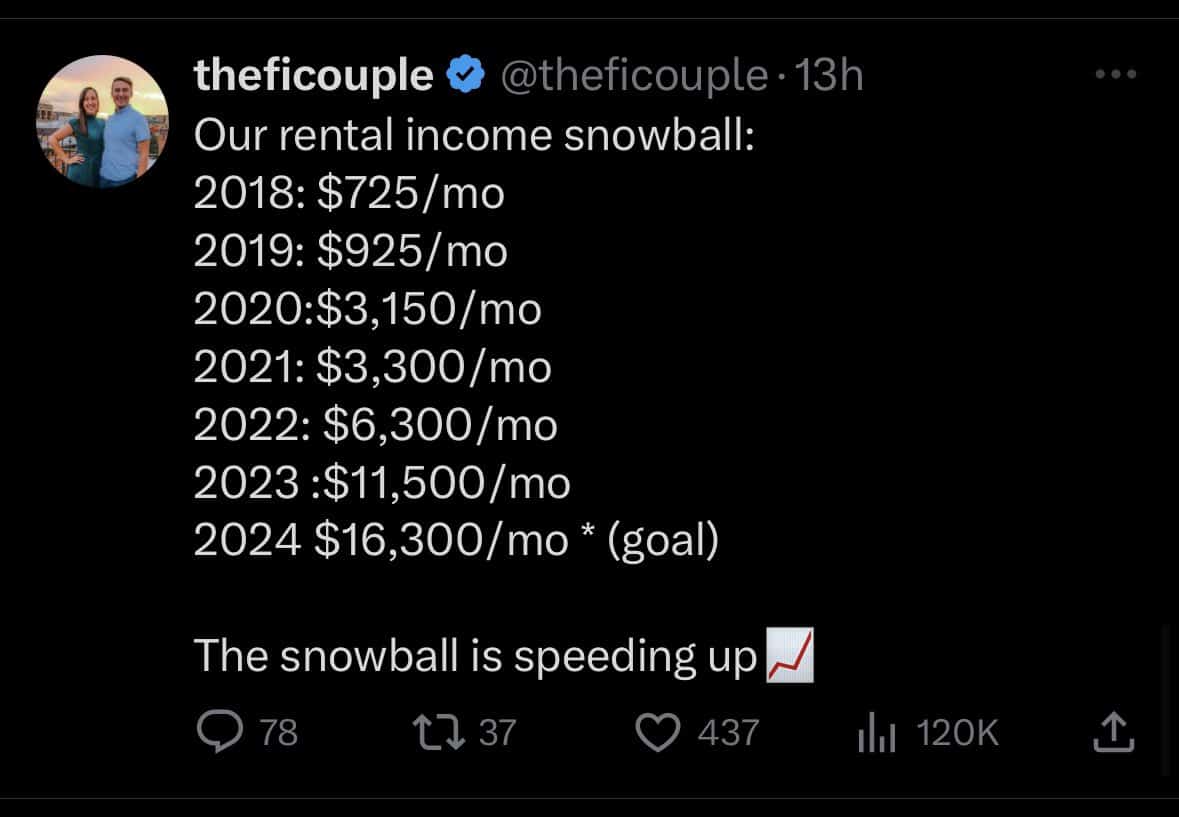

Last week The FI Couple, a real estate investing duo, sent out this tweet highlighting the growth in their rental income since 2018:

