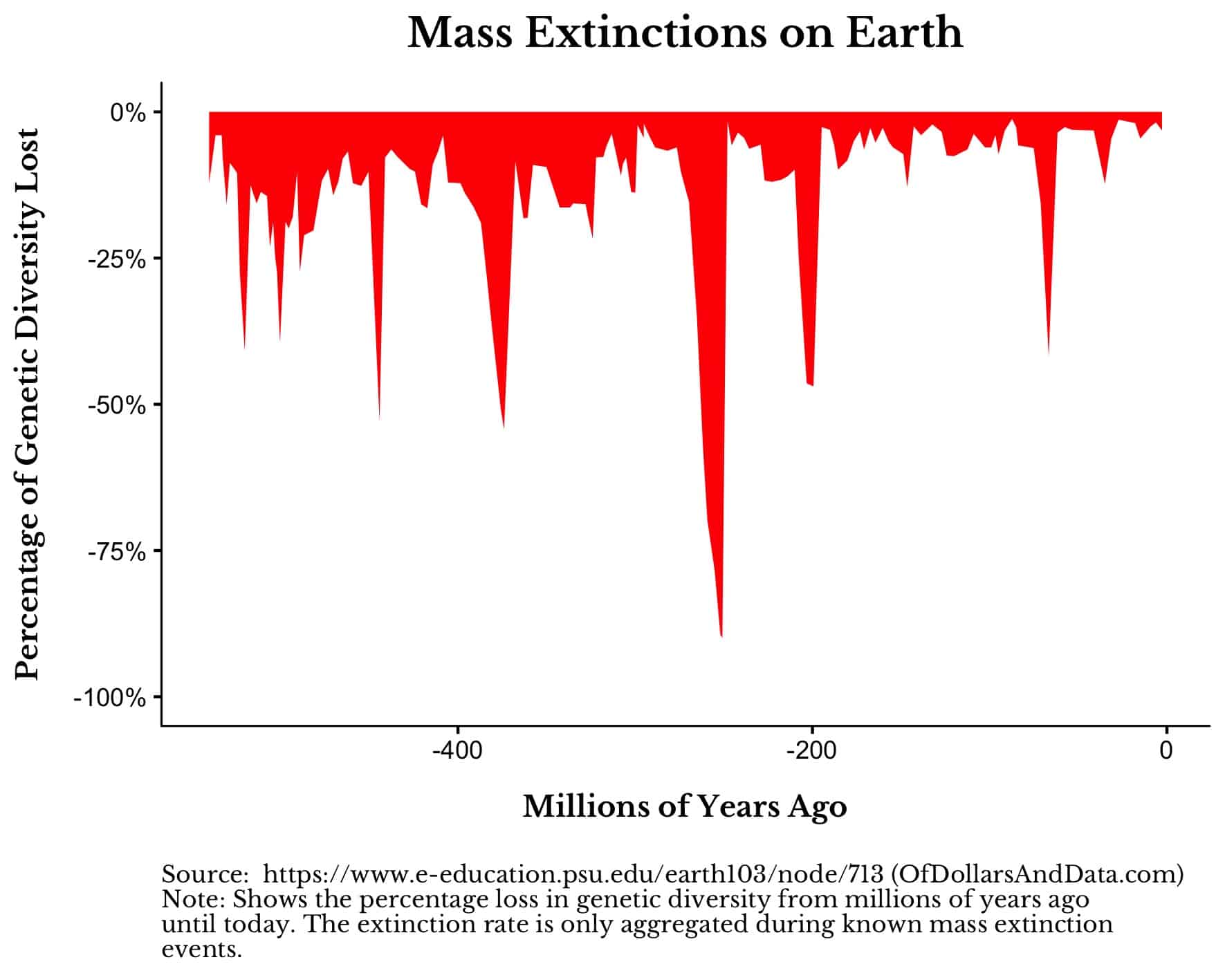

We can visualize just how devastating these mass extinctions were over Earth’s history using some data I found online:

As you can see, the Permian mass extinction is unmatched in its utter devastation of life on Earth. Between the 140 degree (60 Celsius) heatwaves, the 500 mph hurricanes (called “hypercanes“), and the unprecedented volcanic activity, the late Permian was as close to Hell as one could imagine. As the ocean’s became a global jacuzzi, bubbling at 104 degrees (40 Celsius), most of the world’s sea life were killed off. The same went for most of its animals, plants, and insects. Dead. Dead. Dead.

The lesson from ecological history is two-fold. Firstly, extinction is common. As nature creates, so it destroys. And sometimes it destroys almost everything. Second, despite repeated biological carnage, life finds a way to survive. Despite the worst of odds, we are still here. Every animal, every plant, and every microbe alive today evolved from something that survived Earth’s most horrifying eras.

