Before the 1800s, smallpox was a global killer. If you were unlucky enough to contract it, your chance of dying was one in three.

Most of the people in the Americas perished at the hands of smallpox (following the arrival of the Europeans) and millions more in the Old World experienced the same fate. It has been estimated that somewhere between 10% and 20% of the British populace died from this brutal disease.

But, this all changed after an enterprising physician by the name of Edward Jenner pioneered the first smallpox vaccine in 1796. Not only was this the first vaccine in human history, but the word vaccine was coined from the phrase variole vaccinae meaning “smallpox of the cow.”

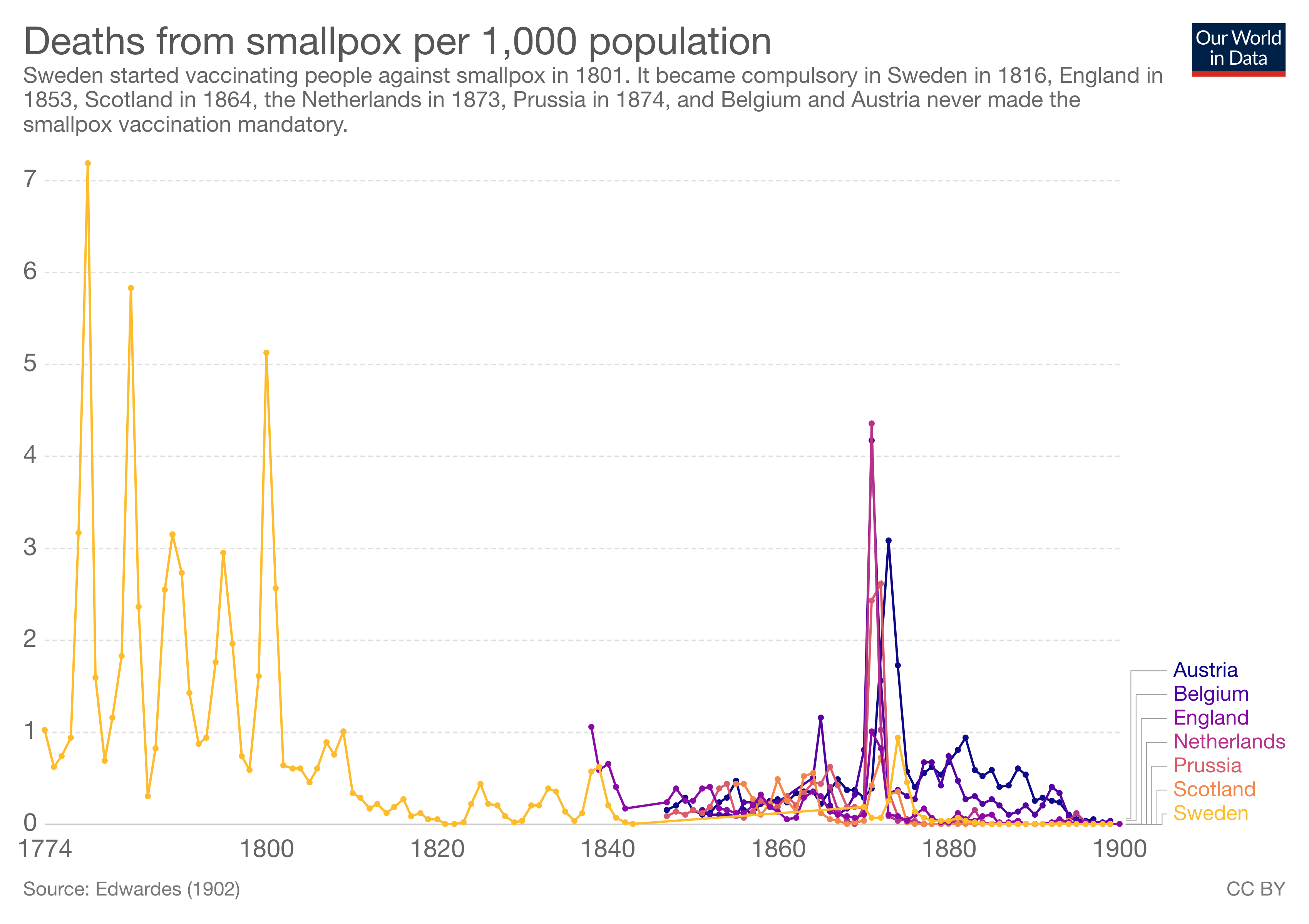

Following Jenner’s discovery, per-capita deaths from smallpox plummeted across the globe over the next century:

The smallpox vaccine was the closest thing to magic that most people had ever experienced. A shot in the arm and you were immune from one of the deadliest diseases in human history.

