Imagine that you just sold your best performing stock (or ETF) of the past few years for a sizable gain. Though you may want to spend (or reinvest) all of the proceeds immediately, you know you can’t because of…taxes. Yes, you will owe taxes on those gains unless you can find a way to offset them.

This is where tax loss harvesting comes in. Tax loss harvesting is the use of investment losses to offset short-term capital gains, long-term capital gains, and even ordinary income taxes. So, if you had $10,000 in capital gains (from a taxable account) and were in the 15% capital gains tax bracket, you would owe the IRS $1,500. However, if you could sell enough other assets to properly generate $10,000 in losses (from a taxable account), this would negate your $1,500 tax bill.

But before we get into the the three ways that tax loss harvesting can save you money, we should first discuss what a successful tax loss harvesting strategy looks like.

How to Tax Loss Harvest Successfully

A successful tax loss harvesting strategy should generate a tax loss in the short run without generating an actual monetary loss in the long run. What I mean by this is that you should never make it an explicit goal to lose money just for the tax benefits. Losing money is always bad for you as an investor. As Warren Buffett’s once said:

The first rule of investment is don’t lose. And the second rule of investment is don’t forget the first rule. And that’s all the rules there are.

However, a good tax loss harvesting strategy can generate losses as they appear without losing money in the long run. How does it do this?

First it sells a security at a loss, and then it takes the proceeds from that sale and buys an “alternate security” that behaves similarly, but not identically to the original security. Why does it purchase an alternate security? Because it wants to generate a tax loss without changing your exposure to the underlying asset class.

