Buying a home is likely to be the biggest financial decision you will ever make. As a result, such a decision requires careful consideration of your financial situation, personal life, and the state of the housing market. And with interest rates at their highest levels since 2008, many are worried that now isn’t the right time to become a homeowner.

But before we write off the housing market entirely, let’s do a deep dive on the real estate market to definitively answer the question, “Should I buy a house now?”

The Current Housing Market

If I had to categorize the early 2023 U.S. housing market it would be slowing sales, decreasing prices, and surging mortgage rates.

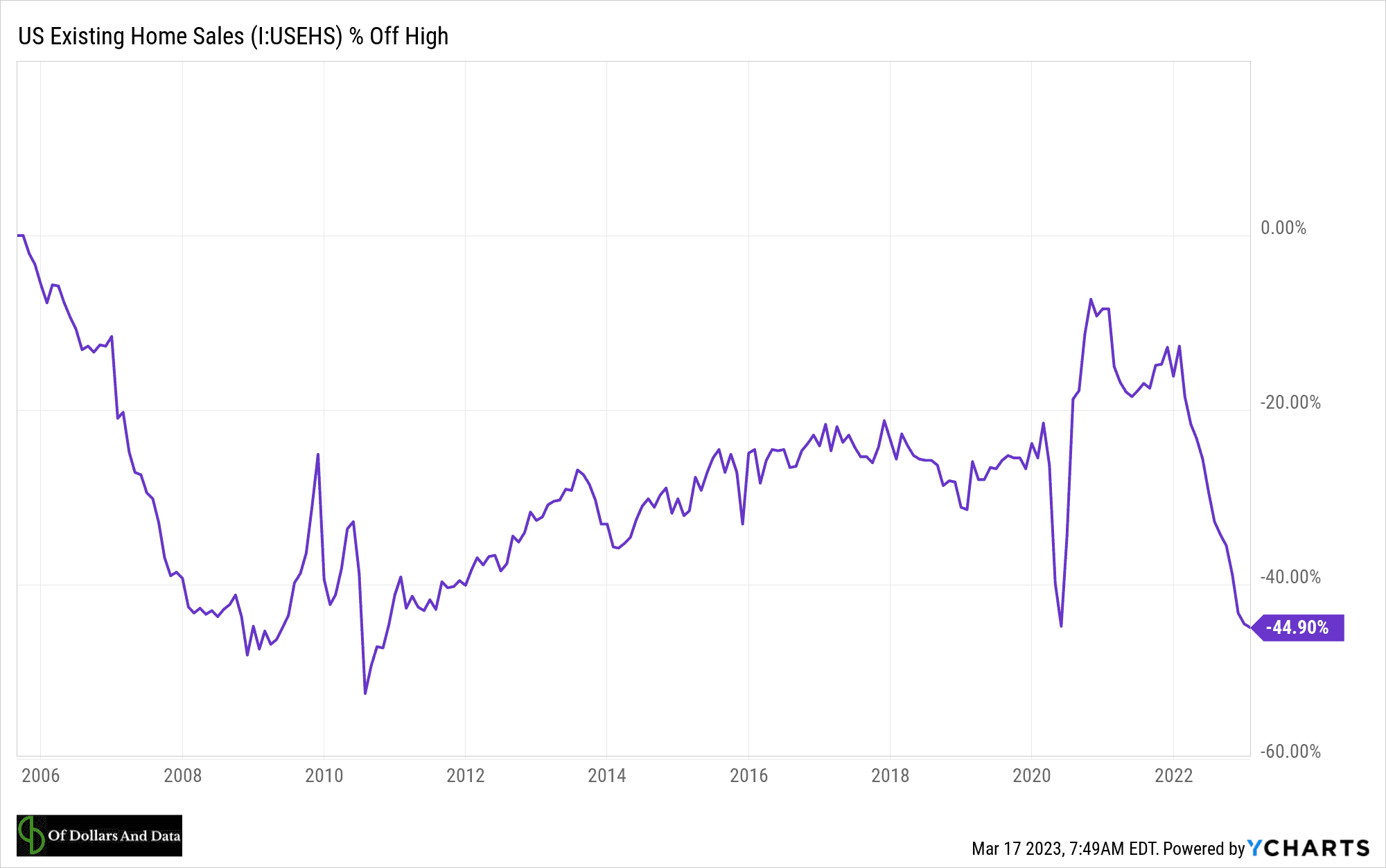

As you can see below, existing U.S. Home Sales have dropped by a lot since their most recent peak in late 2020:

This is the largest decline in U.S. existing home sales since the housing crisis in 2008.