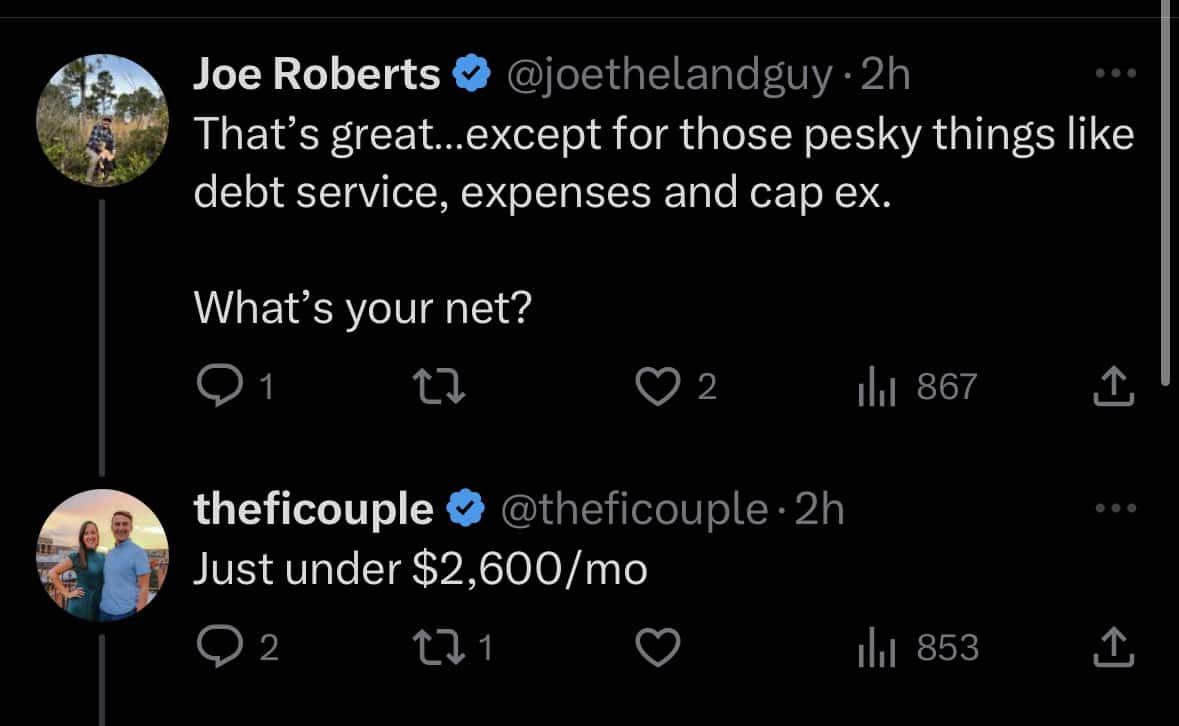

However, when pressed about how much they make net of costs, they stated that they only take home around $2,600 per month:

