In the year 1900, the United States had a high school graduation rate less than 10% and only half of all children aged 5-19 were enrolled in any form of schooling. Why was school enrollment so low and virtually unchanged since the 1850s? Most children were working. As Frederick Lewis Allen stated in The Big Change: America Transforms Itself 1900-1950:

Among the boys between the ages of ten and fifteen, no less than 26 percent—over a quarter—were “gainfully employed”; among girls in the same group, 10 percent were. Most of these children were doing farm work, but 284,000 of them were in mills, factories, etc., during years in which, in any satisfactorily arranged society, they would have been at school.

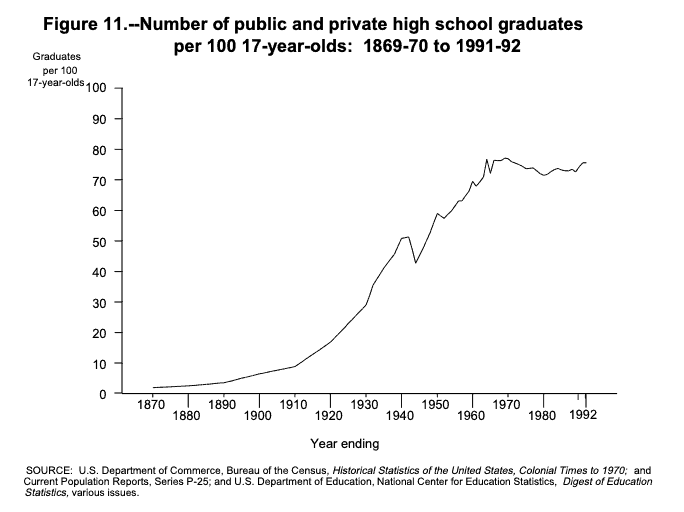

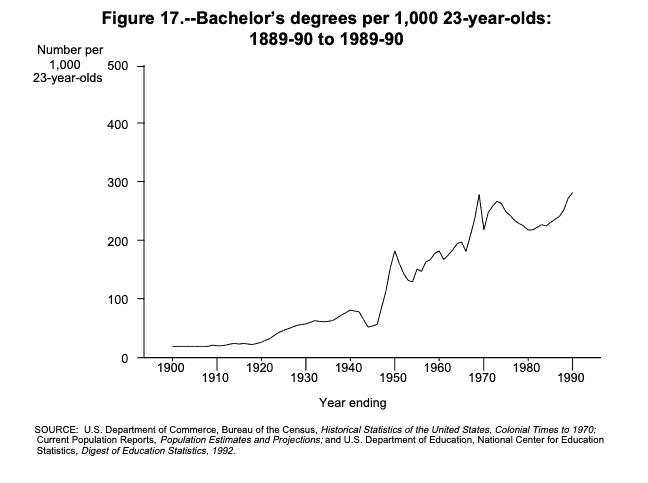

But, it was around the year 1900 that urbanization began to take hold of American society. Across the country, people were abandoning their farms, moving to the city, and putting their children in school. As illustrated by the National Center for Education Statistics in their 120 Years of American Education: A Statistical Portrait, high school graduation rates took off in the early 20th century: By 1940, the graduation rate had hit 50% and continued to increase in the postwar period. As the demand for technical jobs in society increased, the number of college graduates also went up nearly eightfold (chart from 120 Years of American Education):

By 1940, the graduation rate had hit 50% and continued to increase in the postwar period. As the demand for technical jobs in society increased, the number of college graduates also went up nearly eightfold (chart from 120 Years of American Education):

Once again fromThe Big Change:

Once again fromThe Big Change:

At the mid-century there are fewer and fewer people working with their hands, more and more people working at desks; fewer workers with brawn, more workers with brain; fewer whose jobs require only a limited education, more who need an advanced education.

