Meb Faber recently wrote a post on the difficulty of staying rich. In it he states (emphasis mine):

Research has shown that 70% of wealthy families lose their wealth by the 2nd generation, and a whopping 90% by the third generation. Granted, some of that is due to high spending, addiction, bad luck, leverage, or just poor decisions. But a lot of it is how people invest their money.

So, let’s dig deeper on this subject. Imagine I gave you $1 million and told you that you had to maintain its purchasing power over the next 100 years. Assuming you have no descendants that would squander it away, how would you invest your $1 million to preserve its buying power until 2119?

This is a very difficult question to answer because the future is inherently uncertain. However, we can ask a slightly easier question to start: If you had $1 million in 1919 (100 years ago), what could you have invested in back then to preserve its purchasing power until today?

A Flight to Safety?

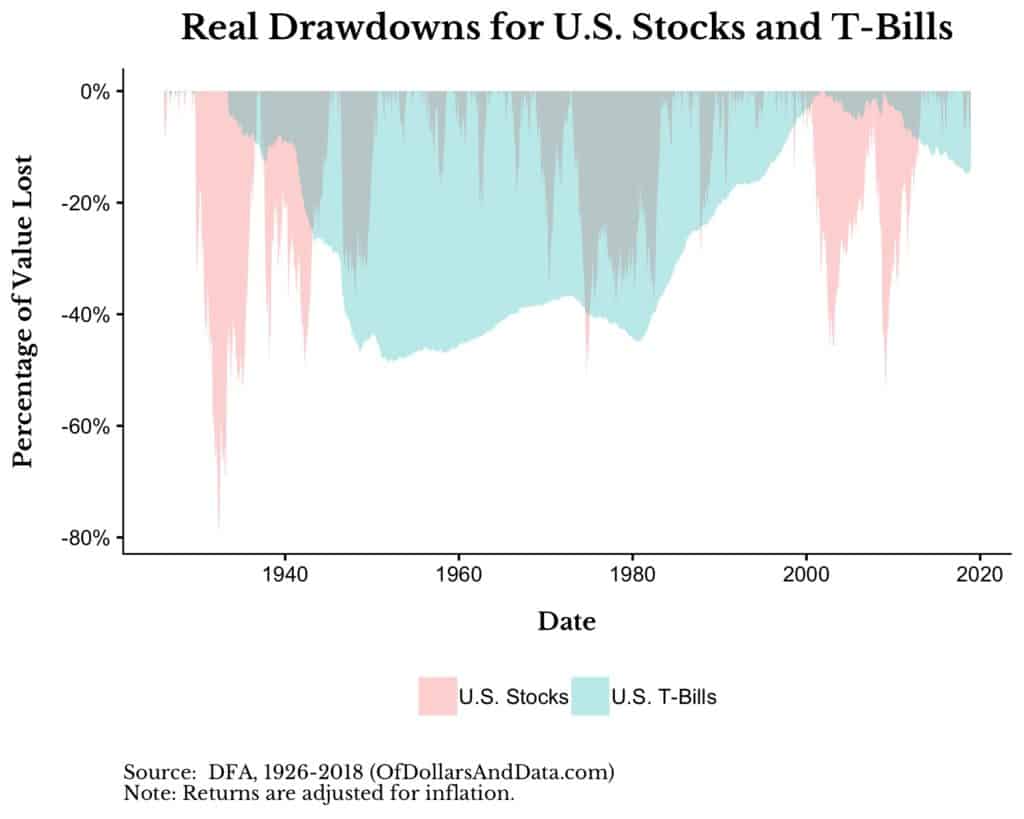

Your first reaction might be a flight to safety. U.S. Treasury Bills, right? Wrong. As Meb’s post points out, T-Bills can have large drawdowns over long periods of time. I looked at the historical drawdowns for T-Bills and U.S. Stocks and came to a similar conclusion:

As you can see, on an inflation-adjusted basis, U.S. stocks tend to fall fast and recover slow, while T-Bills erode wealth slowly with no guarantee of recovery. In the chart above, T-Bills went 68 years with a negative real return. A long-term analysis of U.S. 5-Year Treasury Bonds finds generally similar conclusion to that of T-Bills. So, if T-Bills/Bonds cannot be trusted over very long periods of time, what else can we rely on?

