Buying a home is often considered the biggest financial decision people make in their lives. As a result, it makes sense as to ask yourself whether buying is the right choice when compared with renting. Unfortunately, this decision can easily get bogged down with the many assumptions and costs that go into renting vs. buying a home.

This post aims to fix this by simplifying the decision process to focus on the few key variables that will make a difference in the long run. By the end of this article, you’ll have a clearer understanding of which factors to consider when answering the question, “Should you rent or buy a house?” And, in doing so, you will be better equipped to make an informed choice for your future housing needs.

With that being said, let’s look how to model the buy vs. rent decision in a simpler way.

Simplifying the Renting vs. Buying Decision

When it comes to renting vs. buying a home, I want you to think about each of these decisions as leading to some future bag of money.

When it comes to renting, that bag of money is just the money you save by renting (instead of buying) invested into a diversified portfolio over time. For example, if the rent for a house is $4,000 a month and buying the same house would cost $7,000 a month with your mortgage, property taxes, maintenance, and insurance, then you will be initially saving about $3,000 a month that you can invest into a diversified portfolio. Of course, the monthly savings will change over time (based on inflation), but this is a simple way to think about it.

When it comes to buying a house, the only thing you should care about is the future value of your home. So if you buy a house for $1M today, the question is what will it be in 30 years (once the mortgage is paid off)? We only care about the home price because this is the only thing that leads to a direct pay off for the homeowner. In other words, we should imagine that all of the costs associated with buying a home aren’t seen as actual costs to the homeowner, but, rather, as benefits to the equivalent renter (who avoided these costs by renting instead of buying).

If we look at the problem in this way, the renting vs. buying decision is a dollar-for-dollar equivalent of all cashflows across the life of the mortgage. For example, if maintenance costs increase in year 10, we will assume the homeowner just pays them and the renter sees a benefit by avoiding those costs. However, on the flip side, if inflation surges and rent prices go up, then the renter has to pay these higher rents, which lowers the attractiveness of renting compared to buying, all else equal.

Now that we have a basic idea for how to compare renting vs. buying, let’s look at the factors important to each:

- Renting

- Rent: The main cost associated with renting is the rent paid monthly and the change in that rent payment over long periods of time.

- Moving costs: While not necessarily large, we should incorporate some moving costs that are paid for each time the renter changes their housing situation. I have assumed this is $1,000 per year (and will be adjusted for inflation).

- Inflation: The overall level of inflation has a huge impact on renter’s as they have to consistently pay higher rent over time. All else equal, less future inflation benefits renters while more future inflation benefits homeowners. More importantly, rental inflation tends to outpace overall inflation slightly. Since 1940, rents have increased by about 4.8% per year (on a nominal basis) or about 1% more than inflation over this same time period.

- Portfolio Return: The return on your diversified portfolio above inflation. While U.S. stocks have returned about 7% per year after inflation historically, I believe a 4% is a more conservative return for a globally diversified portfolio going forward.

- Down Payment: The size of the downpayment has an impact on the starting portfolio value for the renter (compared to the buyer). We assume that the renter invests the downpayment in a diversified portfolio instead of a home. For now, I assume the downpayment is 23% of the total home value to account for the typical 20% downpayment along with 3% for the closing costs needed to buy a home.

- Buying

- Mortgage payment: This is the payment amount needed to cover your cost of borrowing to pay for your house. The main inputs here are the loan amount and the interest rate at which you can borrow at. Currently, I assume that you can borrow at around 6.5% for a 30-year fixed rate loan.

- Maintenance: This is the amount of money needed to maintain the home for general repairs. While this will vary over time, many experts estimate that you will spend about 1% of your property’s value on maintenance each year. On a $1M home, this equates to $10,000 per year or about $833 per month.

- Homeowner’s insurance: This covers damage to your home that is outside of general maintenance. For example, damage caused by a flood, fire, or earthquake can be covered by homeowner’s insurance, but you need to check your policy to be sure. Homeowner’s insurance tends to cost 0.5%-1% of a property’s value each year, so we will assume 0.5% to be conservative.