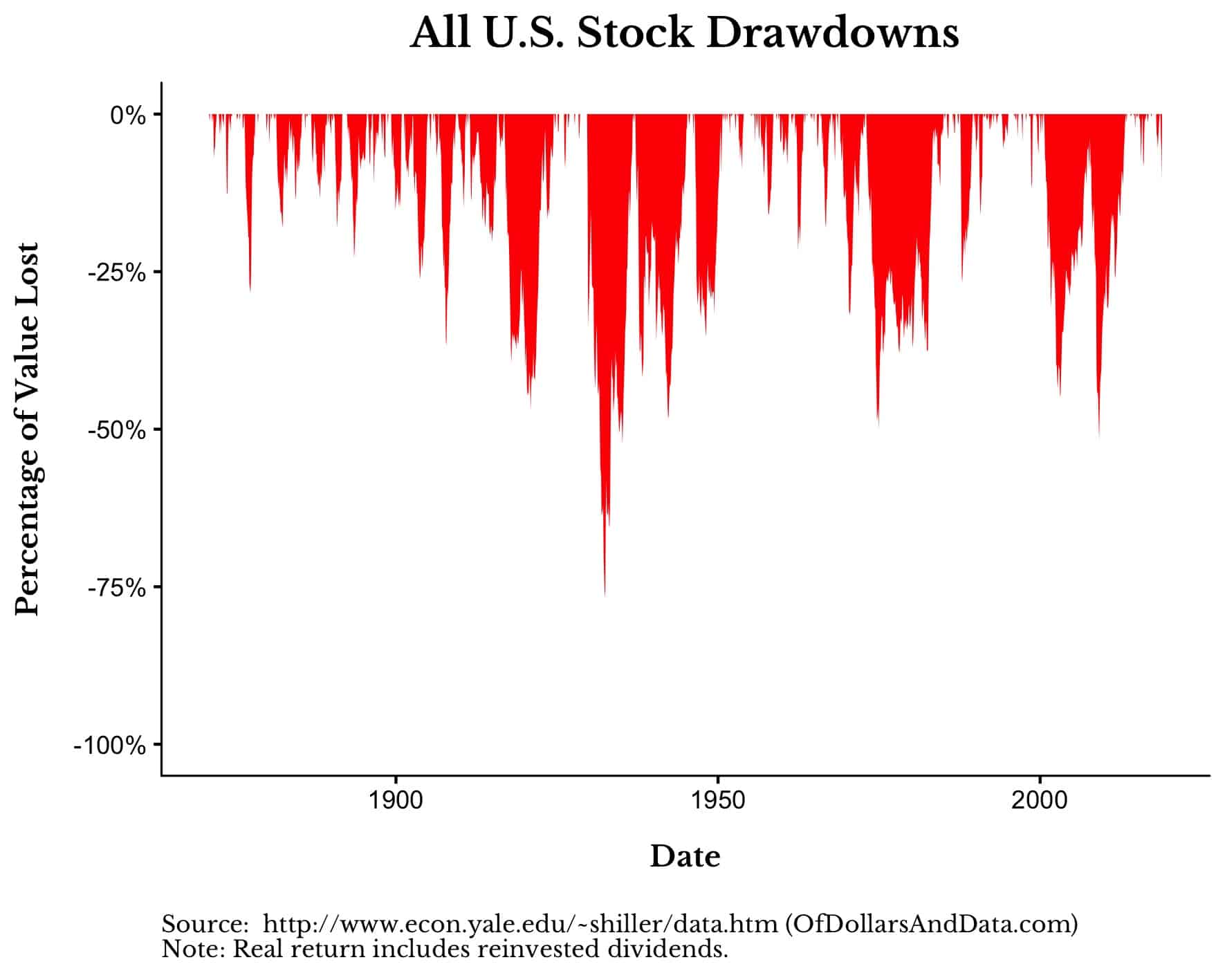

These same lessons also apply to financial history, where global capital markets have managed to persevere through the darkest of times. Consider the drawdowns that have been experienced in the U.S. stock market since 1871:

Each drawdown represents a period of wealth destruction. A period where the market lost a third, a half, or even up to 90% of its value. A period where some American businesses went extinct.