How About Gold?

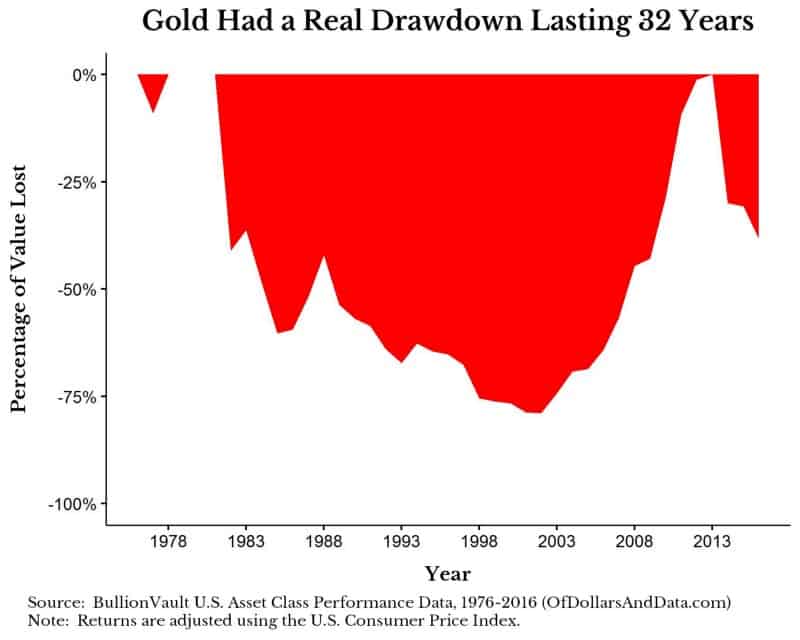

The saying goes that one ounce of gold can always buy a decent man’s suit. Since gold literally was money for most of its history, using it as a way to preserve purchasing power makes sense. An analysis from an author at Seeking Alpha came to a similar conclusion. The only problem with gold is that, like T-Bills, it can have long periods of negative real returns. From 1980 to 2012, gold was in a real drawdown:

Based on this performance, I wouldn’t count gold out, but it also probably shouldn’t be a substantial portion of the portfolio.

What About Stocks?

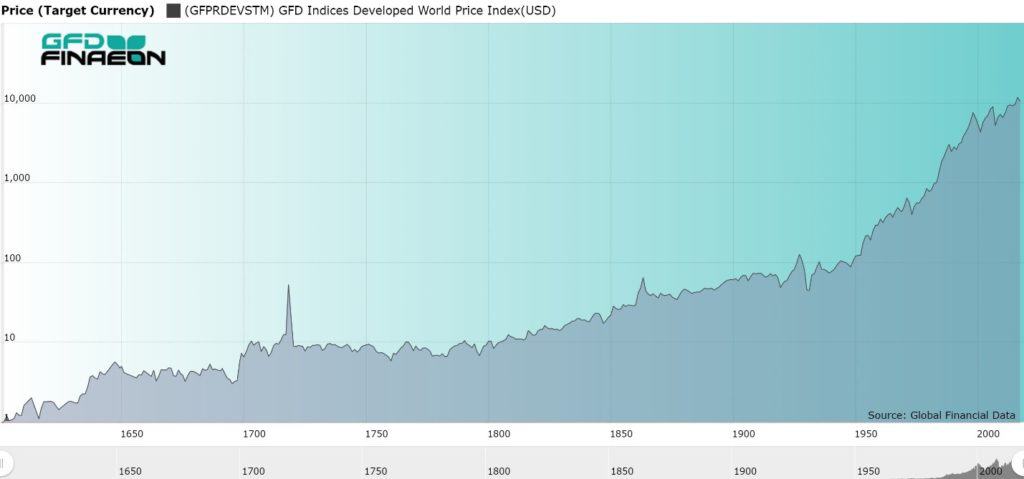

Global Financial Data put together a global index of equities going back to 1601. Their index showed that stocks did well, but not without a few long periods with flat performance:

From 1700-1800, global stocks did basically nothing. It wasn’t until the beginning of the industrial revolution that equity markets started to provide real returns to investors. So, we should put most of our money in stocks for the long haul, right?

