My college advisor once told me something that would fundamentally change how I make decisions:

Solve life backwards

I didn’t know what he meant when he first said it, so he went on to explain:

It’s much easier to solve life’s most difficult problems by working from your end goal backwards instead of from your present state forwards.

His idea was to visualize your future and then move backwards through time to figure out each step prior until you reach where you are today. This concept is similar to Stephen R. Covey’s 2nd habit from 7 Habits of Highly Effective People—begin with the end in mind.

A great example of this idea in action comes from Peter Attia, a physician and longevity expert, who wanted to figure out how to be, physically, the most “kickass” 100-year old possible. However, Attia realized that the standard fitness advice wasn’t right for the job. Therefore, he designed a “100 year-old decathlon” to solve his problem. As he stated in this podcast with Tom Bilyeu (emphasis mine):

What does it mean to be the most kickass 100-year old? I think you then have to reverse engineer all of the things that one should be able to do. So a kickass 100-year old should be able to carry two 25lb bags from a grocery store. They should be able to lift a 30-40lb bag over their head to put it in the compartment of an airplane. They should be able to have a 25lb little terror run at them (i.e. their great-grandchild), dip down into a squat, and grab them and pick them up. They should be able to jump down on the floor and play with cars or dolls and stand up without assistance. And if you start to map out the 25 or 35 things, that becomes a new decathlon.

Attia was able to come up with this regiment by imagining his future as a 100 year-old and then solving backwards. So instead of increasing his one rep max on bench press or improving his mile time, he focuses his training on things that will be practical in his future.

But health isn’t the only area of life that you can solve backwards. You might be able to use this method to enhance your career as well.

Can You Solve Your Career Backwards?

If you wanted to be the CEO of a Fortune 500 company, it would be good for you to know how other Fortune 500 CEOs got there. Thankfully, Jeffery S. Sanders summarized the most common career paths of Fortune 500 CEOs for us:

Though they often began their careers in finance, the executives who have made it to the top are those who have successfully used their financial expertise to become excellent operators.

Interestingly, consulting, at four percent, ranked as the least common early career experience among CEOs.

Sanders’ analysis doesn’t tell you which career path is the most likely to get you to be a Fortune 500 CEO (since it doesn’t control for the population sizes of these various career paths), but it does provide a list of options to choose from.

