This week’s post is inspired by a poll that Jake (@Econompic) asked on Twitter:

You are 25 year old interested in a career in investment management. A genie appears offering you one of the following (with all the learning, networking, benefits, etc… auto populated into your background). Which do you think best improves your career prospects?

- CFA designation

- MBA from top tier school

- Great first job

- Rich parents

With over 2,400 votes cast on Twitter, the results were 7% for CFA, 17.9% for MBA, 37.3% for great first job, and 37.8% for rich parents.

All of these answers can be justified in one way or another. Having a CFA is practically required for some careers in investment management (but not all). Having an incredible network from a top tier MBA would be useful for a host of reasons. We could say the same thing about a great first job, which could propel your career in unforeseen ways.

But, assuming you have the skills required to get a CFA/top tier MBA, I’m going to have to agree with the crowd on this one. All else equal, rich parents are the best advantage you can have if you want a career in investment management. In fact, having rich parents is probably one of the best advantages you can have in life and I have the data to prove it.

How Do Rich Parents Help Their Children?

Of all the things that rich parents can do for their children, one of the biggest is ensuring that they get a good education.

Research in the Journal of Economic Inequality found that the children of wealthier British households had better educational attainment (and also higher lifetime earnings) even after controlling for parental income, parental education, and a host of other factors. You might argue that the children of wealthier households have other attributes that make them more likely to succeed, however, this isn’t always the case.

