This week I want to talk about the U.S. housing crisis of 2007–2008. In particular, I want to tell you what it was like living in an area that experienced arguably the worst housing boom and bust in the United States. Though I try to keep my personal life out of this blog, what I experienced from 2002–2007 was the equivalent of the U.S. housing crisis on steroids, and I thought it would be interesting to share my story. With that being said, let’s begin:

The Brown Valley

It was September 2002 and I was sitting in the back of a Dodge Durango headed east through California’s Inland Empire. My siblings and I were traveling to a place called Moreno Valley to see the new home that our parents had purchased. For those of you that don’t know where Moreno Valley is, it is 60 miles east of Los Angeles, CA in the Riverside, CA metropolitan area.

As we exited the freeway we headed down a long road surrounded by empty brown fields and large stony hills. Years later these fields would all be filled with housing subdivisions, but I had no idea of that at the time. As we drove past the many empty dirt lots I vividly remember looking out the window and seeing my very first tumbleweed. I thought tumbleweeds were something you see in the middle of nowhere in a cartoon or movie, not anyplace I would ever live. I knew we were in the “boonies” and I was sure that our new home would be underwhelming. My skepticism about the new house was rooted in our unfortunate prior living situation, in which we had rented a condo that we later found out was infested with roaches.

We continued driving until we reached a subdivision atop a hill. “Via Del Lago” (Lake Street) it said. As we pulled up to the subdivision there was an iron gate blocking our entry. A gated community? I was shocked. I had never lived in a gated community and thought that maybe my parents had made a wrong turn somewhere. But I was wrong. I later discovered that most of the kids at my middle school thought I was rich because I lived in “The Gates”, as they called it. Unfortunately this could not be further from the truth.

As we pulled through the gates the first thing I noticed was that the houses were massive. Four car garages? Guest houses detached in the front? Was this real? I thought my mind was playing tricks on me. These were some of the nicest houses I had seen in my life. I couldn’t believe we would be living here. As we made a final turn and pulled up to our house I was in awe. What I had failed to notice inside the car was that many of these houses had 3 stories. Yes 3 stories! And so did ours.

I will never forget the feeling of touring that house for the first time. The huge vaulted ceiling when you walked in, the third floor, and the individual bedrooms for myself and each one my 3 siblings made this place more than perfect. It was unlike any home we had ever lived in before. The brown lots and tumbleweeds immediately faded from memory. This was our new home.

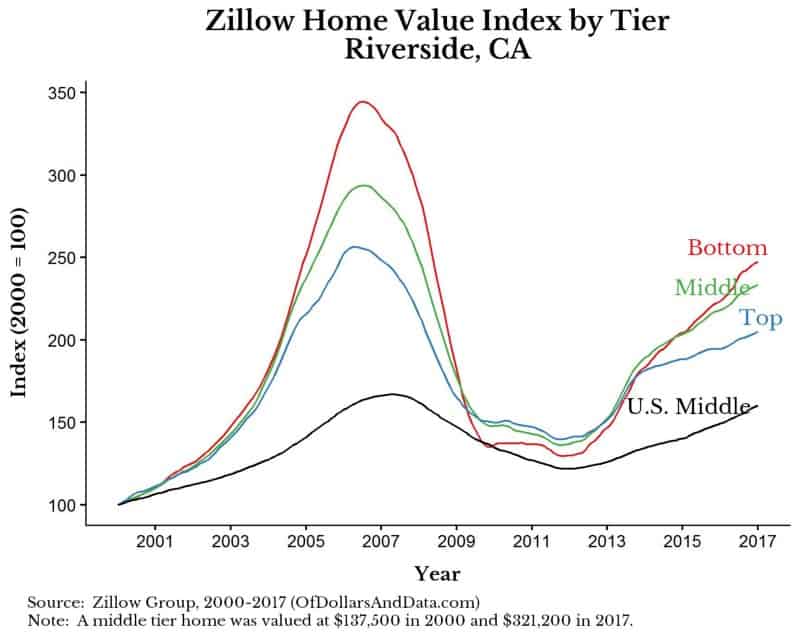

At the time of purchase in September 2002 the home was priced at ~$270,000, which was in the top third of prices for the Riverside metropolitan area.

Let The Good Times Roll

We moved in and everything was great. But, this was just the beginning. Over the next few years, as the housing market boomed, I noticed that things kept getting better for us and those around us. We bought a big screen TV, our neighbors got a nice boat, we bought a dune buggy, and the list goes on. As we started prospering those empty brown lots starting filling up with homes as well. Construction in the area was booming and Moreno Valley started looking less and less like Moreno Valley.

Despite all of the goodies, what I didn’t know at the time was that these were being paid for, in part, by the refinances on our home due to the increased equity value. The ironic part in all of this was that my stepfather was a real estate broker and my mom worked as loan processor for the now defunct Countrywide. They should have known better, right? Or maybe they shouldn’t have? I sometimes wonder if the housing mania blinded those closest to it. By the summer of 2006, near the peak, our home was valued at $575,000, which is more than double what it was purchased for. Though we were enjoying the boom, it wouldn’t last.

