Ramit Sethi recently tweeted:

Making the single decision to increase your savings rate and investment rate by 1% each year will make you more money than all the coffee you will ever buy in your lifetime, combined.

Focus on $30,000 questions, not $3 questions.

In response, Meg Bartelt tweeted the following, which I found quite shocking:

Now every time I see talk of saving 1% more, all I can think of is the lesson that:

If you work 1 more month before retiring, that’s as good as saving 1% more each year for 10 years before retirement.

If you work 3-6 more months, same as 1% more for 30 years.

Bartelt’s tweet has a lot of assumptions, but is she right? Does working a few more months have the same impact as decades of disciplined savings? Or is something else going on?

To answer these questions, I wrote this blog post to examine how much earlier you could retire if you saved more. Once you have this information, then you will be able to determine whether saving more is the right move for you going forward.

To begin, let’s look at how much earlier you could retire if you saved 1%, 5%, or 10% more for 10 years.

Does Saving More For 10 Years Make a Difference?

Imagine you are 10 years away from retirement. You’ve been saving for most of your career and you are sure you will have enough money to quit working in exactly one decade. However, a part of you wants to quit working and retire a bit earlier.

Unfortunately, you know this means that you will need to cut your spending today (to save more) if you want to make this happen. But, before you do, you want to know if it will be worth it.

For example, let’s say that saving 1% more will allow you to retire 1 month earlier (as Meg Bartelt’s tweet above suggests). Would it be worth the sacrifice? Maybe not. But, what if saving 1% allowed you to retire 1 year earlier? Would it be worth it then?

The good news is that we can quantify how much earlier you could retire if you increased your savings rate by 1%. The bad news is that this answer also depends your current savings rate.

Why is your current savings rate so important for when you can retire? Because a 1% absolute increase in your savings rate is a far bigger relative increase for those with a lower savings rate than with a higher savings rate. An example will illustrate this.

Imagine someone who earns $100,000 a year after tax and needs to save 5% per year in order to retire in 10 years. Over this time period they will save $50,000 total [5% * $100,000 * 10 years]. If you were to increase their savings rate by 1% (to 6% in total), they will get to their $50,000 savings goal a little over one year earlier [6% * $100,000 * 9 years > $50,000].

Now imagine someone else who earns $100,000 and needs to save 50% per year in order to retire in 10 years. Over this time period, they will save $500,000 [50% * $100,000 * 10 years]. If they were to increase their savings rate by 1% (to 51% in total), how much earlier would they retire? About 1 month.

This simplified example demonstrates how high savers see less benefit (in terms of retiring earlier) compared to lower savers when they boost their savings rate.

More importantly, this example illustrates that Meg Bartelt’s tweet is slightly misleading. Yes, saving 1% more per year for 10 years can move your retirement date up 1 month, when you have a 50% savings rate. If your current savings rate is more realistic (i.e. 5%-20%), boosting your savings rate by 1% per year for 10 years will have a bigger impact.

We can illustrate this further by plotting how much earlier you would retire (in months) by saving 1% more for all current savings rates ranging from 5% to 50% (while 10 years from retirement):

From this plot we can see that, if your current savings rate is 5%, increasing it to 6% would allow you to retire almost 18 months sooner. However, this benefit diminishes as your current savings rate increases. For example, if your current savings rate is 15%, increasing it to 16% would only allow you to retire 6 months sooner. And so forth.

