Do the wealthy invest differently from everybody else? And, if so, what can we learn from them?

A month ago Bank of America released their 2022 Private Bank Study of Wealthy Americans, which attempted to answer some of these questions. Their study (which took place from May-June 2022) asked 1,052 households with more than $3 million in investable assets how they invest and how they felt about different asset classes as well.

Among their key findings were:

- Younger wealthy households (those aged 21-42) were more skeptical of traditional investments and more likely to support sustainable investing (i.e. ESG) than older wealthy households (those 43 and up).

- In particular, older households allocated, on average, 55% of their portfolios to stocks and stock index funds, while younger households only allocated 25% stocks. In addition, older households allocated only 2% of their portfolio to cryptocurrency investments, while younger households allocated around 15%.

- Lastly, there was a difference of opinion about which investments offered the greatest growth potential going forward. While younger households believed that cryptocurrency, real estate, and private equity offered the best growth opportunities, older households believed it was U.S. stocks, real estate, and emerging market stocks.

At first glance, the divergence in investment beliefs between younger and older wealthy households suggests that wealthy households may be changing how they invest. While the wealthy used to invest in stocks, bonds, and real estate, this study suggests that, going forward, they may prefer investments like crypto, private companies, and other alternatives.

Unfortunately, I don’t think this is the full story, but, an artifact of the study’s design. For example, since wealth is positively correlated with age (i.e. years worked), by subsetting to only those with high amounts of wealth you end up oversampling those younger households with extraordinary financial circumstances.

In other words, wealthy households are exceptional, but younger wealthy households are even more exceptional in how they got wealthy. You can see this clearly in the data. For example, having $3 million in net worth (excluding home equity) would put you in the top 7% among 55-59 year olds, but near the top 0.1% among 25-29 year olds.

This demonstrates just how unique these younger wealthier households really are. Some of them started with more initial wealth (i.e. inheritances, parental support, etc.) than most, while others had atypical financial success (i.e. company went public/acquired, bought crypto early, etc.). As a result, it would make sense that these younger wealthy households would feel differently about how to get rich than most people who get rich. As Michael Kitces stated about this survey:

This isn’t generationally unique. People who make money from private companies (e.g., founders, executives, tech w/ stock options, etc.) tend to keep seeking private/alt investments.

And this is likely what happened here. By looking at the absolute richest younger households, it would be easy to draw conclusions that wouldn’t be applicable to the rest of the wealthy population. But, this raises a much bigger question: how do you define “wealthy”?

What Does “Wealthy” Mean to You?

