Investors have an obsession. That obsession is price.

I get it. The price you pay for a stock (or index fund) is one of the most important factors affecting your future returns. Overpay and you may have to wait a long time to make your money back. Overpay by too much and you may never make money at all.

However, for most of history, the price you paid would have had far less of an impact on your long-term returns than something you might have not even noticed. What am I referring to? Dividends. Reinvested dividends.

Before we get into that though, I’d like to remind you that a dividend is merely a payout from a business to its shareholders. The size of this payout is determined by a company’s Board of Directors and it signals how the company feels about its ability to generate returns from their excess profits. Remember, companies basically have two options when it comes what to do with their profits. They can either:

- Provide a payout to shareholders (i.e. through dividends, share buybacks, etc.), or

- Reinvest the excess profits back into the business (i.e. expand, experiment, etc.)

If a business thinks it can earn a higher return with its excess profits than its shareholders would earn elsewhere (assuming the same level of risk), then it should reinvest those profits back into the business. However, if it believes that it cannot generate market-beating returns, then it should pay a regular dividend. This issue is not always so black and white (e.g. some companies change their stance over time), but that’s corporate finance in a nutshell.

Unfortunately, this decision is not as easy as it looks. Why? Because deciding to pay a dividend (or not) is really just a calculated bet. And there is a big divide in corporate America about this bet and what is better for shareholders. For example, there are those companies that never pay dividends and always reinvest all their profits into new ventures (i.e. Amazon, Berkshire Hathaway, etc.). And then there are those companies that pay regular dividends (i.e. Verizon, Chevron, etc.).

Either way, dividends are important for shareholders because they can be viewed as interest payments, albeit riskier interest payments, from a business. If you reinvest these interest payments, they start compounding, the process becomes fractal, and you can start really building wealth.