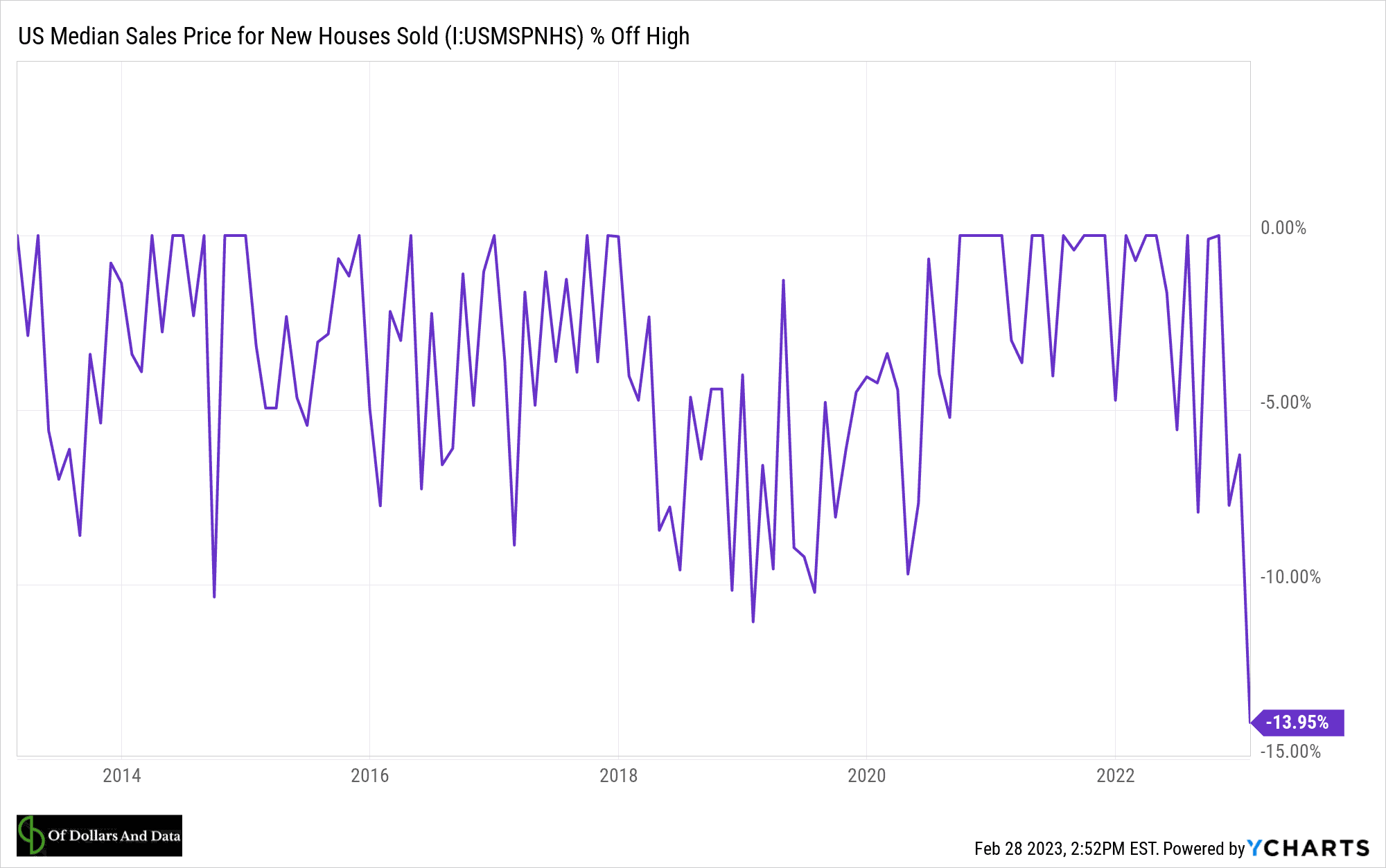

And, with decreased demand, prices have begun to come down as well. The median sale price for existing U.S. homes has dropped by 13% while the median sale price for new U.S. homes has dropped by 14% within the last year:

To put this in perspective, the median sale price of an existing home in the U.S. dropped from $408,600 in May 2022 to $359,000 by January 2023.