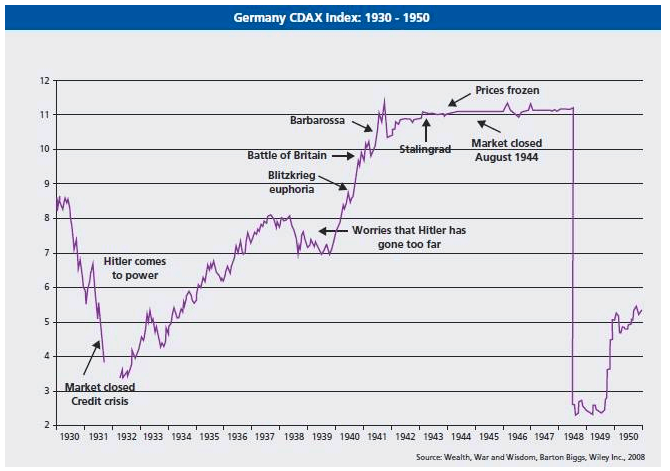

“Not so fast,” says Barton Biggs, the author of Wealth, War, and Wisdom. In his book, Biggs does a in-depth analysis of what happens to equity markets during wars and other catastrophic events. For example, in his analysis of the German stock market during WWII, Biggs found that stock prices plummeted by over 80% (on aggregate) after the German market was reopened at the end of the war:

And Germany is just one example where a country’s equity market was impacted by war. In Russia, it was estimated that 25% of the capital stock was completely destroyed in WWII. It’s hard to imagine the S&P 500 becoming the S&P 375, but this is what can happen during times of conflict.

Safe Havens?

While a large allocation to equities does have merit, we need to take into account the occasional chaos that the world may present to us. For this reason, Biggs suggests another asset class we have yet to discuss:

As a wealthy person, you should have 5% of your money in a safe haven. You should have another 5% in a farm.

Biggs recommends a safe haven (i.e. domestic property or an international store of wealth that you can access) along with a farm where you can go to in case of a prolonged domestic conflict. The ability to lay low and ride out these conflicts is key. I like this idea, but I have a bit of a problem with it. I have no idea how to run a farm or grow produce. So while I want to have 10% of my net worth in some sort of safe haven/farm as a hedge, this is impractical for me and probably most of you. Additionally, the recent flooding in the Midwest demonstrates that even safe havens aren’t safe.

So what is safe? Nothing. Nothing is safe. Not bonds. Not stocks. Not gold. Not farmland. Just because you want markets to provide you with high returns, that doesn’t mean that they will. Just because you think that a currency should be a store of value, that doesn’t mean that it will be.

No single asset will ever be able to safeguard purchasing power across many generations just as no single biological trait can guarantee that an organism will pass on its genes. This is because the investment environment, like the biological environment, is always evolving, always changing. In order to keep up, we must adapt.

The Next 100 Years

So how should you invest through 2119 to preserve your purchasing power? I’d like to hope that a large allocation to global equities with some hard assets (i.e. land, gold, etc.) would provide the sufficient return no matter what the world throws at you, but I can’t know for sure. I don’t mean this to sound all gloom and doom. I just like playing devil’s advocate sometimes when it comes to the plethora of investment choices that the world has to offer us.

Of course I wholeheartedly believe that global equity/bond markets should satisfy the goals of a typical investor during their lifetime (i.e. the next 40 years). However, when it comes to investing over centuries, we have no such guarantees. Nothing is impossible. Nothing is certain. Nothing is safe.

If you liked thinking about these ideas, I highly recommend Wealth, War, and Wisdom by Barton Biggs. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 117. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data