I was only 10 years old when the DotCom bubble was at its peak. Though I didn’t invest through that era, I feel like I finally understand it now. Not because I believe we are in a similar type of bubble today, but because I have now seen valuations that I cannot rationalize whatsoever. Let’s take a moment to review what I’m talking about.

Currently, we have an antiquated video game retailer (GME) being valued at $10 billion (nearly 10 times what it was worth at the start of the year). We have a literal joke internet coin (Dogecoin) that has a market cap of over $50 billion. And I just recently heard about a single deli in New Jersey (HWIN) that was recently valued at over $100 million. The deli had $35,000 in sales over the previous two years. Here’s a picture of the interior:

$100 million. You read that right.

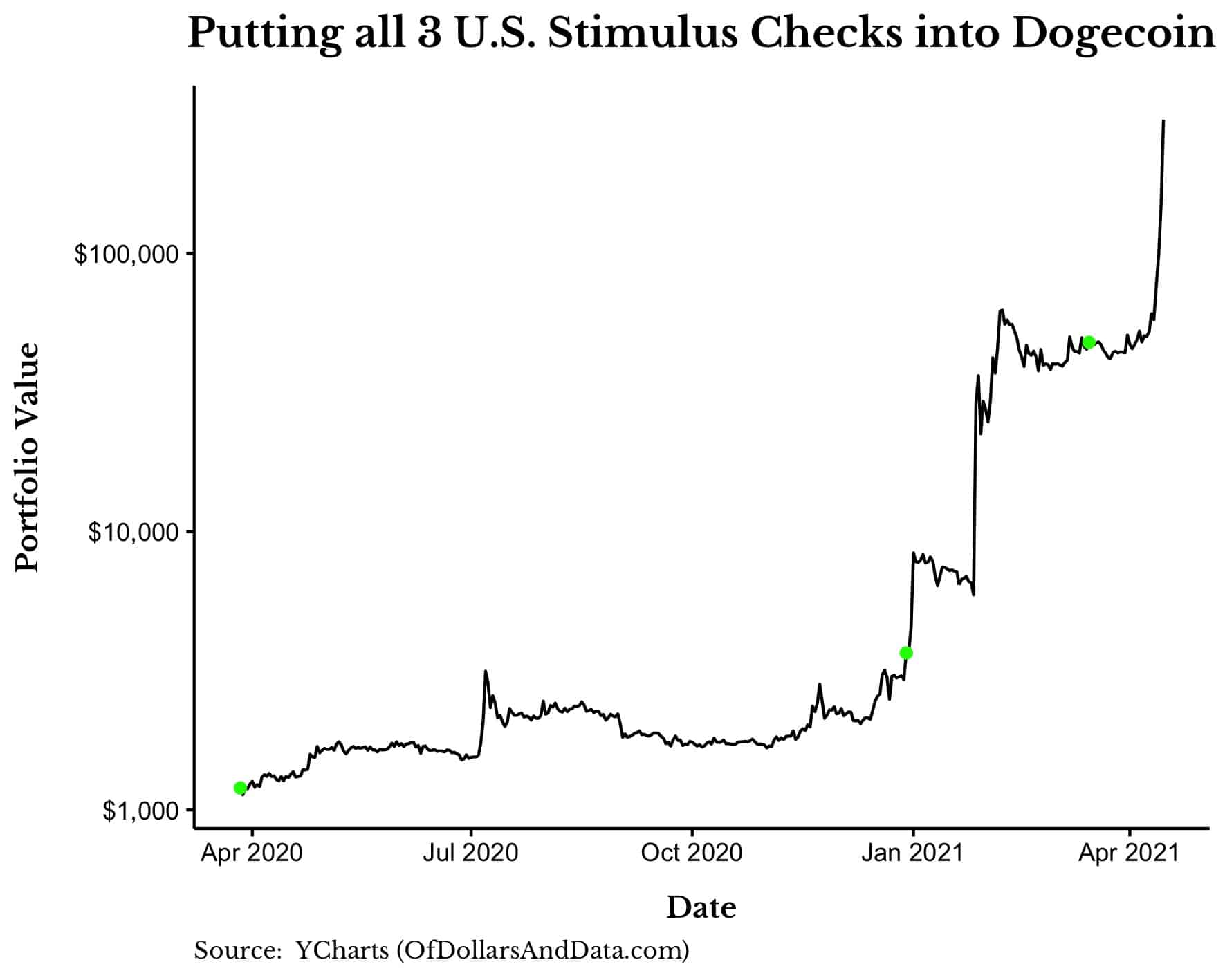

But this is just the tip of the investment iceberg. Because if you actually look at how much some of these assets have appreciated you will be shocked. For example, if you had put the three U.S. stimulus checks into Dogecoin around the time they were sent out, you would have over $300,000 now:

$3,200 in total contributions became $300,000, an over 90x return on your money. It’s the craziest market that I have ever seen.

I wish I could tell you that I understood why this is happening, but I can’t. Of course, I have theories. The U.S. stimulus is partially to blame, people trying to make a quick buck are partially to blame, and the absence of Trump from the national limelight also seems partially to blame. With such a vacuum in the entertainment space, YOLO investing has come to fill the void. This meme says it all:

In all seriousness, I really think there is something to this theory that this is all just for the entertainment value. It reminds me of what Seth Meyers, the comedian, said during the 2011 White House Correspondents dinner:

Donald Trump has been saying he will run for president as a Republican, which is surprising since I just assumed he was running as a joke.

Ironically for Seth, the “joke” became real. The same thing seems to be happening in parts of the investment world as well. The joke internet coin (Dogecoin) is now one of the top 5 largest cryptocurrencies by market cap. The joke video game retailer (Gamestop) is worth over $10 billion. The joke electric car manufacturer (Nikola) has a price-to-sales ratio near 10,000 and is still a multi-billion dollar company. I could go on, but you get my point. The joke as investment idea has arrived.

