You’ve probably heard that “money can’t buy happiness.” This belief stems from a 2010 paper by Nobel laureate Daniel Kahneman and economist Angus Deaton, which fundamentally reshaped our collective understanding of the relationship between money and happiness.

Their paper, “High income improves evaluation of life but not emotional well-being”, found that while a higher income indeed improved people’s life evaluation (i.e. how they rated their life on a scale), it didn’t have a significant impact on their day-to-day emotional well-being after a certain income threshold.

In other words, while more money could make you feel better about your life as a whole, it wouldn’t necessarily make you any happier on a day-to-day basis once you earned over $75,000 a year. This thought-provoking conclusion not only challenged our understanding of what brings true happiness, but also ignited a broader conversation about the role of money in our lives.

In this blog post, I’ll discuss the interplay between money and happiness and explore whether money can’t buy happiness and under what circumstances it can. To begin, let’s take a deeper look at the Kahneman and Deaton paper to understand why they concluded that money can’t buy happiness.

When Money Can’t Buy Happiness

The famed Kahneman and Deaton paper analyzed survey responses from over 450,000 U.S. residents and found the following:

- Life satisfaction continually rises with income. The measure they used for evaluating life satisfaction was the Cantril ladder, which asks respondents: “Imagine a ladder where your best possible life is a 10 on the ladder and your worst possible life is a 0 on the ladder. How would you rank your current life (0-10) on this ladder?”

- Technically, the researchers found that life satisfaction rises with the log of income (i.e. multiples of income), not linear changes in income. The reason why log income is more relevant here is because someone with $10,000 might be much happier than someone with $0. However, someone with $10,010,000 is probably no happier than someone with $10,000,000. In other words, $10,000 means a lot to someone with nothing, but nothing to someone with a lot. I’ve written on how this idea applies to wealth in the past and I plan on expanding on it in the future.

- Emotional well-being rises with income until $75,000, then levels off. This was the key finding that shook the world of happiness research and became widely popularized by the media.

- To measure emotional well-being, the researchers looked at the following metrics:

- Positive affect: When someone reported “happiness, smiling, and enjoyment.”

- Not blue: When someone reported not feeling “worry or sadness.”

- Stress free: When someone reported not feeling stress on the previous day.

- To measure emotional well-being, the researchers looked at the following metrics:

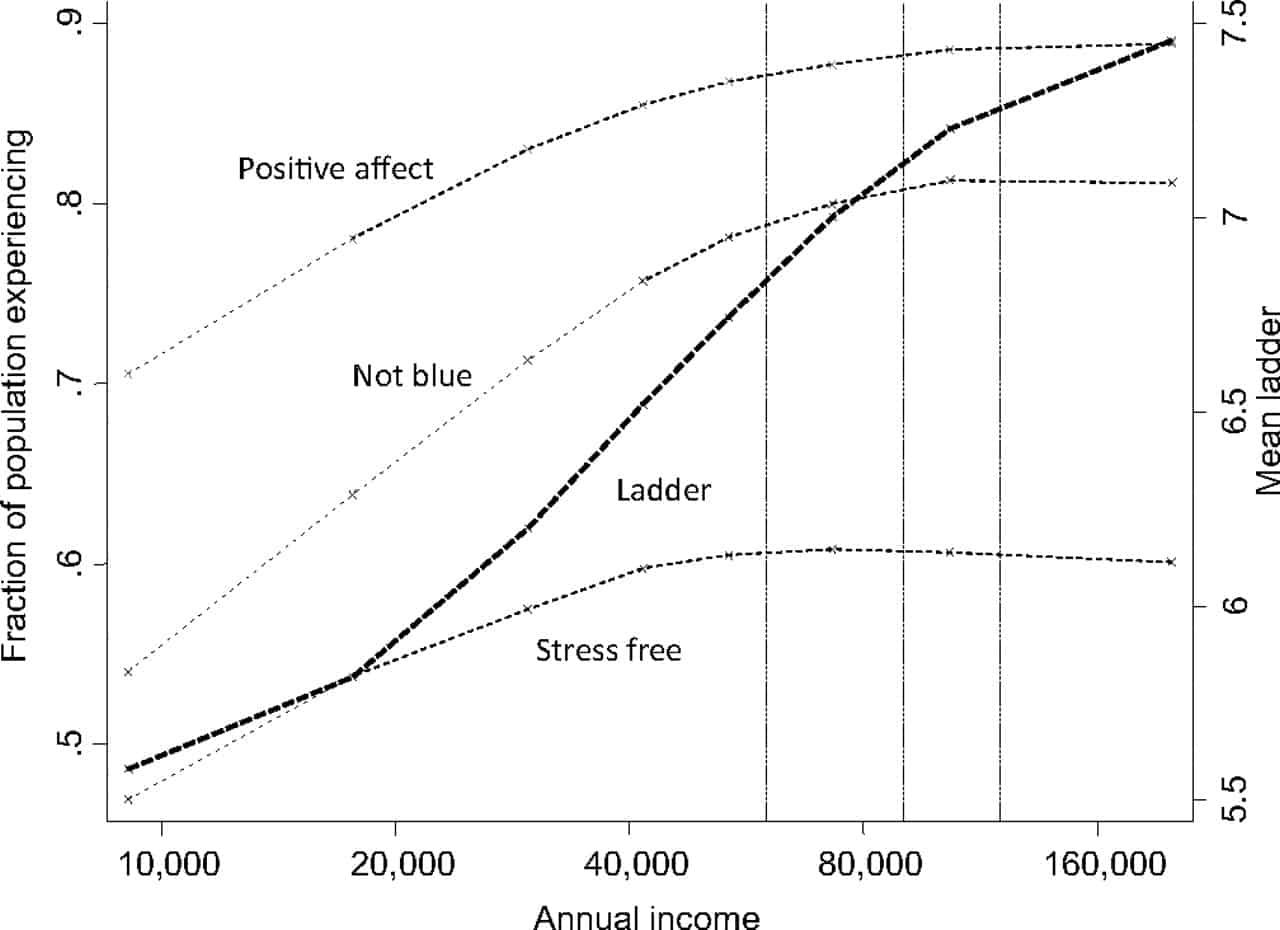

The researchers also created a visualization to show how life satisfaction tended to rise continually with income (this is the “ladder” measure in the chart below) while emotional well-being (i.e. “positive affect”, “not blue”, and “stress free”) leveled off after a certain income threshold:

As you can see, while life satisfaction (“ladder”) continually rises with income, the measures of emotional well-being tended to level off once income reached $60,000 to $80,000. This finding popularized the idea that while people might reflect more positively on their life as they earn more, they won’t necessarily experience more day-to-day happiness along the way.

And for over a decade this was the status quo in happiness research…until a challenger arrived.