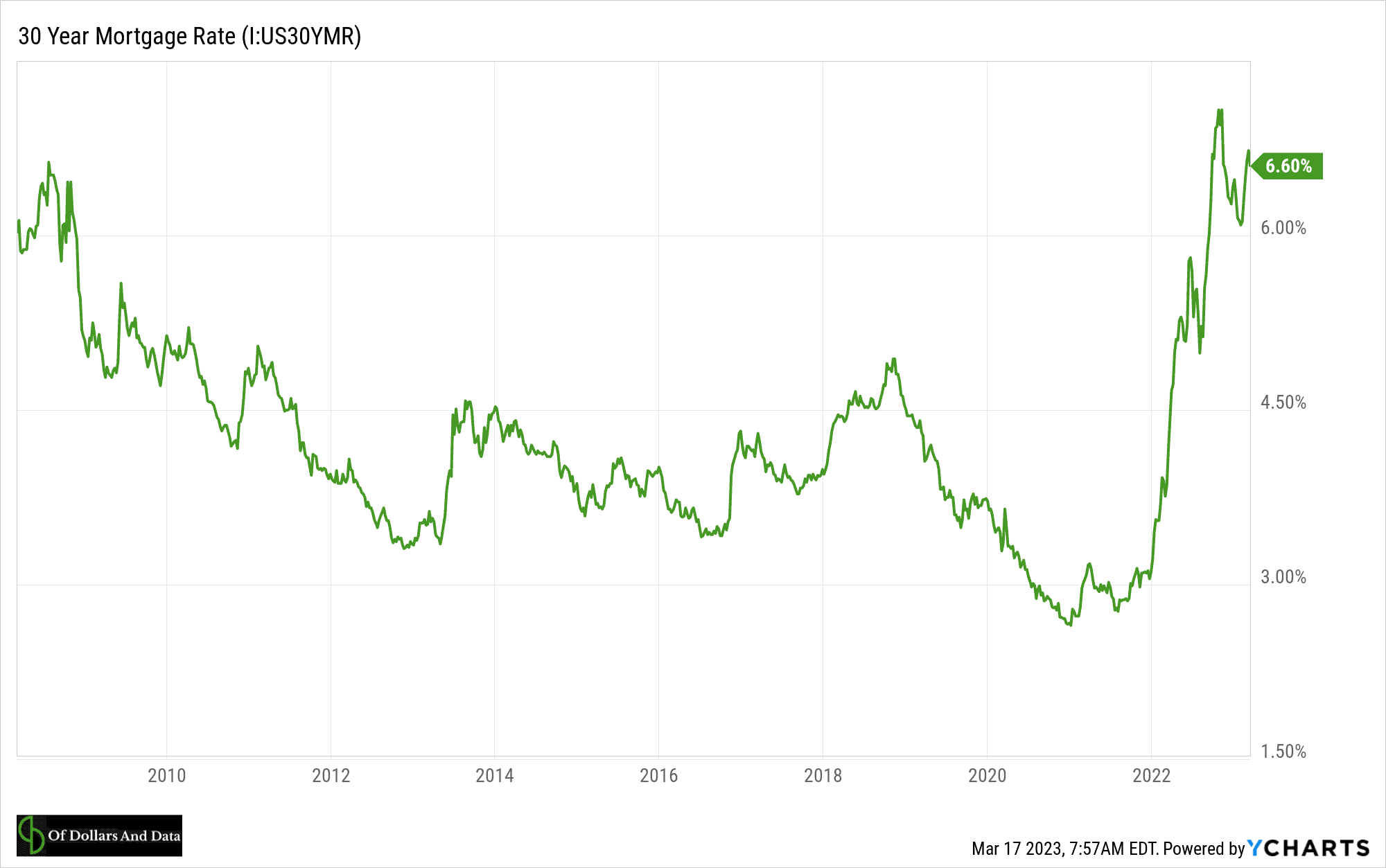

How did this happen? As you probably already know—rising mortgage rates.