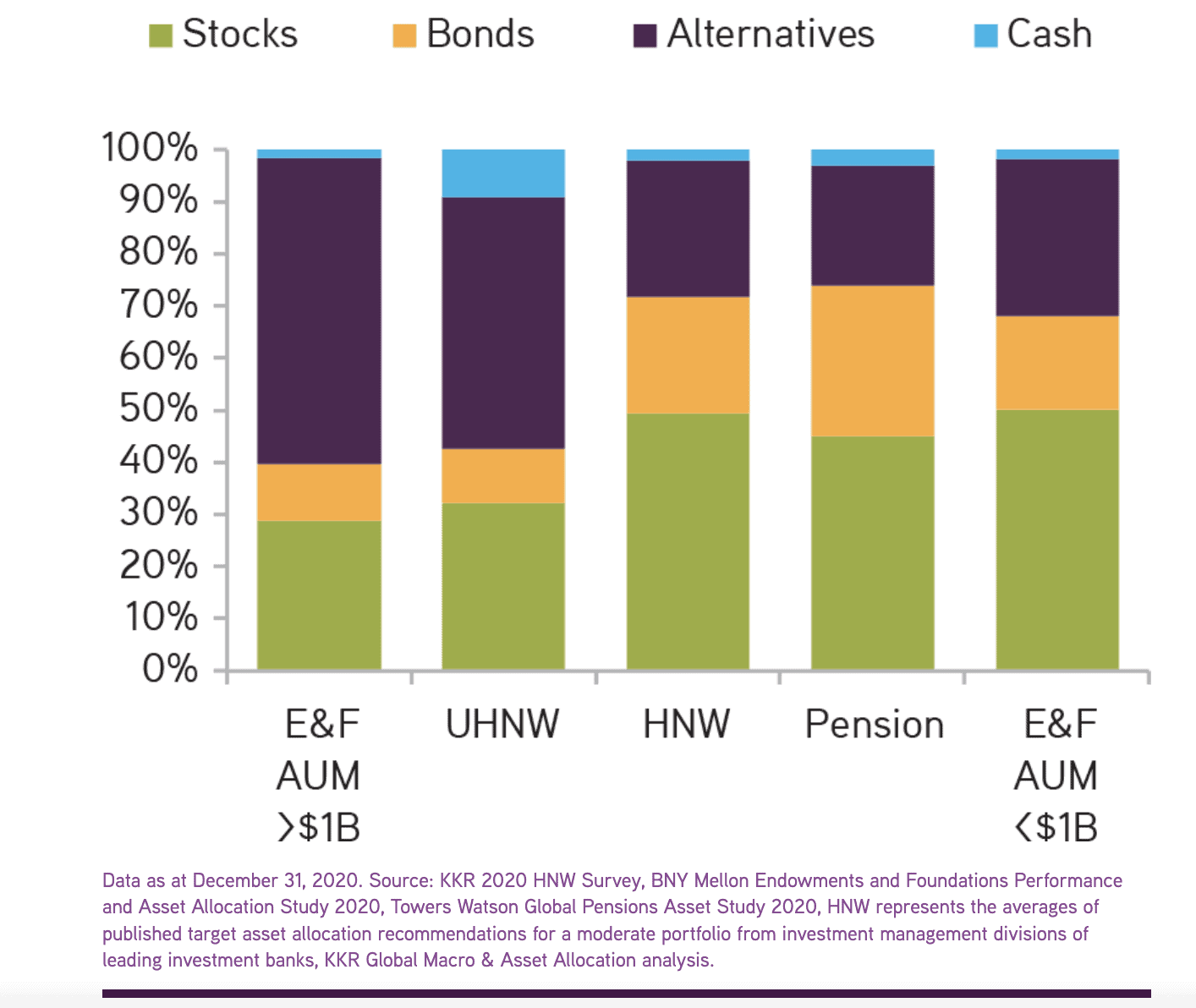

If you want to understand how the wealthy invest, it depends on what you mean by “wealthy”. The best demonstration of this comes from this KKR report, which breaks down how high net worth investors (those with >$1 million in assets) and ultra-high net worth investors (those with >$30 million in assets) invest their money.

As you can see below, high net worth (HNW) investors allocated around 50% to stocks, 20% to bonds, 25% to alternatives, and 5% to cash, while ultra-high net worth (UHNW) investors allocated around 30% to stocks, 10% to bonds, 50% to alternatives, and 10% to cash:

This divergence of capital away from traditional asset classes like stocks and bonds and towards alternatives (i.e. private equity, hedge funds, etc.) seems to be positively correlated with the amount of wealth that someone has. As Ernst & Young reported, only 14% of mass affluent households relied on alternatives in their portfolio compared to 29% of high net worth households and 81% of ultra-high net worth households.

However, this shift towards alternatives only seems to be occurring among the absolute wealthiest households. Among Personal Capital users, the average allocation to alternatives is only around 3%-4%, regardless of age. Though the typical Personal Capital user is likely more sophisticated (and wealthier) than the typical U.S. investor, we still don’t see a big push toward alternatives among these retail investors.

This is true despite the fact that alternatives have become increasingly popular over the past few decades. As Blackrock reported:

Alternative investments — which include non-traditional asset classes such as private equity, private credit, real estate, infrastructure and more — represented just 5 percent of global pension portfolios in 1996. In 2019, they accounted for more than 25 percent.

Though pension investors aren’t the same as wealthy individual investors, their portfolios are becoming more alike over time.

More Assets = More Alternatives?

