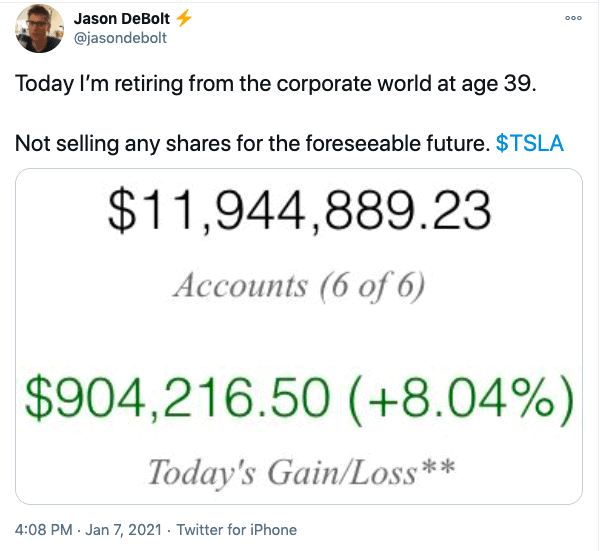

I was scrolling through Twitter last week following the failed coup of the U.S. government, when I saw the tweet that took FinTwit by storm:

It’s impressive to say the least. 39 years old with $12 million in a single stock—Tesla. He started buying in 2013, with an initial investment of $18,750, which has since grown 100x. Over this time period he experienced five separate declines of 30% (or more) and has seen his holdings decrease by more than $1 million in a single day not once, but twice. His conviction and ability to not sell is remarkable to say the least.

Given these extraordinary gains, the prudent thing to tell Jason is simple: Sell down a portion of your shares, diversify your wealth, and create a minimum standard of living that you can’t fall below. Establish a safety net for you and your loved ones by solidifying your position on the wealth ladder. Fund your children’s 529 accounts. Pay off your mortgage. Hell, buy your dream car. I don’t care. Just take the money.

As my colleague Blair duQuesnay wrote a few weeks ago:

Take some money off the table. It doesn’t matter if the stock keeps going up from here. You can still participate with less of your money at risk. Lock it in.

But what’s the chance that Jason will heed this advice? Zero percent. How do I know? His identity is too intertwined with Tesla. Just look at his Twitter bio:

All in Tesla investor since 2013. Early model S owner. Even his last name has the word “bolt” in it which is synonymous with electricity. This guy was born to be a Tesla investor. Jesus Christ could come back, turn water into wine, part the Red Sea and I bet Jason would say, “That’s cool, but Elon is gonna go to Mars.”

All jokes aside, do you think there is any chance that he would listen to some random financial blogger he has never heard of because it would be “prudent”? No way. No way. He’s the “All in Tesla investor”, not the “80% in Tesla investor.” Read Jason’s recent interview with Ramp Capital and you will see what I mean.

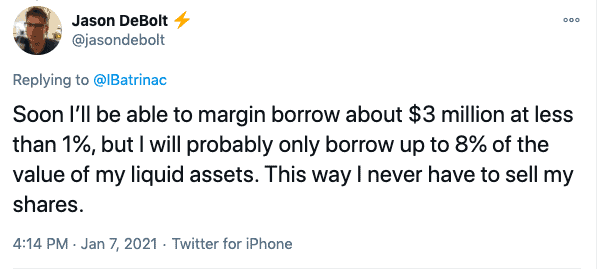

This is what happens when you become your investments. You make decisions that could either (1) make you very rich or (2) lead to ruin. You might think I am being extreme, but Jason has already publicly admitted that he wants to use margin and, thus, increase his risk exposure to Tesla:

Of course, borrowing 8% isn’t that extreme, but if things turn for Tesla and Jason accelerates his borrowing, this could end very badly.

But, to be frank, no matter what happens with Tesla, Jason is likely going to be fine financially. Why? Because he has so much wealth to start with. Even if he sold his Tesla shares for an 80% loss, Jason would still have $2.4 million! That is enough to withdraw $100,000 a year (in real terms) for the next half century (assuming a 4% real growth rate). This means that Jason can live comfortably to age 90, even if Tesla goes belly up. And if Tesla goes all the way to $0, Jason could at least write a book called “How I Lost $12 Million” as a backup plan.

In all seriousness, while Jason will probably be fine even if he is wrong about Tesla, I can’t say the same for you. If you are someone who has a large portion of their wealth in a single position, you should consider whether it makes sense to reduce it a bit. If you are sitting on 100 Bitcoins (~$3.5M) right now, what’s the harm in selling some of them and buying some income-producing assets instead? If you have a huge Apple position, why not peel some off to diversify your holdings?

