The Medallion Fund, managed by Renaissance Technologies, is one of the most successful and mysterious hedge funds in the world. Founded in 1988 by mathematician Jim Simons, the Medallion Fund has produced impressive returns for its investors and has become synonymous with the idea of using mathematical models and algorithms to trade in financial markets.

Despite its success, the fund remains shrouded in secrecy, with little known about the inner workings of its investment strategy. In this blog post, we’ll review the history of the Medallion Fund, examine its outstanding returns, and explore the investment strategies that made it the greatest money-making machine of all time.

The History of the Medallion Fund

Before Jim Simons was running a multibillion-dollar hedge fund, he was the head of the mathematics department at Stony Brook University in Long Island, New York. It was there that he attracted some of the top mathematicians to work alongside him at the university.

However, Simons’ ambitions went beyond mathematics. In 1978 he left academia to found a trading firm which eventually became Renaissance Technologies. Simons filled his firm with brilliant mathematicians, many of whom were former colleagues.

One of these former colleagues in particular, James Ax, was instrumental in getting the firm off the ground. After trading in futures markets for the firm for a few years, Ax and Simons launched the Medallion Fund in 1988. The fund was named after the prestigious awards both had received in mathematics.

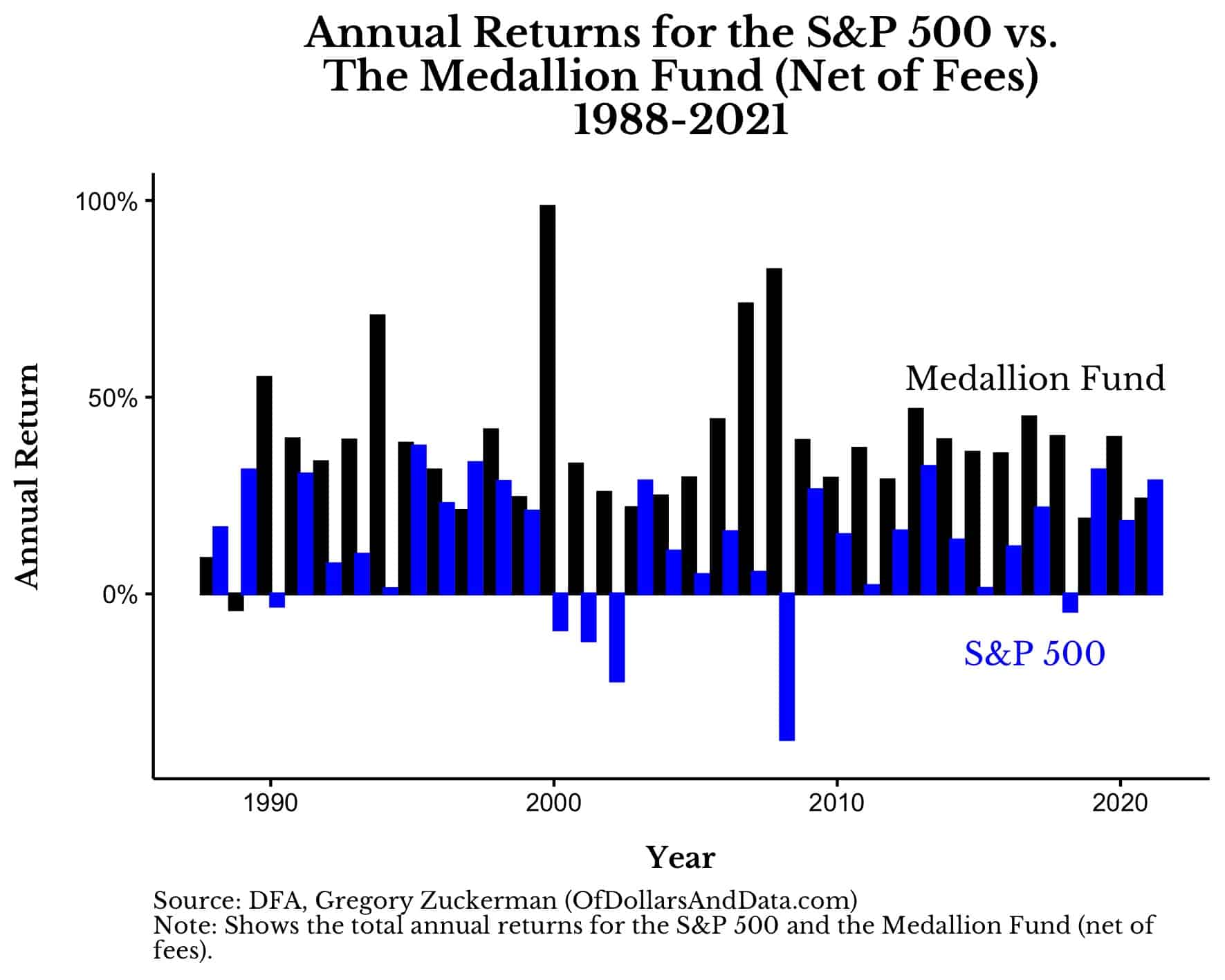

However, the early years of Medallion weren’t easy. In its first year (1988) the fund only returned 9% (net of fees) while the S&P 500 was up over 16%, and in its second year the fund suffered a 4% loss while S&P 500 was up over 30%. Tensions mounted internally and Ax was bought out of the firm in 1989.

Following this, Simons had Elwyn Berlekamp, a prominent game theorist, re-design the firm’s trading system from the ground up in order to get it back to profitability. It worked. In 1990, the Medallion Fund returned 55% net of fees.

However, as the fund became more successful, Simons became more obsessed with making it even better. He called Berlekamp constantly with different ideas on how to increase the fund’s returns. He would call about gold prices. He would call about one futures market or another. The calls seemed never ending. Under constant pestering from Simons, Berlekamp quit.

Following Berlekamp’s departure Simons reportedly told a friend, “The hell with it, I’m going to run it myself.” Simons did just that.