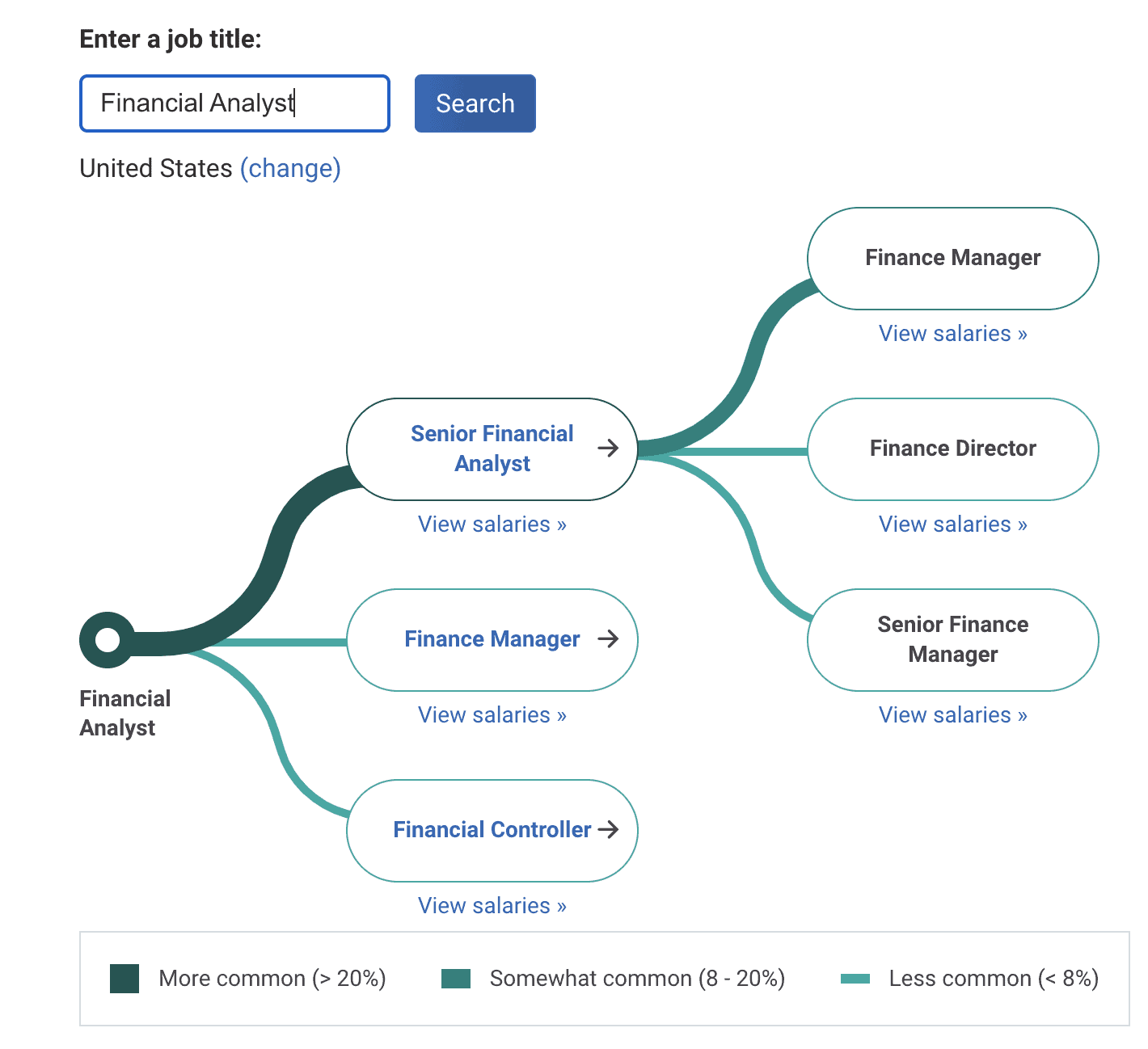

Unfortunately, most of the career planning tools I have seen online focus on solving forwards instead of backwards. For example, this career path planner from PayScale does a great job of showing you which roles are most likely to follow a given role. As you can see below, if you are a Financial Analyst your next most common role is Senior Financial Analyst, Financial Manager, or Financial Controller (in that order):

However, this tool doesn’t allow you to do the reverse—see which roles precede a given role. For example, if you wanted to become a Financial Director, we know that Financial Manager is one pathway (based on the image above), but is it the only one?

Another organization that effectively uses the idea of solving life backwards is Amazon. As highlighted in this article, Amazon tries to “work backwards from the customer, rather than starting with an idea for a product and trying to bolt customers onto it.”

What this means is that before a team gets to work on a new product, the product manager must first write a press release to pitch the product internally. If fellow employees get excited about the press release, then the project is given the green light, but, if not, then it’s back to the drawing board. It’s no wonder that the book that best describes Amazon’s culture is titled Working Backwards.

But you can easily apply this framework to your working life as well. I know because I’ve done it. I remember analyzing my career at my current firm a few years ago and thinking, “What role best suits me here?” I realized that we needed a COO and, given my love for operations/efficiency, it seemed like the perfect fit. So back in October 2019 I bought a book called How to be a Chief Operating Officer by Jennifer Geary:

I read it within a day and quickly realized that there were a handful of things that I wasn’t doing that I needed to do if I wanted to be the firm’s COO. Rather than bore you with all the details, I figured out where I was lacking and then solved backwards on how to fill in the gaps. Nine months later I got the job.

I don’t say this to brag, but to demonstrate how this process works in practice. You start with the end goal and then move slowly towards today. Of all the areas where you can apply this, your finances in retirement might be the most useful.

How to Solve Your Finances in Retirement Backwards

If you want to solve your finances in retirement backwards, then you need to imagine how much money you will spend in retirement. This figure is important because it is the foundational of all retirement projections. More importantly, it will help tremendously if you know how to use a financial calculator. Why? Because a financial calculator is the simplest way to imagine how to move money through time. It’s not a perfect solution, but its a great shortcut to solve backwards.

For example, if we assume that you won’t run out of money in retirement while using the 4% rule, then you only need 25x your expected annual spending to retire (Note: Annual Spending/0.04 = 25 * Annual Spending). Therefore, if we assume that your annual spending is $100,000 (after-tax), this means that you would need $2.5 million to retire.

