This week I want to discuss a book I read recently called Against the Gods: The Remarkable Story of Risk by Peter L. Bernstein. Besides Bernstein’s incredible writing style and memorable anecdotes, the book fundamentally changed how I viewed risk with regards to my personal finances.

My goal with this post is to highlight the main idea of Bernstein’s book and provide a simplified framework for thinking about risk and your money. To start, let’s take a very brief tour on the history of risk in human society.

Until the mid 1650s, human societies viewed uncertainty and risk with something destined from on high. For example, during a recent visit to the ancient Mayan city of Tulum I was told that the Mayans worshipped many different Gods, each of whom controlled a particular aspect of the universe.

If a Mayan farmer needed rain, they would provide an offering to a rain God. If they needed to go to war, they would go to their war deity, and so forth. Chance was outside of the realm of humans and left up to the Gods.

This idea was not unique to the Mayans. Almost universally human societies have, at some point, believed in a God (or Gods) to ask for help or guidance.

It was only within the last few hundred years that this relationship changed and humans decided to go against the Gods and learn the rules of chance. Alas, the title of Bernstein’s book and this post.

While humans have made a lot of progress since ancient times, we are still not great at thinking about risk, especially in terms of personal finances. So, let’s address and simplify risk.

One definition of risk is the chance of losing money. This is a useful definition, but it misses two important components: time and your expected future liabilities. We will need to address these before we can come to a fuller understanding of risk.

Time

To start this discussion, let’s consider a quote from Bernstein:

Risk and time are opposite sides of the same coin, for if there were no tomorrow there would be no risk. Time transforms risk, and the nature of risk is shaped by the time horizon: the future is the playing field.

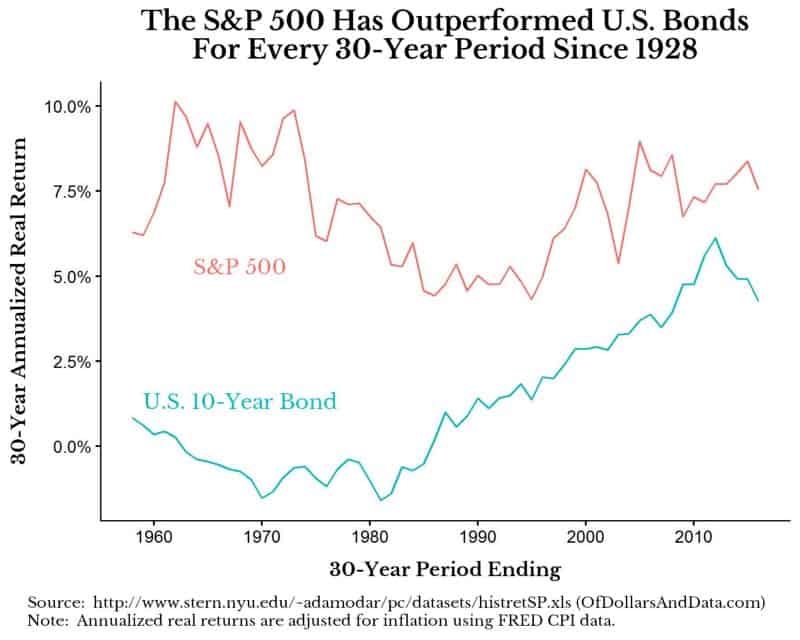

Any definition of risk must contain a time horizon or it is incomplete. For example, the S&P 500 is typically more volatile over a 1 year period than any long term U.S. Treasury bond, but over any historical 30 year period, the S&P 500 is far less risky. Why? Over all 30 year periods for which we have data, the S&P 500 has outperformed U.S. 10-Year Treasury bonds:

It is not necessarily true that this will hold in the future, but the time horizon changes how you perceive and experience risk. The more time you have, the less risk you bear.

Expected Future Liabilities

Every individual has different personal finances and expected future liabilities. Some people want kids, others want a fancy house, etc. Your personal financial situation is incredibly important regarding risk, but can be glossed over when discussing whether an investment is risky.

For example, while one investment may be risky for me, it may not be for you, simply because we have different future expected liabilities. Bernstein’s cites a brilliant quote from Robert Jeffrey, a family trust manager, that summarizes this concept well:

The real risk in holding a portfolio is that it might not provide its owner, either during the interim or at some terminal date or both, with the cash he requires to make essential outlays.

If you need to spend money and you can’t, that’s risk.

Putting these concepts together, I have created an equation for how you can think about YOUR ability to take risk throughout life:

Ability to Take Risk = Assets – Liabilities + Time

Your ability to take risk is equal to your assets minus your expected future liabilities plus the amount of time you have.

Having more assets, fewer future liabilities, and more time all increase your ability to take risk. You can’t control the amount of time you have, however, time provides the opportunity to recoup losses, so more is better.

The two things you can control in this equation are your assets and your liabilities. The more assets you have (hopefully liquid ones that are also diversified), the more cushion you have to survive financial shocks, and the more risk you can take. This is also true with fewer expected future liabilities.

If you need to spend less money in the future, then you can stomach more risk in the present. Therefore, you can control your risk taking ability by adjusting your spending and saving accordingly.

This equation does have its pitfalls though. It doesn’t control for individual investor preferences (i.e. you may want far less risk than you could reasonably put up with), and it doesn’t take into account whether your asset values are inflated or undiversified.

In a bubble, this equation would suggest you could take on more risk when, in reality, you would want to be taking less risk. Your inflated asset values would give you the wrong idea about your true risk tolerance. Proper diversification should mitigate this issue though.

Risk is in the Eye of the Beholder

No matter what stage you are at in your financial life, risk will always be relative to your personal situation. As your situation changes, your ability to take risk will change, and so will your preferences for taking risk. I wish I could give you a silver bullet solution for understanding how much risk you can endure, but this isn’t possible.

There are too many individual factors that contribute to risk in your financial life (i.e. seek out a financial planner).

What I can tell you definitively is that you can control your ability to take risk by adjusting how you save and spend money. If your financial life seems too risky, consult the equation above and pull the appropriate lever until you have peace of mind. Remember, risk is in the eye of the beholder.

Though humanity has gone against the Gods to try and unravel the mysteries behind risk, we really aren’t that different from our ancestors. Many of us, myself included, still have superstitions and beliefs in some random force that influences our lives.

Even for those that don’t believe in a higher power, I wonder how long it would take for them to find faith during a plane crash. Believing in God, Gods, or some force is a uniquely human trait that is likely here to stay.

So the next time you think about risk and your money, realize that you have some control in the situation. Then again, if the Gods favor you, you wouldn’t need to worry about risk…right?

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 31. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data