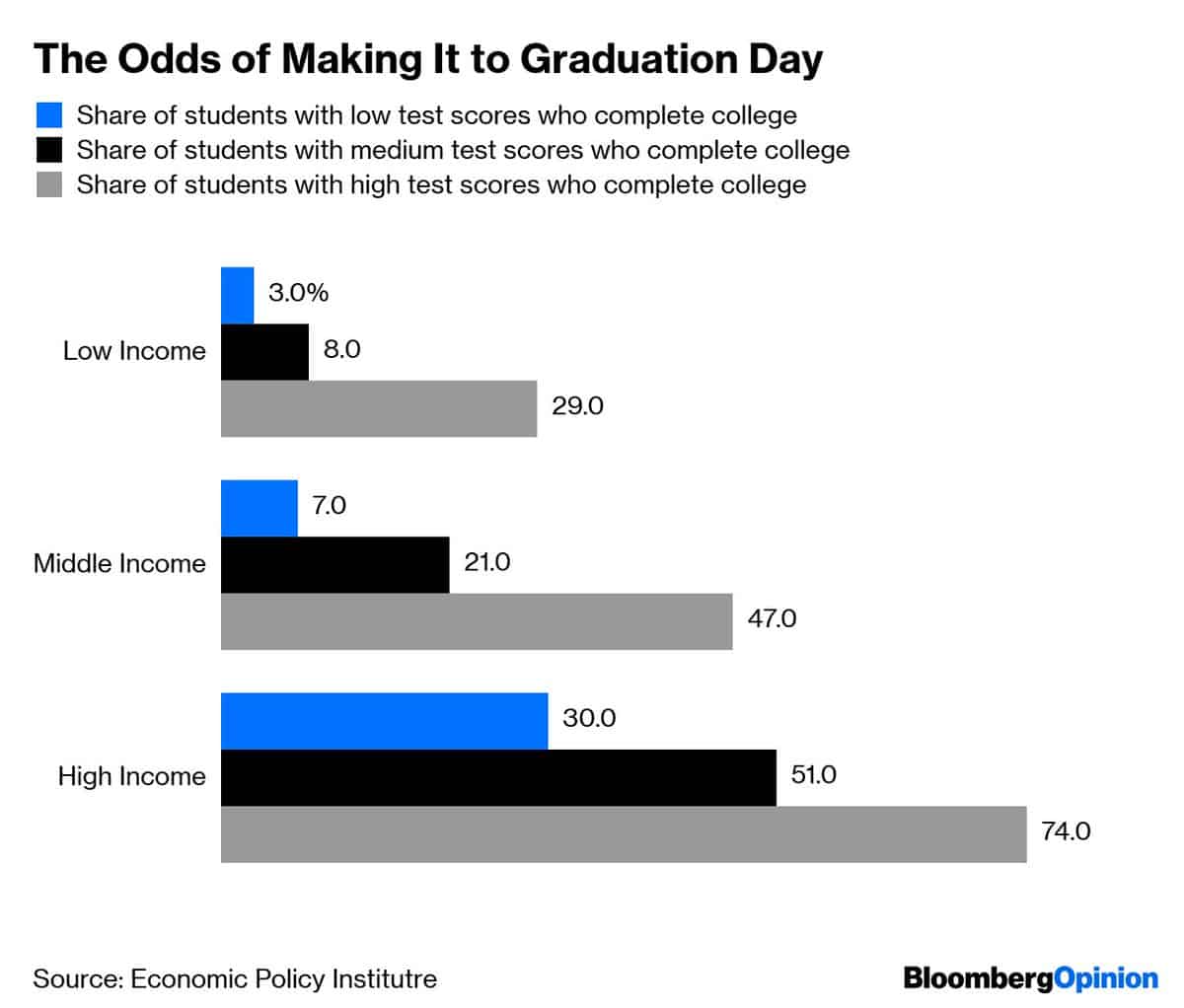

For example, a study out of Georgetown found that those students who scored in the top 25% on a standardized math tests but were in the bottom 25% of socioeconomic status had a 31% chance of graduating college and earning $45,000 by the time they were 35. However, for those students who scored in the bottom 25% of their standardized tests but were in the top 25% of socioeconomic status, the chance of reaching the same milestones was 71%!

This suggests that you will probably do better economically if you are dumb and from a rich family than if you are smart and from a poor family. As the image below illustrates, less intelligent students (from high income families) have the same odds of graduating college as more intelligent students (from low income families):

But it’s not just better education that the rich can give their children. They can also provide jobs too.

According to U.S. Census data, about 22% of men work at the same company as their father before they turn 30. More importantly, research suggests that “children’s earnings at shared employers tend to be higher than at unshared jobs, especially for children of high-earning fathers.” So not only can the rich provide their children with jobs, but the data suggests that those jobs they do provide tend to have better pay as well.

Personally I’ve seen this play out with friends who got internships at companies because they knew someone (or their family knew someone) who worked there. I wish I could say that I disagreed with this, but I almost did the same thing during the summer between my junior and senior year in college.

I knew that if I didn’t find a good internship I could always work with my aunt at a logistics company and earn minimum wage. Yes, that job wasn’t as nice as a job that a rich family might be able to provide, but I was still fortunate to have some job to fall back on if I needed it. Children from poorer families have no such guarantees.

