Americans have an unbridled sense of hope for their futures despite economic realities that seem much more grim. An article published by the Atlantic in 2015 (see here) illustrated the optimism of Americans, which is higher than any other developed nation. While I do tend to fall into this line of thinking myself (I am an American optimist), I am somewhat concerned with the retirement situation in America given the data.

The following tables from the Employee Benefits Research Institute’s 2016 Retirement Confidence Survey illustrate my concern:

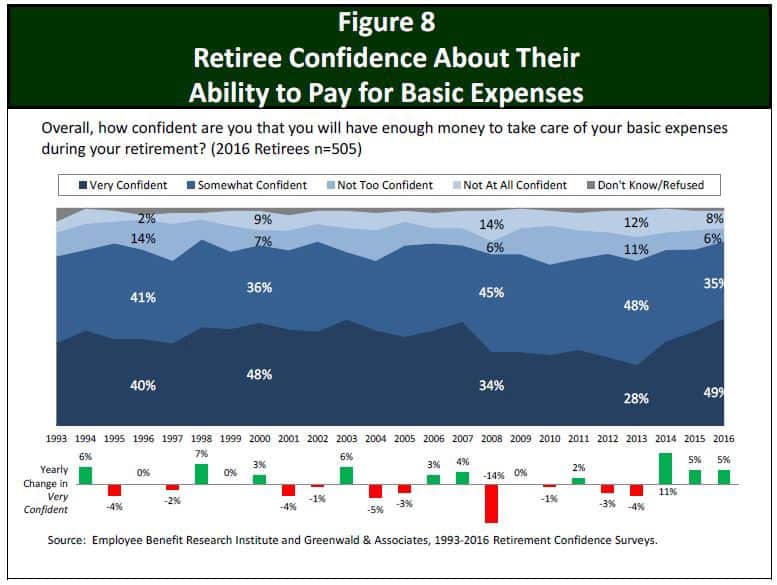

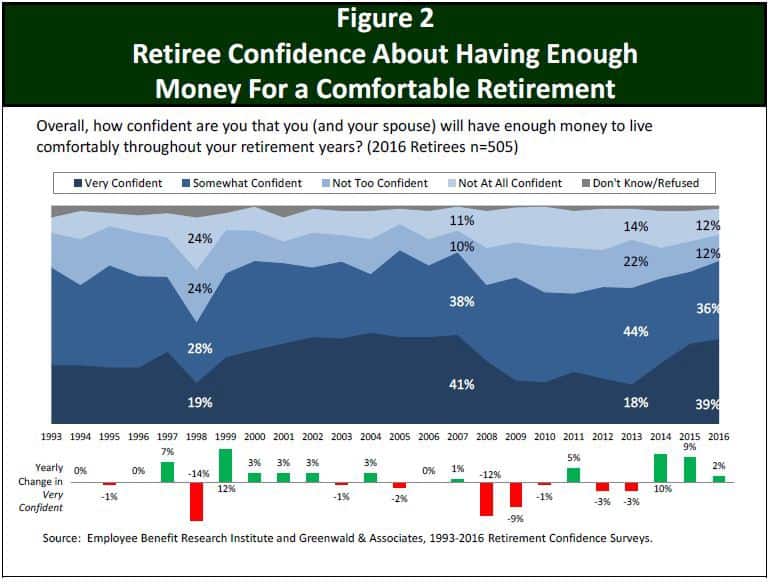

Currently, 84% of retirees are either “Very Confident” or “Somewhat Confident” that they will have enough money to take care of their basic expenses during retirement. Additionally, 75% of retirees are either “Very Confident” or “Somewhat Confident” that they will be able to live comfortably during their retirement years (see figure below).

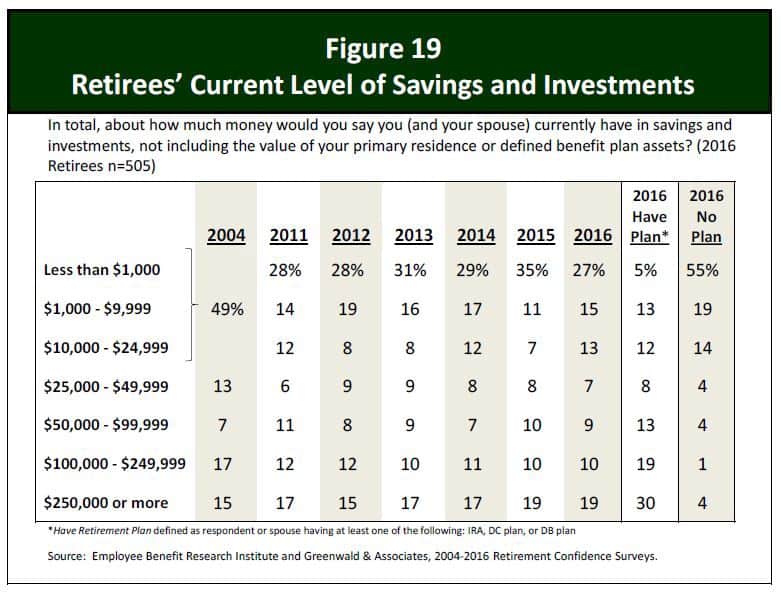

Despite these positive impressions, the amount of money retirees have saved for retirement (excluding defined benefit/pension plans) is catastrophically low:

As the table above shows, in 2015 roughly 55% of American retirees had less than $25,000 saved for retirement, and 71% of all American retirees had less than $100,000 saved. Even if you subset to those with a retirement plan in 2016, 51% of American retirees had less than $100,000 saved. That means that half of all American retirees will likely not have enough money for retirement.

Even if we assume that most Americans will get Social Security income, where the average benefit is roughly $16,000 per year (as of November 2016, see here), and that the median balance at retirement is $130,000, this article suggests this is reasonable, the math doesn’t look good. With a 4% withdrawal rate over 30 years, this gives our average American retiree $21,200 a year to live off. Now this is better than living off of dog food, but I doubt $1,766 a month will be a “comfortable” retirement for most Americans.

Despite these financial facts, Americans’ optimism regarding their economic future will likely remain high. This is one of the things that makes America great and truly inspiring. While past performance is no prediction of future results, I would much rather live in a country where people believe they can pull through difficult circumstances than in one with a dismal outlook.

How You Can Retire Comfortably (I am truly optimistic about this)

The best way to retire comfortably is to continually purchase a diverse set of income producing assets with low costs over a long period of time. While the specifics of such a strategy can be much more nuanced given your age, experience level, appetite for risk, and other factors, a consistent approach to growing your wealth is buying things that make you money instead of things that cost you money. Until next time…thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 02. This post does not have any code, but my programs for other posts are here: https://github.com/nmaggiulli/of-dollars-and-data