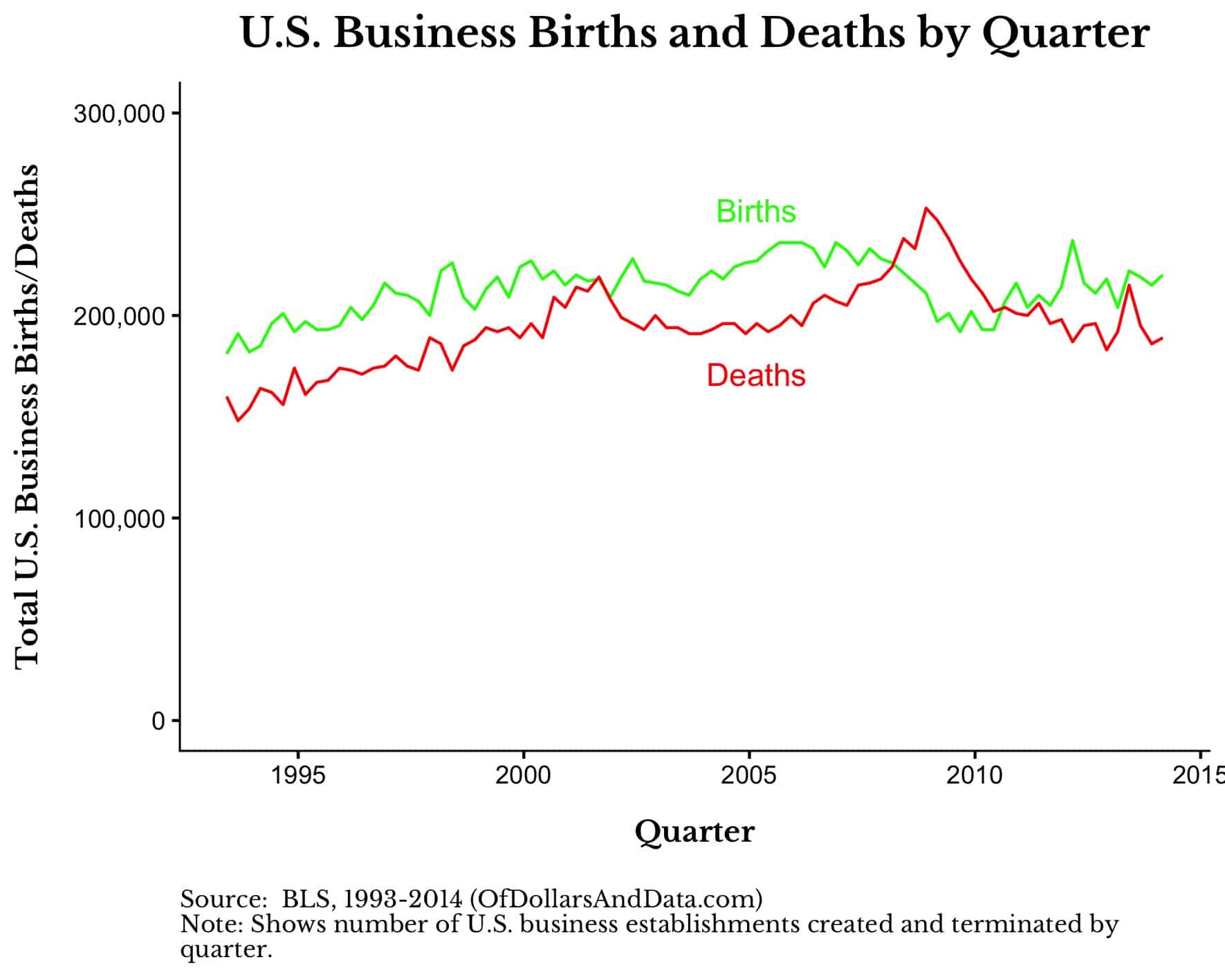

If we examine U.S. business births and deaths during the Great Financial Crisis, we can see this unfold more clearly. Over the two years from Q2 2008 to Q2 2010, the American economy lost, on net, 241,000 businesses:

Yet, this is child’s play compared to the Great Depression where half of all U.S. banks failed and millions of Americans lost their life savings. Read The Great Depression: A Diary by Benjamin Roth and you will see just how bad it was. Unemployment was at record highs, few had money to spend, and people were starving in bread lines. And this all happened less than 100 years ago!

Yet, this is child’s play compared to the Great Depression where half of all U.S. banks failed and millions of Americans lost their life savings. Read The Great Depression: A Diary by Benjamin Roth and you will see just how bad it was. Unemployment was at record highs, few had money to spend, and people were starving in bread lines. And this all happened less than 100 years ago!

Yet, despite the bleakness of the times, the lost fortunes, and the ruined lives, the American financial system survived. As Warren Buffett so eloquently stated:

In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.

But we don’t just have to focus on the U.S. to make this point. We can do Japan, who was ravaged by war and, eventually, one of the world’s worst asset bubbles. Or we can do Germany who experienced severe hyperinflation. Or Argentina and their debt crisis. All fell on hard times and all are still here today.

This is the nature of financial markets. They experience shocks to their component parts (i.e. bankruptcies, panics, etc.) and they somehow endure. It is as if they have a will to go on, a will to survive…

Just Survive

In the world of investing, you don’t have to be bold. You don’t need to find alpha. You just need to survive. This idea was brilliantly expressed by Meb Faber in Corey Hoffstein’s Flirting with Models podcast (start around 36:00):

I think a lot of what applies to our world of professional management, but also investors, is you just wanna stay in the game…the biggest important thing is to make sure that you live to invest another day. A lot of the very basic stupid mistakes are the most important things to avoid.

Faber’s idea is similar to the one Charles Ellis put forth in Winning the Loser’s Game. Ellis said that the key to being a successful investor was not in winning, but in not losing. By avoiding the big mistakes that befall most investors, you can come out ahead in the long run. This means avoiding leverage, short-term thinking, and a host of other behavioral biases that have plagued investors since the dawn of capital markets. So, don’t try to win. Just survive.

The title of this post comes from this lesser know Pantera song and most of the extinction facts come from The Ends of the World, one of the most fascinating books I have read recently. I highly recommend it. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 120. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data