Should I buy stocks now?

It’s the question I’ve gotten more than any other in the past couple of weeks. My response has always been, “Yes, but realize that the market can go a lot lower.” Unfortunately, my warning has proved correct.

After writing about the worst day of our investment lives following a 7.60% one-day loss last week, the market went on to lose 9.51% three days later and lost another 11.98% earlier this week (the 2nd worst one-day decline in market history).

As a result of the increased market activity, the CBOE Volatility Index (“VIX”) recently made record highs. For those less familiar with the VIX, you can think of it as a kind of “Fear Index” for the markets. As markets crash, the VIX goes up (and vice versa).

But, the VIX is useful beyond just being a measure of investor fear, because it can also be used as a buying signal. As the saying goes:

When the VIX is high, it’s time to buy.

Is this phrase true? Does a higher VIX imply higher future returns? Let’s find out.

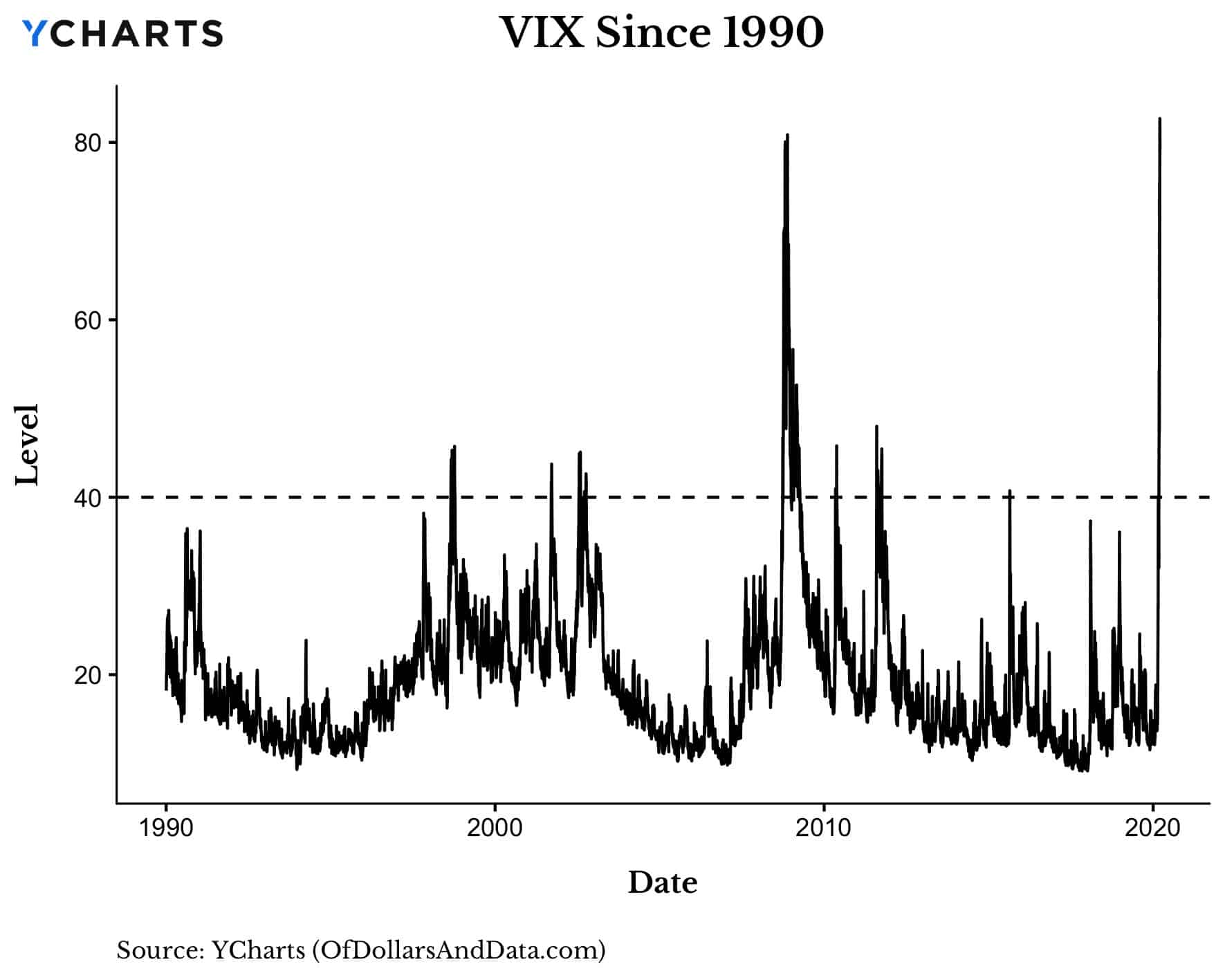

Below I have plotted the VIX level since tracking started in 1990, with a horizontal line at 40:

I chose the VIX level of 40, because this seems to be the point at which markets begin to panic and selloff in a big way. From the plot above, you can see that every major market crash of the modern era coincided with the VIX surpassing 40.