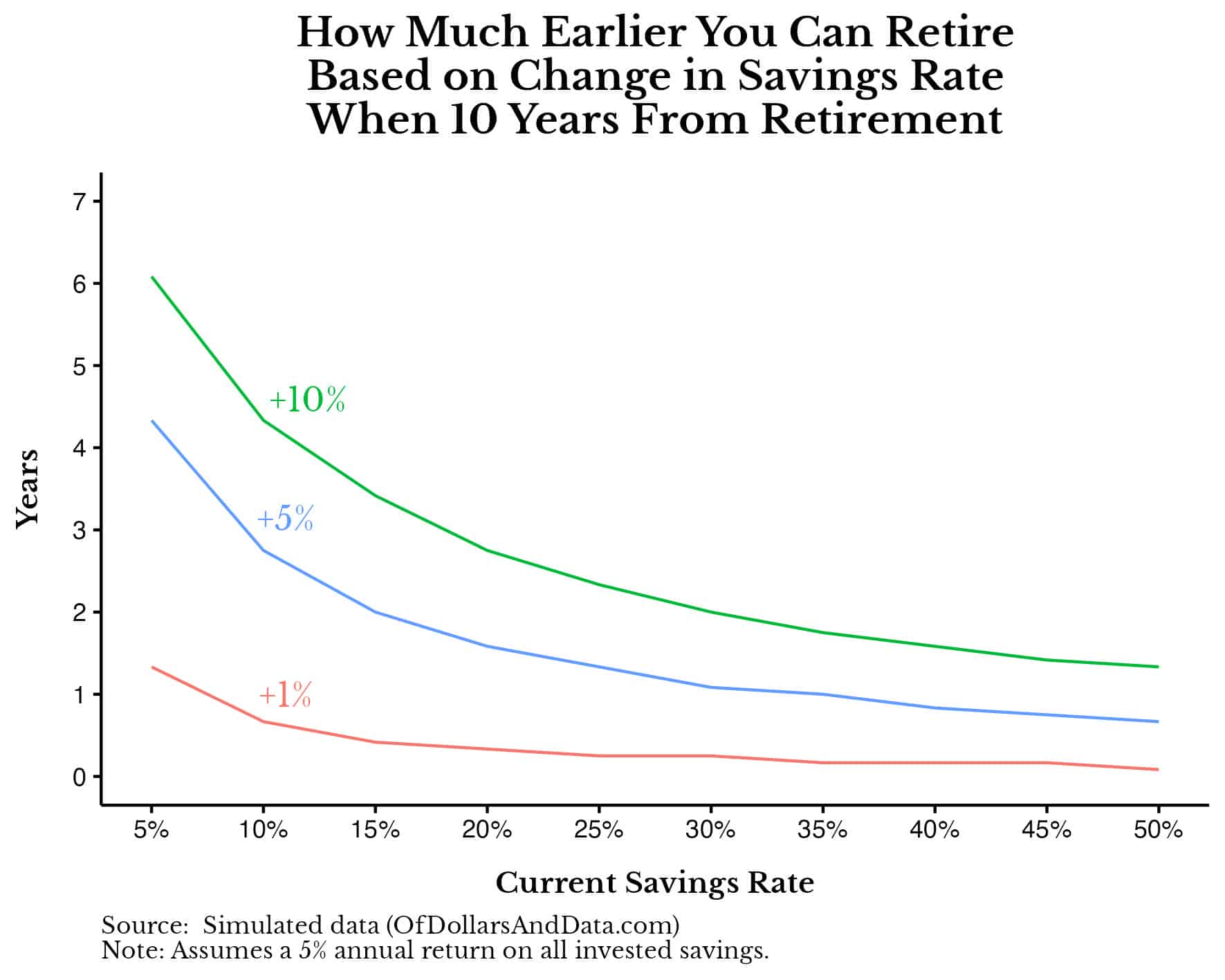

We can expand on this example even further by showing the same plot as above but also including the lines for a 5% increase and a 10% increase in your savings rate [Note that the y-axis is now in years not months]:

As you can see, boosting your savings by 5% or 10% has a much larger impact on how much earlier you can retire. In particular, if your current savings rate were 5% and you increased it by 10% (to 15% in total), you could retire 6 years earlier. However, if your current savings rate were 40% and you increased it by 10% (to 50% in total), you would only retire about 1.5 years earlier.

The exact figures are quantified in the table below which shows how much earlier you can retire (in years) based on your current savings rate and how much more you save (for someone 10 years from retirement):

| Current Savings Rate | Save 1% More | Save 5% More | Save 10% More |

|---|---|---|---|

| 5% | 1.30 | 4.30 | 6.10 |

| 10% | 0.70 | 2.80 | 4.30 |

| 15% | 0.40 | 2.00 | 3.40 |

| 20% | 0.30 | 1.60 | 2.80 |

| 25% | 0.20 | 1.30 | 2.30 |

| 30% | 0.20 | 1.10 | 2.00 |

| 35% | 0.20 | 1.00 | 1.80 |

| 40% | 0.20 | 0.80 | 1.60 |

| 45% | 0.20 | 0.80 | 1.40 |

| 50% | 0.10 | 0.70 | 1.30 |

My biggest takeaways from this table are the following:

- Increasing your savings rate is more impactful for those who save less. Going from a state of no (or low) savings to one of some savings provides the most marginal benefit to your finances. In other words, getting off of zero is more important than going from a 40% to 50% savings rate.

