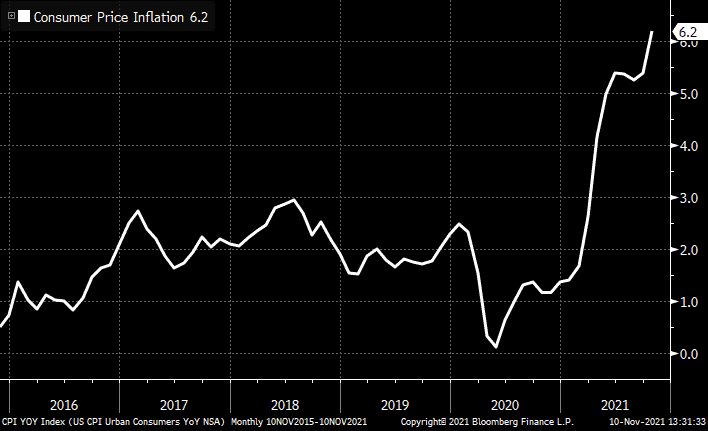

Inflation is back with a vengeance. This week the BLS reported 6.2% inflation for the year ending October 2021. And, as Bloomberg noted, this is the highest inflation has been since 1990:

While this can be somewhat alarming, inflation from October 2019 to October 2020 was just 1.2%, so the two-year inflation is about 3.7% on an annualized basis. Yes, this is higher than it has been in recent years, but it is still nowhere near hyperinflation territory.

Nevertheless, the question on many investors’ minds right now is: how should I invest during higher inflation?

Let’s dig into the data.

Which Asset Classes Perform Best During Inflation?