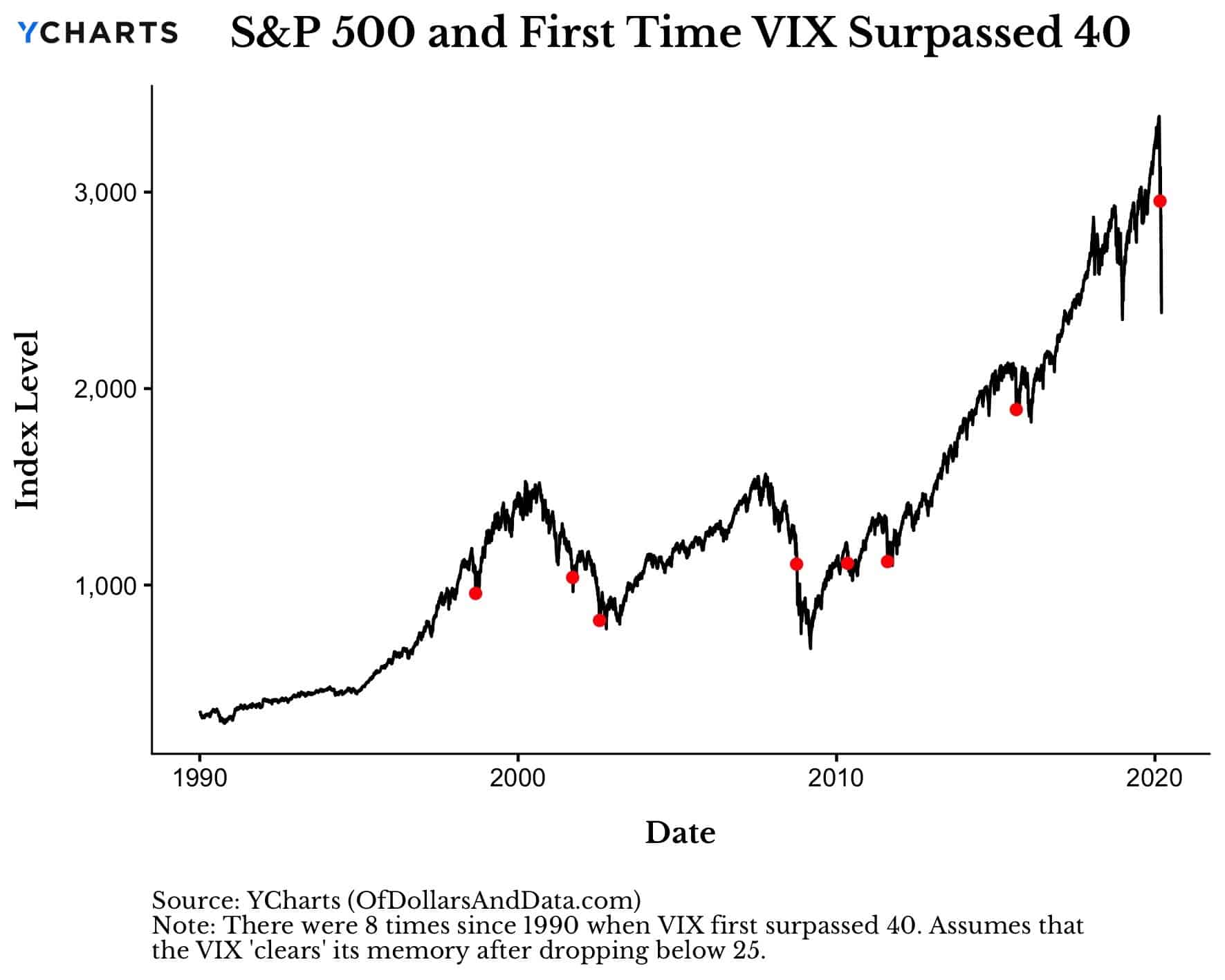

To be precise, since 1990 there have been 8 occasions when the VIX first surpassed 40 before calming again:

More importantly though, only 2 of these 8 occasions (2002 and 2008) saw market declines immediately after the VIX surpassed 40. The others saw markets go up in relatively short order.

This is an important point, because, it suggests that a high VIX is a leading indicator of a market bottom (note: sample size is small).

