Now that my blog has gotten some traction among my friends, I have been getting questions like this more often:

“Nick, I just saved up $1,000 and I want to know where I should invest it to get the best return.”

Immediately I think about going into full financial adviser mode to discuss asset allocation, ask about their risk preferences, and understand their goals, but the truth is: their investment returns won’t matter…for now.

With small amounts of money, the total return over the course of a year will be trivial. It would be far better for an individual to focus on saving more money (or growing their income) than worrying about what return they will get in the short run.

For example, let’s say you save up $1,000 and put it into an ETF with an expectation of getting a 10% annual return ($100). You could spend your entire annual return in 1 night going out with friends. Dinner + drinks + transportation and it’s gone.

Now compare this with your future self that has $2 million in a retirement account. A 5% decline in your account value, which is not unreasonable in some years, will result in a $100,000 loss! You couldn’t save that in a year unless you had a very high income or an amazing savings rate.

Therefore, savings have a larger impact on the poor and investments have a larger impact on the rich.

To walk you through my thinking further let’s simulate a 40 year investment life cycle. Let’s assume you make $50,000 a year and save 15% annually (i.e. you save $7,500 each year for 40 years). Additionally, we will assume that you get a 5% annual return on your money with a 9% standard deviation.

This should represent a diverse set of assets (i.e. not as risky as the S&P 500, but not as safe as U.S. bonds). You can imagine the simulation as follows:

In year 1 you save $7,500 and get no investment return on it. In year 2 you get some investment return (random but averages 5%) on the original $7,500 you saved and you save another $7,500. In year 3 you get another random return on the money you had at the end of year 2, and you save another $7,500. This continues onward for 40 years.

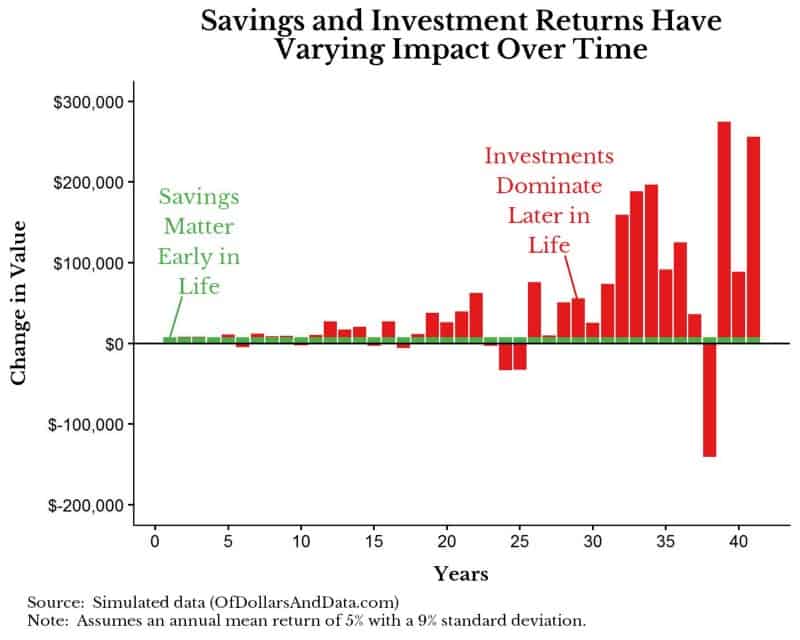

If we were to plot 1 random simulation and show how much was saved in each year (green bar) versus how much was gained/loss from investments in each year (red bar) it could look something like this:

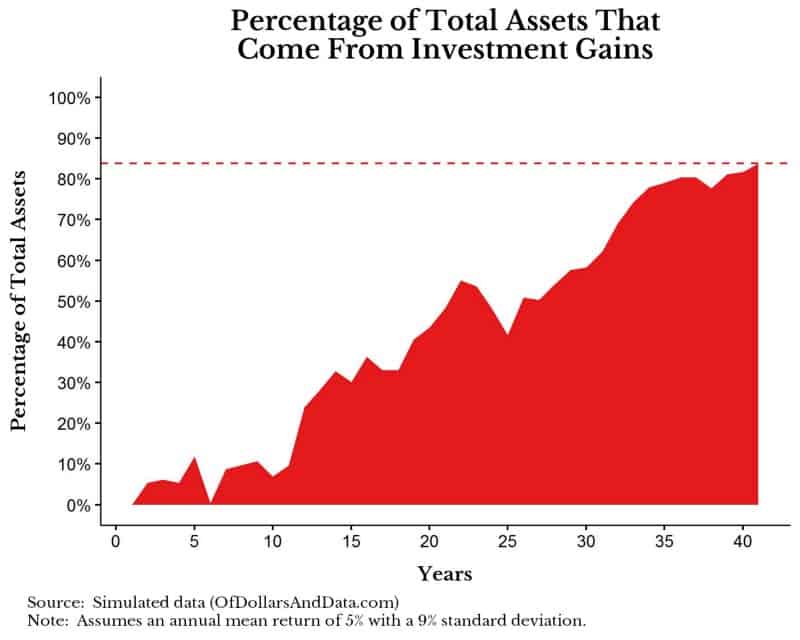

As you can see, the green bars are constant over time since you always save $7,500, but the red bars fluctuate as they represent your random investment returns. Additionally, early in your investment life cycle savings are much larger than investment returns as you would have very little assets. However, as you gain more assets, your gain (or loss) from these assets has a much larger impact on your finances. In particular, by the end of this simulation you would have saved $300,000 ($7,500 * 40 years), but you would have gained ~$1.6 million from investments. This $1.6 million represents 84% of the total assets in year 40 with the $300,000 saved representing the other 16%. If we were to visualize what percentage of your total assets come from investment gains over your life cycle it would look like this (note: the dotted line represents the 84% ending value I discussed above):

As you can see, early on savings are completely building your wealth, however, somewhere near the middle of the life cycle, investment gains become more important.

Regardless of the math and theory behind all of this, the relevant question is:

Should YOU be focusing more on saving or investing?

To answer this, I would ask you to consider the following:

Which is Greater?

Your Total Assets * Your Expected Annual Return

or

Your Expected Annual Savings

If Total Assets * Expected Annual Return > Expected Savings this means your investments are earning you more than you are saving, so you should focus on your investments. However, if you can feasible save more than your assets can earn you in a year, focus on saving.

Practically speaking, if you have $100,000 in assets with an expected return of 5% each year, this means you would expect your investments to earn $5,000 annually (or $100,000 * 0.05). Additionally, if you expect to save $7,500 a year, which is greater than the expected $5,000 from investments, you should focus on saving more money.

Note that this is a spectrum, so it does not imply that you can ignore your investments or your savings rate! However, this should illustrate how important each one is to your financial picture.

Savings is For the Rich Too

Despite the dichotomy I have tried to create between saving and investment income in this post, the truth is that saving is far more important. The ability to save money is highly correlated with financial success because it allows you to live on less and have more disposable income for investing.

You should also consider reading arguably the best personal finance blog post on the internet: Mr. Money Mustache’s Shocking Simple Math Behind Early Retirement. This one post summarizes the entire philosophy behind his blog and it completely revolutionized how I think about saving money.

Regardless of how much you are saving now, you can always change this in the future, so stay positive and get to saving. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 16. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data