There are two kinds of risks in investing and in life—fast risk and slow risk.

Fast risk is the stuff that makes headlines. It’s the things that we are warned about everyday:

Don’t drive without a seatbelt.

Don’t cheat on your spouse.

Don’t use too much leverage.

The reason for this is simple—the consequences of fast risk are immediate and usually devastating. You get severely injured. You get divorced. You go broke. There’s a hard break between how your life was before and after the fast risk materialized.

But then there’s slow risk. Slow risk is the accumulation of bad decisions that eventually leads to an unwanted outcome. It’s developing heart disease after decades of improper eating. It’s getting divorced after neglecting your spouse for years. It’s sitting in cash while you wait to buy the dip.

With slow risk, there’s no single event that you can point to and say, “Here’s where I went wrong.” No. It’s the cumulative effect of your improper decision-making that leads you astray.

The simplest analogy to differentiate between fast risk and slow risk is heroin vs. cigarettes. Heroin is fast risk. Cigarettes are slow risk. Heroin tends to kill people quickly (especially in the event of an overdose), while cigarettes tend to kill people slowly.

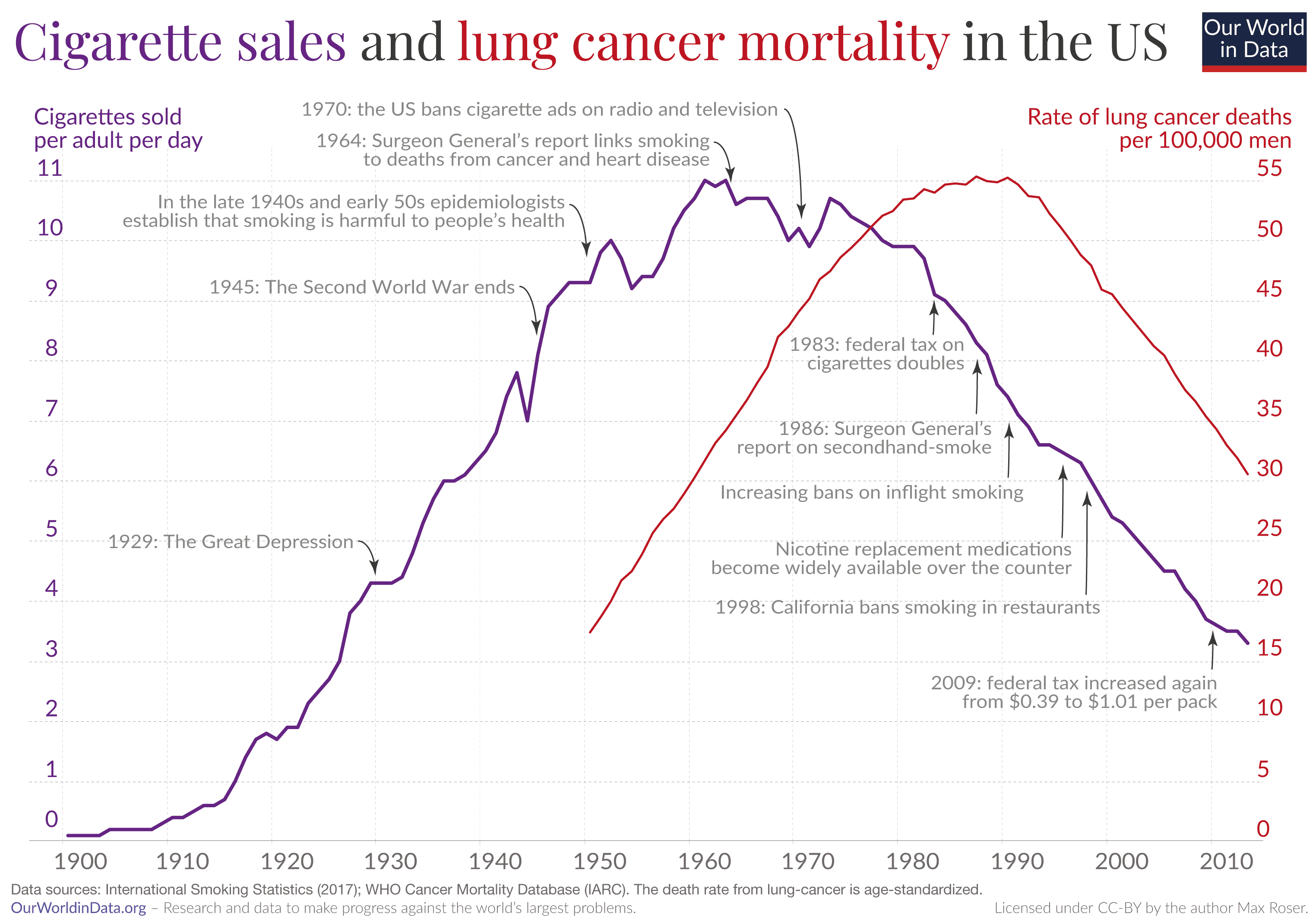

If you look at cigarette sales and lung cancer deaths in the United States over time, you will see what I mean:

The 25 year lag between the two data series suggests that, on average, it takes roughly 25 years of smoking to develop fatal lung cancer. It’s no single cigarette that causes the cancer. It’s all of them that do.

Unfortunately, most of the time when people talk about risk, they are talking about fast risk. Why? Because we evolved to avoid fast risk. We evolved to assume that the rustle in the grass behind us was a predator rather than nothing at all. If you didn’t make this assumption, you probably wouldn’t have passed on your genes. Case closed.

In the ancestral environment the bias against fast risk was helpful. But for investors today, it can sometimes do more harm than good. Because a bias against fast risk means a bias against the very assets that we need to help us build wealth in the long run. Nowhere is this more evident than when examining the risk characteristics of different asset classes over time.

For example, stocks have lots of fast risk, but little slow risk. The S&P 500 could drop 20% tomorrow, but 30 years from now it’s likely to be much higher than it is today. On the other hand, cash has lots of slow risk, but little fast risk. Next year your dollar should be worth about the same as it is worth today. But 30 years from now? Not so much.