Despite the miraculousness of this discovery, it took time before vaccines became the known solution to a common problem. Today, there are no substantive scientific debates about whether vaccines work. Despite what the anti-vaccination community might say, vaccines are essentially a solved game.

This is why you won’t see any articles titled, “7 Tips to Prevent Polio This Winter.” No. There is only one right answer: get vaccinated and ensure that everyone else does as well.

Unfortunately, investing isn’t a solved game. There are no true secrets to be learned. And if there were any, everyone else would already know them.

This is why there will never be a quick or easy way to get rich. Because if getting rich were easy, everyone would be rich by now.

As Rory Sutherland stated in his recent book Alchemy:

Most valuable discoveries don’t make sense at first; if they did, somebody would have discovered them already.

This does not imply that we won’t make new discoveries in the future, but that these discoveries will probably be counterintuitive.

Now think about what this conclusion implies about the multitude of problems you and I face today. If any of these problems were easy, they would have been solved already.

This means that only the hardest, most complex problems remain. It is a form of survivorship bias that will cause us difficulty for the rest of our lives.

Investing is the perfect example of a complex problem with no known solution. The closest thing we have to a “solution” is to Buy and Hold a diversified portfolio. But, even Buy and Hold is anything but easy.

Why do I say this? Because, as I have written about before, there is a big difference between the destination and the journey. It reminds me of this line from Fred Schwed’s Where Are the Customers’ Yachts?:

Like all of life’s rich emotional experiences, the full flavor of losing important money cannot be conveyed by literature. You cannot convey to an inexperienced girl what it is truly like to be a wife and mother. There are certain things that cannot be adequately explained to a virgin by words or pictures.

Lived experience cannot be replaced by numbers and charts just like the complexity of investing cannot be simplified with a few soundbites. The world is far messier than that. Yet, most of the mainstream financial advice out there is premised on getting rich with a few simple tips. But, it’s never that easy.

Take me for example. You want my financial secret? Be born at the 90th percentile of IQ and work ethic. Have good parents that love and support you. Start getting straight As in 3rd grade and don’t stop.

Get into a great college that offers generous financial aid. Get a high paying job after graduation. Save 35% of your after-tax pay. Invest in a globally-diversified portfolio of income-producing assets.

Of course this took hard work, but it took just as much, if not more, luck. But that message doesn’t sell, does it? And no this isn’t some fake humility. I’ve just had a gift since I was a little kid. Plain and simple.

But, who wants to hear that you have to get lucky and that hard work is the new tables stakes? No one.

Most people don’t want the truth. They want a secret. So if that’s what you want, I’ll give you the only secret you will ever need—there are no secrets.

Where the “Experts” Might Not Be Experts

Everything I discussed above regarding having “secret” knowledge was centered on investing, but the same logic applies to other domains as well.

For example, why do you think the market for health and nutrition advice is so vast? Because, just like investing, there are no secrets, but people want to believe that there are.

You might argue otherwise by saying things like “just cut sugar”, “remove all carbs” or “avoid animal products,” but then I would argue that health/nutrition is far more complex than that.

The biggest sign that an industry’s experts are not truly experts is when the industry has a large variance in its popular opinions. For example, if some people believe that you should do X and another group believe that you should not do X, then that field is likely not well understood.

I am not saying that there are no experts in investing or diet/nutrition, just that a large variance suggests that the experts know less than what we might initially perceive.

Besides variance of opinion, the other thing to look out for are “simple” or “easy” solutions to these complex problems. Humans have been trying to solve certain kinds of problems (i.e. investing, health, etc.) for thousands of years, so you should be skeptical of anyone who claims to have a simple solution.

Yes, some people will have useful tips, but no one person will have all the answers. And remember, what worked for them may not work for you.

I am guessing this advice is somewhat like preaching to the choir, but you would be surprised how many times I have fallen for “simple” solutions in non-investing domains. It’s probably because my guard is down when I have little familiarity with a topic.

So, don’t make my mistake. Stay on the alert, especially in those areas that you know little about. That’s where they will try to get you.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 143. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data