The Crash

As quickly as it started it was all over within a few years. I don’t know whether it was the refinancing or whether my parents got an ARM loan, but we could no longer afford the payment and had to leave. In December 2007 we lost the house and by the end of the housing crisis over 10 million Americans had lost their homes as well. I didn’t care much when we had to move as I had gotten into college and was ready for the next step in my life. More importantly, the house that once brought me so much joy just became another thing. This would be my first run on the hedonic treadmill.

My family ended up renting in another subdivision outside of “The Gates” and we went on with life. By this point, Moreno Valley was full of housing subdivisions and there were “foreclosure” or “for sale” signs on nearly every single block of these subdivisions. The boom had finally gone bust.

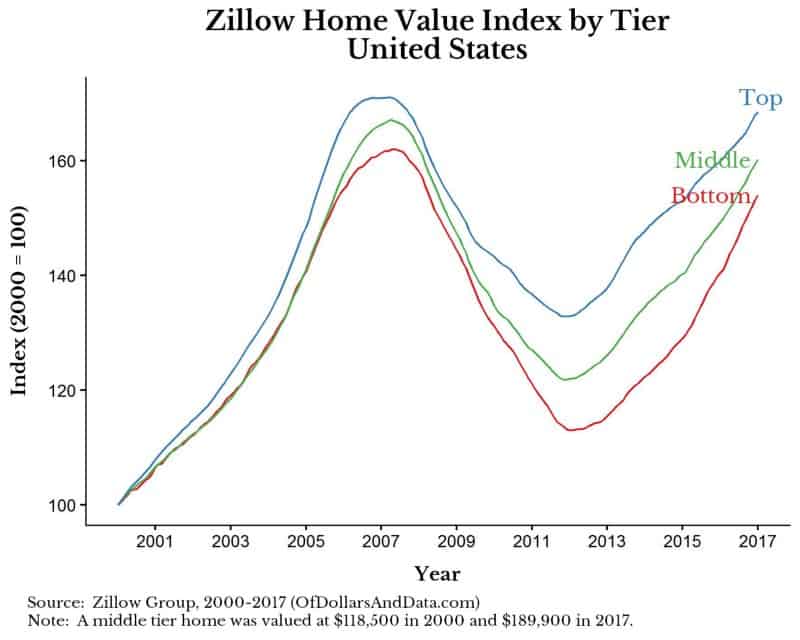

To give you some perspective, below is the Zillow Home Value Index for the U.S. broken out by housing tier. The “Top” tier is the top third of home prices, “Middle” is the middle third of home prices, and the “Bottom” is the bottom third:

And for comparison here is the same chart for Riverside, CA, the metropolitan area that contains Moreno Valley. Notice that the y-axis has changed! The U.S. “Middle” tier in the chart above is the same as the black line in the chart below:

As you can see, the housing price changes in the Riverside metropolitan area, were some of the worst in the nation (only Stockton, CA was worse). This was especially true for the cheaper “Bottom” tier housing. The funny part about this story is that most of my friends from Moreno Valley did not experience anything like this. Why? They were living in the same homes that they had lived in for their entire lives (they didn’t switch houses) and their parents didn’t do refinances on their homes.

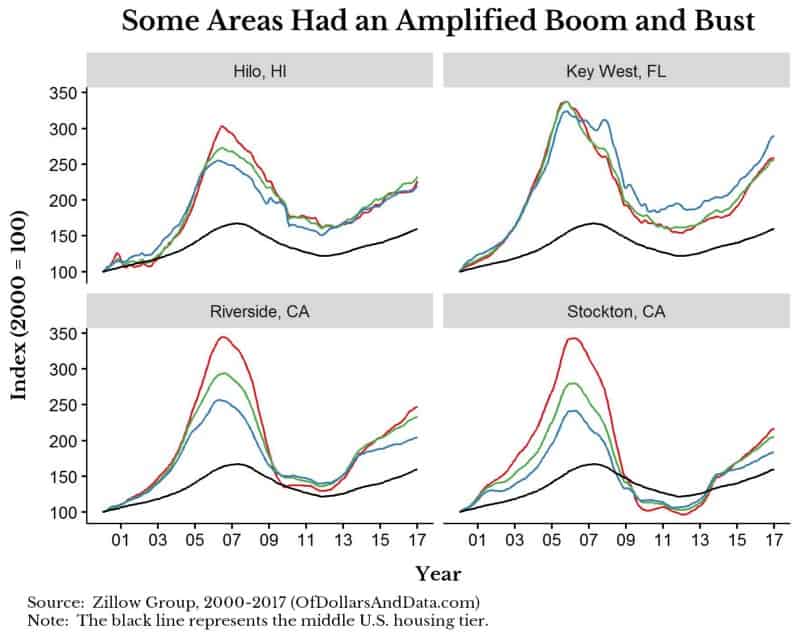

This highlights the fact that the United States housing market is diverse and not all areas experienced the housing bubble in the same way. For example, there were certain areas that saw an extraordinary boom and bust, like Moreno Valley (Note: the black line is the U.S. middle housing tier):