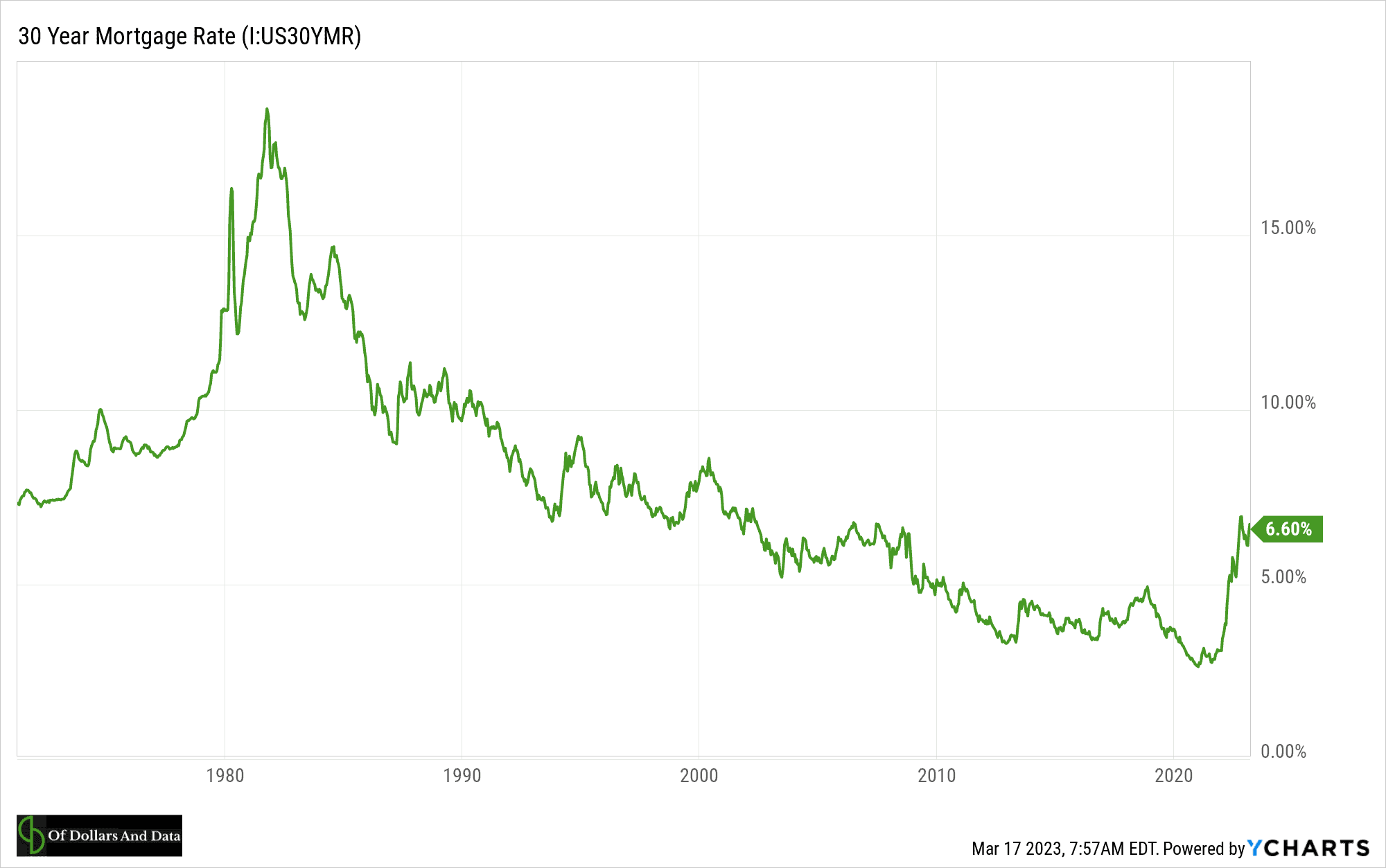

The 30-year mortgage rate in the U.S. is at its highest level since 2008:

And higher mortgage rates mean more costly mortgages.

How much more costly? To be precise, the monthly mortgage payment required to buy the median existing U.S. home has gone up over 75% since the beginning of the pandemic [assuming a 20% downpayment and a 30-year fixed rate mortgage]:

To put this in perspective, in January 2020 the monthly mortgage payment required to buy the median existing U.S. home was under $1,000. As of January 2023, it was $1,772 (which is down 11% from the peak of $1,995 per month in October 2022).

