With the dreadful investment year of 2022 behind us, we can now shift our focus to the future and how we can bounce back financially. Unfortunately, for many people, this means falling into the trap of spending countless hours trying to find the right investments to maximize their returns. However, the truth is, such attempts are usually wasted time and energy. Too many people spend too many hours chasing alpha that would be better spent in some other productive activity. We can demonstrate this with a simple example.

Assume someone with $10,000 invested spends 10 hours a week doing stock research looking for the best investments. Let’s also assume that their research is good and they are able to beat the market by 10% a year as a result. While this is impressive, unfortunately, their 520 hours of work (10 hours per week * 52 weeks per year) only netted them an additional $1,000 (10% alpha * $10,000). This means that our star analyst was doing stock research for under $2 an hour ($1,000/520 hours).

If the analyst’s ultimate goal was to build wealth, you can see how they would’ve been far better off by picking up a part-time job instead of analyzing 10-Ks. Even if we were to increase the analyst’s portfolio size to $100,000, their 10% alpha (i.e. $10,000) is roughly equivalent to what they could have made driving for Uber in the same amount of time.

I don’t say this because I have anything against investment research, but to point out something that the investment industry doesn’t want you to know—most people don’t get rich through their investment decisions, they get rich through their income. They get rich through their work. Even those who do get rich from their investments, typically, had to work to get the money they used to invest in the first place.

Billionaires are no exception to this rule either. When starting Microsoft, Bill Gates said that he never took a day off in his twenties and Elon Musk is known for sleeping in his factories/offices. As the psychiatrist Phil Stutz said in the incredible documentary Stutz, there are three aspects of life that we cannot eliminate: “Pain, uncertainty, and constant work.” It’s work all the way down.

I emphasize this point because right now a lot of people are looking for ways to improve their financial situation in 2023. They are reading books, looking through guides, and trying to find new investments that will grow their wealth. This is fine and all, but I’m here to remind you that none of this will compare to taking action and putting in the work. I can demonstrate this with data from my financial life as well.

What Drives Changes in Wealth?