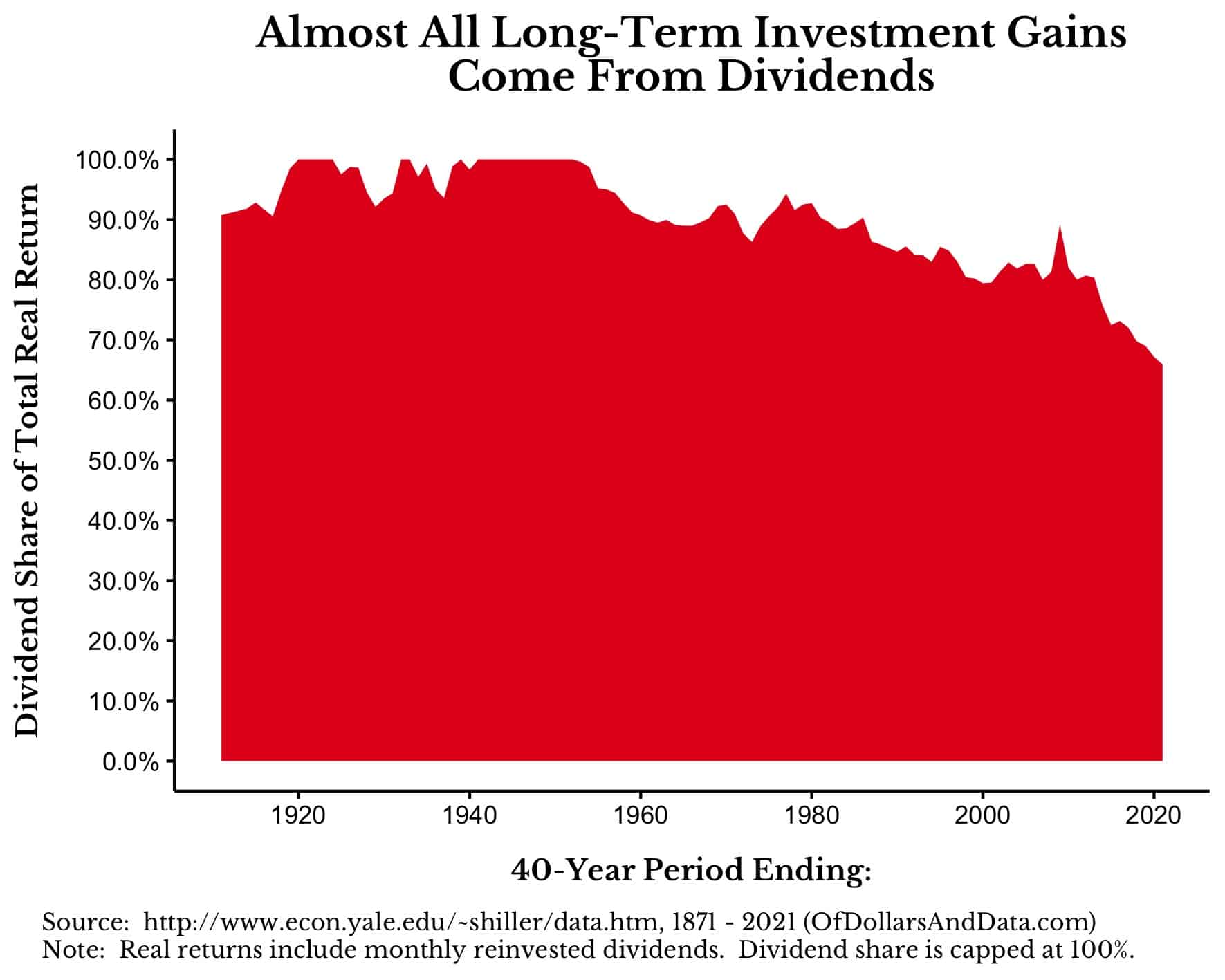

If you want to get an idea for how important this is, consider the plot below. This plot illustrates the percentage of total return that came from dividend reinvestment versus real price appreciation in U.S. stocks over rolling 40-year periods from 1871-2020. As you can see, over a typical investment life (40 years), the vast majority (80%+) of your gains will come from dividend reinvestment:

For example, if you had invested in U.S. stocks over the 40 years from January 1980 to January 2020, your inflation adjusted price return would have been 791%. However, when you include reinvested dividends your return surges to 2,417%. In this instance, the return generated by price only accounts for 1/3 of your total return when including reinvested dividends.