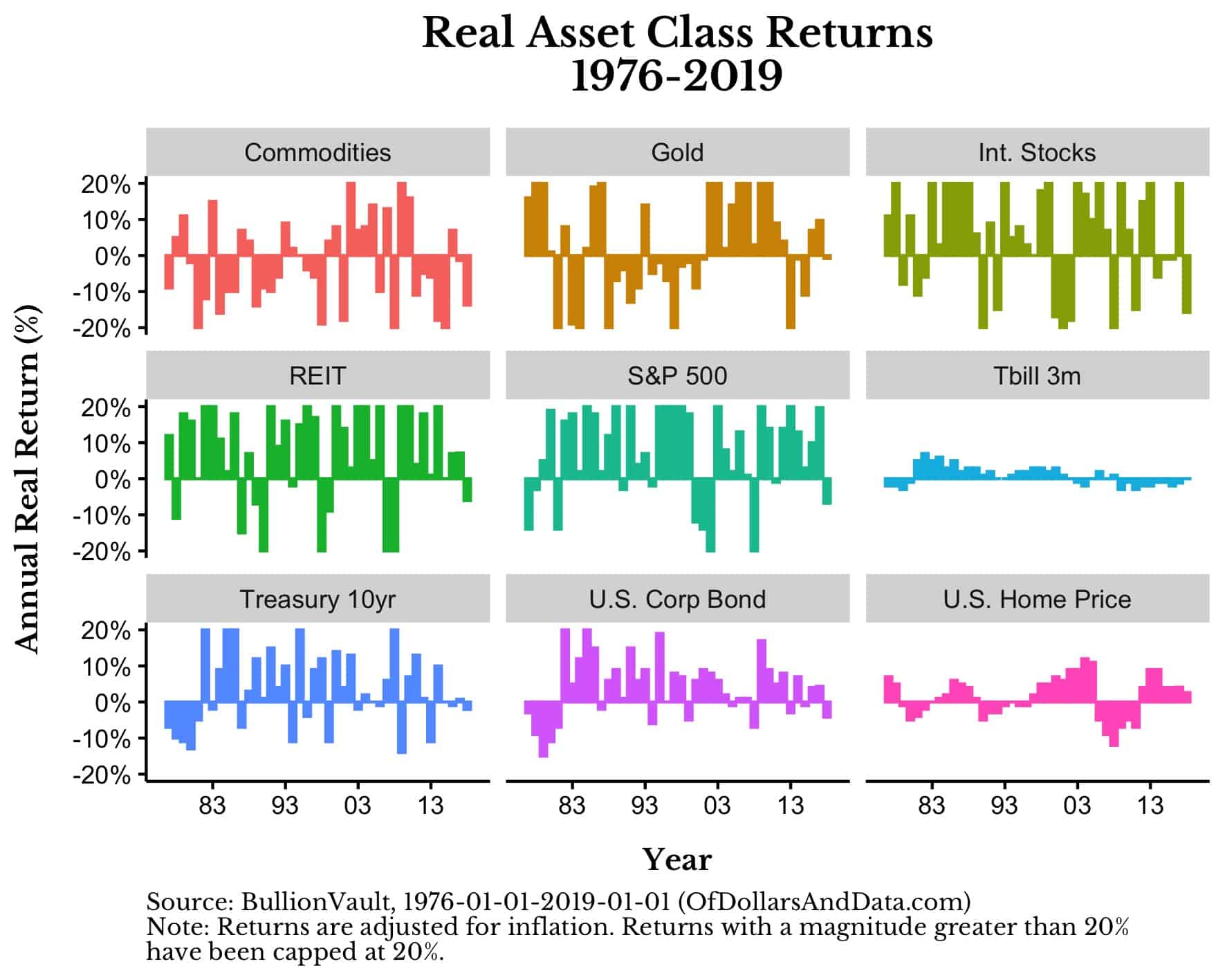

To start, let’s look at the inflation-adjusted (“real”) annual returns of nine different asset classes from 1976-2019 (the data comes from BullionVault). Note that I capped all real returns at 20% (-20%) so that we could better visualize the performance behavior of these different asset classes:

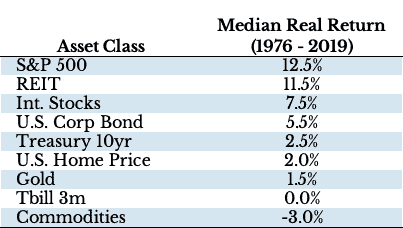

The first thing you will notice is that some assets have higher volatility (Gold, equities, REITs) than others (Tbills, U.S. Home prices). More importantly, those assets with higher volatility tend to have higher real returns than those with lower volatility. You can see this more clearly in the table below, summarizing the median real return of these nine asset classes from 1976-2019:

As you can see, equities and REITs tend to be near the top, followed by bonds and ending with gold, 3-month TBills and commodities.

What is intriguing about this table is that gold, the highest volatility asset among the group, has some of the lowest real returns. Even if we use the average real return (instead of the median), gold is still ranked in the middle of the group (5th). This tends to go against the narrative that gold is a good inflation hedge, but maybe something else is going on.