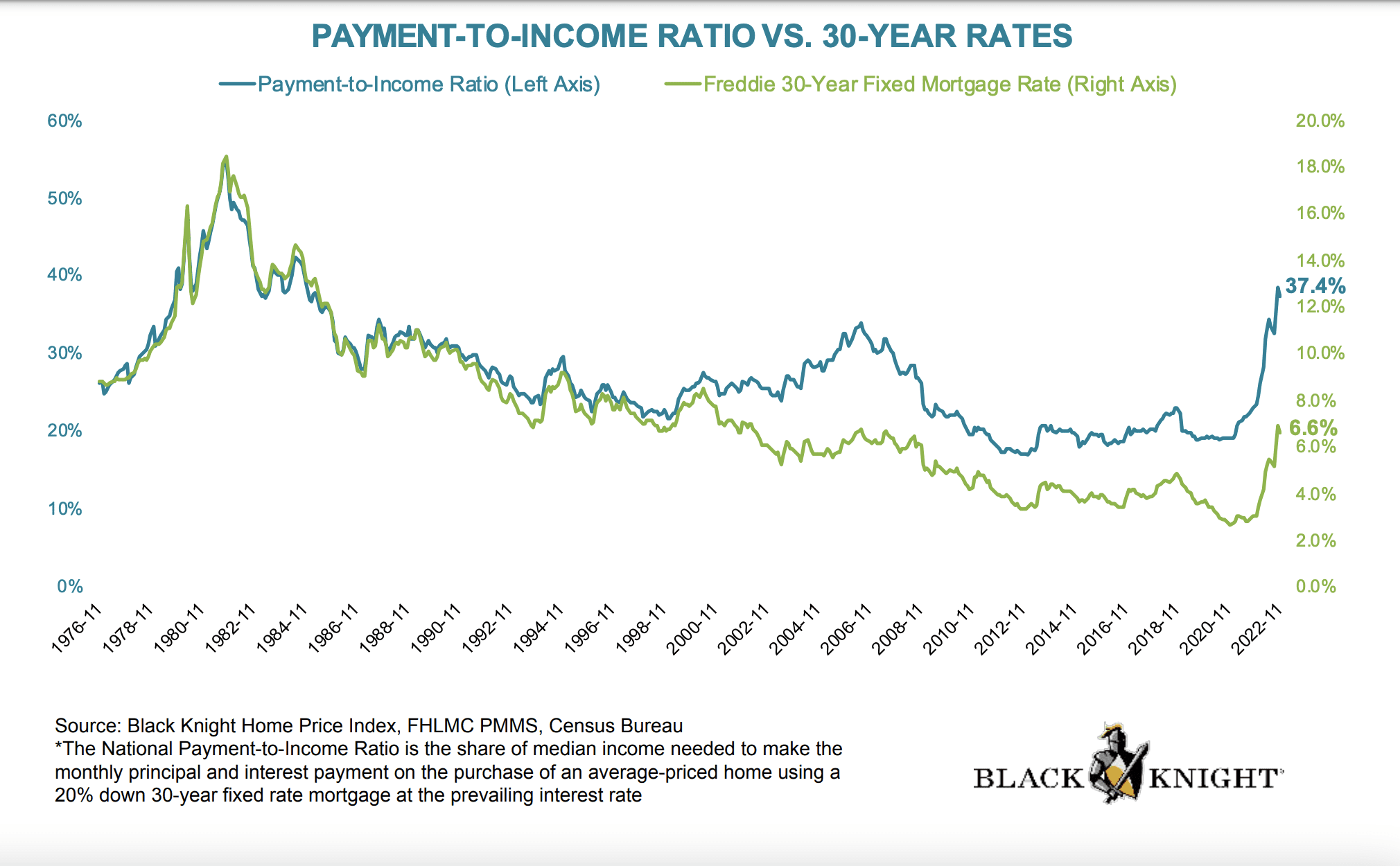

With such rising costs, affordability has become a serious issue in the real estate market. As research from Black Knight illustrated, the payment-to-income ratio for the average-priced home in the U.S. is at its highest level since the early 1980s:

As a result, many prospective home buyers are being priced out of the market. And for those homeowners that can afford to buy, they have little incentive to because they don’t want to give up the low mortgage rate they locked in years ago.