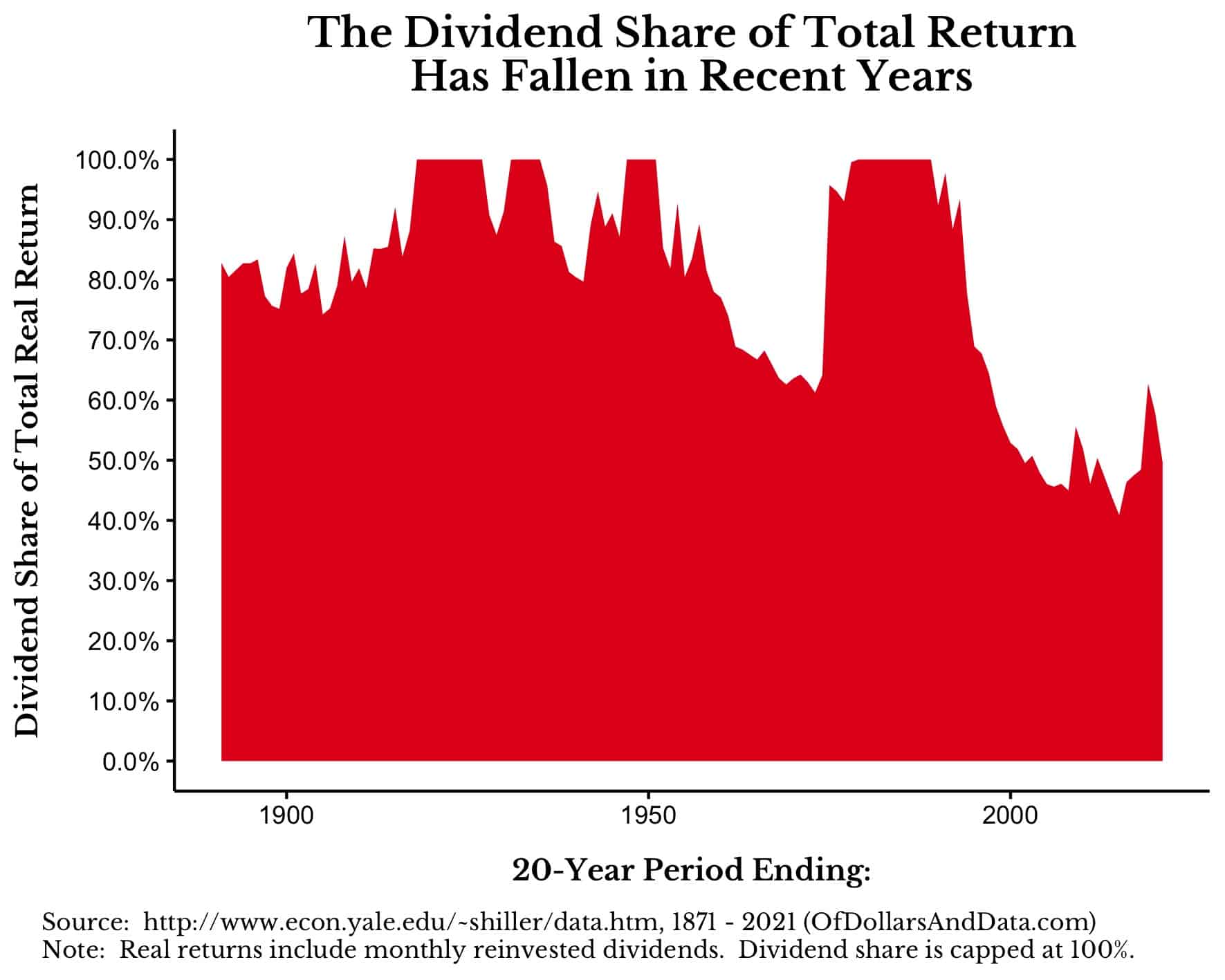

Even over shorter periods of time (i.e. 20 years), the vast majority of the investment gains in U.S. stocks come from dividend reinvestment. And though the dividend share of total return has dropped in recent years with the decline in dividend yields, it is still a sizable part of your returns:

Despite the recent fall in dividend share, this plot demonstrates why you shouldn’t focus on price as much as the dividends you will earn along the way. Those dividends, which are hard to notice in the short run, are impossible to ignore in the long run.

One simple action done many times leads to powerful results.

That’s what dividend reinvestment is all about. You earn dividends that earn you more dividends that earn you more dividends, etc.

For a more personal view of this, below I have listed the total amount of dividends I have received in my retirement accounts by year:

2014: $411

2015: $626

2016: $1,223

2017: $1,466

…

2020: $4,577

I know that these amounts are not substantial by any means, but this is just the beginning of this process. Imagine the dividends 34 years from now as I get closer to retirement.

This illustrates why reinvested dividends are so important. What starts off as an insignificant sum can grow to much, much more. Don’t get me wrong, price is useful to investors because it is easy to measure and it provides immediate feedback. However, it pales in comparison to the importance of the dividends (and their reinvestment), which you don’t see on a day-to-day basis.

This is why price is the wrong thing to focus on as an investor. Focusing on price is like looking at the size of the fruit, rather than the number of seeds it contains. I don’t care if you can grow apples 20% larger then mine if I can produce 50% more seeds per apple. Guess who will win in the long run?

Change Your Investment Mindset

Though I am a fan of dividends, I don’t necessarily believe that you should only own dividend-paying stocks. There are plenty of great companies that don’t pay dividends that can build your wealth just as easily as dividend-paying stocks.

On the other hand, Tweedy, Browne Company LLC released an incredible report on what active approaches have worked in investing over time, and one of these approaches was buying stocks with high dividend yields. There is no guarantee this strategy will hold in the future, but, generally, dividend-paying stocks have outperformed non-dividend paying stocks throughout history.

Regardless of what approach you take, if you want to be free from the investor obsession with price, you need to change your investment mindset. How so?

Ignore the price, remember the dividends.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 264 (originally post 32). Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data