How long does it take to double your money? The traditional advice says to use the rule of 72—take 72 and divide it by your expected annual return to calculate the numbers of years to double your money.

So, if you expect your wealth to grow by 4% a year, then dividing 72 by 4 gives you 18 years before your money will double. If you expect your wealth to grow by 12% a year, then it would take 6 years (72/12 = 6) to double. And so forth.

While the rule of 72 is convenient, it also has a fatal flaw—it can only measure the doubling time on a singular investment. Unfortunately, no one invests like this. No one invests their money once and then never invests again. Most people are adding regularly to their investable assets over time.

Therefore, if we want to understand how long it will take to double our money, we should adjust for any new money being added. And that is exactly what this blog post will do.

Below I provide a new framework for estimating how long it will actually take to double your money. The good news is that it’s probably less than you think. Let’s begin.

How Your “Wealth Savings Rate” Impacts Doubling Time

If you want to figure out how long it will take to double your money, you first need to know something called your wealth savings rate. Unlike your savings rate, which is the amount of money you save relative to your income, your wealth savings rate is the amount of money you save relative to your wealth.

So, if you have $100,000 in total wealth (i.e. assets minus liabilities) and you expect to save $20,000 over the next year, then your wealth savings rate is 20%. The formula for wealth savings rate is:

Wealth savings rate = expected annual savings / total wealth

Your wealth savings rate is important because it can significantly reduce how long it takes to double your money. For example, if you believe your wealth will grow at 6% per year (after inflation), then, according to the rule of 72, your wealth would double in 12 years (72/6 = 12).

However, if your wealth savings rate is 10%, then your money would double in less than half that time. To put this in perspective, someone with $50,000 in wealth saving $5,000 per year while earning 6% annually would reach $100,000 in about 5 and 1/2 years compared to 12 years for someone who saved $0 per year. That’s a huge decrease in the expected doubling time from only a modest increase in annual savings.

This is why knowing how much you are saving relative to your wealth each year is essential for understanding how long it will take to actually double your money. With that being said, let’s see how long it takes to double your money based on various wealth savings rates and rates of return.

How Long Will It Take to Double Your Money?

If we want to understand how long it will take to double your money, we only need to know your wealth savings rate (defined above) and your expected rate of return.