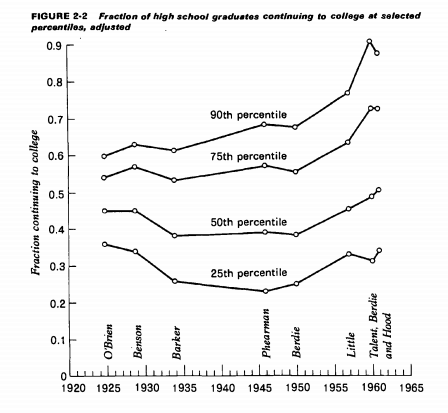

However, it wasn’t just that more jobs were requiring more education, but the individuals receiving these educations were increasingly the most cognitively gifted in society. In 1975, Paul Taberman and Terence Wales illustrated how individuals with higher cognitive ability (IQ) were more likely to go to college than individuals with lower cognitive ability. From their chapter titled “Mental Ability and Higher Educational Attainment in the Twentieth Century” we can see this relationship increasing over time:

The shift we see above occurred most dramatically at the uppermost part of the cognitive spectrum, especially within elite universities. As Charles Murray stated in The Bell Curve: Intelligence and Class Structure in American Life:

In fact, the mean SAT-Verbal score for the incoming freshman class [at Harvard in 1952] was 583, well above the national mean but nothing to brag about. Harvard men came from a range of ability that could be duplicated in the top half of many state universities.

In the fall of 1952, the mean SAT-Verbal score for incoming freshman at Harvard was at the 66th percentile. Today, the mean SAT-Verbal score (760) is at the 99th percentile. This change was the result of an American educational system that had become increasingly efficient at identifying the most gifted students in the country. The cognitive aristocracy was born.

With the creation of a cognitive upper class, the ramifications are starting to become more apparent everyday. The New York Times recently published an article on the separation of the U.S. labor force into two distinct groups. The first group is highly educated and highly compensated while the second group has less education and no clear path for career advancement.

Unfortunately, there are many individuals in the second group that should be in the first group. Noah Smith, a columnist at Bloomberg, recently highlighted how the education system fails to identify many talented students from poor and minority backgrounds. The proposed solution to this problem is more standardized testing for such students earlier in their educations.

While I do support the solution proposed by Smith, it is a solution that exacerbates the problem of the cognitive aristocracy. Testing will help identify those students with the most talent, but what will it do for those that struggle in school?

When I think about this problem my immediate reaction is probably similar to yours: we need to improve the education system. I agree with this wholeheartedly, but this solution will have its limits. If you believe the studies that cognitive ability is 60%-80% genetic, then even the best education system can only do so much. You can tell people to “learn to code”, but that doesn’t guarantee that it will work.

So, what should we do in a world where intelligence is becoming more and more important in the labor market?

What Beats Cognition?

A growing cognitive aristocracy is important for one reason, and one reason alone—income. If being smarter, on average, didn’t help you to have a higher income, then this post would be moot. So how do we improve the incomes of those who didn’t win the genetic lottery or never received a great education? We give them capital.

Of all the solutions I have heard to fix the growing divide between rich and poor, the idea that seems the most reasonable is a sovereign wealth fund (SWF). A sovereign wealth fund is a government-managed, globally-diversified portfolio of assets that periodically distributes income to all of its citizens. Every citizen owns one share of the fund (i.e. equal ownership) and no citizen can sell their share or acquire more shares. Norway has a SWF, Alaska has a SWF, and others are being tested out. I particularly like Matt Bruenig’s proposal of a Social Wealth Fund for America.

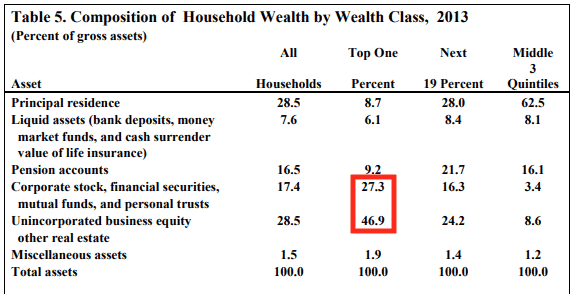

I like the idea of a SWF because it gives every American one thing that many of them have not had historically—asset ownership. If we look at the composition of household wealth between the top 1% and everyone else, the largest difference is the percentage ownership of financial securities and other business assets (table from this paper):

And since most of the income of the top 1% is derived from capital income (not labor income), you can see why increasing capital ownership for everyone else could be beneficial. I have doubts about the future growth of labor income for many Americans, but I have far less doubts about the future growth of capital income. So, what beats cognition? Capital. As Josh Brown once said, “Just own the damn robots.”

Lastly, how should we fund a SWF and what should it invest in? I don’t know, but sovereign wealth funds deserve a more thorough examination. If you are interested in reading more on this topic, check out Matt Bruenig’s SWF proposal and the The Bell Curve, where many of these ideas stem from. I don’t agree with everything in The Bell Curve, but the authors’ main points warrant further discussion. Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 111. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data