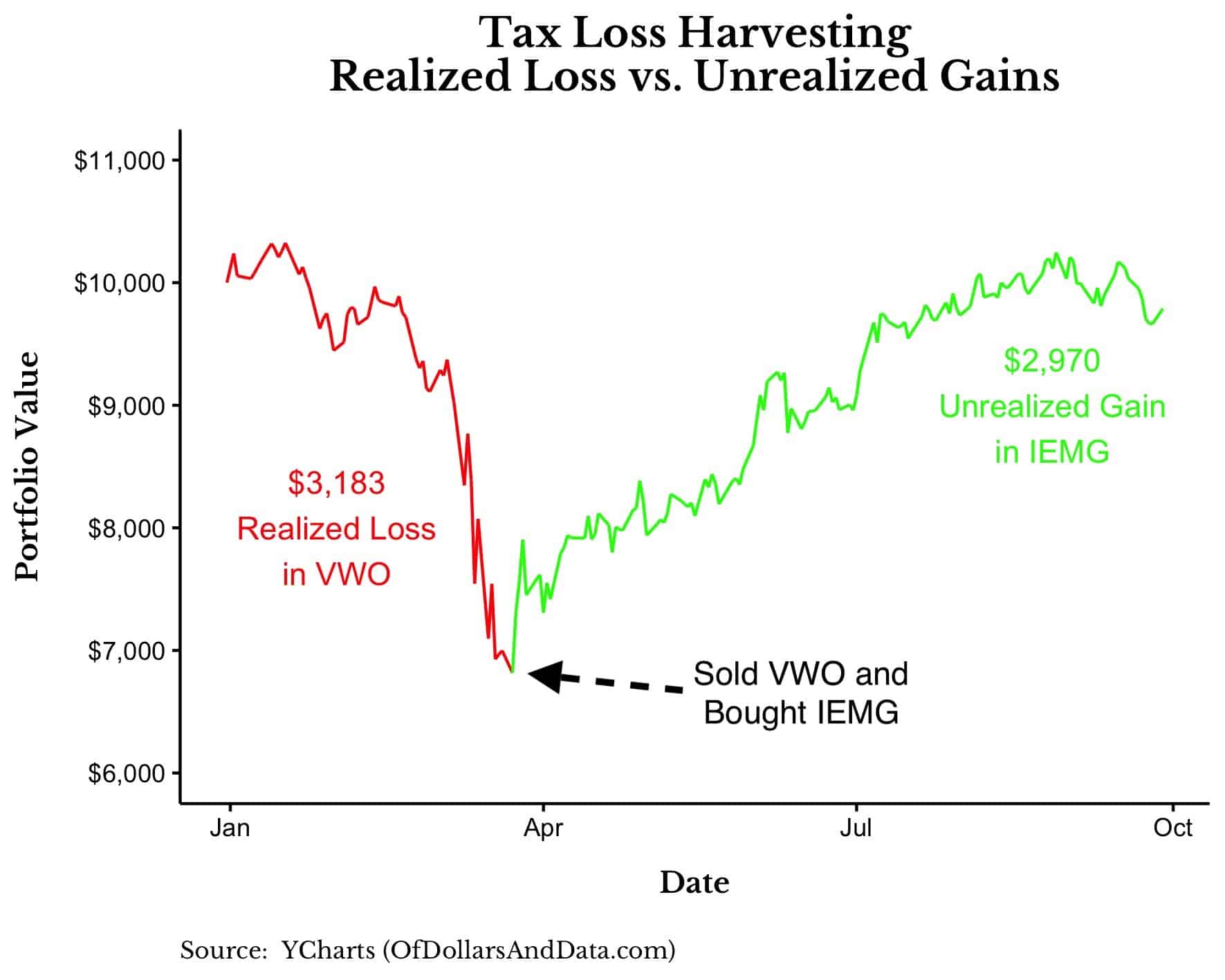

For example, let’s say you owned $10,000 of VWO (Vanguard FTSE Emerging Markets ETF) in a taxable account as of January 1, 2020. The optimal tax loss harvesting strategy would have sold your VWO on March 23, 2020 (i.e. the coronavirus bottom) to generate the largest tax loss possible, and then would have immediately taken the proceeds from that sale ($6,817) and bought shares of IEMG (iShares Core MSCI Emerging Markets ETF) to replace it.