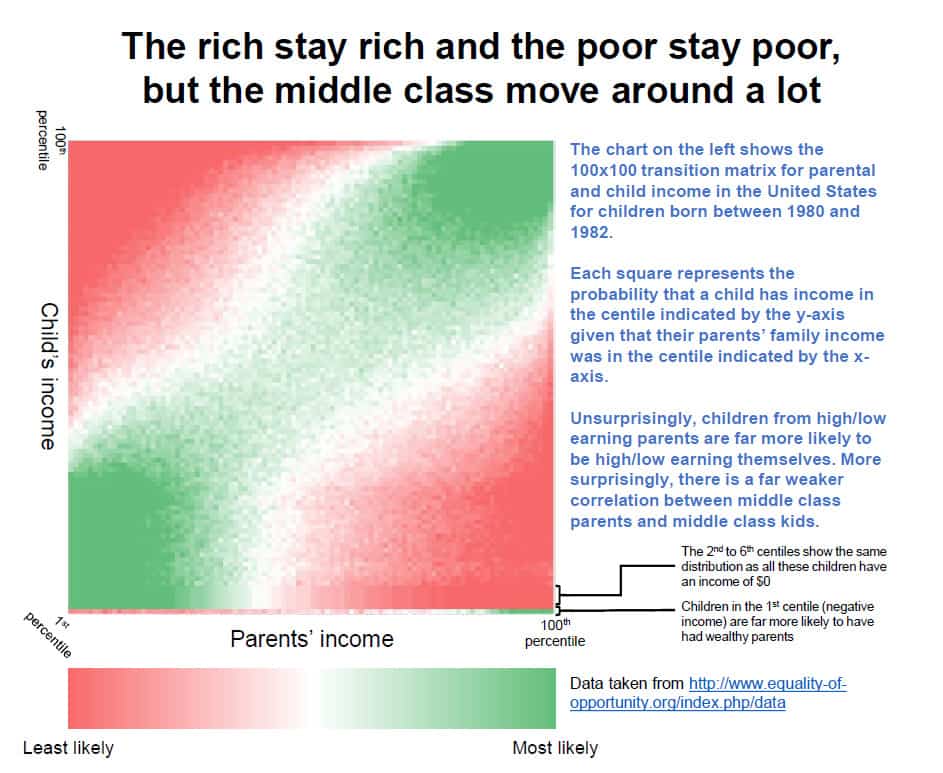

If we look at income mobility data from the Equality of Opportunity Project (h/t Reddit), we can see this quite clearly. As the chart below illustrates, children from the richest and poorest families tend to have similar incomes to their parents later in life:

This chart suggests that parental income is highly predictive of child income at the extremes, but less so in the middle of the income distribution.

This phenomenon isn’t just true on a relative basis, but on an absolute basis as well. As Max Roser tweeted (you can read the full article here):

A person’s home country explains *two-thirds* of the variation of income differences between all people in the world.

It’s not just having richer parents within your country of origin that matters, but how rich your parents are relative to the rest of the world as well. This reminds me of Warren Buffett’s idea of an “ovarian lottery” which emphasizes the importance of where you were born and who you were born to. As Buffett states (h/t Cullen Roche):

[The ovarian lottery is] the most important event in which you’ll ever participate. It’s going to determine way more than what school you go to, how hard you work, all kinds of things.

This is why being born into a rich family can be such a huge advantage in society. It will determine your peer group, your educational choices, and much more. However, it’s not a silver bullet when it comes to finding meaning and success in life.

Being Rich Only Gets You So Far

Despite all the advantages that having rich parents gives someone, this doesn’t imply that they didn’t have to work for what they have. In fact, all of the people I know who grew up in rich families work incredibly hard. Yes, there is selection bias in my sample, but I know it’s not all mommy and daddy’s money at play.

However, I do think that their parents’ wealth provided them with a bigger opportunity set for success. Corey Hoffstein often says that in order to succeed in life you should try to “maximize your surface area of luck.” He means that you should meet more people, try new things, and build new skills in order to expand what opportunities come your way. Having rich parents is the easiest way to do this. However, it isn’t a guarantee for success.

Think of it like a spider’s web. Some children are born into rich families with a massive web that can catch the many opportunities that come their way. They can learn a multitude of activities and hire coaches to train them. They can pursue what major they want instead of what major will pay well later in life. They can work less hard when looking for a job.

All of these things are small, but provide a greater surface area of luck (a bigger web) to rely on. As Susan E. Mayor concluded in The Influence of Parental Income on Children’s Outcomes:

Although parental income generally has only a small to modest effect on any particular outcome, it contributes to many aspects of children’s well-being. This means that income gains have the potential to make a significant cumulative difference to the lives of children.

It is this cumulative difference that matters. A spider with a bigger web is likely to catch more flies.

However, this doesn’t imply that all children born to rich parents can coast through life. They still have to do something when an opportunity falls in their web. If they don’t, then they could end up far behind someone else who capitalized better on their much smaller web.

Ultimately, web size matters, but it’s not insurmountable. Being born into a poor family with a smaller surface area of luck just means that you have to be that much more diligent on whatever opportunities do come your way. Of course this isn’t fair, but the world was never meant to be fair.

Some of us are born short. Some tall. Some ugly. Some beautiful. Some smart. Some dumb. Some rich. Some poor.

Yes, one of the best advantages in life is having rich parents. However, one advantage that is even better is realizing that you don’t need rich parents in order to succeed. Thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 255. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data