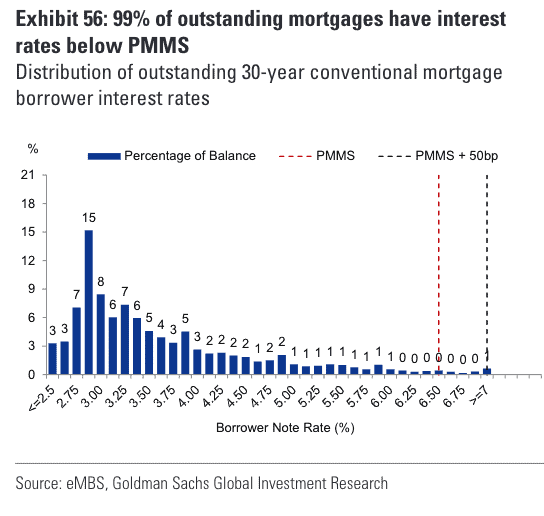

You can see this clearly if you look at the chart below (from Goldman Sachs Global Investment Research) which shows that 99% of borrowers have a mortgage rate below the current market rate:

Between the affordability issues and increased mortgage rates, it’s no wonder that the housing market has slowed significantly.

However, despite these bearish headwinds in housing, there are many reasons why now is a great time to be a homebuyer.

Why It’s a Buyer’s Market in Real Estate

The 18th century banker Baron Rothschild once said:

The time to buy is when there’s blood in the streets.

While Rothschild was referring to stocks and currency trading, the advice can apply to any asset class experiencing distress. And with the housing market going through its most difficult period since 2008, there’s definitely some “blood in the streets” that homebuyers can capitalize on today.