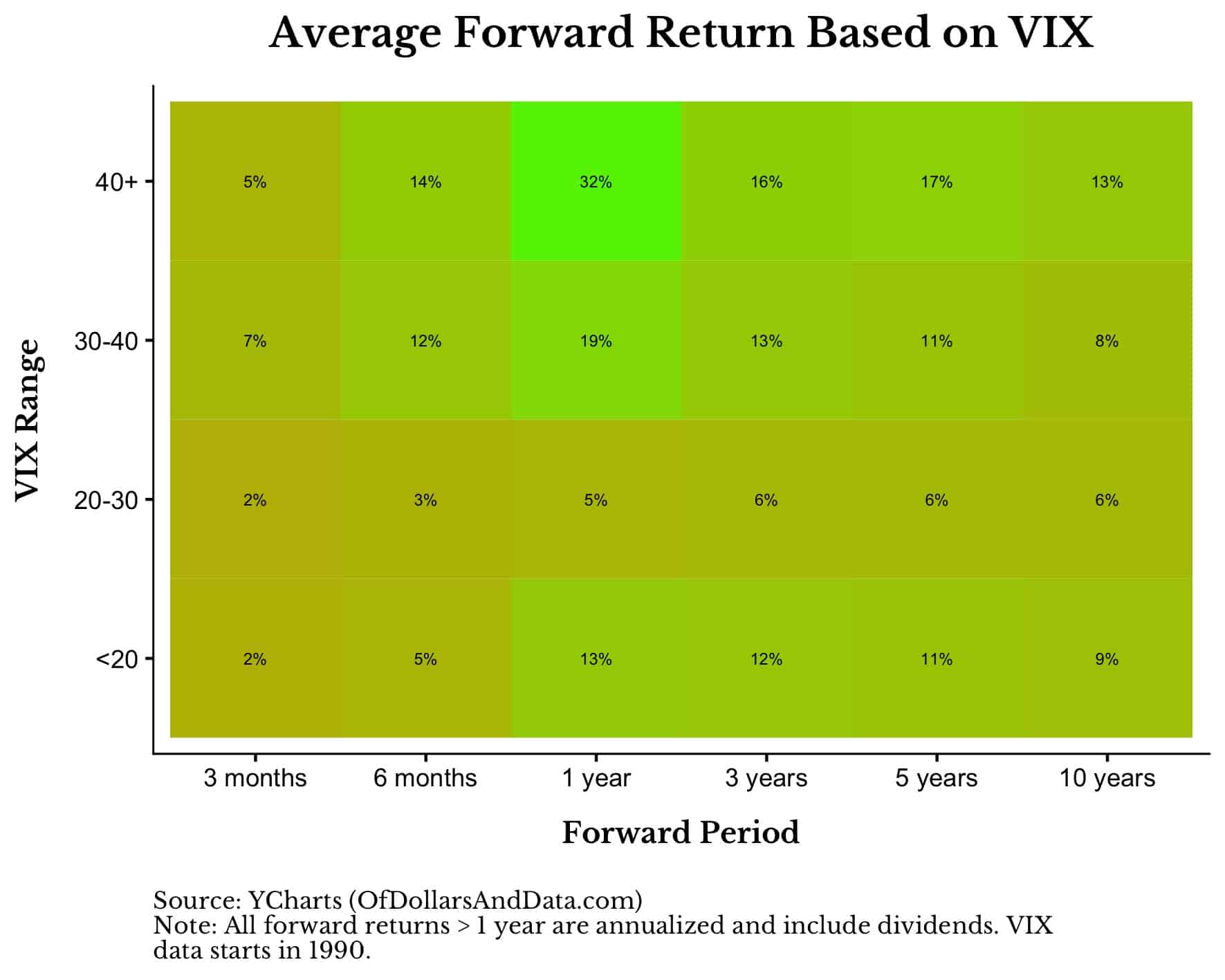

To dig deeper on this, I broke the data into different VIX ranges (<20, 20-30, 30-40, and 40+) and then created a heatmap of their average future returns over the next 3 months, 6 months, etc:

As you can see, on average, when the VIX is higher so are future returns! And, no this is not just a few outliers skewing the results. The median results look the same as well.

But, maybe you don’t care about the average or the median. Maybe you think the coronavirus crash is going to be similar to 2002 or 2008 (the periods where losses continued to mount after VIX first surpassed 40).

Though I have already mentioned how this crash is different from 2008, the coronavirus crash seems to have this in common with 2002 and 2008. Since the VIX first passed 40 on February 28, 2020, the market has sold off 14.4%!