- Property taxes: These are taxes paid to state and local governments for owning property. They average about 0.84% of a home’s value (across all states), but can be as low as 0.3% (in Hawaii) and as high as 1.79% (in New Jersey).

- Inflation: The overall level of inflation generally benefits homeowners as they see their home prices rise, all else equal. As I stated in Just Keep Buying, “Robert Shiller, the Nobel Prize-winning economist, calculated the inflation-adjusted return on U.S. housing was ‘only 0.6% a year’ from 1915–2015.” This is quite similar in magnitude to the 1% increase in rental prices (above the level of inflation) going back to 1940 stated above. Therefore, we can assume that U.S. home prices will increase at the same rate as rents going forward, or about 1% higher than the overall level of inflation.

Though there are a lot of factors that can impact the renting vs. buying decision, most of these can be reasonably estimated and won’t vary over time. Therefore, what really impacts the decision to buy vs rent is your monthly rent, your monthly mortgage payment, and the overall rate of future inflation.

We will discuss why this is true in a moment, but let’s use a real world example to make the renting vs. buying decision come to life.

Renting vs. Buying (Example Walkthrough)

I currently rent a 700 sq. ft 1-bedroom apartment in Manhattan for $4,150 per month. If you think this is expensive, try buying one instead. Today, similar 1-bedroom apartments in Manhattan range from $800k-$1.3M. If we use $1M (for simplicity), after putting 20% down ($200k), you’d be left with an $800,000 mortgage. And with a 6.5% 30-year fixed rate, your monthly mortgage payment would be around $5,000. Add property taxes and insurance and you are looking at closer to $6,500 a month. Finally, add money for home repairs/maintenance (or an HOA fee) and you’ll be at $7,500 a month to own an apartment that rents for roughly half the price.

Using this information, we have everything we need to compare the renting vs. buying decision except the overall level of inflation. However, the overall level of inflation is arguably the most important factor in the model. Let’s see why.

From 1940 to 2021, U.S. rental inflation increased by about 4.8% per year. If we assume this level of inflation going forward, an apartment that rented for $4,150 per month today would rent for around $16,900 three decades from now. Let’s compare this to the cost of owning a similar $1M apartment. The cost of owning would start at around $7,300 per month today and end at $14,307 in 30 years after adjusting for inflation on maintenance, insurance, and property taxes, over the life of the mortgage.

Note that since the rental payment at the end of 30 years exceeds the cost of buying ($16,900 > $14,307), we assume that the renter must sell down some of their portfolio to cover their increased rent. In this way, the renter who saved money during the early stages of the mortgage has to end up spending extra money near the end of the mortgage because of higher rent prices. Unlike the homeowner, the renter did not lock up their cost of housing and pays for it decades later.