Money Can Buy Happiness: A Challenge to the Status Quo

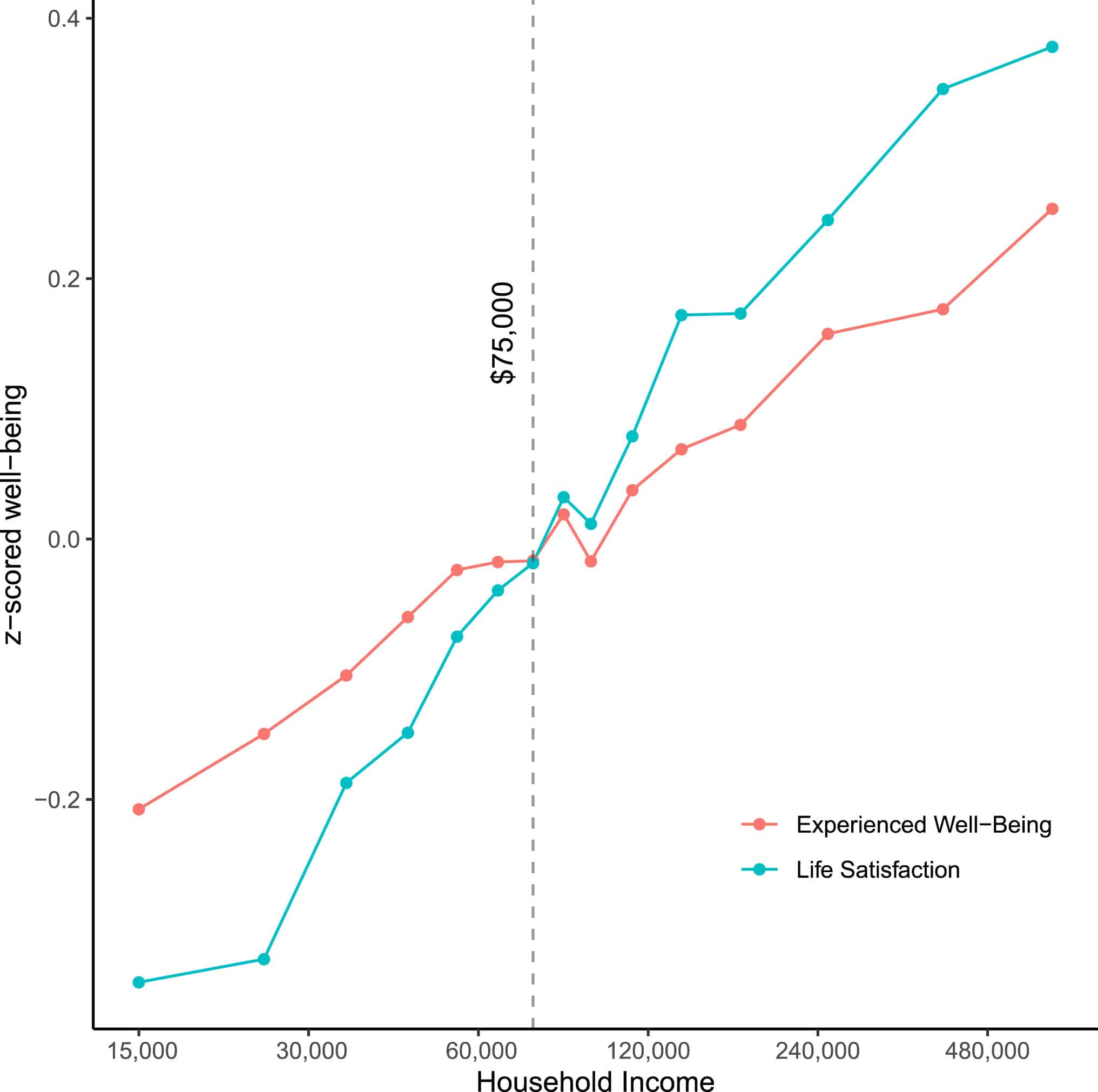

In 2021, a study by Matthew Killingsworth titled “Experienced well-being rises with income, even above $75,000 per year” shook the foundations of happiness research by contradicting the findings from Kahneman and Deaton’s famed 2010 paper. In particular, Killingsworth’s study found that both life satisfaction and emotional well-being continued to increase with income (i.e. the log of income), even beyond the $75,000 threshold reported by Kahneman and Deaton.

In other words, Killingsworth found that the more money people made, the happier they tended to be, regardless of how much they were already earning. You can see this in the chart below from his paper:

Why did Killingsworth’s findings look so different from Kahneman and Deaton’s?

It came down to his data source. Instead of relying on traditional survey methods (like Kahneman and Deaton), Killingsworth used an application called “Track Your Happiness,” which collected real-time data from over 33,000 employed U.S. adults by randomly asking them about their mood and what activities they were doing throughout their day. In doing so, Killingsworth was able to get a more accurate measure of emotional well-being than prior studies had found.

Did this mean that Killingsworth’s findings were correct and Kahneman and Deaton’s were not? Not necessarily. Though Killingsworth’s conclusion seemed to contradict that of Kahneman and Deaton, there was a bit more to the story. Thankfully, earlier this year Killingsworth and Kahneman released a collaborative paper that resolved this conflict.

Resolving the Conflict (When Money Does and Doesn’t Buy Happiness)

When Killingsworth and Kahneman realized they had a conflict in their results, they decided to dig deeper to reconcile their differences. The result was a paper released in March 2023 titled, “Income and emotional well-being: a conflict resolved.”

In their paper, they identified the primary reasons as to why Kahneman’s original paper found a leveling off effect in emotional well-being with higher income and why Killingsworth’s original paper didn’t:

- Kahneman’s evaluation of emotional well-being wasn’t measuring happiness, but unhappiness. As they stated, “…they quite reasonably believed that the Gallup questions on which they relied provided a measure of happiness in general, when in fact these questions were only useful as a measure of unhappiness in particular.” In other words, Kahneman’s original measure of well-being wasn’t picking up more happiness at the higher end of the income spectrum, but more misery (which wasn’t present in the data). This is why we see a leveling off in this measure above a certain income.