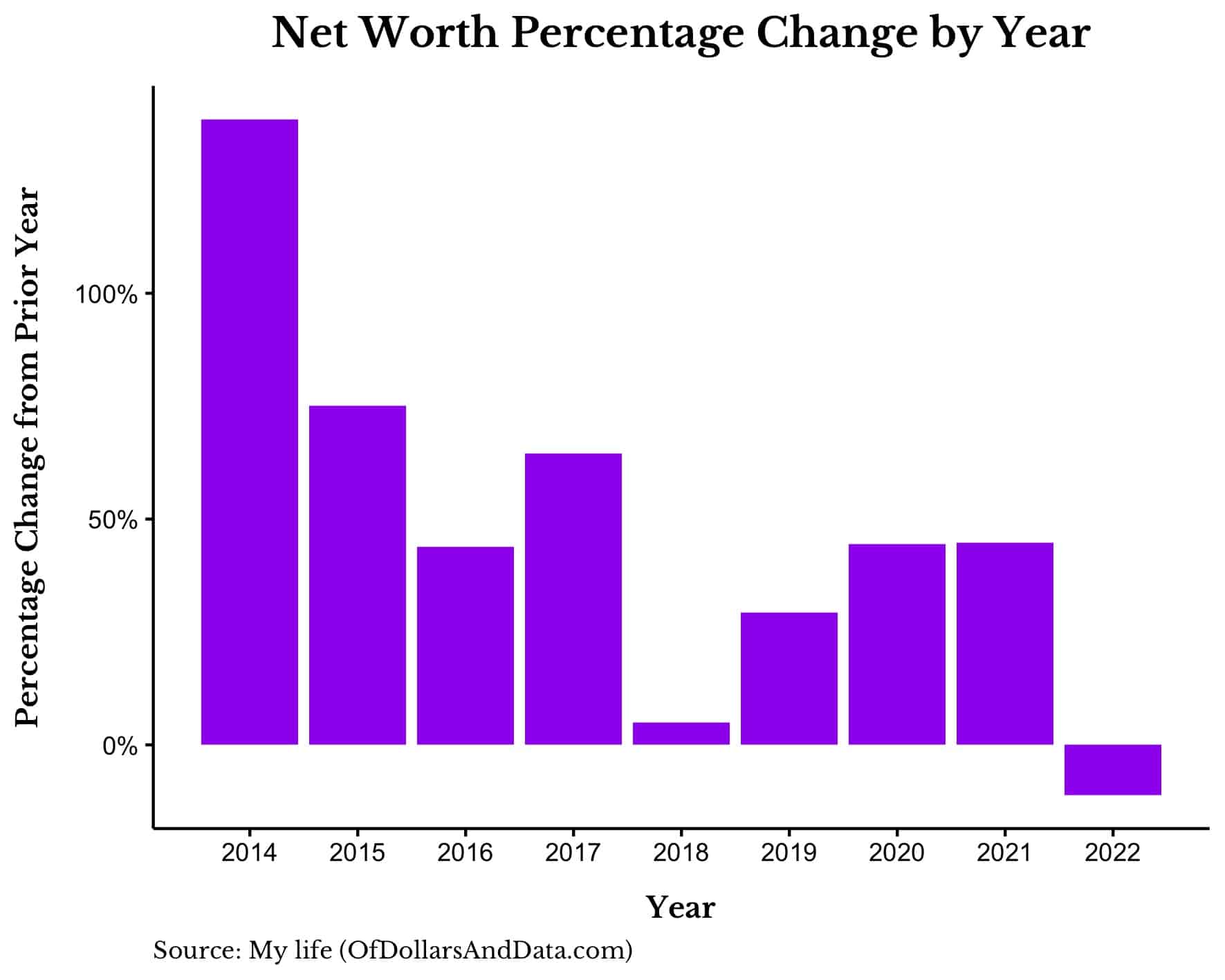

To start, below is a chart showing the annual percentage change in my net worth since 2014 (1.5 years after I graduated college):

As you can see, early on my net worth increased by a lot on a percentage basis, but the growth has since slowed. In fact, 2022 was the first year ever where I saw a decrease in my net worth from the year prior. To be specific, my net worth dropped by 11% in 2022 though my portfolio was down over 20%. What prevented my net worth from declining by 20% like the rest of my portfolio did? My ability to save money to offset my investment losses.