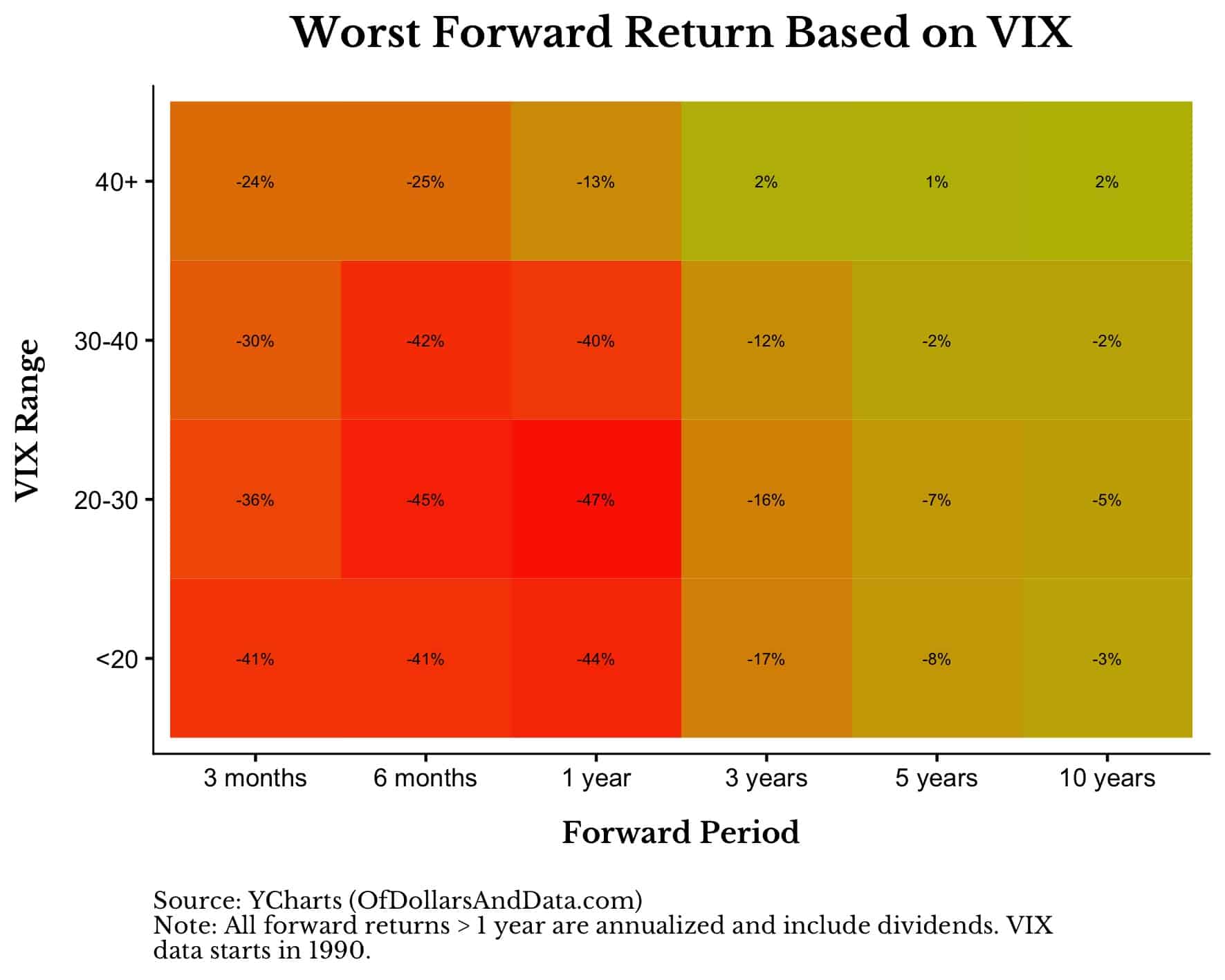

Either way, we can examine the worst future returns broken out by VIX range to get a better idea of what may come next:

As you can see, future losses are still a possibility no matter what the VIX is doing. Despite this, the best worst case scenario occurs when the VIX is higher than normal.

And with the VIX currently at 75, now seems like a better time to buy stocks than almost any other. As Baron Rothschild once said:

The time to buy is when there’s blood in the streets.

And with the blood flowing, will you heed the baron’s advice?

Of course, losses may counting to mount for months (or longer). Of course, this time might be different.

But, even if the market relationships that have held up for the last three decades prove useless, then what? If you have cash to buy stocks now and you won’t buy, when will you? What’s your plan?

If you are afraid of losing money, then why are you even considering stocks at all?

With stocks, losing money is nearly half the game. Fortunately, making money is the other half.

Nevertheless, it’s, ultimately, your decision. As one of my favorite films said:

I can only show you the door. You’re the one that has to walk through it.

Not For Everyone

Despite all the heatmaps and historical analyses above, I don’t recommend that everyone go out and buy stocks right now. Why?

Because if this is your first time in the stock market, now is not the time to play. As the financial writer Adam Smith (pseudonym) once said:

If you don’t know who you are, this is an expensive place to find out.

And find out you will.

Because you are either going to find out that (1) markets can go lower and you weren’t really in it for the long haul, or (2) you are God’s gift to timing the market.

And if, God forbid, you end up in the 2nd group, I pray for your investment soul.

Because one of the worst things that can happen to a new investor is a big win. The overconfidence it breeds will plant the seeds for a much larger, future investment error.

So, if you are buying stocks now to try and make a quick buck, please don’t. Stay inside and do something else.

However, if you are still interested in the future, come back later and talk to us. Because you won’t get rich by buying now, but you might get rich if you come back later.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 171. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data