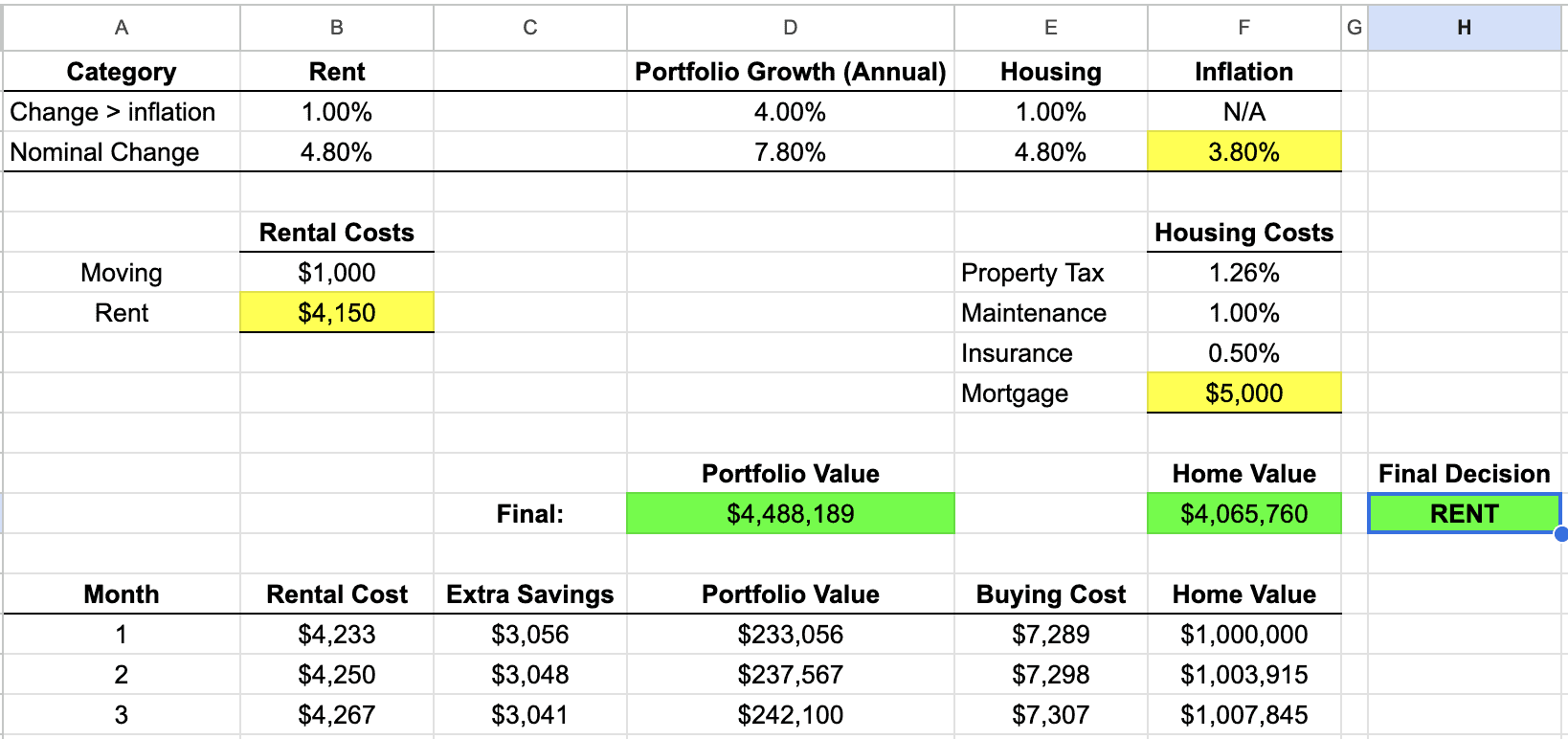

But that’s less important. What really matters is how the buyer and renter fared after 30 years. The buyer, who bought a $1M apartment in 2024 would’ve been able to sell that apartment for $4.1M after 30 years (due to inflation). The hypothetical renter, on the other hand, would’ve earned a 7.8% nominal return (4% above inflation) on their additional savings over 30 years. As a result, their final portfolio value would be $4.5M or about $400k more than what the homeowner would have after 30 years.

I created a simple rent vs. buy model in Google Sheets where you can see these results for yourself. Feel free to copy this to Excel/Google Sheets and run the numbers for yourself. While you are able to alter all of these assumptions in the model, I have highlighted the most important ones (rent, mortgage, and future inflation) in yellow for you. Note that all of the values shown are nominal dollars:

As you can see, with my base case set of assumptions, renting is clearly the winner.