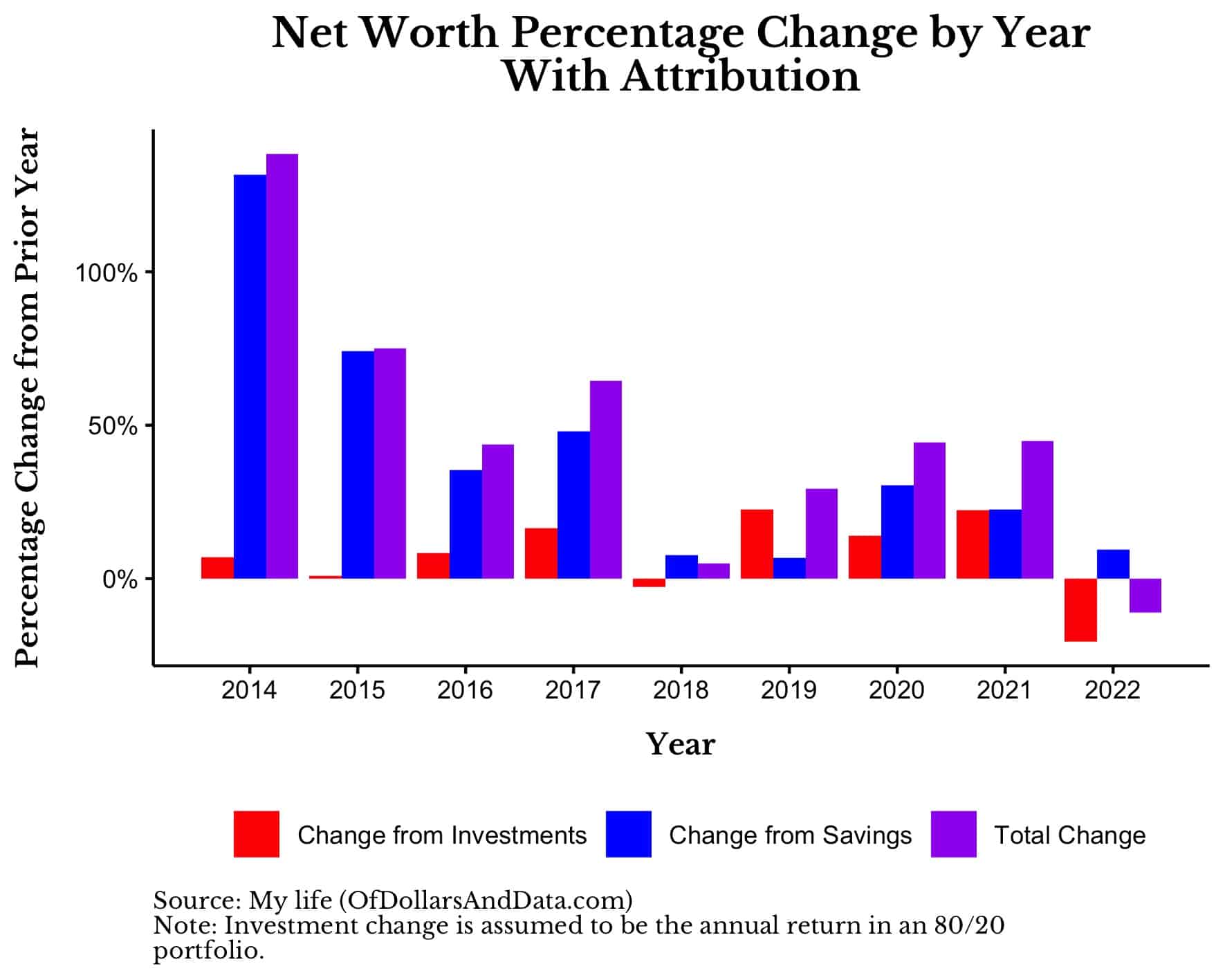

You can see this more clearly in the chart below which shows my annual percentage change in net worth broken out by my change in investable assets (red) and my change in savings (blue). More simply, the red bar (change in investments) plus the blue bar (change in savings) equals the purple bar (change in net worth):

In most years both the change from investments and the change from savings are positive, meaning that my change in net worth would be positive as well. However, in years like 2018 and 2022, market declines contribute negatively to my change in net worth.

To put these numbers in context, imagine I had a $100,000 net worth at the beginning of 2021. According to the chart, by the end of 2021 I would have had $144,000 in net worth (i.e. a 44% increase). Half of this increase (22% or $22,000) would be attributable to the rise in my portfolio while the other half (22% or $22,000) would be attributable to how much I saved in 2021.