Over the next few years, he hired the elite mathematical talent that would take the Medallion Fund to new heights. The rest, as they say, is history. In 1994, Medallion generated a return over 70% (net of fees) and in 2000 it generated its highest return ever of 98.5%!

Now that we have covered the history of the Medallion Fund, let’s look at just how exceptional the Medallion Fund’s returns have been over time.

What Were the Medallion Fund’s Returns?

Renaissance’s flagship Medallion Fund generated 62% annualized returns (before fees) and 37% annualized returns (net of fees) from 1988-2021.

To put this performance in perspective, $1 invested in the Medallion Fund from 1988-2021 would have grown to almost $42,000 (net of fees) while $1 invested in the S&P 500 would have only grown to $40 over the same time period. Even a $1 investment in Warren Buffett’s Berkshire Hathaway would have only grown to $152 during this time.

This means that the Medallion Fund outperformed one of the best asset classes of the last few decades by 1,000x and one of the best investors of all time by 250x!

What Fees Did the Medallion Fund Charge?

While hedge funds are famously known for charging 2 and 20 (2% annual management fee and a 20% performance fee), Simons and his team generated arguably the greatest track record in investment history while charging 5 and 44.

This fee structure may not sound much higher than 2 and 20, but it is worlds away.

For example, if we assume that Simons used the 5% management fee to cover the costs of running the fund (i.e. data, computing, etc.) and was only able to re-invest the money earned from the 44% performance fee, within less than a decade the Medallion Fund would have had more money than its original investors.

So if you gave them $1 million to manage in 1988, by the end of 1997 you would have $15.8 million, however, Simons would have $15.9 million even though he started with $0.

What About the Medallion Fund’s Annual Returns?

As impressive as their performance was, comparing the Medallion Fund’s annual returns (net of fees) to the S&P 500 takes their accomplishment to another level:

Since inception, the Medallion Fund has only lost money in a single year net of fees (1989). More importantly though, the fund’s returns have been partially negatively correlated with the market (correlation = -0.41).

For example, in 2008 when the S&P 500 lost 37%, the Medallion Fund posted a gain of 82% net of fees!

How Did the Medallion Fund Make Money?