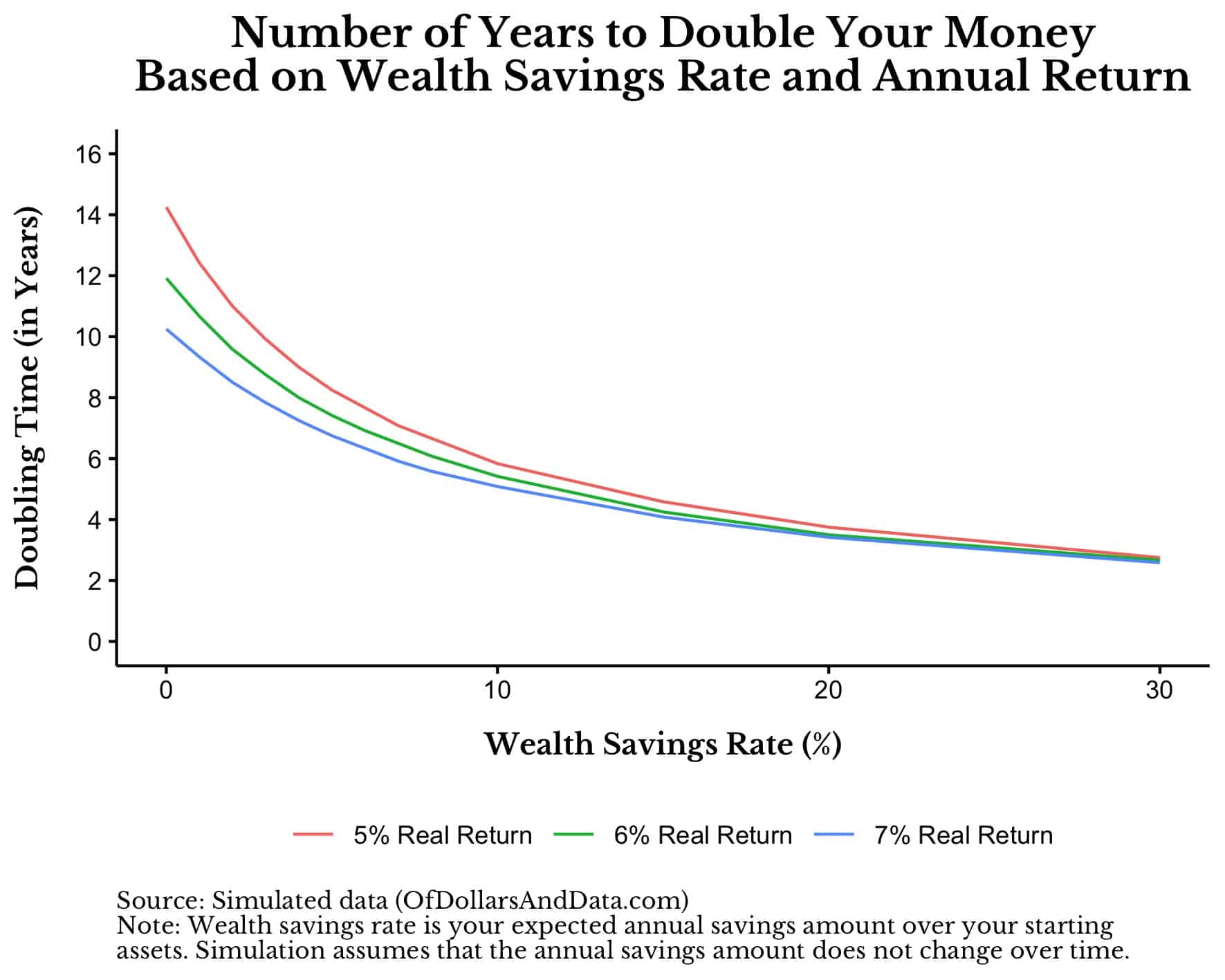

Fortunately, I’ve done this in the plot below for various wealth savings rates and expected real returns. Note that I used expected returns in 5%-7% range because 5% is the long-term real return on a 80/20 global stock/U.S. bond portfolio (rebalanced annually) and 7% is the long-term real return on a 100% U.S. stock portfolio:

As you can see, as your wealth savings rate increases, the amount of time to double your money drops dramatically. With a 0% wealth savings rate and a 7% real return (far left point on the blue line), you would expect your money to double in a little over 10 years. However, with a 10% wealth savings rate, this doubling time gets cut in half to around 5 years.

To be more specific, the table below has the doubling time (in years) for various wealth savings rates and expected returns.

Doubling Time (in Years) for Various Wealth Savings Rates and Expected Returns

| Wealth Savings Rate | 5% Real Return | 6% Real Return | 7% Real Return |

|---|---|---|---|

| 0% | 14.2 | 11.9 | 10.2 |

| 1% | 12.4 | 10.7 | 9.3 |

| 2% | 11 | 9.6 | 8.5 |

| 3% | 9.9 | 8.8 | 7.8 |

| 4% | 9 | 8 | 7.2 |

| 5% | 8.2 | 7.4 | 6.8 |

| 6% | 7.7 | 6.9 | 6.3 |

| 7% | 7.1 | 6.5 | 5.9 |

| 8% | 6.7 | 6.1 | 5.6 |

| 9% | 6.2 | 5.8 | 5.3 |

| 10% | 5.8 | 5.4 | 5.1 |

| 15% | 4.6 | 4.2 | 4.1 |

| 20% | 3.8 | 3.5 | 3.4 |

| 30% | 2.8 | 2.7 | 2.6 |

You should be able to use this table to figure out approximately how long it will take you to double your money given where you are today.

For example, if you have $50,000 in investable assets and you plan on saving $4,000 per year going forward, you would have a wealth savings rate of 8%. Using the table above, and assuming a 5% real return, this means that your money should double 6.5 years from now.

Of course, savings and investment returns are never so smooth, but this should be a decent long-term approximation. And for those with a wealth savings rate greater than 30%, you have nothing to worry about. Your money will double soon enough.

Lastly, please keep in mind that this doubling formula only works for the first time you double your money. After your money has doubled, you then need to re-calculate your doubling time based on your new wealth savings rate.

For example, if you have $50,000 and you are saving $5,000 a year (i.e. a 10% wealth savings rate) while earning 5%, then you should double your money in around 5.8 years (from the table above). However, once you’ve doubled your money to $100,000, your new wealth savings rate will only be 5% ($5k/$100k).

Looking at the table above (with a 5% annual return), this means that it will take 8.2 years to double your money from there. So while the doubling from $50,000 to $100,000 took 5.8 years, the doubling from $100,000 to $200,000 will take 8.2 years since you didn’t change how much money you saved annually. If you wanted to double your money again in 5.8 years, you would have to increase your annual savings to $10,000 to get your wealth savings rate back to 10% ($10k/$100k).

I emphasize this point because this framework only works based on the initial wealth savings rate you supply. If any of those conditions change, then you will need to re-calculate your doubling time accordingly.

Now that we have a rough idea of how long it will take for you to double your money, let’s wrap up by discussing why it matters.

The Bottom Line

After examining the data above on how long it actually takes to double your money, two important points stand out:

- Initial increases in your wealth savings rate lead to the biggest declines in the amount of time it takes to double your money. In other words, saving something is better than saving nothing.

- As your wealth savings rate increases, your expected returns become less important.

I want to emphasize these two points because they illustrate the relative importance of saving over investing, especially for those just starting out. Though I will always toot the compounding horn, the fact remains that the quickest way for most people to double their money is to save more, not to chase higher returns.

Of course your rate of return matters, but it only matters after you done the hard work of saving money. As Morgan Housel once said of Warren Buffett:

If, at age 30, Buffett was worth $24,000 instead of the $1 million he actually accumulated, and went on to earn the same returns, how much would he be worth today?

$1.9 billion.

That’s 97.6% lower than his actual net worth of $81 billion.

The punchline is that 97.6% of Buffett’s current success can be directly tied to the base he built in his teens and 20s.

The rule of 72 is great, but it has nothing on someone who can keep investing throughout their life.

Just Keep Buying and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 337. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data