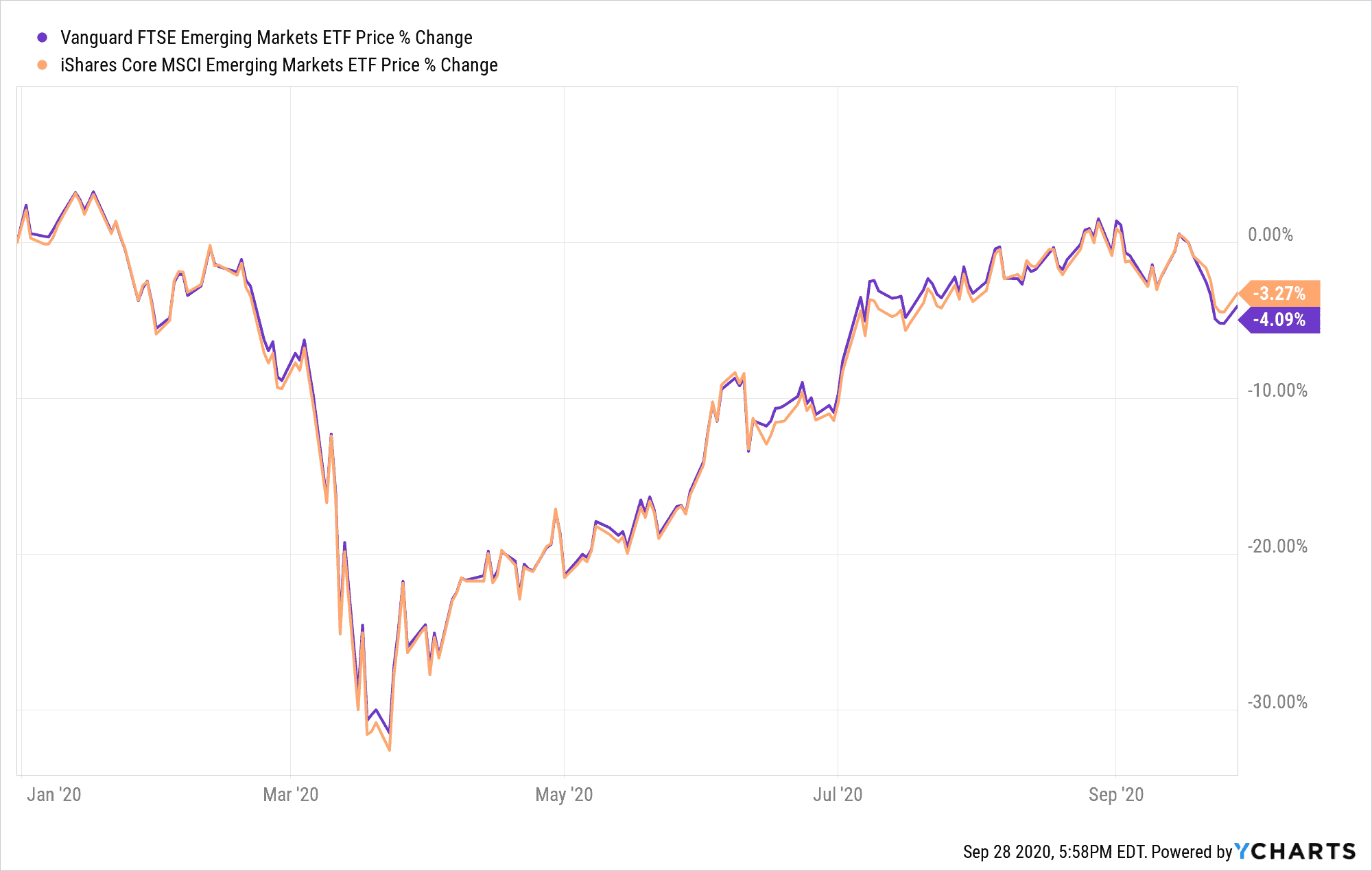

In doing so, this strategy would have generated $3,183 in losses while keeping your exposure to emerging markets constant throughout 2020. I say “constant” because, as you can see from the chart below, IEMG performs basically the same as VWO:

This is important because buying an alternate security like IEMG it gives you the performance of VWO without actually owning VWO.

This detail might seem mundane, but from the IRS’s point of view, it matters a lot because of something called the “wash sale” rule. As Publication 550 states about wash sales:

A wash sale occurs when you sell or trade stock or securities at a loss and within 30 days before or after the sale you:

- Buy substantially identical stock or securities,

- Acquire substantially identical stock or securities in a fully taxable trade,

- Acquire a contract or option to buy substantially identical stock or securities, or

- Acquire substantially identical stock for your individual retirement arrangement (IRA) or Roth IRA.

In other words, you can’t claim a tax loss on a security if you end up repurchasing that same security (or a “substantially identical” one) within the next 30 days (or in the 30 days prior). However, the rules around what is a “substantially identical” stock/security are not 100% clear.

For example, while selling VOO (Vanguard S&P 500 ETF) to buy SPY (SPDR S&P 500 ETF) would definitely generate a wash sale, selling VWO (Vanguard FTSE Emerging Markets ETF) to buy IEMG (iShares Core MSCI Emerging Markets ETF) wouldn’t.

How do I know? Because Betterment, one of the domain experts on tax loss harvesting, lists IEMG as the security alternate for VWO in their taxable accounts. This is basically Betterment’s way of publicly admitting that they use alternate securities (or what they call “parallel securities”) to avoid the wash sale rule. And they do it because it is the most optimal thing you can do within the confines of the tax code.

For example, if you wanted to follow the optimal tax loss harvesting strategy described above when switching from VWO to IEMG earlier this year, it would have looked something like this:

Of course, no tax loss harvesting strategy would ever be expected to perfectly time the market bottom like the example above, but it illustrates my point. The realized losses generated by VWO (in red) will net out against the unrealized gains in IEMG (in green), assuming you sold your IEMG position.

This insight suggests that all tax loss harvesting is merely a strategy of tax deferral. You are avoiding taxes now to pay for them (ideally at a lower rate) later.

Now that you know how a good tax loss harvesting strategy works, let’s discuss the three ways in which it can save you money.

1. Ordinary Income Deduction

One of the biggest benefits of tax loss harvesting is the ability to reduce your ordinary income tax liability through excessive capital losses. For those individuals with capital losses greater than their capital gains for the year, they can deduct up to $3,000 (or $1,500 if married filing separately) off of their ordinary income. Any losses in excess of this amount may be carried forward indefinitely to offset capital gains and ordinary income in future years.

How much of an actual monetary benefit is this on an annual basis? For most taxpayers, it’s far less than you think. For example, if we assume that you, like my average reader, are in the 24% federal income tax bracket (income = $85k-$163k a year), then the annual write off is only $360 after taxes (24% * $1,500).