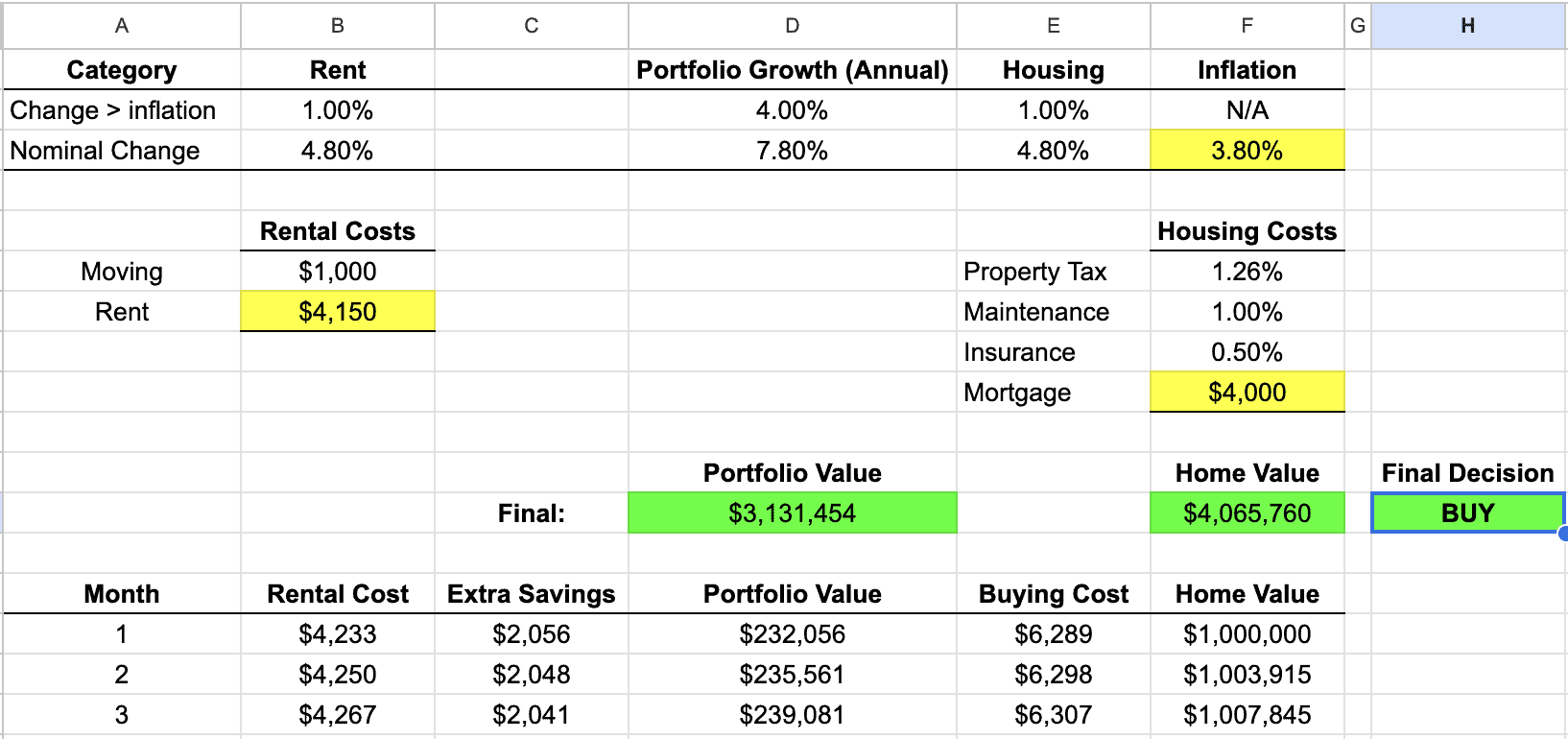

However, change just one variable and our conclusion can change. For example, drop the monthly mortgage payment to $4,000, (which corresponds to a 4.4% 30-year fixed mortgage when borrowing $800,000), and now buying prevails:

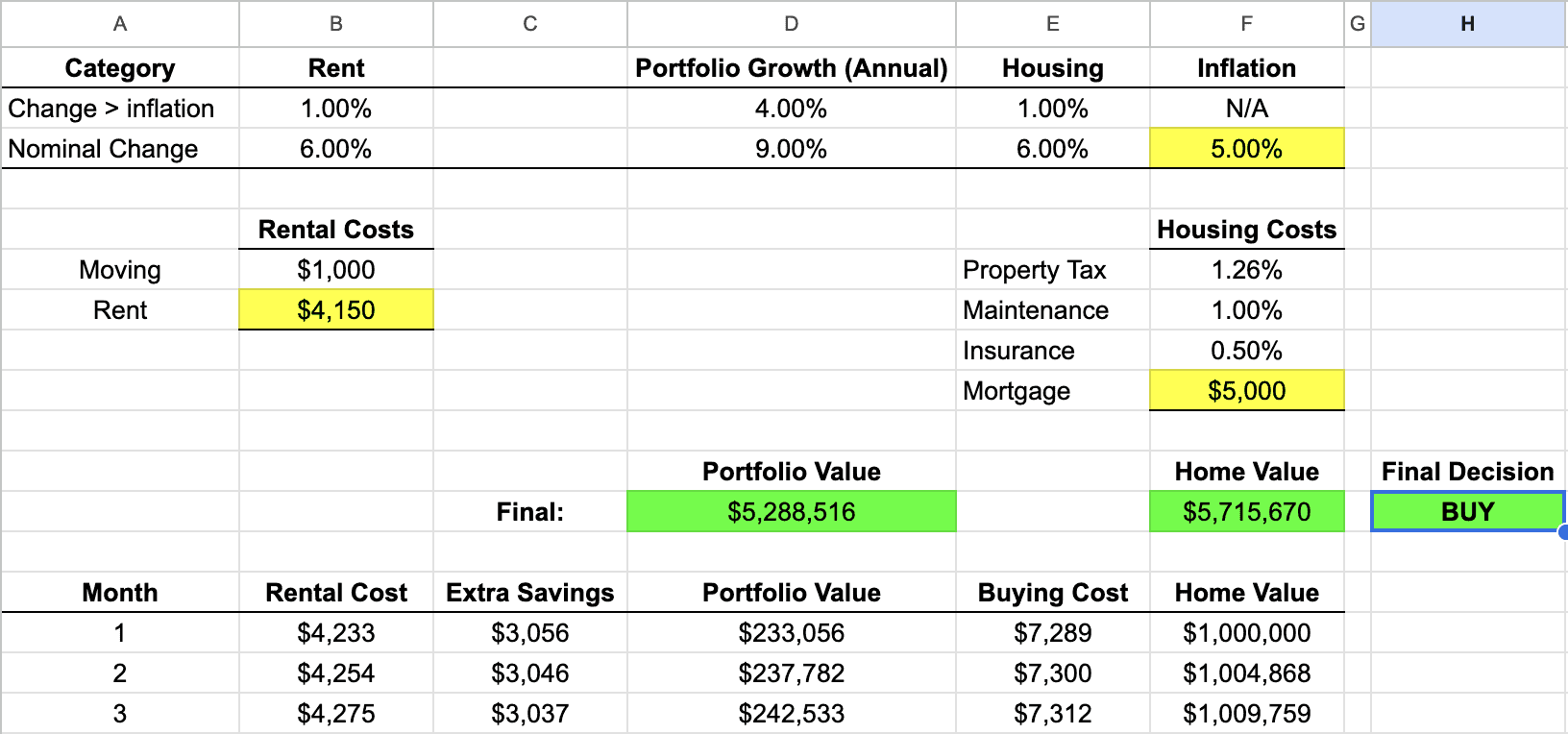

In addition, you could leave the mortgage at $5k a month, but change the overall level of inflation to be much higher than it has been historically and buying would also win.

For example, if overall inflation averages 5% for the next 30 years (about 1.2% higher than history), buying would outperform renting over the next 30 years:

When you look at it in this way, buying a home is really just a hedge against future inflation. If you think future inflation will be high, you should try to buy to lock in your housing cost as a fixed price. Renters lose out in this scenario because they are constantly having to pay the market price for rent, which is increasing over time. On the other hand, when inflation is low, homeowners can lose out if they lock in a higher than normal mortgage that isn’t inflated away over time.