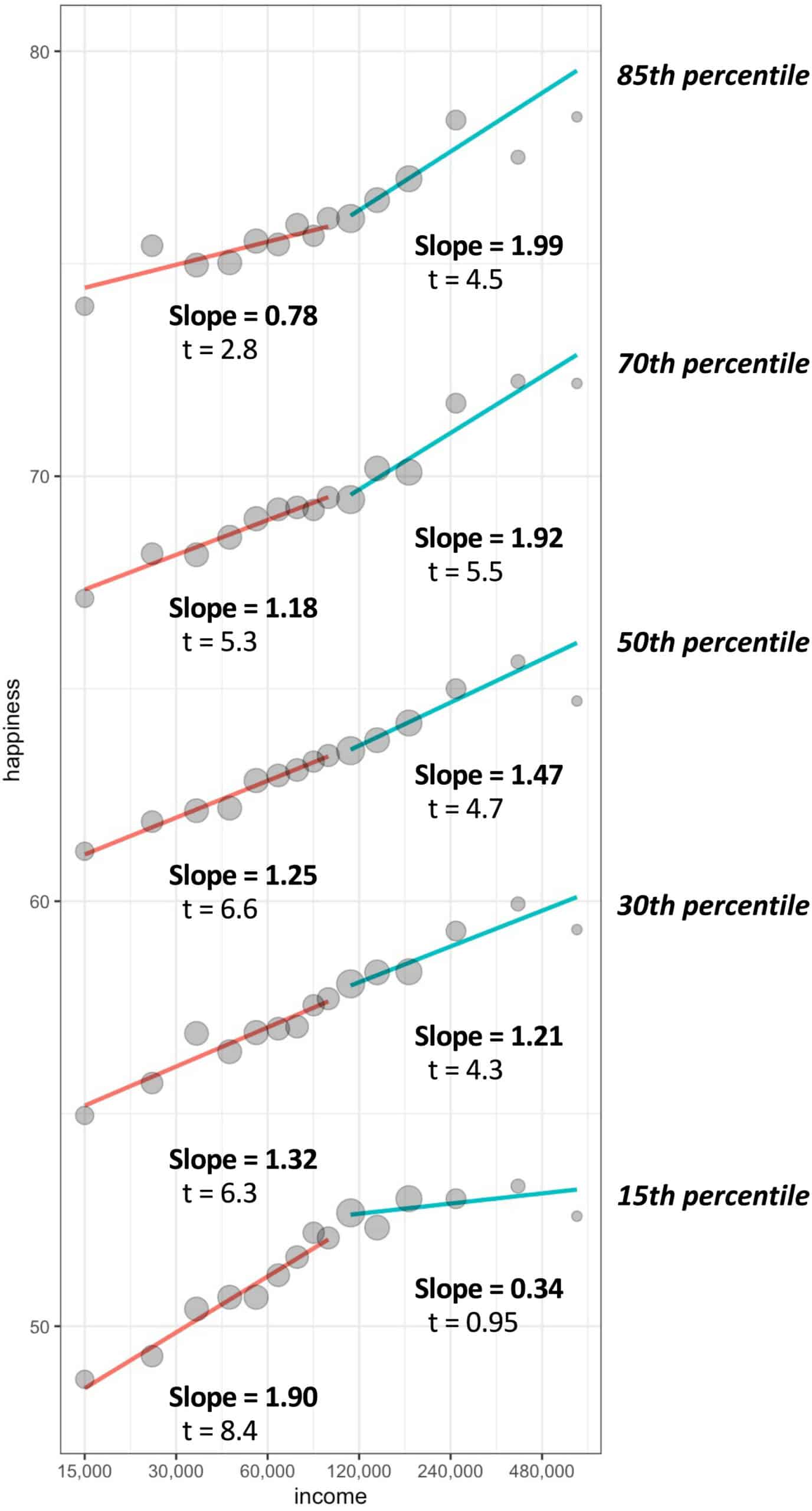

- Killingsworth’s data does find a leveling off of emotional well-being with income, but only for the unhappiest people. When Killingsworth’s data was broken out by income and happiness level, it became clear that rising incomes don’t improve emotional well-being for people in the lowest 15%-20% of happiness. When visualized, this relationship becomes much more apparent:

As you can see, for those reporting lower levels of happiness, additional income does not seem to improve their emotional well-being (i.e. the slope of the fit line is closer to 0). This data matches Kahneman’s original findings which, as stated in the first point above, seemed to be measuring unhappiness rather than happiness.