If you compounded this $360 benefit at a 4% real rate of return for 40 years, you would get a total lifetime benefit of $34,209. This is a nice chunk of change, but, technically, it is overstated since it doesn’t adjust for the fact that the losses you achieve through tax loss harvesting today have to be netted out against the additional gains that you will need to pay taxes on in the future.

As I mentioned above, proper tax loss harvesting is ultimately a tax deferral strategy. In this example you reduce your ordinary income tax now, but end up increasing your capital gains later. In the VWO/IEMG example above, you would have used the losses in VWO to reduce your ordinary income tax liability today in exchange for an increased capital gains liability on IEMG in the future.

And since the tax rate on your ordinary income (24%) is higher than the tax rate on long-term capital gains (15%), you can see why tax loss harvesting can be beneficial. And for those in a higher income tax bracket, the benefits of this simple tax arbitrage are even more pronounced.

2. Deferring Known Taxes into the Future

Besides taking advantage of the ordinary income deduction, tax loss harvesting can also be useful when trying to defer taxes into the future. For example, if you know with certainty that you are going to have a large amount of gains in the coming year (i.e. you plan to sell a home, large position, etc.), then having tax losses can provide you with some flexibility as to whether you want to pay the taxes now or later.

For example, if you know your capital gains tax rate will be lower in the future, then pushing your gains into the years with the lower rate is a clear tax arbitrage. As a reminder from IRS Publication 550 (see p. 67), single individuals with a total taxable income below $39,375 (or married couples with taxable income below $78,750) have a 0% long-term capital gains tax rate.

So if you can defer taxes into your retirement, there is a scenario where you and your spouse realize gains of $78,750 a year completely tax-free. Yes, tax-free (assuming you have no other income). Technically, if you include the $24,800 standard deduction for a married couple, you and your spouse could realize up to $103,550 of long-term capital gains with no federal taxes due. This is just one of many ways in which tax loss harvesting can provide more flexibility when it comes to financial planning.

However, this is just the tip of the iceberg. If you take tax loss harvesting to its extreme, some say that the benefits are to die for.

3. Passing No Taxes to Your Heirs

Of all the benefits of tax loss harvesting, the one that makes it irresistible is the ability to defer your future taxes to no one. That’s right, you can make your unrealized gains disappear. There’s just one catch—you have to die first.

What I am talking about is a tax rule known as stepped-up basis. For the uninitiated, the stepped-up basis rule says that your cost basis on your assets resets to whatever the value of the property was on the date of your death. So any unrealized gains (and losses) will be wiped out upon your demise. This means that you can pass on all of your property (i.e. stocks, bonds, real estate, etc.) without any tax at the federal level as long as the total value of your estate is below $11.6M (if single) or $23.16M (if married).

So that Berkshire Hathaway class A share you purchased in December 1994 for $20,000 that currently has ~$300,000 in unrealized gains? Not anymore. Your heirs would now own it with a basis that was “stepped-up” to the market value of Berkshire class A on the date of your death.

This rule might seem outlandish because it is. With stepped-up basis you can pass on a $2M home, a $3M art collection, and a $6M investment portfolio (with $4M in unrealized gains) to your heirs for $0 in federal taxes.

How does this have anything to do with tax loss harvesting? Because when you combine tax loss harvesting with the stepped-up basis rule, you don’t just defer taxes, you can avoid them altogether. For example, if you can manage to tax loss harvest every year without realizing any capital gains until you die, then you can get all of the benefits of tax loss harvesting without any of the costs.

Of course this is easier said than done, but it illustrates why tax loss harvesting, when combined with the stepped-up basis rule, can be so powerful.

However, before you start your tax loss harvesting journey, don’t make the same mistakes I did.

Things to Avoid When Tax Loss Harvesting

Despite the multiple benefits of tax loss harvesting outlined in this article, if you don’t know what you are doing, then you can make some serious mistakes. How do I know? Because I made a tax loss harvesting mistake and I feel like I am someone who is quite diligent when doing research on these topics. This is why I recommend getting professional help when doing anything that involves taxes and the IRS.