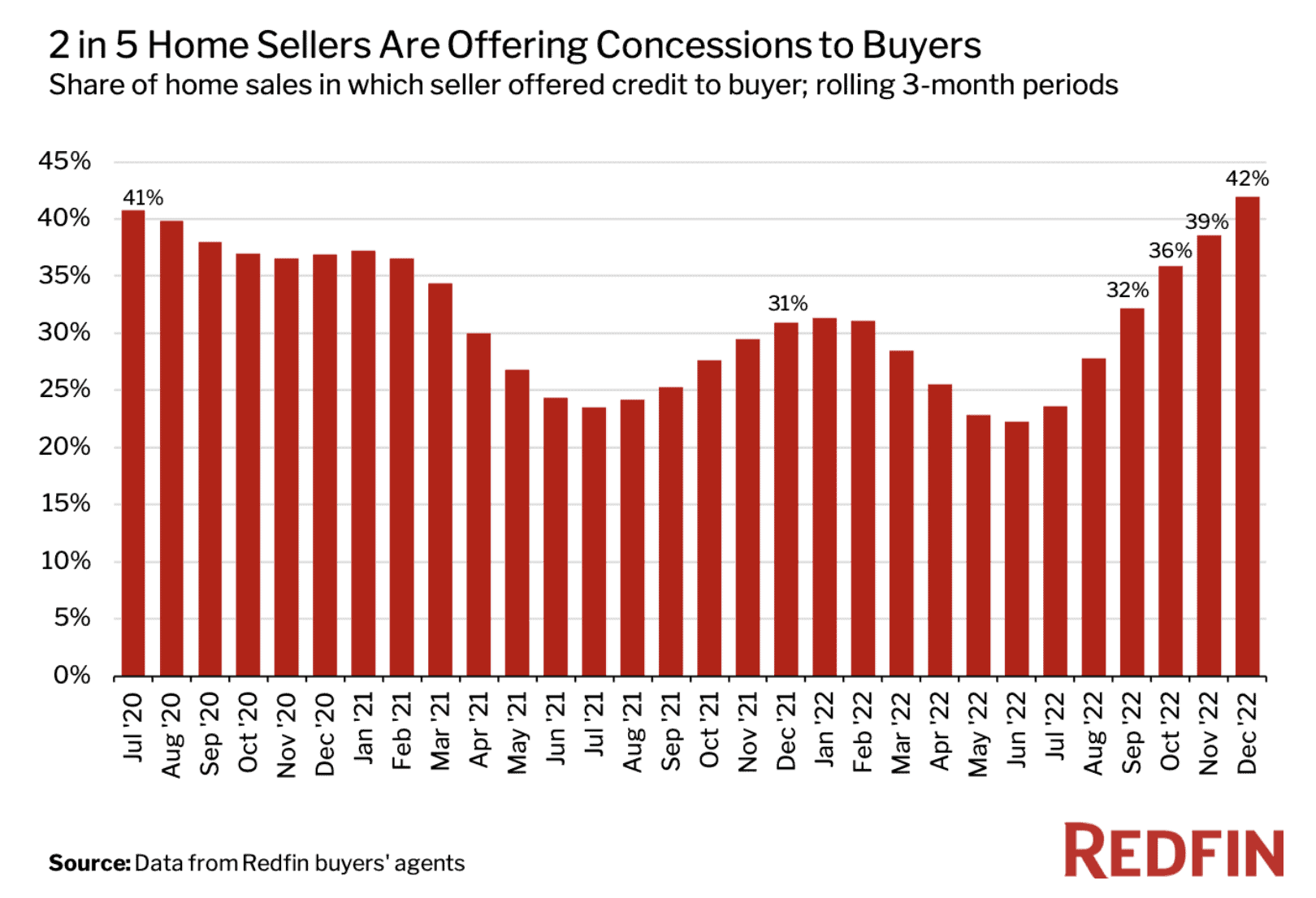

You can see this clearly in this chart from Redfin which shows how seller concessions are on the rise:

As a reminder, seller concessions are those costs associated with buying a home (such as closing costs) that the seller agrees to pay for. Not only are we seeing a rise in these concessions in the data, but anecdotally I’m hearing about it as well.

Real estate agents I’ve spoken with have told me that not only are many sellers covering closing costs, but they are also throwing in money for repairs/upgrades in an effort to win buyers over. While you won’t see these seller concessions in list prices, they are a real benefit to homebuyers that demonstrate how the market is shifting in buyers’ favor.

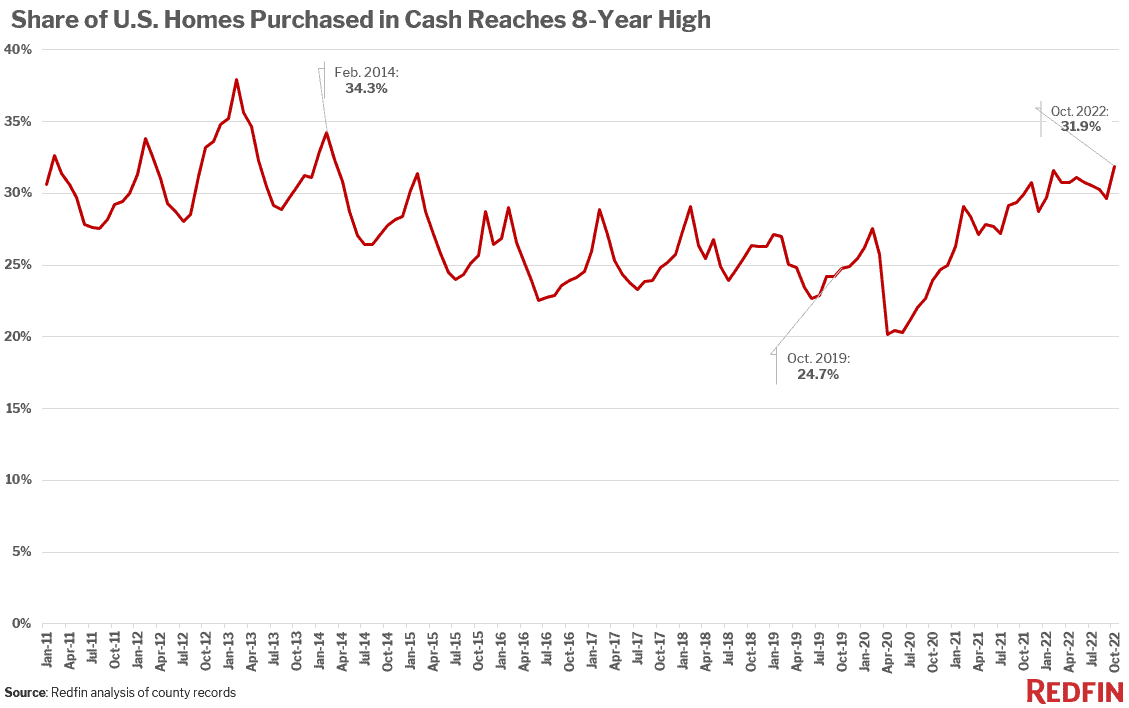

This is especially true for all cash homebuyers. If you can purchase a home without having to take out a 6%-7% mortgage, you have an edge over those who are unwilling or unable to compete with you. This explains why all cash home purchases are at the highest levels since February 2014 (according to Redfin):

Once again, since so many buyers are unwilling to accept a higher mortgage rate, all cash buyers (who don’t need mortgages) have more leverage over sellers.