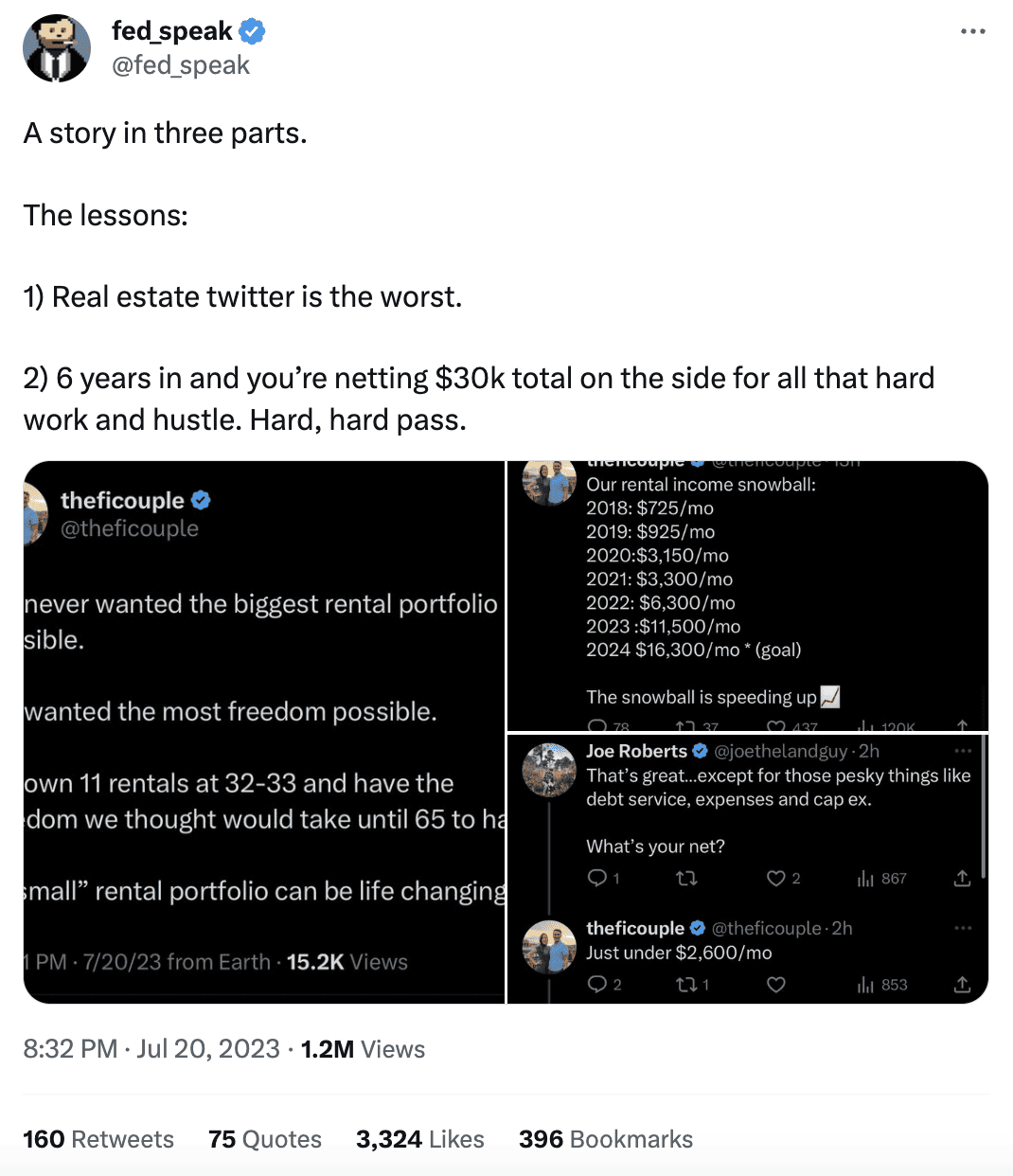

After seeing this series of tweets, @fed_speak sent out the following tweet which started a firestorm on real estate Twitter:

At first glance, I see his point. That’s six years of doing research to find properties, visiting those properties, taking out debt to buy them, looking for tenants, and maintaining each property for only $30,000 a year. Given that The FI Couple has 11 rentals, they are netting less than $250 per rental per month. That’s a lot of work for not a lot of money. Additionally, when you consider the amount of risk they are taking on (via leverage), this seems like a bad deal.

But, this isn’t the full story. Because The FI Couple isn’t just making $30,000 a year off of their properties. They are also building equity in them over time as well. Assuming they used 30-year fixed rate mortgages on all of their units, then in three decades they will have $2-$3 million in equity before any price appreciation. In addition, they’ve been able to transform their lives by paying off $100k in student loans and starting a family (through IVF which they couldn’t previously afford). When you take all of this into account, the deal doesn’t seem so bad after all.

Regardless of which side of the debate you are on, this raises a larger point about what Mitchell Baldridge calls, “return on hassle.”

What is Return on Hassle?

Return on hassle is the idea that you need to consider the time and work associated with an investment in addition to its expected return. In the case of real estate investors, you have to factor in the mental and physical work associated with finding tenants, maintaining your properties, and taking on debt, among other things. These are all “hassles” that most traditional investments (i.e. stocks, bonds, etc.) don’t require.

But, I believe that these hassles generate higher returns in expectation. Otherwise, why would people spend so much time and effort investing in real estate in the first place? Why deal with all of this when you could just buy a few index funds and call it a day? Here are some theories I’ve heard:

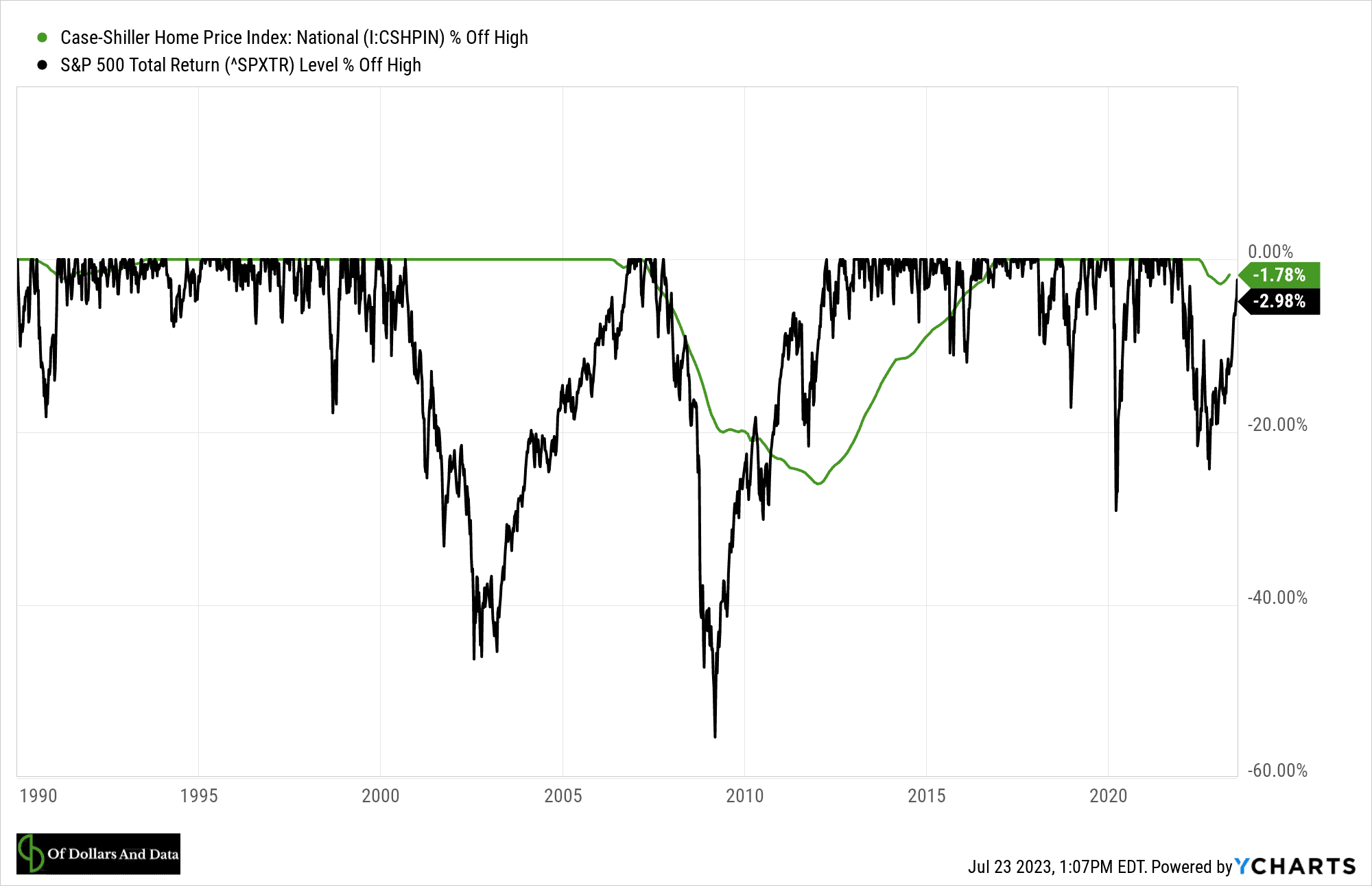

- Real estate is less volatile than stocks. As the chart below illustrates, U.S. home prices declined by half as much compared to U.S. stocks as a result of the Great Financial Crisis:

While fixing a broken pipe at 2AM is annoying, it’s highly unlikely that the price of your property will ever drop by 50%.

- Real estate gives you more control over your investment. As a real estate investor you get to pick the property, the tenants, and how you maintain that property over time. You don’t have this same level of control when you buy most other traditional investments.

- Real estate is less liquid (which is a feature, not a bug). Some have argued that the illiquidity of real estate is not a downside, but an upside that prevents you from panic selling when the going gets tough. Though you won’t find this benefit on a spreadsheet, it’s something that you shouldn’t overlook.