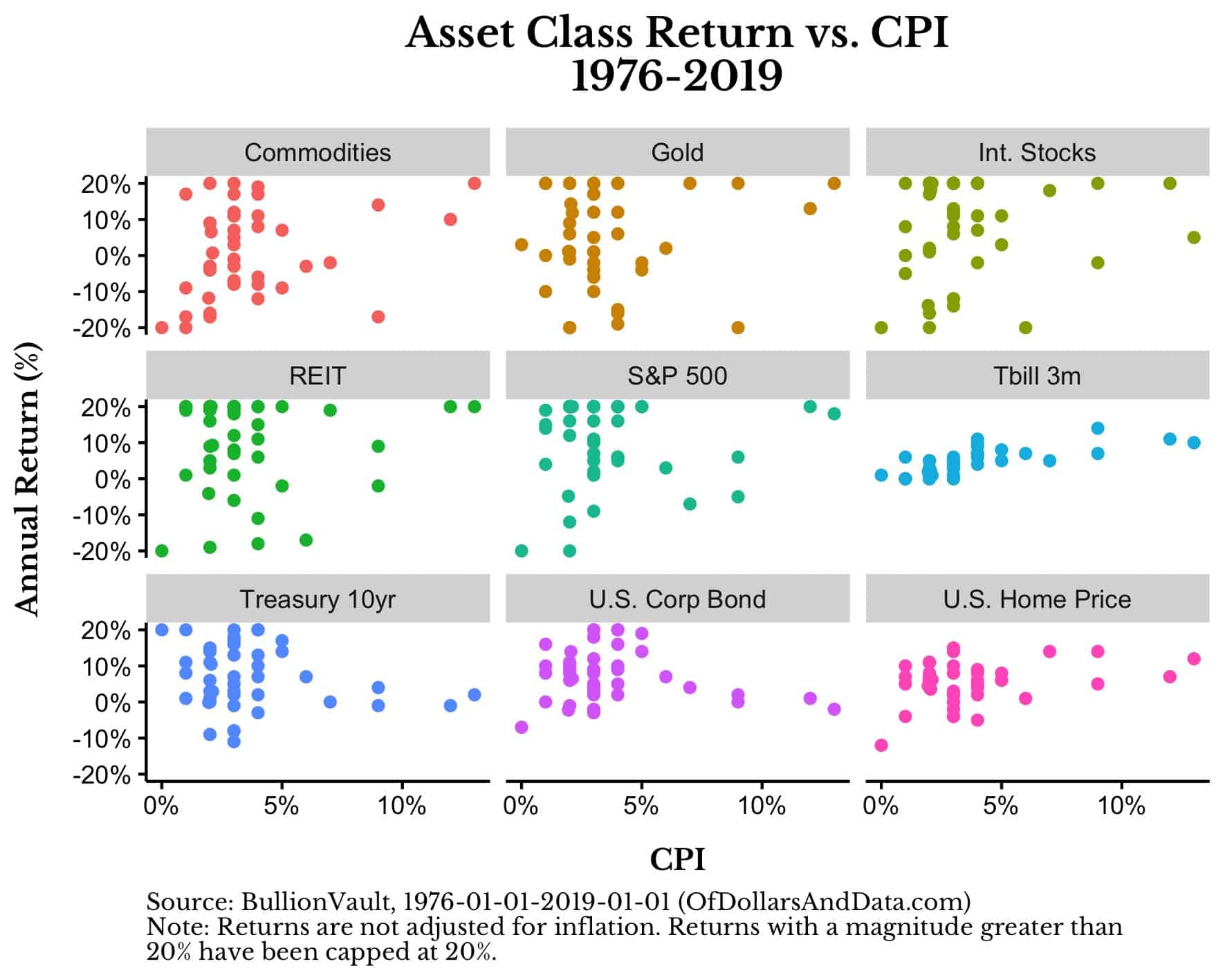

To dig deeper, I created another plot showing the nominal annual returns of these nine asset classes against annual inflation (“CPI”) for all years in the data:

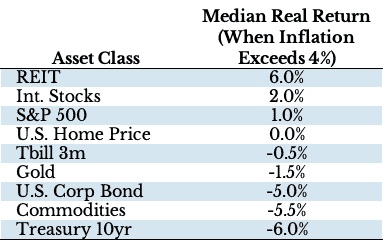

As you can see, those assets that tend to perform the best against inflation, especially when it is higher, are those that also tend to be more volatile (equities, REITs, gold). But, once again, volatility isn’t the only story. Because even if we subset the returns to only those years where inflation exceeds 4%, gold doesn’t come out looking good:

Even when we subset to the higher inflation years, gold doesn’t seem as great of an inflation hedge as it marketed to be. To be fair to gold, there were only eight years from 1976-2019 where inflation exceeded 4%, so this data may be lacking in its completeness. Nevertheless, that’s still 45 years where gold has performed worse during higher inflation periods than REITs, stocks (US or Intl.), and U.S. Home prices.

What’s an Investor To Do?

From the data above we can conclude that equities, REITs, and real estate tend to preserve their purchasing power, even during higher periods of inflation. Logically this idea makes sense given that these assets are all based on monetary payments made to businesses or landowners. Therefore, if payments start going up due to inflation, the value of those businesses and land/property should go up with them.

