In March 2007, Elizabeth Warren gave a talk on “The Coming Collapse of the Middle Class.” Warren presented research on the changing income and expense structure of the American family and why this new structure was financially riskier than in prior decades.

Despite all the anecdotes, data, and charts, it was something that Warren said about bankruptcy that stuck with me the most (emphasis mine):

There are more children in America that live in homes that will file for bankruptcy this year than live in homes that will file for divorce…So let me say that to you in a different way. Do you know anybody that got divorced in the last 6 or 7 years? Then, statistically speaking, you know more who went bankrupt. Why do you think you don’t know more that went bankrupt? Because you can’t hide divorce, but you can sure hide bankruptcy.

As I thought more about this shocking statistic, I wondered what other financial topics people hid from their closest friends and family. To find out more, I asked users on Twitter to share the money stories that they couldn’t discuss publicly.

I got DMs that addressed issues ranging from the mildly annoying (i.e. why do men have to buy such expensive engagement rings?) to things far more personal.

One advisor told me a story about the time they were having a one-on-one with the grandson of a billionaire when the grandson told them, “I won’t view myself as being successful unless I, independently of family connections, make a billion.”

The advisor said that this was a common problem in ultra-high net worth (UHNW) families, who make risky investment decisions in hopes of solidifying their own independent fortunes.

I had another advisor reach out and tell me about the difficulty of discussing the cost of fertility treatments with middle-aged couples who wanted children. They stated:

So let’s start on the low end, freezing sperm and eggs. That’s roughly $500/year (sperm) – $10,000 (eggs). Then, if you want to try fertility treatments, it can be $5,000-$10,000 per treatment. If you have multiple treatments and iterations? Some couples spend $50,000 on pregnancy, most of which is not going to be covered by insurance.

If you think talking about money is hard, imagine trying to discuss this and your client’s impending decline in fertility.

There was the man who recounted how his business partner’s tax problems with the IRS almost cost him his advisory business. The IRS threatened to send a letter to all of his clients unless they got a monthly payment to pay off the partner’s tax liabilities.

Long story short, the man was able to create a new company and move over his clients while ending the relationship with his deadbeat business partner. Morale of the story: Run a credit check on someone before you start a company with them.

Another common theme in the messages I received was how difficult it was to deal with money and family. One advisor, who was managing his parents’ money, found it hard to get his parents to agree to the same spending plan.

Another advisor confessed that he had so much difficulty trying to make financial decisions with his wife that he had to hire an outside financial planner to make the process easier.

All of these issues, and more, get at a bigger question: Why is it so hard to talk about money?

Ramp Capital discussed this in a post where he highlighted how little he knew about the financial situations of his family and friends. I received a DM from a female attorney who said that her colleagues were far more open about their sex lives than their pocketbooks. So, why is money so taboo?

Money is hard to talk about because it is easily equated with status. The human brain wasn’t meant to keep track of the complex social environment we live in today, so we take shortcuts to make it easier to understand the world and how we fit in it.

In Social: Why Our Brains Are Wired to Connect, Matthew D. Lieberman explains this well when discussing the difficulty chimpanzees encounter when inferring status as their social group gets larger:

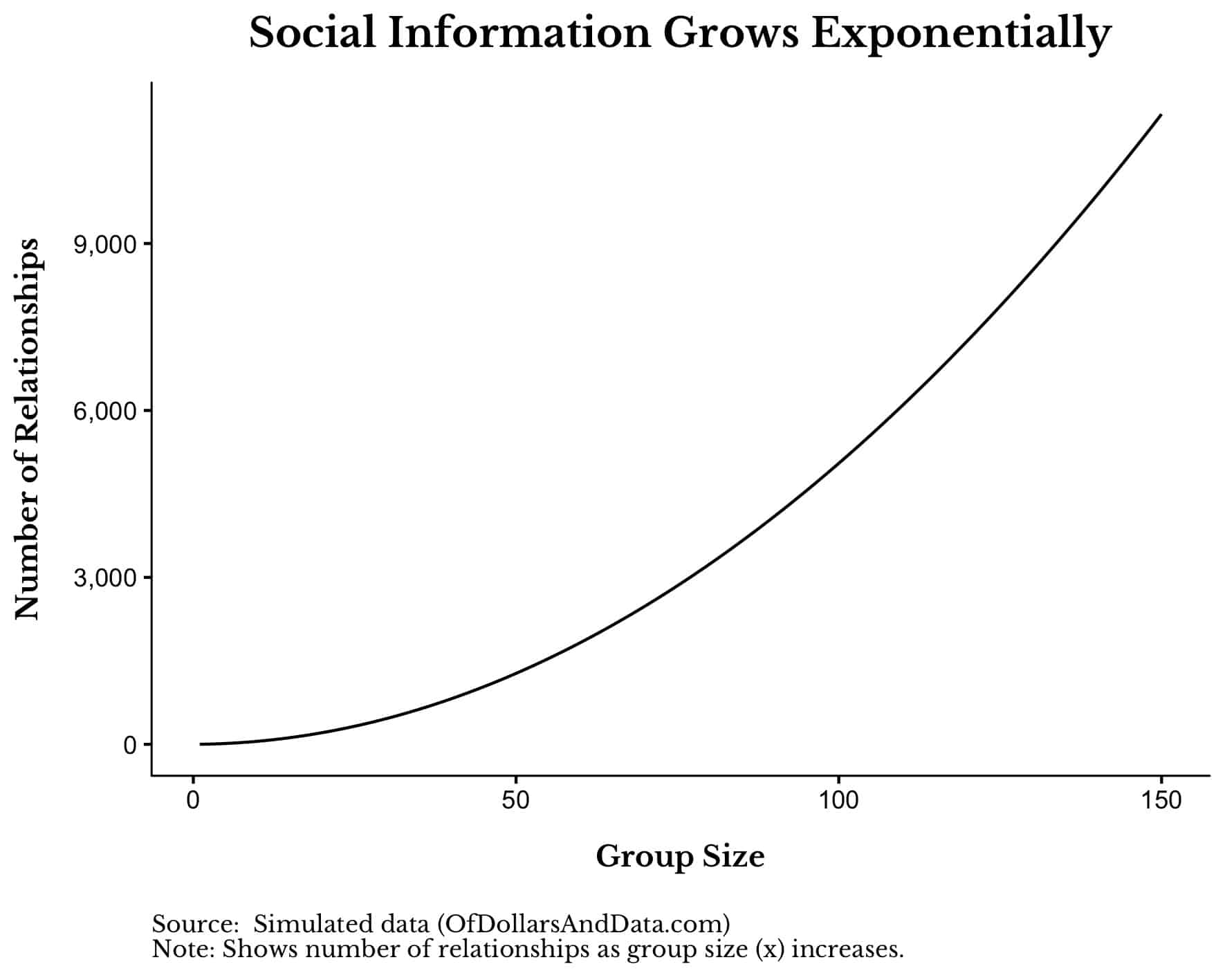

They need to keep track of everyone’s status relative to themselves, but they also need to know the status of each chimpanzee relative to the others. If there are just 5 chimps in a group, each chimp needs to keep track of the social dynamics of 10 chimp-to-chimp relationships, or dyads. A group of 15 requires keeping track of 100 chimp-to-chimp relationships to be fully informed. Triple the group size to 45, and now there are 1,000 dyadic relationships.

This concept is governed by a simple formula, but can be more easily understood visually:

This is why money is a useful, though flawed, tool for inferring status. With the tens of thousands of people you will interact with over your lifetime and the thousands more you will see online, there is no way that you, or any other human, could keep track of the status of all of these people.

So what do we do? We use things like attractiveness, fame, and money, among other things, as simple heuristics to infer status.

Talking about money is so difficult because it is inherently discussing a person’s place in the dominance hierarchy, and people, rich and poor alike don’t like discussing this. Well, they don’t like discussing it explicitly.

People do seem to be okay with implicit “discussions” of money via status signaling. For example, tell people you are wealthy and they will despise you, but drive a fancy car, wear a nice watch, etc., and they will sign up for your seminar.

If you still don’t think that money is a form of status signaling, just consider what Adam Smith (pseudonym) wrote in The Money Game:

The irony is that this is a money game and money is the way we keep score. But the real object of the Game is not money, but it is the playing of the Game itself. For the true players, you could take all the trophies away and substitute plastic beads or whale’s teeth; as long as there is a way to keep score, they will play.

Watch What They Do, Not What They Say

Before you start shouting that “Money isn’t status” or “Net worth isn’t self worth,” let me say that I agree with you. We should never treat people differently based on the number of commas in their bank account.

If you polled most people, they would likely agree with this statement. However, do you think that those same people would treat a homeless man the same as a rich man? I think not.

It’s not what people say, but how they act that ultimately matters. This concept, known as revealed preferences, exemplifies how people use money as a proxy for status though they probably wouldn’t admit this if asked.

While I wish we lived in a world where we could be more open about our financial struggles, there is some money that we just don’t talk about. Thank you to Preston McSwain and Ramp Capital for inspiring this post (follow them!), and thank you for reading.

If you liked this post, consider signing up for my newsletter.

This is post 119. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data