- Real estate has much better tax treatment. I’m no expert when it comes to real estate taxation, but there are a lot of tax games that you can play with real estate that you simply can’t play with other investments. From 1031 exchanges to complex depreciation schedules, there are many ways to minimize what you pay to Uncle Sam through real estate investing.

- Real estate feels more tangible than a stock ticker in a brokerage account. I don’t agree with this argument, but can understand why some people find a physical property more appealing than symbols on a screen.

Regardless of what you believe about investing in real estate, it’s no better or worse than any other investment. It just has a different set of tradeoffs. Some people are okay with these tradeoffs and others aren’t.

This is where so much online discourse goes awry. One party is focusing on one set of tradeoffs while ignoring others and vice versa. As a result, everyone ends up talking past each other rather than realizing that all of this comes down to personal preference.

For this reason I’ve created the Return on Hassle Spectrum to help you decide which kind of investments might be right for you. Let’s look at that now.

What is the Return on Hassle Spectrum?

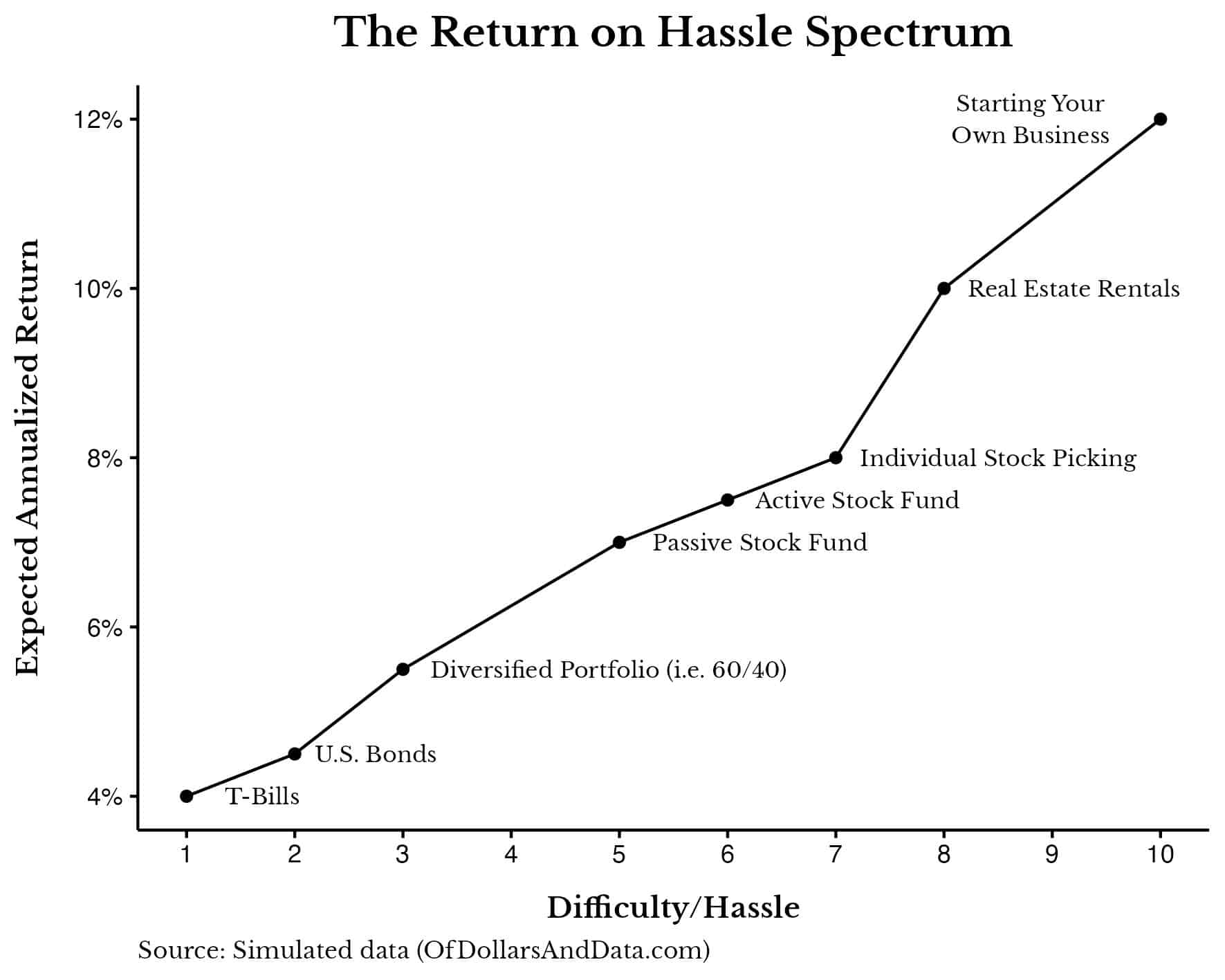

The Return on Hassle Spectrum (below) shows the difficulty/hassle of an investment compared to its expected annualized return. Note that I said expected annualized return because these are the returns that I would hope to generate given the hassle of going down that particular path.

For example, though I don’t believe that most people can beat the market by picking individual stocks, I still placed “Individual Stock Picking” above “Passive Stock Fund” on the Return on Hassle Spectrum. Why? Because you have to believe that you can beat the market (and generate higher returns), otherwise why would you be stock picking at all?

The same goes for “Real Estate Rentals” and “Starting Your Own Business.” If you don’t think you can generate a higher return with these paths, then you shouldn’t be spending time on them. With that being said, here’s how I envision the Return on Hassle Spectrum:

Starting in the bottom left corner we have “T-Bills” and “U.S. Bonds” with the lowest difficulty given the predictability of their cashflows and their lower price volatility. As you move up the spectrum you get a diversified portfolio and then different forms of stock selection (i.e. “Passive Stock Fund”, “Active Stock Fund”, and “Individual Stock Picking”) based on increasing difficulty/hassle.