What’s even more intriguing about the Medallion Fund’s historic run is that the people who produced it knew next to nothing about business and individual companies.

As Greg Zuckerman highlighted, when co-CEO Robert Mercer was asked how the firm made so much money with its models he responded:

Sometimes it tells us to buy Chrysler, sometimes it tells us to sell.

Unbeknownst to Mercer, Chrysler had been acquired by Daimler AG in years prior and no longer existed as a stock!

This funny anecdote illustrates just how reliant the Medallion Fund was on its quantitative models as opposed to underlying business fundamentals. As Zuckerman noted:

Early on, Simons made a decision to dig through mountains of data, employ advanced mathematics, and develop cutting-edge computer models, while others were still relying on intuition, instinct, and old-fashioned research for their predictions. Simons inspired a revolution that has since swept the investing world.

So, how does the Medallion Fund make money? It finds individual patterns in data and exploits each pattern just enough to turn a small profit. And when you add up all of those small profits, you end up making a lot of money.

What is the Highest Fee the Medallion Fund Could Have Charged?

When you combine its raw performance, its negative correlation with the market, and the agnosticism of its operators toward understanding actual businesses, the Medallion Fund has created a unique track record that is unlikely to be surpassed within our lifetimes.

With such a monumental achievement, I started to wonder: how much was this performance worth? Though Renaissance historically charged a 5% management fee and a 44% performance fee, what is the most they could have charged and still beaten the market over this time period?

If it were 1988 and Jim Simons presented you with the opportunity to invest in the Medallion Fund, what is the largest annual management fee (no performance fee) you would be willing to pay? 10%? 20%? 30%? 40%? Let’s assume that you know with certainty the fund’s future returns.

I asked my Twitter followers this question and 38% voted that they would willingly pay a 40% annual management fee to invest in the Medallion Fund starting in 1988.