On the other hand, those assets that tend to do poorly during periods of higher inflation are those assets that pay their investors fixed payments over time. As inflation ramps upward, these fixed payments tend to lose their purchasing power, which causes the underlying asset (i.e. the bonds) to decline in value as well.

So what’s the typical investor to do if they expect inflation to stay elevated for a long time?

Buy equities/REITs/productive land or take out debt to buy physical real estate.

Of course, you could take out debt to buy stocks/REITs, but I don’t recommend this approach because of how volatile these asset classes can be. All it takes is one market plunge and you can be on the hook for lots of money.

This is why taking out debt to buy physical real estate is much safer than taking out debt to buy more volatile asset classes. Since housing is less likely to crash in such a glorious fashion, you can rest easier while holding this debt. More importantly, if inflation stays high, the payments you make on your mortgage will shrink (in real terms) over time.

My grandparents saw this happen first hand after buying their first home in 1972 right before the high inflation of the 1970s kicked off. One decade after they bought their home and their mortgage payment had been cut in half (in real terms). We may be on the cusp of something similar here in the U.S., but who knows?

What matters most in this scenario is how bad you think the inflation will get. Because, generally, the more extreme the inflation, the better these strategies will perform.

But don’t just take my word for it, consider what Frederick Taylor wrote in The Downfall of Money when discussing Germany’s hyperinflation:

So, who did well out of the inflation in Germany? Creditors lost almost everything. By contrast, everyone, broadly speaking, who owed money, had their debt liquidated by inflation…Investors in stocks and shares – unlike fixed investments, these increased in price along with the inflation over the years in many cases provided an excellent return.

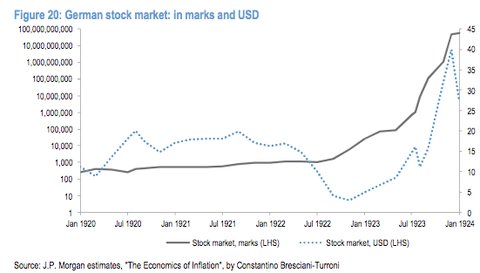

If you look at the value of the German stock market, in both German marks and USD, during this inflationary time period you can see this quite clearly:

Businesses tend to retain their value during inflationary periods because they can push that inflation (through higher prices) to their customers. While this isn’t true of every business in every circumstance, inflation isn’t as scary for stocks as you might have initially believed.

What About Crypto?

Lastly, I have to address the elephant in the room—cryptocurrency. Is this a good investment during inflation? Honestly, we have no clue. We don’t have enough data to rely upon to make an argument either way. Given that cryptocurrency has only existed in a world of mostly low inflation (2010 onward), it is hard to know what it will do now that inflation has picked up.

Yesterday as the CPI numbers came out, Bitcoin promptly surged to an all-time high and the Bitcoiners rejoiced that high inflation was the cause. However, at the end of the trading day Bitcoin briefly fell to below $63,000. Investing is hard.

I don’t say this to poke fun at either side, but to say that the truth is—we don’t know. You can believe Bitcoin will be around for a long time (hint: me) yet have no conviction on its future price. I could see a world where Bitcoin never makes it to $100k and one where it goes beyond $500k. Both seem plausible.

The more important question you should ask is: how much value does a particular cryptocurrency provide to its owners? If you think the value is high or increasing quickly (and is currently undervalued), then that cryptocurrency will probably outperform inflation. If not, then it probably won’t. Either way, there’s only one thing that ultimately matters…

The One Thing That Always Beats Inflation

Regardless of what you believe about stocks, real estate, gold, or crypto, there is one truism that will always protect your assets against inflation—own things that provide value to humans.

If you own things that other people will want, no matter what is happening in the world, then your purchasing power is likely to remain intact. This is true regardless of what measuring stick you use. Remember, currency is just a measure of value.

Therefore, what you should really care about isn’t the measuring stick, but the value that you own and where you own it.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 268. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data