Though you have probably never heard of Wally Jay, he is considered one of the greatest judo instructors of all time. Despite never once competing in judo (only in jiujitsu), Jay consistently produced champions in judo and other martial arts.

One of Jay’s key insights was that not everyone learned like he did:

The biggest mistake is for an instructor to teach exactly the way he was taught. Once a teacher said to me, “All of my boys fight like me.” Then when we got on the mat, not one of his students could beat one of mine.

Not one. So I told him that he had to individualize his instruction.

This lesson seems to be lost on many financial commentators/bloggers who provide personal finance advice based on their own experiences, which are typically outside the norm. The exceptions become the rule and then personal finance becomes a bit too…personal.

I am reminded of the words of Richard Hamming:

Please remember that what made you great is not appropriate for the next generation.

One prime example of this comes from one of the finance bloggers that got me into this scene, The Financial Samurai (aka Sam). Sam has done a lot of great work, but there are times when he applies his personal experience far too stringently when giving advice to others.

The best example of this is his post titled “The First Million Might Be the Easiest: How to Become a Millionaire by Age 30”.

In this post Sam breaks down his journey to $1 million by age 28.

If you don’t have time to read the whole thing, the summary comes down to: have one incredible lucky trade in the Dot Com bubble (make 50x), earn a boat load of money in finance, and live a relatively frugal lifestyle.

And for his age, Sam was making a “boat load” of money. Between the ages of 24 and 25, Sam increased his net worth from $260,000 to $400,000 by saving 70% of his after-tax income.

Even if we assume 10% of the gain in his net worth was asset appreciation (despite a falling stock market), this means that he earned something like $160,000 in after-tax income as a 25 year old.

It’s not an unbelievable sum, but easily puts him in the top 1% of income earners for his age.

So, how do you become a millionaire by age 30? Make a ton of money and don’t spend most of it. Shocking, right?

The issue is that this advice just isn’t an option for basically everyone. And I am not talking about the 61% of Americans that couldn’t cover a $1,000 emergency expense directly from their savings.

Even for people like me, who were born with lots of advantages and also received a great education, it would have been anything but “easy” to earn this much so quickly.

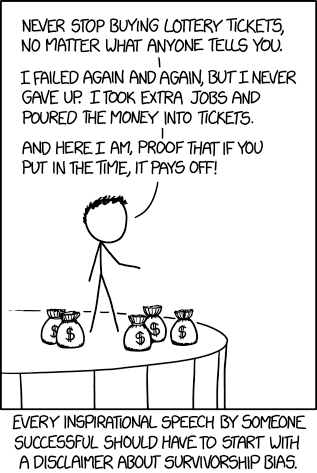

The trouble with Sam’s advice is that it is based on his atypical/outlier experience, but he doesn’t present it that way. It reminds me of this brilliant comic from XKCD:

Just like the news never interviews the people that didn’t win the lottery, we rarely hear from the people who followed a particular set of financial advice and never got rich. This is known as survivorship bias and it has infected our industry like the plague.

They say that, “history is written by the victors,” well so is most of the financial advice.

Now, of course, it is probably better to listen to a self-made rich person than a self-made poor person when it comes to financial matters. However, this doesn’t imply that the rich person understands how they got rich.

It’s easy to come up with a story for how you earned your wealth after you earned it. It’s like shooting an arrow and then painting the bullseye.

What’s hard is finding a person who creates a system (and publicly documents it) while they are poor and then uses that system to get rich.

Of course, even this person could have gotten lucky, but we could at least try to test this.

This concept, known as the post hoc fallacy, explains how individuals come up with causal explanations for their success though these explanations may be inaccurate. A passage from More Money Than God summarizes it well:

The lesson is that genius does not always understand itself—a lesson, incidentally, that is not confined to finance. “Out of all the research that we’ve done with the top tennis players, we haven’t found a single player who is consistent in knowing and explaining exactly what he does,” the legendary tennis coach Vic Braden once complained. “They give different answers at different times, or they have answers that simply are not meaningful.”

So the next time a finance guru claims that they got rich because of X or Y or Z, remember that the full story is usually more complex than that.

The Real Secret to Getting Rich

Last year an article triggered most of the internet by claiming that you should have 2x your annual salary saved by the age of 35. I was fortunate enough to have saved 2x my salary by the age of 27. Why haven’t I written about my “secret”?

Because the “secret” is the thing in personal finance that no one wants to talk about: it’s easy to save money when you have a high income.

Genius revelation, right? Call the Nobel committee for me. Tell them its pronounced “Ma-Julie.”

In all seriousness, you can talk about cutting expenses all you want, but it’s income that builds wealth. So when I hear a blogger say they saved 70% of their after-tax income and then I find out they made easily over $200k, their “sacrifice” is a bit hollow.

Yes, there are people who make $200k+ at age 25 and blow it all, but I can tell you that it’s not that hard to save when you make a lot and have few liabilities.

How do I know? Because I was easily able to save 40% of my after-tax income without ever creating a budget. I never analyzed what I was spending because I didn’t need to.

Yet, I traveled to 15 countries, dined at expensive restaurants weekly, and lived in an apartment in one of the nicest areas of San Francisco. Where was the sacrifice? There wasn’t any.

And I am supposed to tell you how to get wealthy? LOL. Earn a high income and just keep buying. Great advice, right?

Unfortunately, the sad truth is that most Americans will NEVER be able to do this. They will never earn enough money to invest and get rich.

Remember that 54% of U.S. households don’t own any stocks and 69% of working Americans save 10% of their income or less (with 21% of working Americans saving nothing at all).

This is why the personal finance industry loves the “cut your lattes and get rich” style of advice. They love it because it opens a new door in a world where the other door (high income) is closed for most people.

It makes the dream seem attainable. But it’s all bullshit.

How do I know? Because, as my colleague Ben pointed out, to get rich by “cutting lattes” you need to earn 12% annual returns! This is ~3% above historical averages (when compounded). Math. Simple math shows it’s a fantasy.

My only solace is knowing that your life satisfaction doesn’t depend on your finances beyond a certain point. As I have said before, “It’s not about the money.” Then again, why would you listen to me for financial advice? I’m one of the victors.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 121. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data