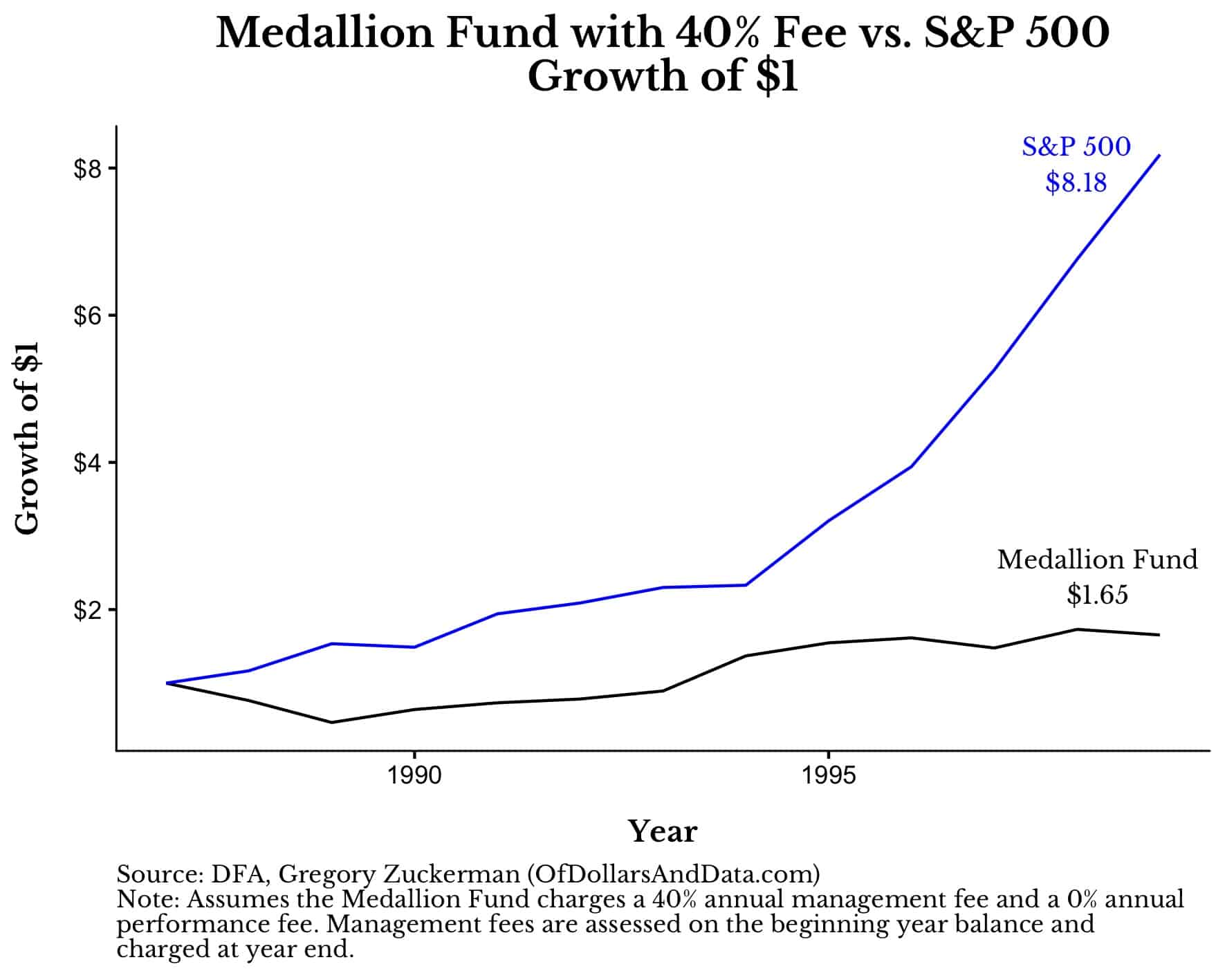

To test FinTwit’s intuition, I re-ran the Medallion Fund’s returns assuming it charged a 40% management fee annually and compared the performance to the S&P 500 for the first 12 years of the fund:

With a 40% management fee, the S&P 500 would have outperformed the Medallion Fund by 4x by the end of 1999.

After seeing this, would you stick with Medallion? It’s a tough question to answer. Yes, you know that Medallion will do well going forward, but maybe 40% is too steep of a fee to pay for this performance. So what’s it going to be? Are you in or out?