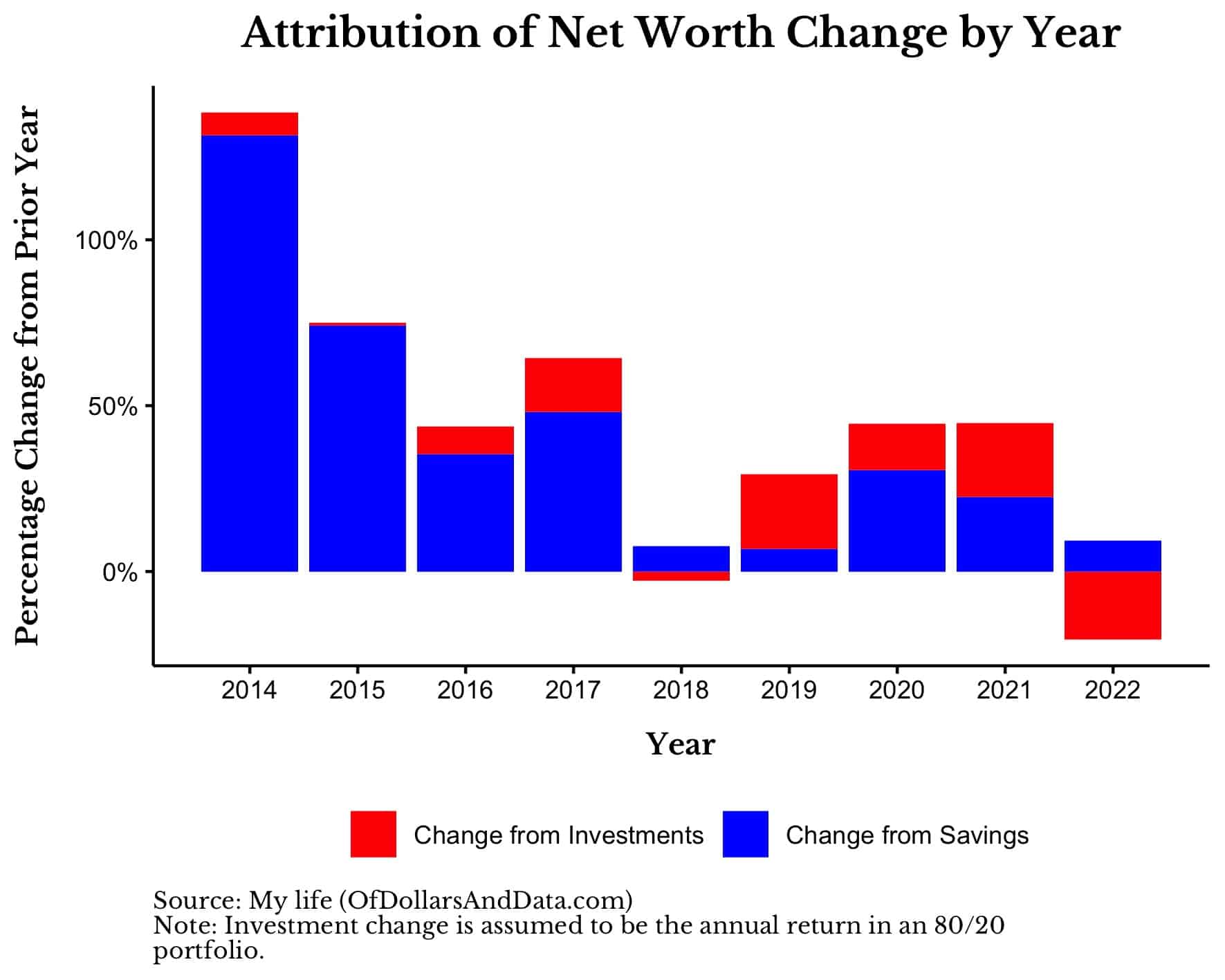

To get a better idea of how much savings and investments contribute to my change in net worth each year, we can plot the share of change in my net worth attributable to each of these over time:

What this chart shows is that, early on, nearly all of my change in net worth came from how much money I was saving (blue) and not how well my portfolio was performing (red). While it’s easy to see this in my financial life, the same is likely to be true for yours as well, and I have a framework to prove it.

The Save-Invest Continuum

I shared the personal financial data above to demonstrate how my finances have changed over time. As you can see, it wasn’t my investment choices that got me here (so far), it was my ability to work and save money. This was true in practice when analyzing my finances, but it is also true in theory for anyone else’s.

Formally, I’ve defined this concept as the Save-Invest Continuum. The idea is that early on in life (or when you have fewer assets to your name) your savings have a bigger impact on your wealth and later on in life your investments have a bigger impact.