This is why this is the craziest market that I have ever seen. And, in some ways, it is even crazier than the DotCom bubble. Why? Because the logic behind today’s valuations is very different from the logic behind the valuations in the DotCom bubble. While valuations in 1999 were definitely excessive, investor could at least try to justify these valuations based on projected cashflows and the expected growth of the internet. And they were generally right on both counts. As famed venture capital Marc Andreessen stated in an interview with Barry Ritholtz (see 17:32):

The DotCom Crash hit in 2000 and all these ideas that were viewed as genius in 1998 were viewed as complete lunacy and idiocy in 2000. Pets.com being the classic example. So, it’s actually really striking. All of those ideas are working today. I cannot think of a single idea that isn’t working today. The kicker for the Pets.com story is that there is a company Chewy that just got bought for $3 billion.

Andreessen’s argument is that the DotCom investors weren’t wrong, just early. But what about today’s meme investors? What cashflows do they have to project (if any)? What is their thesis for why to buy Gamestop, Dogecoin, or that single deli in New Jersey? I have no idea.

While it can be tempting to call a top here, I know from market history that these kind of euphorias can last much longer than one might imagine. Will dogecoin (and many of these other assets) eventually crash? Almost certainly. But, will they go to zero when they do? I have no clue. Maybe the joke as investment idea is here to stay and we will see repeated cycles of boom and bust across different securities over the next few years. Or maybe the party will soon come to an end.

Either way, the only advice I can give is to stay the course. Remain focused on what truly matters and enjoy the craziness from a far. Yes, this won’t be easy to do. It’s never easy to see so many people making so much money with so little effort, but you have to fight this urge. And if you can’t, then take a very small percentage of your investable assets and play along. Just don’t get sucked in. Because, if you do, you may not make it out. As Charles Mackay said in Extraordinary Popular Delusions and the Madness of Crowds:

Men, it has been well said, think in herds. It will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.

Happy investing and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 238. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data