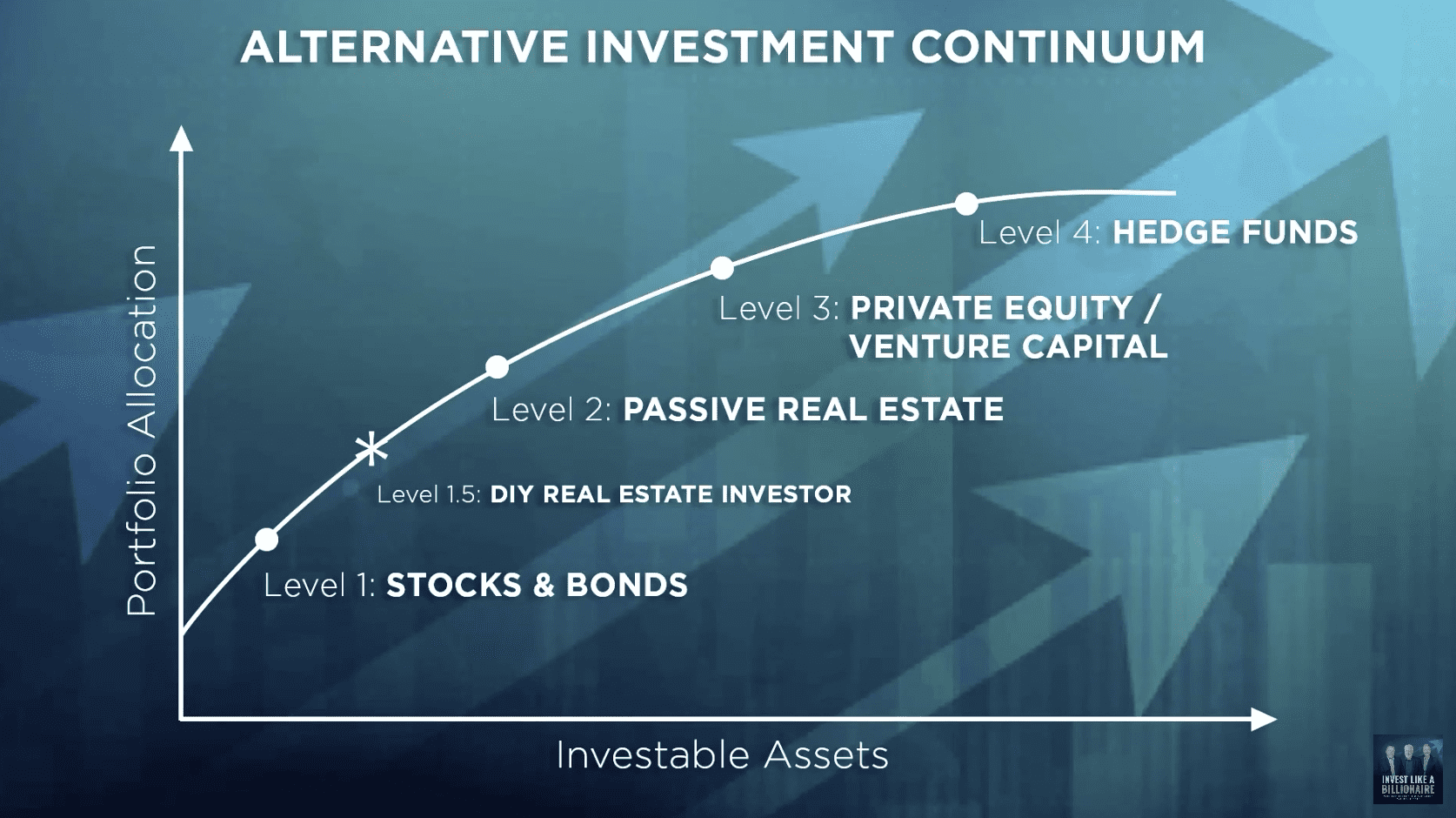

To understand why there’s been a shift toward alternatives among the wealthiest investors, consider the “Alternative Investment Continuum” put forth by Bob and Ben Fraser on the Invest Like a Billionaire podcast. Their framework suggests that as an investor’s assets increase, they tend to allocate more to alternative investments:

Why is this the case? Because access to alternative investments is typically limited by your bankroll. While anyone with $1,000 can buy shares of an S&P 500 index fund, the same isn’t true when it comes to investing in private equity or a hedge fund. For some wealthy investors, the exclusivity of an investment can be even more attractive than the promise of outperformance. Not all investing is about money, sometimes it’s about status too.

Either way, just because wealthy investors allocate more to alternatives this doesn’t imply that alternatives are what got them rich in the first place. These ultra-wealthy households could’ve gotten rich in a myriad of other ways that didn’t require alternatives at all. They could’ve been born rich, or sold a private company, or joined a successful startup as an early employee. Once they were wealthy, then they could’ve acquired their alternative investments.

I raise this point because there seems to be an obsession with the wealthy and how they invest their money as if their allocation decisions are what created their wealth. Of course, for some wealthy individuals this is true. Warren Buffett got rich based on how he invested his money. But many other wealthy people didn’t. They got rich as business owners or doctors or lawyers (or something else) and have since allocated their wealth to private equity and hedge funds. Keep this in mind before making any changes to your portfolio.

The Bottom Line

If we can learn anything from how the wealthy invest, it’s that they do it in a lot of different ways. Some of them own stocks, bonds, and real estate, while others utilize a wide range of alternatives. And though the data shows that wealthier people tend to own more alternatives, this doesn’t mean that they’ve abandoned traditional asset classes. Try not to forget that the wealthiest 10% of Americans own nearly 90% of all U.S. stocks!

All of this suggests that there are many ways to get rich. There are many ways to preserve and grow your wealth. The hard part is finding what works best for you.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 320. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data