More importantly, it’s not just the general level of inflation that matters, but how housing performs relative to overall inflation as well. So far I’ve assumed that housing and rents will outpace general inflation by 1% per year, as they did historically. But if home prices & rental rates rise more slowly than general inflation, then renting becomes more attractive, all else equal.

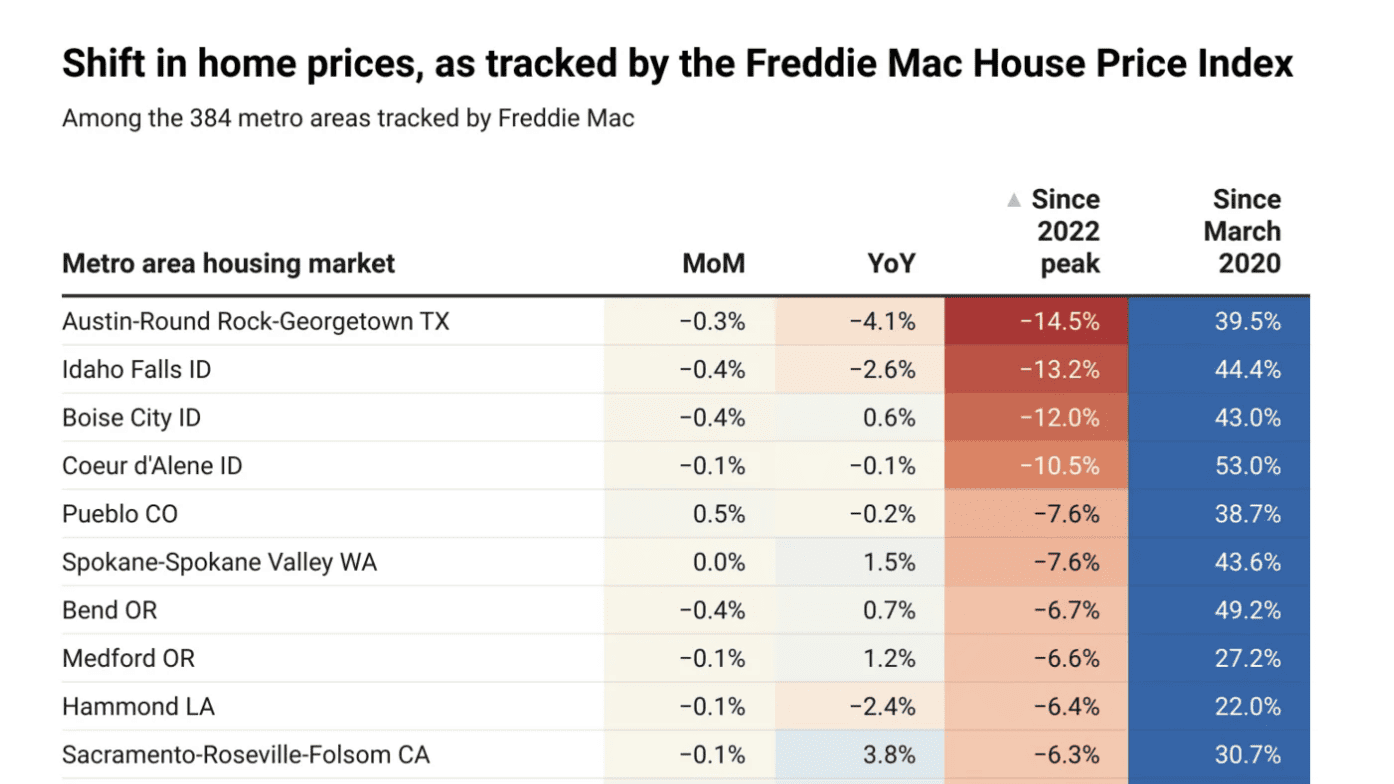

While home prices dropping might seem like an unlikely possibility, there is some evidence of it already happening in certain metro areas. As ResiClub Analytics found, the Austin, Texas metropolitan area in particular has already seen a 14.5% decrease in home prices since their 2022 peak:

This suggests that the 1% return in housing prices above inflation may not necessarily hold in the future.