I only recommend this approach because human psychology suggests that it’s the wise thing to do. Since wealth has diminishing marginal utility, each additional dollar you earn provides less happiness than the dollar before. This is why going from $0 to $1M in wealth provides a much bigger boost to someone’s happiness than going from $1M to $2M.

So, from a happiness perspective, the best thing you could do is put some base level of wealth into a diversified portfolio and have the excess be concentrated in riskier assets. Though in years past I never would have made this recommendation, I have since learned about the step-like nature of wealth. I now understand why big concentrated bets can make sense for some people. If those bets fail, you aren’t really that much worse off, but if they succeed you are a lot better off.

This is equivalent of choosing $500k (with a chance for $5M) over $1M with certainty. Going from $500k to $1M might change your life a little, but going from $500k to $5M would change it a lot. But remember, both of these options are still better than a coin flip between $0 and $10M. This is the power of diversification and reducing your risk exposure.

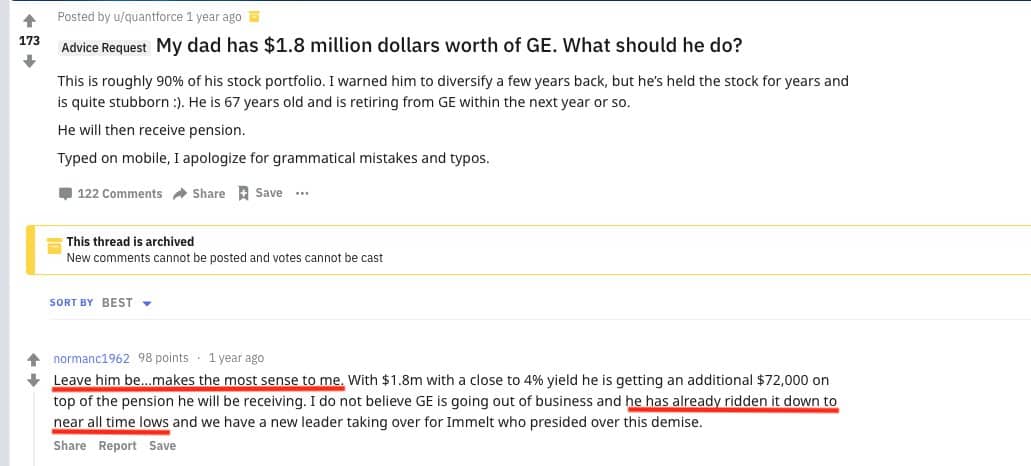

As obvious as this advice might seem, people ignore it all the time. For example, consider this thread on Reddit where someone asked whether their father should diversify their $1.8M of GE stock:

While the original poster clearly wants their father to diversify, the most upvoted comment says to, “Leave him be,” since “he has already ridden [GE] down to near all time lows.”

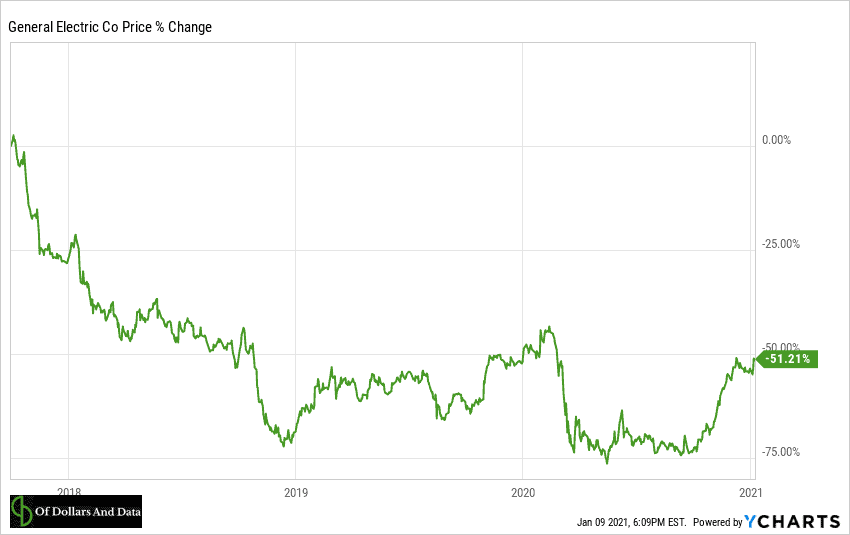

Well guess what? Those “all time lows” got even lower:

Since the date of this post (9/30/17), GE stock has declined by 51%! Had the father followed the top commenter’s advice, his $1.8M would now be worth less than $900k. If he had instead put that money into the S&P 500, it would have grown to $2.9M today (assuming no taxes/fees). This is why you don’t take financial advice from Reddit.

What do you do instead? You celebrate your big win, you reduce your exposure, and then you diversify. Trust me. Just take the money.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 222. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data