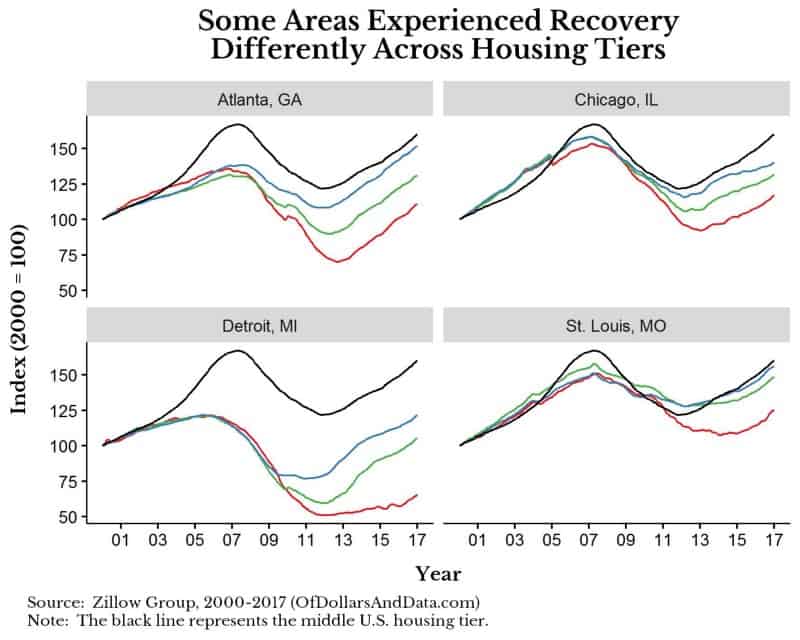

Some areas that saw a diverse range of outcomes across different classes of housing (i.e. cheaper homes fared worse than expensive homes):

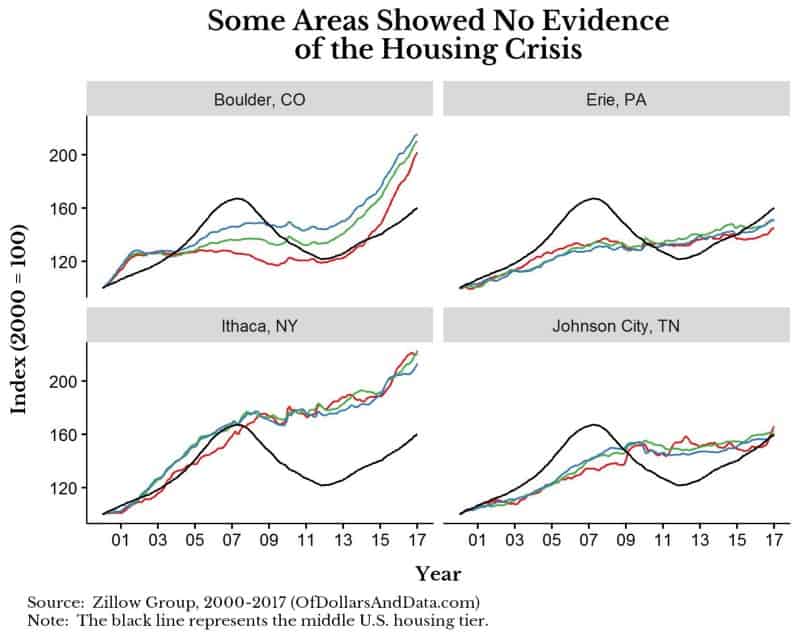

And some that showed no housing bubble whatsoever:

It is clear that though we all lived through the same housing bubble, our experiences varied greatly. This reminds me of the joke about a fighter with a broken nose, two black eyes, and his arm in a sling. When his friend says, “Your last fight must have been awful,” the fighter responds, “Yea? You should’ve seen the other guy.”

This brings me back to a point I have brought up in previous posts: you can’t just look at the average, the distribution matters too. For example, there is evidence that urban areas (and specifically higher priced homes) have done much better than their rural counterparts in recent years. If you are interested at looking at more pricing data from Zillow for a specific metropolitan area, I highly recommend using this interactive tool by the Economist.

Responsibility and Housing

With the story above, it begs the question of who is responsible for the housing crisis? It is easy to place blame looking backward, but I am not sure if it is that simple. What if Silicon Valley is currently in a housing bubble? Are the people who buy expensive homes there acting foolishly? I don’t think so. But if it crashes, we will say otherwise. We judge the past based on the present.

More importantly, think about the incentives during the housing crisis. What parents don’t want a good life for their children? After living in a bad situation, would you possibly sign a contract you didn’t fully understand to try and provide your family with a better living experience? Everyone wants to live the American dream. And when society is telling you that you can live the American dream, wouldn’t you start to believe it too?

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 15. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data