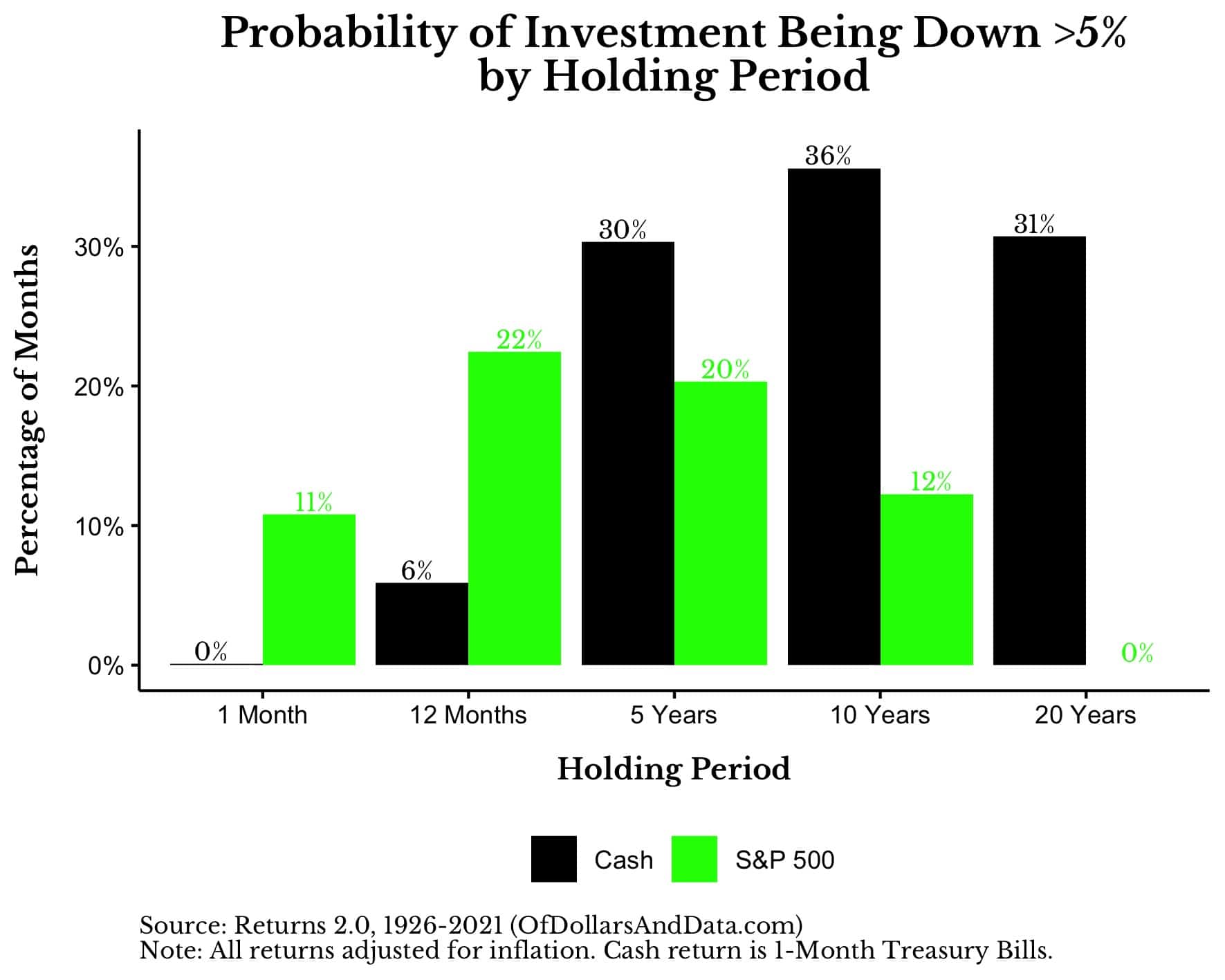

You can see this more clearly by looking at the probability of cash and the S&P 500 being down by 5% or more (in real terms) over different time horizons throughout history. As you can see in the chart below, while cash is unlikely to be down more than 5% in the short run, over longer time periods it has trouble sustaining its purchasing power. The opposite is true for the S&P 500 which often loses value in the short run, but usually doesn’t lose value over longer time periods:

What this chart shows is that, over every 1 month period in the data, there is an 11% chance that the S&P 500 will be down by 5% or more (in real terms) and a near 0% chance that cash will be down by 5% or more (in real terms). Over every 12-month period these numbers are 22% for the S&P 500 and 6% for cash, and so forth.

As you can see, as your time horizon increases the risk of losing money in stocks decreases and the risk of losing money in cash increases. My estimates for cash are conservative as well since I assumed the cash was invested in 1-month Treasury Bills. Had you kept the cash under your mattress, the numbers would have been far, far worse.

Either way, the chart above illustrates the difference between fast risk and slow risk and how that transition depends on time. As Peter L. Bernstein noted in Against the Gods:

Risk and time are opposite sides of the same coin, for if there were no tomorrow there would be no risk.

This is why cash isn’t really a risk-free asset but more of a fast risk-free asset. Cash still has plenty of risk, but it is of the slow variety.

I mention this point because, as investors, we tend to spend most of our time focusing on fast risk without thinking as much about slow risk. I understand why. Slow risk doesn’t make headlines. Every time a hedge fund blows up you will probably hear about it. But you never hear about the person who sat in cash for 20 years because they were too afraid to get invested. Both are equally devastating, but one seems less spectacular than the other.

So my challenge to you today is to ask yourself whether you are minimizing fast risk at the expense of slow risk. Are there parts of your portfolio (or your life) where you are taking more slow risk than you realize? Are you making suboptimal decisions that may come to one day haunt you? There’s nothing wrong with trading fast risk for slow risk as long as you know that you are doing it.

But lots of people don’t realize that they are making this tradeoff. They don’t realize the error of their ways until it is too late. As I have written before, what’s hard to notice in the short run becomes impossible to ignore in the long run.

Until then, happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 265. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data