When the British occupied India under colonial rule in the mid to late nineteenth century, they had a problem — Cobras. These venomous snakes were numerous in India and, unsurprisingly, the British were not fond of them.

As a result, the British government set up a program by which they would pay anyone to bring them a dead cobra. Initially, this worked wonders as dead cobras started flooding in. However, after some time, the British discovered that some of the Indians had played a trick on them.

Indians looking to cash in on the cobra buyback program setup cobra farms to breed cobras. These cobras were killed and given to the British for the bounty.

As soon as the British discovered this cobra farming scheme, they ended the buyback program. Indian cobra farmers, with no other use for the cobras, abandoned their operations and set the cobras free. As a result, the number of cobras in India increased.

This is called the cobra effect and perfectly illustrates the law of unintended consequences. While no one knows if this story is true, there are plenty of examples that mirror its result, namely, individuals making decisions to cause one outcome to occur can accidentally cause the opposite.

The cobra effect is hard to foresee before hand and appears quite often in the investing world. And that is what I am here to talk about today.

If we took a high level tour of the greatest investing blunders of all time, I would argue that they all suffered from the cobra effect.

Given that the strict objective of investing is to get wealthier, I cannot imagine a more unintended outcome than losing vast sums of money. However, I don’t want to talk about get rich quick schemes or penny stocks.

The cobra I want to talk about today is bonds.

What words come to your mind when I say “bonds”?

Safety? Low risk? Principal preservation?

These are all generally true…in the short run.

Over longer periods of time, bonds have simply been ineffective at building wealth.

And with today’s very low yields, your return on bonds after inflation and taxes is essentially 0%.

So, unless you require 0% returns going forward (i.e. you have more money than you could ever need), you need to hold ample amount of equities.

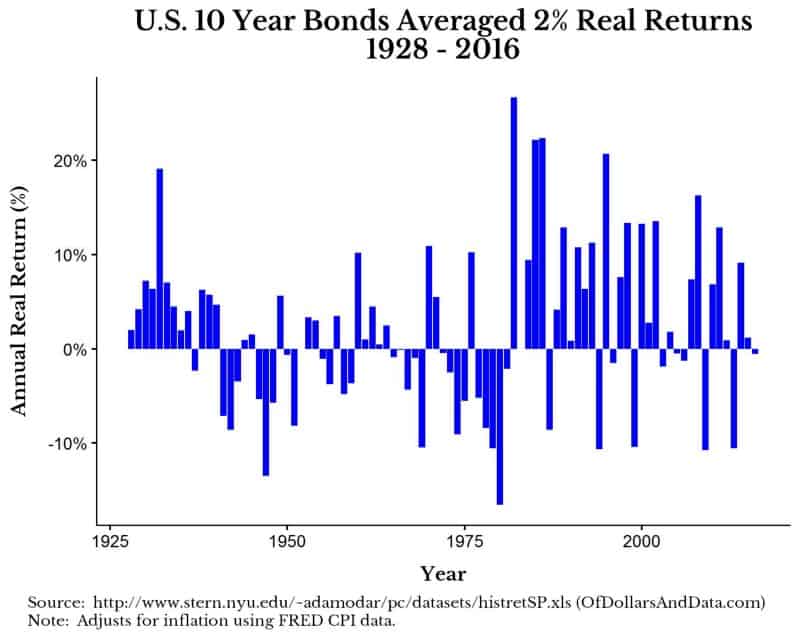

For example, the average real return on 10-year U.S. bonds from 1928–2016 was 2%:

While this isn’t 0%, this 2% is being heavily skewed by the higher bond returns starting in the early 1980s.