You can probably guess why owning an active fund is harder than a passive one and why being a stock picker is more difficult (mentally) than owning any kind of fund. Finally, we finish up with “Real Estate Rentals” and “Starting Your Own Business” as the most difficult pathways for investors to build wealth.

Note that though my estimates for expected annual returns are imprecise, their ordering is not. Directionally, I would expect investing in T-Bills to have less difficulty/hassle than investing in stocks because T-Bills are lower risk. I would also expect investing in stocks to have less difficulty/hassle than investing in real estate, and so forth.

More importantly, higher difficulty investments should be associated with a wider array of outcomes. While all T-Bill investors get basically the same returns, some business owners become billionaires while others go bankrupt. This dispersion in outcomes for the highest difficult investments is also what makes them so hard to stick with. You have to spend a lot of time and effort on these pathways before you see a big return.

This is partially what @fed_speak overlooked in his original tweet. Though The FI Couple isn’t rolling in the dough now, they are building equity that will allow them to be fabulously rich later. Of course, this requires a ton of time, effort, and risk-taking on their part, but those are the tradeoffs they’ve chosen to live with.

If you don’t agree with them, that’s fine. I don’t either. As someone who owns a diversified portfolio (difficulty = 4), I don’t find real estate investing (difficulty = 8) particularly appealing (especially given current mortgage rates). But that doesn’t mean that this investment choice is wrong or bad. It’s just not right for me.

But you know what was right for me? Starting a blog nearly 7 years ago and spending 10 hours every single week writing online. And though I didn’t make any real money for 3 years, today it’s paying off in a lot ways. Of course, most people wouldn’t want to go through this. They would see me spending 10 hours a week writing online (while making no money) and say “Hard, hard pass.” And that’s fine. I don’t blame them.

But we shouldn’t judge someone else’s investment choices because we wouldn’t make them. After all, we get to choose what hassles we want to deal with and which ones we don’t. We get to decide our liabilities of success. So find what’s right for you. That’s all that really matters.

With that being said, special thanks to Mitchell Baldridge, @fed_speak, and The FI Couple for their feedback on this post. And, as always, thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 357. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data