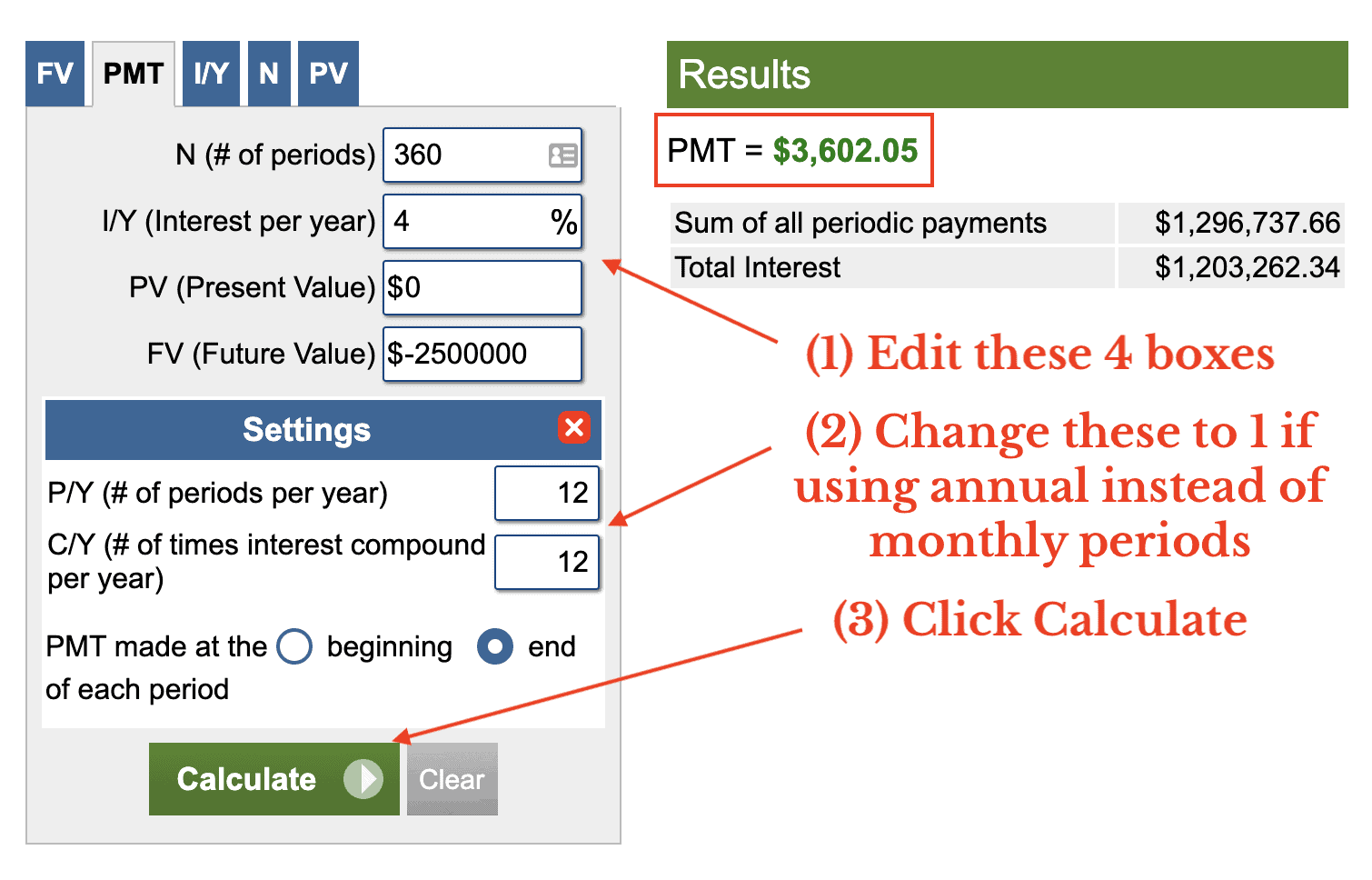

But how much do you have to save each month to get there? If you invest for 30 years (or 360 months), can earn 4% per year on your portfolio (after inflation), start with $0, and need $2.5 million, then you will need to save about $3,600 a month.

In financial calculator speak, this means that N = 360 months, I/Y = 4%, PV = $0, and FV = $2.5 million. If you open the financial calculator here, click the “PMT” tab (to solve for the required payment amount), plug in the values listed above, change the “Settings” for P/Y and C/Y to be 12 (since we are using monthly periods but an annual return %), and hit calculate, it will give you PMT = $3,600. See here to follow along (and how to change the assumptions):

You can easily modify any of these variables to make this more relevant to your financial situation. For example, you could change the FV (how much money you need at the start of retirement), increase the PV (how much money you have now), or increase the I/Y (expected rate of return after inflation).

After finding the right payment amount (PMT), you can then take this one step further. For example, if I know that I spend $100,000 a year (after-tax) and I need to save $3,600 a month, this means that I need an after-tax income of $143,200 per year [$100,000 + 12 * $3,600] to live and save accordingly. And if we assume that I pay a 35% effective tax rate, this means that I need a pre-tax income of ~$220,000 per year to get there.

Of course, this is an extreme example. If I were to spend less money in retirement, invest for longer, have more money to start, or earn a better return each year, then my required payment (and required income) would not need to be as high as what is shown here. Nevertheless, this demonstrates how one could solve retirement backwards using a handful of assumptions.

Unfortunately, this is also what makes this method difficult to follow at times. Sometimes, things don’t go according to plan. You could iteratively solve backwards each step of your journey, yet still get thrown off course. And, once you are off course, there are no guarantees that you will be able to get back on.

Despite the simplicity of solving life backwards, life is never so simple. Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 298. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data