When taking these points together, Killingsworth and Kahneman were able to agree on a few major points:

- More income seems to be correlated with higher emotional well-being and higher life satisfaction (on average). The authors agree that this is true when you have a proper measure of happiness (instead of a measure of unhappiness).

- The same increase in income has different effects on happy and unhappy people. Both Killingsworth and Kahneman’s data seem to suggest that increased income above a certain threshold impacts happy people more than it impacts unhappy people. This logically makes sense as some forms of unhappiness, such as personal or emotional struggles, cannot be solved by money. For example, if someone close to you were to die, increasing your income probably wouldn’t make you happier. In this instance, no amount of money can buy your happiness back.

Through their collaborative efforts, Killingsworth and Kahneman were able to reconcile their conflicting findings, providing a more nuanced understanding of the relationship between income and happiness.

Now that we’ve looked at what the research says on money and happiness, let’s now turn to the practical implications of these findings.

The Bottom Line

The relationship between money and happiness is complex and nuanced. While increased income seems to contribute to an elevated sense of well-being and life satisfaction, it isn’t a magic cure-all for every type of unhappiness. As the collaborative work of Killingsworth and Kahneman has shown, the impact of additional income varies significantly depending on an individual’s current income and current happiness level.

More importantly, Killingsworth and Kahneman’s research is based on cross-sectional samples where the causality between income and happiness is difficult to determine. In other words, their research doesn’t consider how changes in income impact individual happiness over time. So we can’t say whether increasing someone’s income causes them to be happier in the future.

And when we do have data on income changes over time, the results are mixed. For example, some studies on lottery winners find no long-term boost in happiness, while other studies find some improvement in mental well-being in the years after a windfall. Given these conflicting claims, it seems likely that the impact of money on happiness is smaller than we might imagine.

So, what does this mean for you? Here’s my take, based on everything I’ve reviewed:

- If you have a lower income, more income probably will make you happier. Across every happiness level, more income was associated with higher well-being among those with the lowest levels of income. You can see this clearly in the chart above from the Killingsworth and Kahneman collaboration. If you are interested in learning more about how to increase your income, Ch.3 of my book Just Keep Buying lays out some strategies that can help.

- If you have a high income and are unhappy, more income probably won’t make you happier. As the data suggests, if you have a high income and are unhappy, more income probably won’t help. Instead, focus on the other things in life that can boost your happiness such as building relationships, maintaining your health, and finding purpose and fulfillment. Each of these will likely have a bigger impact on your well-being than more money ever could.

- If you have a high income and are already happy, more income probably isn’t worth the effort. Though the research suggests that happy people with high incomes could be even happier if they increased their incomes further, this probably isn’t worth the enormous amount of effort that is needed to do so.

- You have to remember that these studies are based on the log of income (i.e. multiples of income), not linear changes in income. This means that high earners have to increase their income by much more than low earners (on an absolute basis) to receive the same boost in overall happiness. For example, if we assume the same relationship between the log of income and happiness across the curve, someone going from $10,000 to $20,000 in income would get the same boost in happiness as some going from $100,000 to $200,000 in income.

- Given this relationship between income and happiness, your best bet as a high-earning, happy person isn’t to maximize your income, but to focus on the other lower effort areas of your life where you could increase your happiness more easily. Once you have done this, then income maximization make more sense, given the effort required.

In the end, the pursuit of happiness is a deeply personal journey where money is just one of many factors to consider. And while the evidence suggests that money can’t buy happiness, it can definitely make many parts of your life much easier.

However, it’s also crucial to remember that the richness of life isn’t always encapsulated by monetary wealth. Instead, it often lies in the experiences we have, the relationships we nurture, and the sense of purpose we cultivate. Let’s not forget to invest in these aspects of life as well. Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 346. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data