Do you think you can predict the future? I am guessing you, like me, would confidently say no.

But, what if I asked you to predict the future of a very specific thing? Say the future of a company (i.e. Snapchat, Uber, etc.) or a product? Now it doesn’t seem as far fetched to make a prediction, does it?

And if I asked you whether you were better than the average person at making these specific predictions, I am guessing you might say yes.

Just think about it. You are decent at making predictions, aren’t you?

Think of all of the times you saw something and you knew it was going to be a hit? I bet right now you can name at least a few things that you were completely right about before they became foregone conclusions.

For example, I remember seeing Youtube when I was in high school in 2006 and I knew it was going to be the biggest thing ever. I told my friends, but they were skeptical.

Making predictions is fundamental to human societies. From forecasting weather patterns to trying to anticipate the next billion dollar startup, we have a tendency to try and imagine what the future holds.

However, when it comes to investing, making predictions is more likely to harm you than help you. And this goes beyond the simple argument that stock picking is harmful because you are likely to underperform an index fund/ETF.

Yes that is true, but that argument misses a much larger behavioral component as to why passive investing is better for you and most other investors:

Passive investing frees you from the psychological impact of identifying with your investments.

Think of it this way: If you put a sizable portion of your net worth into individual stocks, and those stocks underperform the market, this would challenge your identity.

You might start to think that you were a loser because you made a choice that lost you money. This explains why investors tend to sell their winners and hold their losers for far too long. They are hoping that the losing stocks will rebound so that they will be vindicated as good active investors.

Personally, I regret the few active investments I have made historically not because of my slight underperformance relative to the market, but because of the psychological effects it had on me.

I still remember having 2% of my net worth in a tech stock and checking it like mad throughout the day. EVERY. SINGLE. DAY.

However, I never batted an eye when my passive investments (the other 98%) fluctuated on a daily basis and gained or lost far more money than that one tech stock.

The passive investments didn’t define me in the same way as my 1 active stock pick. I wasn’t any more of a winner or loser when my ETFs changed in price, because investing in broad based indices like the S&P 500 didn’t feel like making a prediction.

Michael Batnick has an incredible post where he describes something he calls the “satisfaction yield”, which exemplifies the idea of an investment identity. In his post he describes 2 different investments scenarios with the same starting and ending value, but with very different paths getting there.

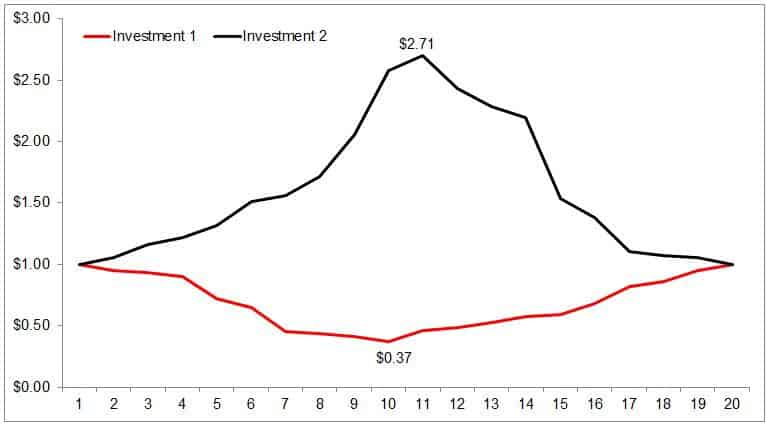

“Investment 1” has an initial fall and recovery while “Investment 2” has a large initial appreciation and a subsequent decline:

If you are an investor in “Investment 1” you probably feel like a hero. You might as well have saved a kitten from a burning building. However, if you are an investor in “Investment 2” you probably feel like a loser for not selling earlier when you knew that you should have.

From a purely rational perspective, you should be okay with either investment, but your investment identity would feel better with Investment 1.

My argument here is to abandon your investment identity altogether. Go passive and do more important things with you life. All the time you will spend researching and worrying about your active investments is not worth it.

Spend that time doing something more valuable. Remember that investing is easy, if you allow yourself to make it easy.

Take the Red Pill

When it comes to prediction, it is easy to recall all of the times we got it right. But what about all the times we got it wrong?

For my one Youtube hit, I was completely wrong on Facebook, Snapchat, Uber, and many other companies that I didn’t think had any monetization value. Maybe I am terrible at predicting the future, or maybe most people are and they don’t realize it.

My advice to combat this is simple: free your mind from your investments. Go passive and just keep buying. Continue to average in and you will not be disappointed.

I have had friends tell me how liberating this mindset is for investing. It has worked well for me so far and I am just getting started. As always, thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 28. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data