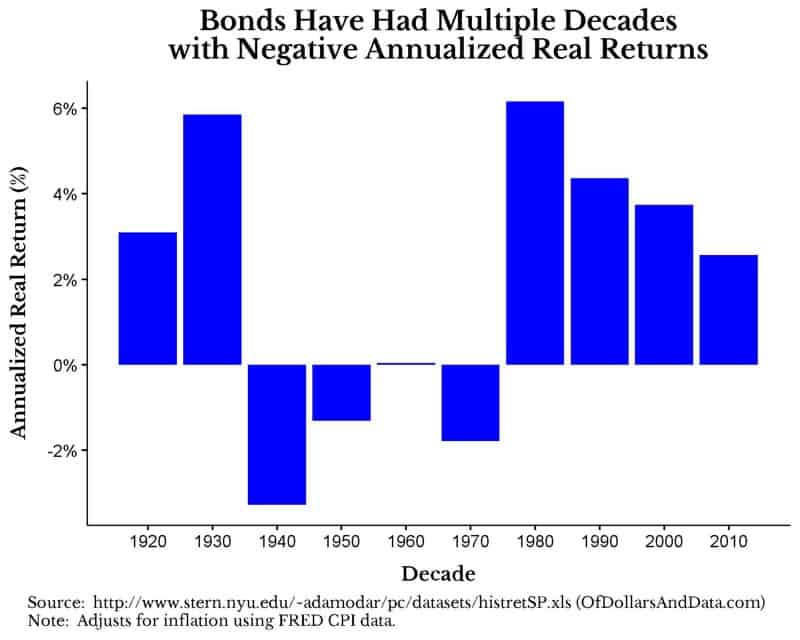

If we look at the returns by decade you can see that for 4 decades, starting in 1940 and ending in the late 1970s, annualized bond returns were negative or close to 0%!

As you can see, besides the 1980s where bond yields were through the roof, the long term record for bonds is quite unimpressive.

Therefore, all of your long term capital preservation and growth will need to come via equities or equity-like investments (i.e. REITs, etc.).

So how does the cobra effect occur with bonds? Retirees, scared of losing principal, might shift all of their assets into CDs and Treasuries for “safety.”

For the first decade or so 100% in bonds works fine, but, as the retiree ages, the scourge of inflation and taxes slowly dwindle away their nest egg and the probability of running out of money starts to sky rocket.

The decision to provide safety has made the retiree less safe in the long run. Nick Murray puts it best in his book Simple Wealth, Inevitable Wealth:

You can have blissful emotional and financial security on this end of your remaining lifetime — right here, right now. We’ll get you some money market funds, a six-month CD, Treasury bills, and maybe some very high grade corporate bonds maturing in the next five years.

The number of currency units you’ve got will hardly fluctuate at all. You’ll get a little current income, and you will sleep like a baby. Of course, one day — and that day may not come for twenty years or more — you’ll run out of money. Perfect security on this end of your investing lifetime; total insecurity (indeed, disaster) on the other end.

He continues (emphasis his):

There is no such thing as no risk. There’s only this choice of what to risk, and when to risk it.

The risk of owning bonds shows up later in your investment life, while the risk of owning equities can show up much earlier. And why should we expect anything different?

As someone who wants to build and keep wealth, you should expect to go through a handful of periods where you might be down 40%+. This is the nature of investing.

If you don’t want the volatility, then you deserve the meager result you will surely obtain. In the case of a 100% bond portfolio, we could re-imagine a famous Benjamin Franklin quote:

Those who give up return for security deserve neither return nor security.

How To Use Bonds Effectively

For the record, I am not against holding bonds in a portfolio. I am just against holding 100% bonds, unless you have sufficient capital such that your returns don’t matter.

I also can’t tell you what % of your portfolio should be in bonds, as this would require me to know your goals, temperament, and individual circumstances. However, I can say with some level of certainty that bonds will not be a builder of wealth going forward.

Despite the bad rap I have given to bonds, I do think there are effective ways of using them.

For example, I currently hold ~20% of my net worth in bonds though I am only 27. Some might say that is stupid given the amount of time I have for equity compounding, but I hold bonds for 2 reasons:

- To dampen volatility during downturns.

- As a form of liquidity to rebalance back into stocks during these downturns.

Since investing is primarily a behavioral exercise, not an analytical one, bonds can act as a form of insurance against panicking when there is blood in the streets. The fact is that I don’t know how I will react during a 30%+ drawdown, since I haven’t experienced one yet.

Therefore, I am using my bonds as an experiment on myself to see how I will react when a larger drawdown does eventually occur. If I play it cool, I will likely reduce my bond exposure in the future.

The key is to know yourself as an investor. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 37. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data