This week I want to discuss what I believe will be the most important economic issue in the coming decades: income and wealth inequality.

However, before I dive into this, I want to emphasize that inequality by itself is not necessarily a bad thing. In the U.S. most people support some level of inequality to reward those who work hard, take financial risks (i.e. starting a business), or get lucky. This is true as long as there is equality of opportunity (i.e. everyone starts at the same place). The problem is that everyone does not start at the same place though we would like to think they do. Putting this aside, the big question is: should we have a mechanism in place to prevent extreme levels of inequality, even if everyone does start off equally?

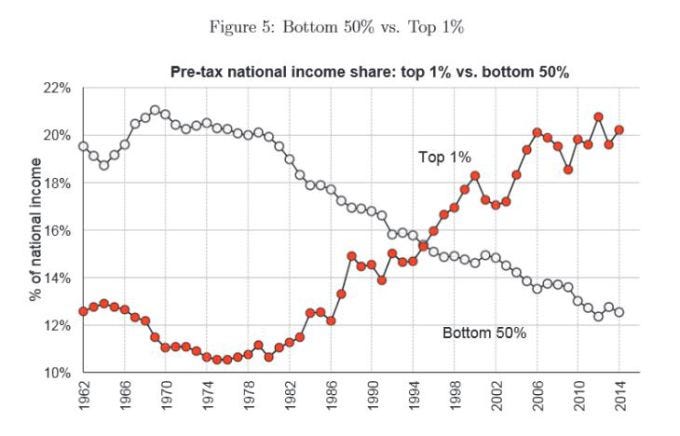

If you haven’t read or heard much on income/wealth inequality, I highly recommend watching this video to understand how unequal wealth has gotten within the U.S. If you don’t have time for the video, this chart will do (from this article):

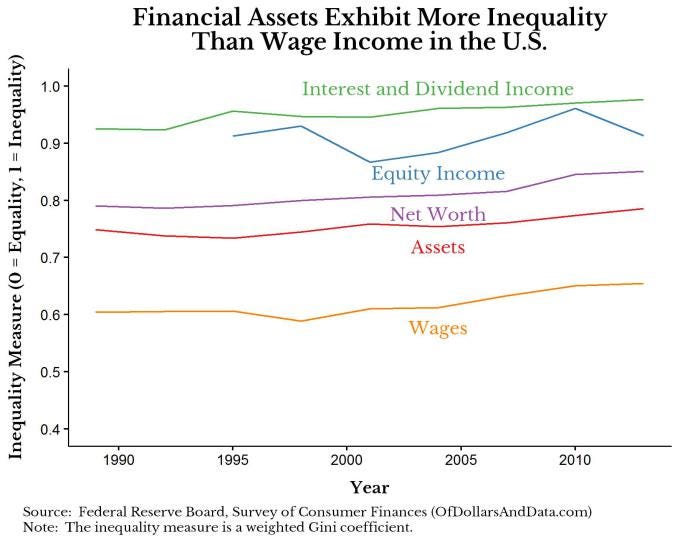

As you can see that the top 1% has seen a huge increase in the share of national income while the bottom 50% have seen a decrease in their share. However, this is for total income. If we were to look at specific kinds of income and assets in the U.S. more generally, we would see a clearer picture of what is driving inequality. Using the Survey of Consumer Finances data I looked at the inequality across households for various financial metrics (i.e. Net Worth, Assets, Dividend Income, etc.). I found that though income inequality is getting worse, financial assets exhibit far more inequality:

The y-axis here is an inequality measure (a Gini coefficient calculated using the household weights from the Survey of Consumer Finances). As you can see income from financial assets exhibits far more inequality than traditional wage income. This data aligns with a Bloomberg article that discusses some of the main drivers of recent inequality including: an increased share of capital income compared to labor income and rising concentrations of capital.

Essentially, technological changes have given the owners of capital a bigger share of the gains than the individuals using that capital. This is why business owners are getting rich while employees are not, though employees are far more productive than they used to be (see my article on productivity here). One solution is to get more individuals to have more ownership of capital (i.e. businesses, stocks, etc.), which is easier said than done.

So inequality is increasing, but what’s the big deal? Simply: large enough relative differences in income/wealth can lead to civil unrest. Yes I am talking about “grabbing the pitchforks” among other things. You might think I am crazy for suggesting this as a possibility, then what do you think about the Silicon Valley elite who have already started preparing for this scenario? I think as a nation we need to realize that even with equality of opportunity, we need to have some mechanism in place to prevent extreme levels of inequality if current trends continue. The Giving Pledge which has the support of many top billionaires is a start, but I don’t think this will be enough, especially with the current tax proposals being considered in Washington.

Equality and Justice For All: Do Any Solutions Exist?

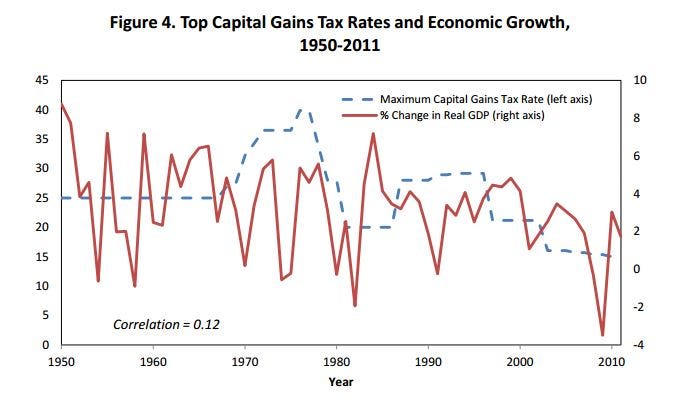

Given where we are today, do any solutions exist to slow or reverse rising inequality? One possibility, which almost never discussed by the media/politicians, is raising the capital gains tax. One study attributed most of the changes in inequality to lowered capital gains taxes in recent decades.

The counter argument against increased capital gains taxes is that they lower incentives for investment and harm economic growth. However, there seems to be no empirical evidence of this. In a testimony by Leonard E. Burman in 2012, Burman found that there was no significant correlation between the capital gains tax and economic growth in the U.S:

Now, even if we increased the capital gains tax, this does not address how to increase the income/wealth of lower classes. Capital gains is a way to slow the rich down, but it won’t necessarily speed up the poor. For this reason I don’t like this solution that much.

A better solution that also addresses the imbalance in financial asset ownership was proposed in a book by Jerry Kaplan. The idea is to set a company’s corporate tax rate based upon the number of people that would benefit from ownership. Therefore, those companies that have wider distribution of ownership would be taxed less than companies with concentrated ownership. This would provide an advantage in the marketplace to those companies that are owned most equitably by the most number of people. I personally think it is a fantastic idea in theory, though it may be difficult in practice and can likely be gamed.

One final caveat on this discussion is that inequality is not static. The people in the top 1% percent of income in one year are not all the same people in the next year. There is some level of income mobility in the U.S. as this New York Times article discusses how “12 percent of of the population will find themselves in the top 1 percent of the income distribution for at least one year” and “56 percent will find themselves in the top 10 percent.”

I hope you enjoyed thinking about some of these issues as I am unsure myself on how we can solve them. Please comment if you have any thoughts on this, I would love to hear them. I don’t know what the future holds, but I hope it isn’t pitch forks. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 10. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data