But, in addition to getting professional help, below are a few things to avoid when tax loss harvesting:

1. Don’t own the same securities in your taxable and non-taxable accounts

Owning the same securities in your taxable and non-taxable accounts is an easy way to accidentally invoke the wash sale rule. I did this when I sold an ETF in my taxable account (for a tax loss) and then purchased the same ETF a few days later in my non-taxable account (IRA) during a portfolio rebalance. If you remember from the wash sale rules, acquiring a “substantially identical security for your individual retirement arrangement” is not allowed.

This mistake was not something I meant to do on purpose, but the IRS doesn’t care about my intent. They only care that I created a wash sale, which means I cannot use the tax loss from my taxable account. Usually when you create a wash sale you can adjust the basis of the security that you washed, however, since I washed it in an IRA, I get no such adjustment. More importantly, since I rotated the funds from my tax loss position into an alternate security (as I should have), the alternate security now has additional gains that I will owe taxes on in the future.

This means that my clumsiness imposed all of the costs of tax loss harvesting (future capital gains in the alternate security) without any of the benefits (tax losses from the original security). Using our example from above, this is like selling VWO to buy IEMG, but not getting the tax loss on VWO.

This is why I recommend that the securities in your taxable account be different from the ones in your non-taxable accounts. I used to think that your taxable and non-taxable accounts should have the same securities + allocation for simplicity in implementation. However, if you want to tax loss harvest, it’s just too risky.

One option is to have a core security and two alternate securities for every asset class that you invest in. One of the alternates would be for your non-taxable account and the other would be for your taxable account (when tax loss harvesting). While this ensures that you never accidentally invoke the wash sale rule, the implementation can get complex pretty quickly. For example, if your portfolio has 4 asset classes (stocks, bonds, real estate, and gold), you would have to keep track of 12 different securities (4 x 3).

Another option is to split up your allocation across all of your accounts where only certain kinds of securities are in certain accounts. For example, you might put your equities in your taxable account and your bonds in your non-taxable account such that you never have to worry about wash sales events across accounts. While this can be helpful for separating asset classes, it also makes rebalancing across your portfolio much more difficult.

But even if you get your taxable and non-taxable allocations right, there is still more to worry about when tax loss harvesting.

2. Don’t automatically reinvest dividends in your taxable accounts

I know you have probably heard the advice many times before, “Make sure to automatically reinvest your dividends.” However, if you want to be a tax loss harvester, automatically reinvesting your dividends in your taxable accounts can invoke wash sales. How?

Imagine you sell a stock for a loss in your taxable account and then take the proceeds to purchase an alternate security. So far, so good. However, a few weeks later you receive a dividend payment from the original stock that automatically repurchases some shares. A wash sale is born.

Your error in this case was not in forgetting that a dividend would be paid because you owned the stock before the ex-dividend date. I don’t expect you (or anyone) to keep track of the dividend dates across all of their positions. No, your error was in automatically reinvesting that dividend back into the original security. The automated behavior is what created the wash sale.

This is why I don’t automatically reinvest my dividends in my taxable accounts. Because, in addition to preventing messy wash sales, when you don’t automatically reinvest your dividends you have more flexibility around paying taxes and rebalancing. It’s a win-win from an investor’s perspective.

The Bottom Line

Tax loss harvesting is a strategy that can be used to save you money through the ordinary income deduction, tax deferrals, and even tax avoidance (upon death). However, given the complexity of the tax code, it is probably best to get professional help when implementing a tax loss harvesting strategy. If you want to learn more, the Betterment white paper on tax loss harvesting is a superb resource.

Lastly, despite the benefits associated with tax loss harvesting, I think investors place too much emphasis on tax optimization relative to other financial priorities. Yes, everyone (including me) wants to reduce their tax burden, but I don’t think that you should place tax decisions above all else. Tax optimization isn’t life optimization.

In fact, the best thing you can do, many times, is pay your taxes. It’s nothing to look down upon. If anything, a big tax bill is a sign of success. It’s a sign that you created so much value that the government wants a piece of it. Of course, this doesn’t mean we shouldn’t be prudent about the tax code, but we don’t need to worry ourselves to death either.

I also want to give a shoutout to Bill Sweet, my firm’s Chief Financial Officer and resident tax guru, for providing invaluable feedback on this post. Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 207. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data