Nevertheless, while there are a lot of factors that can impact whether you should rent or buy a house, the most important factor seems to be the future level of inflation, which is hard to predict ahead of time. Of course, if you believe that the U.S. money printer will not slow down anytime soon (leading to higher future inflation), then buying a home now can be attractive even with interest rates above 6%.

Now that we’ve walked through a specific rent vs. buy example, let’s discuss whether it’s a good time to rent vs. buy a house more generally in 2024.

Should You Rent or Buy a House in 2024?

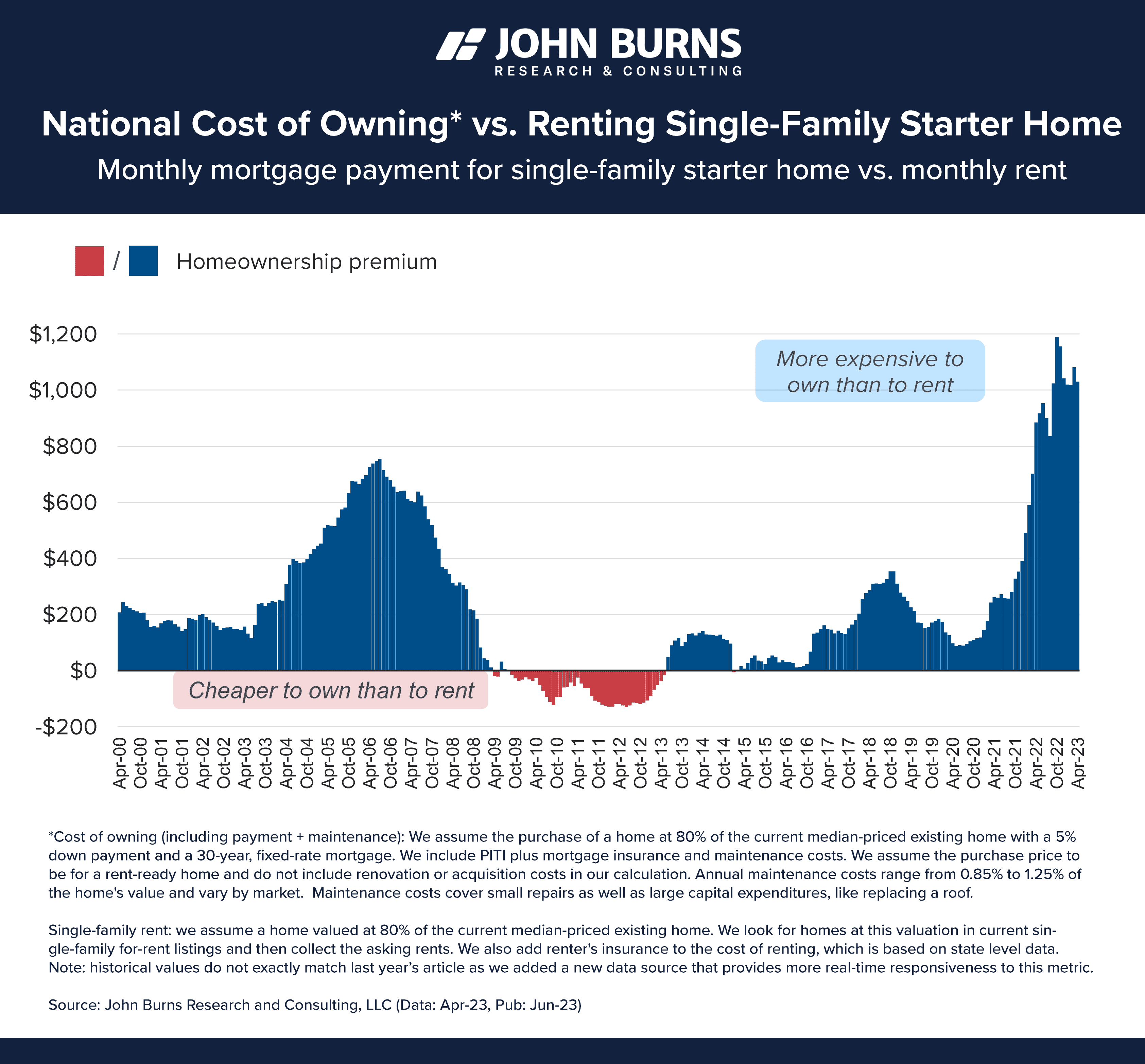

While my sample walkthrough above might seem extreme since it used NYC housing prices, the rising cost of homeownership isn’t a NYC-specific phenomenon. As John Burns Research & Consulting found, as of July 2023, homeownership is about $1,000 per month more expensive than renting (on average) across the United States. As their data shows, it’s more expensive to own today than it’s been over the past few decades:

Looking at this chart you can see that the last time it was cheaper to buy than rent was in 2012-2013. This was right as I was graduating college with no assets to my name. Even if I wanted to buy, I, like many other Millennials at the time, didn’t have the money to do so.

Though my finances have changed drastically since 2012, as I’ve shown above, renting can still make sense in certain circumstances. You should run the numbers yourself to see if it does. I have and I will remain a renter for the foreseeable future.

However, sometimes the decision to rent vs. buy a home isn’t just about the numbers. For this, we turn to our concluding section.

The Non-Monetary Reasons to Rent vs. Buy

Though the decision to rent vs. buy a home can be one where the math dictates what you should do, sometimes there’s more to life than money. In particular, the non-monetary considerations for renting vs. buying a home come down to flexibility vs. stability.

Renters have far more flexibility than homeowners. Not only do renters have better access to their wealth (it’s more liquid than home equity), but they also can move whenever they want. However, such flexibility comes at a cost of reduced stability. For example, if you enroll your child in a school while renting and your landlord decides to kick you out, you may have to move your child to a different school district as a result. This instability could prove to be chaotic to your child’s social development as they have to make new friends and get used to a new environment.