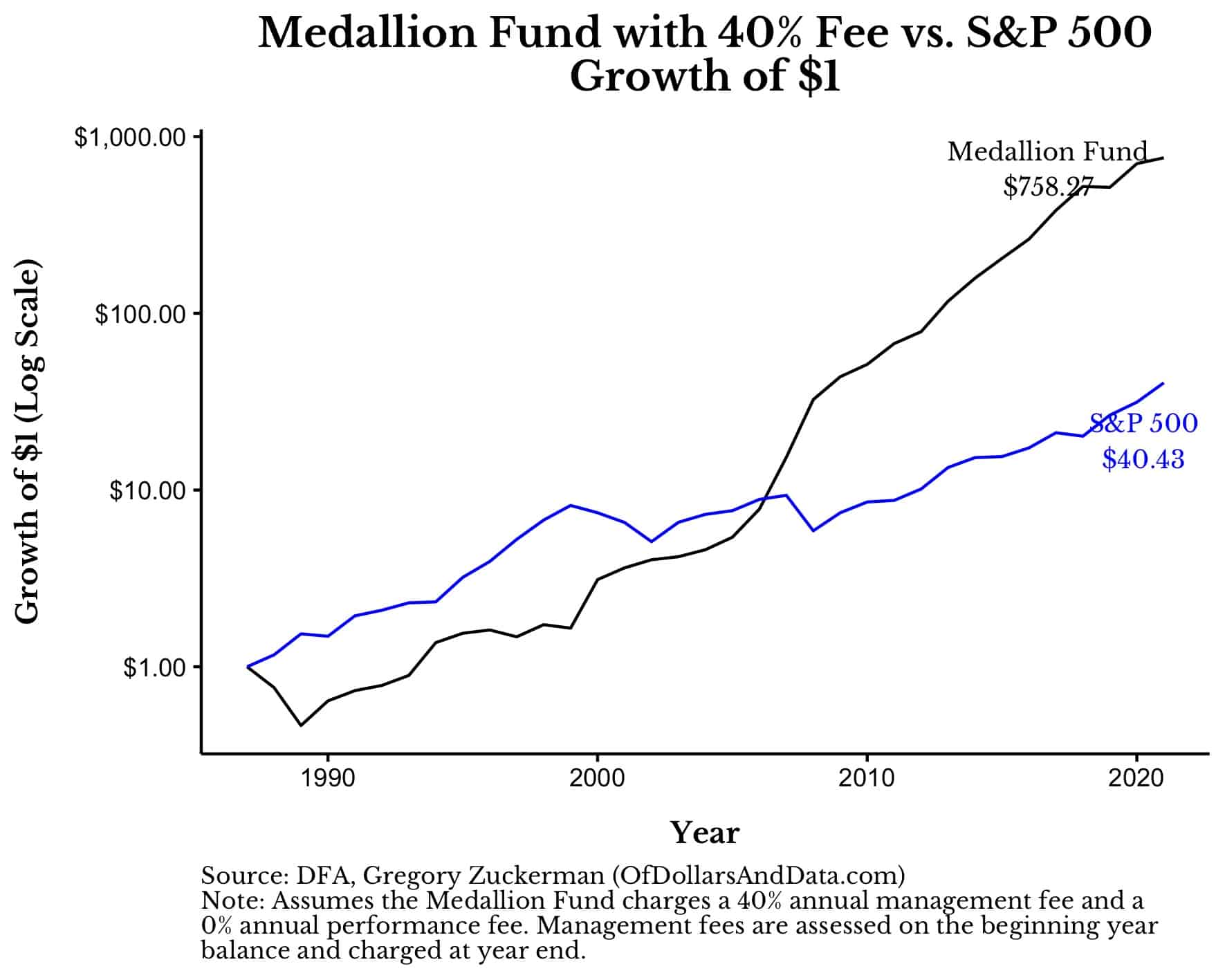

If you decided to bail on the Medallion Fund, I’m sorry, but you made the wrong choice (Note that the y-axis is a log scale):

Though the Medallion Fund underperforms in the early years, by the end of 2021 it would go on to trounce the S&P 500 by over 18x. As I have demonstrated, paying 40% annually to the Medallion Fund would have been worth it all along (FinTwit’s intuition was correct).

In fact, the Medallion Fund could have charged a maximum annual management fee of 49% and still beaten the S&P 500 through the end of 2021!

Yes, I understand the ridiculousness of this thought experiment. No investor in their right mind would ever be willing to give up half of their capital annually in fees.

However, that’s the point! Only through absurdity can we understand just how outlandish Renaissance Technologies’ results really were.

How Can You Invest in the Medallion Fund?

Lastly, you may be wondering how you can invest in the Medallion Fund. The bad news is that you can’t. The Medallion Fund has been closed to outside investors since 1993. At this point, all the fund’s profits and underlying capital are owned by Jim Simons and other Renaissance Technologies employees. Until the next Medallion Fund comes along, you and I can only dream…

There’s More to Life Than Money

Despite my endless gloating over the triumphs of the quantitatively-focused Medallion Fund, there is a very human element to Simons’ story. It’s easy for us to look at his track record and think that Simons must be one of the most fortunate guys in the world.

However, there are some things that go beyond investing, algorithms, and money.

In 1996 Simons lost one of his three sons to a biking accident. Seven years later, another one of his sons drowned while abroad in Bali. Simons could have studied every piece of data and known the odds of every possible event, but what could have prepared him for this?

Even the man who solved the markets was not immune from tragedy.

And though I don’t know Simons, I am willing to bet that he would give it all up to have his two sons in his life today. Think about that.

The man who had the most magnificent investing track record of the modern era would gladly be lifted out of the history books if he could have his boys back. If that doesn’t tell you something about the value of money, then I don’t know what will.

If you are interested in learning more about Simons and Renaissance Technologies, I highly recommend reading The Man Who Solved the Market along with this video interview with the book’s author Greg Zuckerman.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 151. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data