- Once you’re saving a lot, saving more doesn’t move the needle. As you can see in the table above, once your current savings rate is 25%, saving 1% more has a negligible impact on when you can retire (if done over 10 years). While saving money is important, being hyper-focused on your savings rate may cause you to overlook other areas of your finances.

If saving more doesn’t seem worth it (because the numbers in the table above are too low), then you might just need to save more for a longer period of time. For that, we turn to our next section.

What About Saving More For Longer Time Periods?

If you really want to retire earlier, then you are going to have to save more for a longer period of time. You can see this clearly in the tables below which show how much earlier you can retire (in years) based on your current savings rate and how much more you save (for someone 20 and 30 years from retirement).

Here’s the table showing how many years you would save if you increased your savings rate (while 20 years away from retirement):

| Current Savings Rate | Save 1% More | Save 5% More | Save 10% More |

|---|---|---|---|

| 5% | 2.20 | 7.60 | 10.90 |

| 10% | 1.20 | 4.70 | 7.60 |

| 15% | 0.80 | 3.40 | 5.80 |

| 20% | 0.60 | 2.70 | 4.70 |

| 25% | 0.40 | 2.20 | 3.90 |

| 30% | 0.30 | 1.80 | 3.40 |

| 35% | 0.30 | 1.60 | 3.00 |

| 40% | 0.20 | 1.40 | 2.70 |

| 45% | 0.20 | 1.20 | 2.40 |

| 50% | 0.20 | 1.20 | 2.20 |

And here’s the table showing how many years you would save if you increased your savings rate (for those 30 years away from retirement):

| Current Savings Rate | Save 1% More | Save 5% More | Save 10% More |

|---|---|---|---|

| 5% | 2.80 | 9.80 | 14.60 |

| 10% | 1.40 | 6.00 | 9.80 |

| 15% | 0.90 | 4.20 | 7.40 |

| 20% | 0.80 | 3.30 | 6.00 |

| 25% | 0.60 | 2.80 | 5.00 |

| 30% | 0.50 | 2.30 | 4.20 |

| 35% | 0.40 | 2.00 | 3.80 |

| 40% | 0.30 | 1.80 | 3.30 |

| 45% | 0.30 | 1.60 | 3.00 |

| 50% | 0.20 | 1.40 | 2.80 |

The remarkable thing about the 30-year table is that even if you save 1% more for 30 years, you don’t even get to retire 1 year earlier (for most savings rates).

This part of Bartelt’s original tweet was far more accurate. Saving 1% more for 30 years (with a current savings rate of 30%) would only move your retirement up by 6 months (as she stated). However, if your saving rate was only 5%, increasing it to 6% would allow you to retire nearly three years sooner.

This data illustrates how small changes in savings rates can really add up over time to allow you to retire much earlier. Now that we’ve looked at saving more over longer periods of time, let’s wrap things up by discussing why it all matters.

The Bottom Line

The decision to save more in order to retire earlier isn’t black and white. As we’ve seen in this post, it depends on a variety of factors such as your current savings rate, how much more you want to save, and how far away you are from retirement.

If you have a lower savings rate, saving more can have a significant impact on how much earlier you can retire. However, as your current savings rate increases, the decision to save more becomes much more of a tradeoff.

For example, is retiring four years earlier worth saving 10% more for 20 years? What about saving 1% more for 30 years so that you can quit work six months sooner? Would that be worth it? I don’t know. But, I hope that the data presented above makes it easier for you to determine this for yourself.

Lastly, it’s crucial to strike a balance between saving for the future and enjoying your lifestyle in the present. This is something that I struggled with throughout my 20s, but have since gotten a better handle of. The key breakthrough I had was to shift my mindset away from micro-managing my savings to a philosophy of “save what you can” with an emphasis on increasing my income in the future.

While this may not work for everyone, I’ve found that it frees my headspace to spend more time thinking about business/income opportunities and less time worrying about whether I’m spending too much. In the end, deciding whether to save more and retire earlier is a very personal decision. I just hope that you can determine for yourself whether the juice is worth the squeeze. Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 347. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data