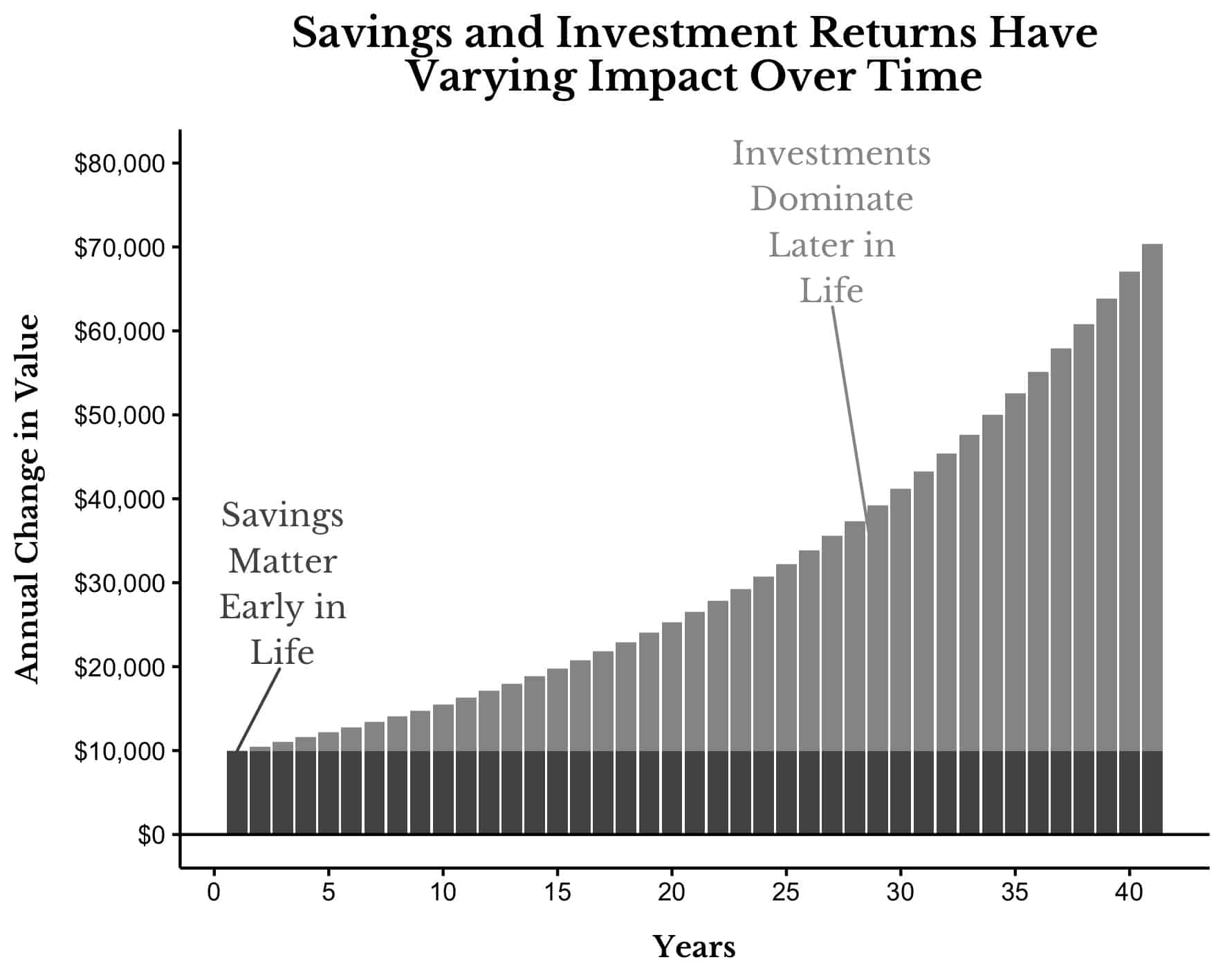

You can see this clearly in this chart from Chapter 1 of Just Keep Buying, where I plot the annual change in value of someone’s net worth broken out by savings and investments (assuming they save $10,000 annually with a 5% annual return):

While this example is a bit simplistic, it gets at my underlying point. Saving money is the key to building wealth earlier in time. This is especially true if your income is increasing. Think about it. If your income is going up over time, you probably can save even more money than you did in the year prior. More importantly, it’s also likely that your investments haven’t had time to catch up with this increased income.

While this example is a bit simplistic, it gets at my underlying point. Saving money is the key to building wealth earlier in time. This is especially true if your income is increasing. Think about it. If your income is going up over time, you probably can save even more money than you did in the year prior. More importantly, it’s also likely that your investments haven’t had time to catch up with this increased income.

This is why savings (and our ability to save money) continues to be important for most people even into mid-career. It’s only once you have built a sizable nest egg that your investments begin to dominate your wealth.

So when deciding on where to focus your efforts over the next year, prioritize your income. Prioritize taking action. Because it’s the one thing you can always control.

I have no idea how 2023 will turn out, but if you’ve been taking it easy in 2022, this is your wakeup call. It’s time to work.

Happy New Year and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 329. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data