As Rob Henderson wrote in his recent book Troubled, stability may be even more important than wealth in determining lifetime outcomes for children:

A team of psychologists found that compared to children raised in wealthier families, children raised in lower-income families are no more likely to engage in risky behaviors or commit crimes as adults. However, compared with children raised in stable environments, children raised in unstable environments are significantly more likely to engage in harmful or destructive behaviors.

While there is more to stability than where you live, being able to provide a consistent environment for your children as a homeowner can be worth far more than money. For this reason, the flexibility you sacrifice in the short run can be worth the stability you gain in the long run.

Putting the non-monetary issues aside, the most eye-opening thing I learned from this analysis was that you cannot know with certainty whether buying or renting is the right choice until far into the future. Why? Because of future inflation! Until future inflation is realized, either side could be more favorable for any period of time.

This is why it’s kind of infuriating to see people argue about buying vs. renting online when they won’t know the better outcome for 30 years. It’s like watching a bunch of people call the winner of a football game after the first point is scored. The game isn’t over yet!

So don’t waste your time arguing about this stuff or even worrying about it. You can’t know future inflation after all. All you can do is make an educated guess and let the chips fall where they may.

Ultimately, whether you decide to rent or buy a home is a completely personal decision. You don’t need to justify it to anyone but yourself. Even though there are societal pressures to buy (vs. rent), that doesn’t mean that it’s right for you.

This is why I recommend running the numbers and figuring out what’s important to you. Do you care more about flexibility or stability? Do you believe future inflation will be high or low? Is now the right time for you to buy?

I can’t answer these questions for you, but I hope they help guide you on your journey. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 391. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data