Ultimately, it’s a buyer’s market in real estate because there aren’t many buyers out there. As a result, if you are looking to buy, you can probably get a better deal than you would have in previous years.

Of course, this doesn’t mean that now is the perfect time to buy. Home prices could drop further after all. But, how long will that take? Since home prices tend to adjust much more slowly than the stock market, you might be waiting a while before you see the lower prices you want.

And while you are waiting, mortgage rates could go even higher. In fact, if house prices dropped by 5% as mortgage rates increased by 0.5% (from 7% to 7.5%), your mortgage payment on a 30-year fixed rate loan would remain unchanged. So waiting it out is no guarantee that you will get a lower mortgage payment.

And, as scary as it seems to buy a home with a 7% mortgage, this is pretty normal historically. As you can see in the chart below, mortgage rates were at or above current levels most of the time since 1971:

And even if rates drop in the future, you should be able to refinance at these lower rates. And if rates don’t drop (or go even higher), then you won’t regret locking in at 7% now.

Of course, there’s more that goes into buying a home than mortgage rates and seller concessions. For this, we turn to our next section which looks at when is the right time to buy a house.

When is the Right Time to Buy a House?

Regardless of what is happening in the housing market, the right time to buy a home is when you can meet the following conditions:

- You plan on being in the home for at least 10 years

- You can afford it

- You have a stable personal and professional life

Let’s take each of these in turn.

The 10-Year Rule

In my book, Just Keep Buying, I estimated that the transaction costs of buying a home tend to be around 2%-11% of a home’s value. As a result, you will want to ensure that you stay in a home long enough to make up for these costs.

If we use the middle of this range, then we are assuming that the transaction cost on a typical home is around 6% of its value. Using Robert Shiller’s estimate for real U.S. housing returns of 0.6% per year (from this NY Times article), this means that it would take 10 years for the typical U.S. home to appreciate enough to offset its transaction cost.

This is how the 10-year rule was born. Of course, I don’t expect all housing to appreciate at 0.6% per year. Some areas will appreciate faster and some areas won’t appreciate at all.

Nevertheless, using the 10-year rule is a great way to orient yourself for the long term and prevent your wealth from being eaten up by transaction costs.

How Do You Know if You Can Afford A House?

In addition to making up for transaction costs, you will want to make sure you can afford the house you are in. How do you know if you can afford it? If you can put down a 20% down payment and your debt-to-income ratio is below 43%.

Why 43%? This is the maximum debt-to-income ratio you can have for your mortgage to be considered qualified to lenders in the U.S.

As a refresher, the debt-to-income ratio is defined as:

Debt-to-Income ratio = Monthly Debt/Monthly Income

So if you have a monthly gross income of $5,000 and a monthly mortgage payment of $2,000, then your debt to income ratio would be 40% ($2,000/$5,000). Of course, having a lower debt-to-income ratio is preferred, but 43% is the absolute max you should have.

Additionally, being able to put 20% down on a house shows that you have the financial discipline to save money. I am not saying that you have to put 20% down on a home, but that you should be able to. If you have the ability to put down 20% of the home’s value, then you are likely in a place financially where you can afford the home.

Don’t Let the Mortgage Market Dictate Your Life

Lastly, buying a home is about far more than just dollars and cents. Even if you see opportunities in real estate, you will want to make sure you have a relatively stable personal and professional life before you lock in a 30-year loan.

For example, if you are currently single but you expect to have a family in the future, buying a home may be the wrong move purely because of the transaction costs (see the 10-year rule above). Additionally, if you hate your job and are planning a major career shift soon, you may want to wait until you have more clarity on your income before signing up for three decades of ongoing payments.

These are just a few examples where instability in your personal or professional life can make buying a home a more difficult experience.

On the other hand, there are also cases where your personal life requires that you buy a home even if the timing isn’t ideal. I recently asked a friend why he was looking for a home with rates as high as they are and he said, “I don’t let the mortgage market dictate my life.”

This is a great point. Money matters, but some things matter more. Buying a house when rates are at 7% might be sub-optimal financially, but this doesn’t mean that it is sub-optimal personally. After all, who regrets locking in a higher mortgage rate on their deathbed? I won’t. You probably won’t either.

Happy investing and thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 340. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data