In the past few weeks, a few things have happened that have led me to do some digging on Bitcoin and why I think it is not that different from most other risky assets. For those of you that do not know what Bitcoin is, it is a digital currency that can be used to make peer to peer payments without an intermediary (i.e. a bank). Bitcoins have no central backer and rely on a decentralized network of record keepers that work off of the same ledger of transactions (called the “blockchain”). The idea of the blockchain is to record all transactions and share this information with the Bitcoin network without having to rely on one entity to verify or control the currency.

The interesting thing about Bitcoin is that there is a fixed supply of Bitcoins that can ever be “mined.” Without getting into the details, Bitcoins can be mined by having computers perform increasingly complex calculations. Currently, there are over 16 million Bitcoins in existence (with a market cap of about $40 billion), but the theoretical limit for total number of Bitcoins is 21 million, which we are predicted to reach by 2140.

This matters to you as an investor, because a cryptocurrency, like Bitcoin, may one day replace the U.S. dollar as the reserve currency of the world. I think this is unlikely to happen soon, but if we get closer to this possibility, the value of Bitcoin will soar. This is the fundamental relationship behind all currency valuations: belief. As more people believe in Bitcoin as a legitimate currency, the value goes up, and as less people believe in it, the value will go down.

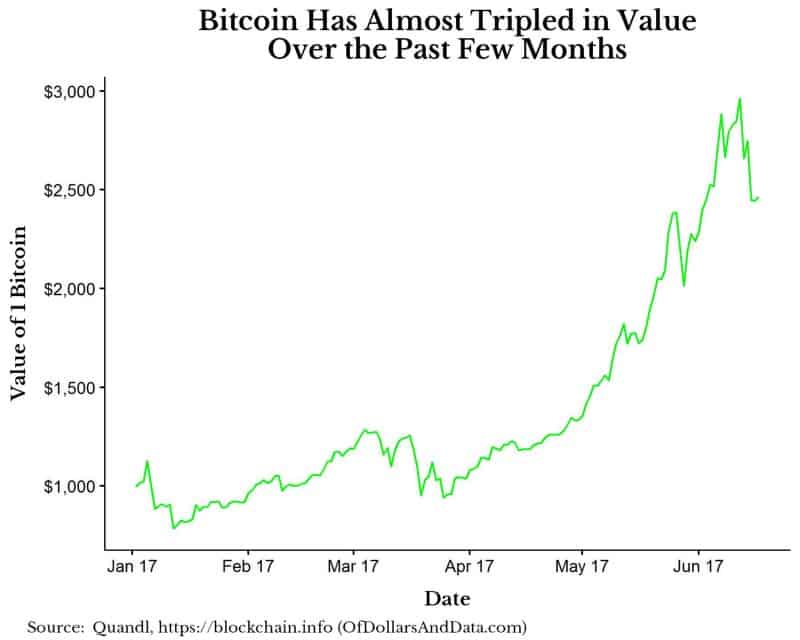

To start with some context, Bitcoin has been on a wild ride upward this year:

While this may look enticing, you have to realize that getting to this point was not easy. Below is an animation showing the drawdowns (i.e. declines from peaks) in Bitcoin over time. To make this feel more real, imagine owning Bitcoin in late 2010 and watching the value of it drop by over 50% on more than 4 occasions. Though this would have been difficult to endure, you would have been rewarded handsomely had you held on:

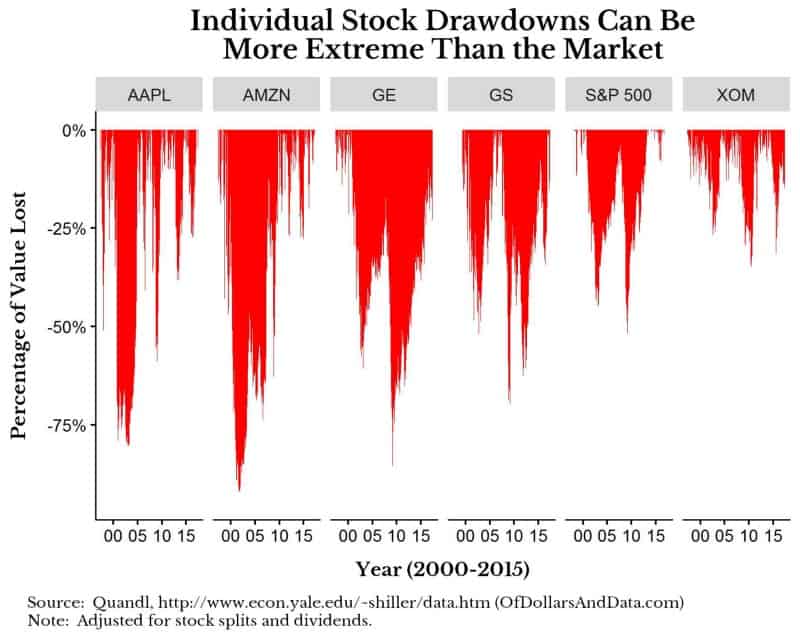

This brings me to my main point: How is Bitcoin’s behavior as an asset that much different than any other risky asset (i.e. individual stock)? Yes, it is probably more volatile than an individual stock, but it’s not like individual stocks are a picnic either. I have already shown how successful stocks can experience large drawdowns over time:

So why do some investors shun Bitcoin and cryptocurrencies? They may call it speculative, but I see it as no more speculative than buying an individual company’s stock. You might counter argue that a company produces income while Bitcoin does not. I see that point, but I would argue that belief is as fundamental to a company’s continued income as it is to Bitcoin’s increase network of users. Is it any more far-fetched to believe that a company’s income is going to grow at X% a year for 10 years than to believe that Bitcoin could continue to increase its user base? I have created valuation models during my career and those models are as prone to beliefs and assumptions as anything else.

For example, most of the value of most tech companies comes from expected cashflows that can be decades in the future. I have a friend who works at Uber who told me that Uber’s entire future is basically a long term self-driving car play. Just like Bitcoin, most risky assets require some form of belief.

Belief is What Makes Us Human

In the end, it is not beliefs that matter, but what actually happens in the real world. Whether an earnings report is released for a company or a cryptocurrency is adopted as a store of value, information eventually comes out that corrects our collective beliefs. Despite the fact that not all beliefs are equally valid, the act of believing is what makes us human.

I recently started reading Sapiens: A Brief History of Humankind by Yuval Noah Harari, and one of Harari’s key insights focuses on the power of belief:

Telling effective stories is not easy. The difficulty lies not in telling the story, but in convincing everyone else to believe it. Much of history revolves around this question: how does one convince millions of people to believe particular stories about gods, nations, or limited liability companies?

How different is it to believe in Bitcoin over believing in the U.S. government? How about the success of an individual company? The only difference I see is the number of current believers. Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 27. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data