They were 10 hours into the mission when things started to go wrong. First, someone noticed that fuel was leaking out of the right wing of their B-52 bomber. In an effort to prevent disaster, the commanding officer, Major Walter S. Tulloch, tried to empty the fuel out of the left wing to balance the plane before making an emergency landing in Goldsboro, North Carolina. Unfortunately, the fuel wouldn’t drain and this sent the plane into a downward tailspin. If this wasn’t bad enough, the crew had another problem — there were two nuclear bombs on board.

Major Tulloch had his crew evacuate the disintegrating plane knowing that the nuclear bombs had multiple fail-safes to prevent an accident. However, under the extreme circumstances of the B-52 being ripped to shreds, the bombs’ locking pins were pulled out, their thermal batteries were activated, their parachutes opened, and their barometric switches closed. When they hit the ground, the crystals inside the bombs crushed and sent firing signals. Thankfully, nothing happened. Why? One mechanical switch in the cockpit of the B-52 set to “SAFE” prevented two nuclear bombs, over 250 times more powerful than the bomb dropped on Hiroshima, from detonating on U.S. soil.

This story is told in Command and Control: Nuclear Weapons, the Damascus Accident, and the Illusion of Safety by Eric Schlosser and illustrates an incredible point about how unexpected side effects can occur during extreme conditions. Years after the Goldsboro accident, Stan Spray, a nuclear safety researcher, made a startling discovery that demonstrates this idea perfectly (emphasis mine):

It had always been taken for granted that if two circuits were kept physically apart, if they weren’t mated or connected in any way — like separate power lines running beside the highway — current couldn’t travel from one to the other. In a normal environment, that might be true. But strange things began to happen when extreme heat and stress were applied. When circuit boards were bent or crushed, circuits that were supposed to be kept far apart might suddenly meet. The charring of a circuit board could transform its fiberglass from an insulator to a conductor of electricity.

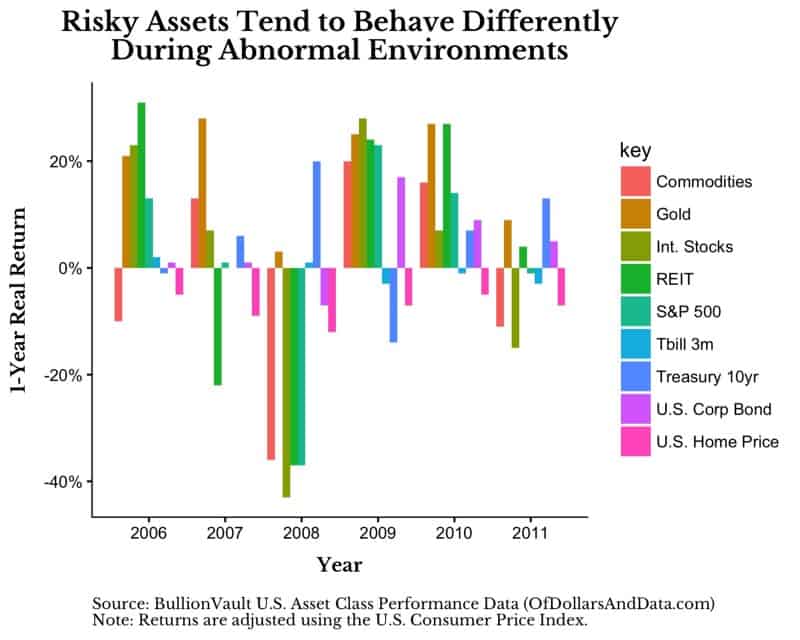

Spray and his team realized that many of the most basic safety assumptions failed during what they called “the abnormal environment.” Things that were supposed to prevent an event could actually cause the event. This is just as true in nuclear safety as it is in investing. When markets become abnormal, many assumptions that hold during normal times (i.e. diversification) break down. You can see this at the annual level during the 2008 crash as most risky assets lost value at the same time:

This chart is harder to read for individual asset classes, but the general pattern highlights the abnormal environment that existed in the market from 2008–2009. A similar occurrence happened in the early February 2018 “correction” as I jokingly stated on Twitter:

I have discussed this idea previously here, but wanted to expand on it further. The problem with abnormal environments is the increased probability of multiple bad events occurring in succession. This can have a huge impact on your financial situation if you do not plan properly.

For example, you might estimate that the probability of you (or your spouse) being unemployed in any given month is 1%. Therefore, the chance that both of you will be unemployed in a given month seems low (~1 in 10,000). However, during abnormal environments, it is far more likely that both of you could lose your jobs, while markets tank, while your family needs additional support, etc. As you can see, the problem is believing that the likelihood of a rare event is independent of another rare event.

The issue here is that it is difficult to foresee how one unlikely event can lead to other unlikely events until after they have occurred. Is there any solution to this problem of expecting the unexpected? Planning with an advisor is probably your best bet, but there are no guarantees. You could hold 12 months of emergency cash, but what happens if we get another Great Depression that lasts years? You could try and solve the optimal bond/stock mix, but how good will that be knowing that the future is likely to be different from the past?

This leads me to the conclusion that most investors (myself included) are probably taking too much risk in the same direction across their portfolio and human capital. In other words, when asset values fall in financial panics, you are probably more likely to lose your job as well, which makes things even worse. Chris Cole from Artemis Capital calls this being “short volatility” in the sense that your portfolio/career is setup only for normal times (i.e. low volatility markets).

Cole’s solution is to incorporate some “long volatility” products (i.e. put options, etc.) into your portfolio to hedge this risk. In doing so, you would be able to profit in the event of extreme market conditions. There are two problems with this strategy though:

- Long volatility products aren’t simple or mainstream for typical retail investors.

- Long volatility products require underperformance during normal times. This maybe difficult for investors to hold in the long run.

I read about this stuff a lot and I still don’t fully understand how I should be thinking about incorporating long volatility into a portfolio. Maybe someone in FinTwit can enlighten me more on this…

Always/Never

The problem with designing a nuclear bomb is the inevitable tradeoff between reliability and safety. Schlosser explains in Command and Control:

A safety mechanism that made a bomb less likely to explode during an accident could also, during wartime, render it more likely to be a dud. The contradiction between these two design goals was succinctly expressed by the words “always/never.” Ideally, a nuclear weapon would always detonate when it was supposed to — and never detonate when it wasn’t supposed to.

This same idea can be applied when designing your portfolio where there is an inherent tradeoff between growth and downside protection. Too much growth (i.e. risky assets) and you may be tempted to sell during market panics. However, too much downside protection and you may never reach your financial goals. The key is striking a balance that you feel comfortable with and seems reasonable. No one will ever know the future, but finding ways to add an extra layer of protection from the abnormal environment is probably a good idea. Whether you do that with more bonds or decide to look into long volatility is up to you. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 60. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data