On the first day of ceramics class the teacher announced that the students would be split into two groups. One group would be graded on the quantity of the work they produced while the other group would be graded on the quality of the work they produced. The “quantity” group had to create as many clay pots as possible over the next few months while the “quality” group had to produce a single clay pot as best they could.

Months later as the students turned in their pots to be graded, the teacher came to a surprising realization — all of the highest quality pots were produced by students in the “quantity” group. In Art & Fear: Observations on the Perils (and Rewards) of Art Making, the teacher theorized why:

It seems that while the “quantity” group was busily churning out piles of work — and learning from their mistakes — the “quality” group had sat theorizing about perfection, and in the end had little more to show for their efforts than grandiose theories and a pile of dead clay.

When it comes to accomplishing a particular goal, the process matters.

I tell this story because I recently wrote a piece on value investing and wanted to invest some money in the space. Without knowing any better, I thought I could just buy the Russell 1000 Value Index and call it a day. It won’t really matter which value investing product I buy, right?

Wrong. Wrong. Wrong.

After doing more research, I realized how much process mattered when it came to selecting which value stocks to invest in. To illustrate this, I used Alpha Architect’s Active Share Visualization Tool to compare a few value ETFs and how differently they are constructed.

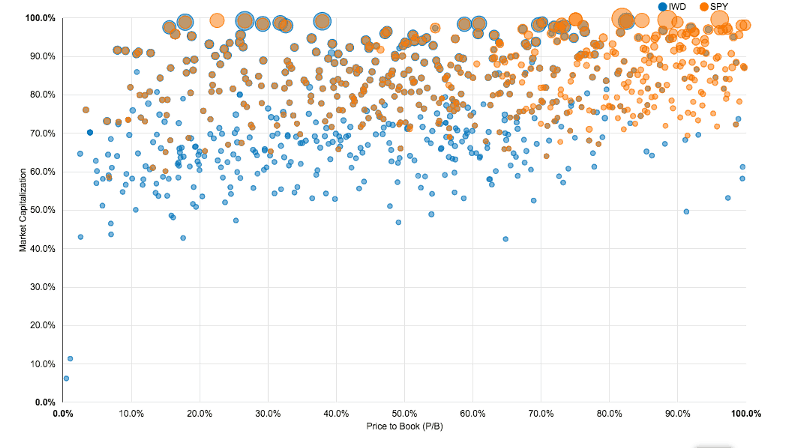

To start, let’s look at how the iShares Russell 1000 Value Index (IWD) differs from the S&P 500 (SPY) when we look at company size (market capitalization) on the y-axis and cheapness (price-to-book) on the x-axis. Note that IWD is in blue and SPY is in orange and the size of each bubble represents its share in that particular index:

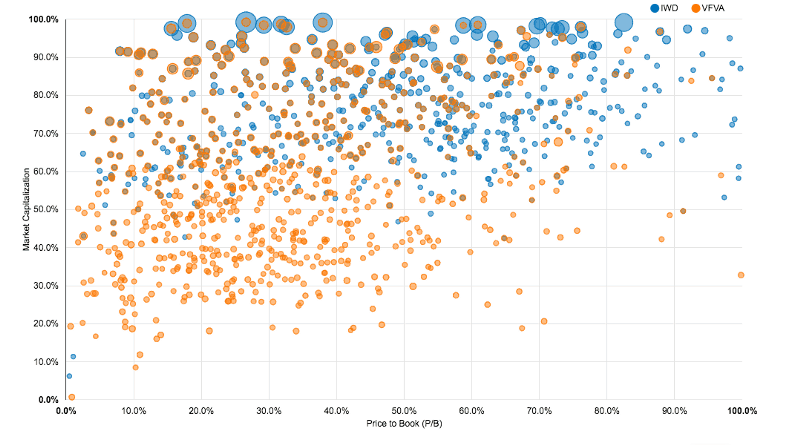

As you can see, IWD has many smaller, cheaper stocks when compared to SPY. However, if we go further down the rabbit hole, we can start comparing IWD to actively managed products that take a rules-based approach to selecting value stocks. One such example is Vanguard’s U.S. Value Factor ETF (VFVA) which I have compared to IWD below:

As you can see, VFVA (in orange) tilts even more toward smaller, cheaper companies when compared to IWD (in blue). Vanguard uses a quantitative screen along with other rules in their stock selection process. However, Vanguard’s fund is still invested in a large number of securities. There are other asset managers, such as Alpha Architect and O’Shaughnessy Asset Management, that hold more concentrated portfolios of value stocks and use completely different selection processes.

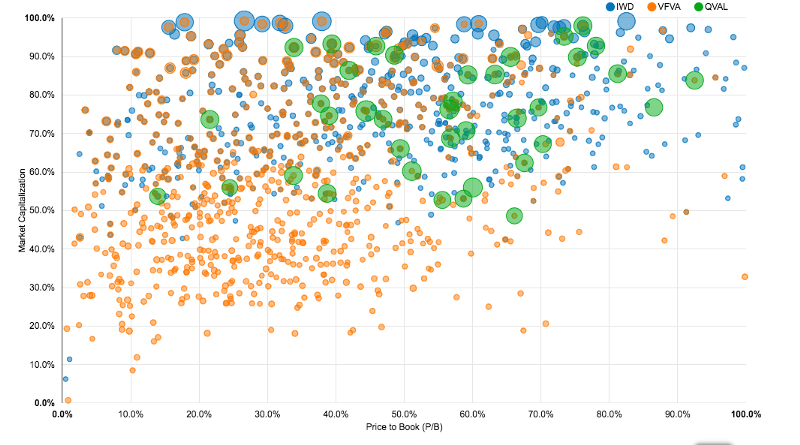

To see this in action, I have plotted Alpha Architect’s Quantitative Value Fund (QVAL) in green against IWD and VFVA from the previous chart (Disclaimer: I own a small position in QVAL):

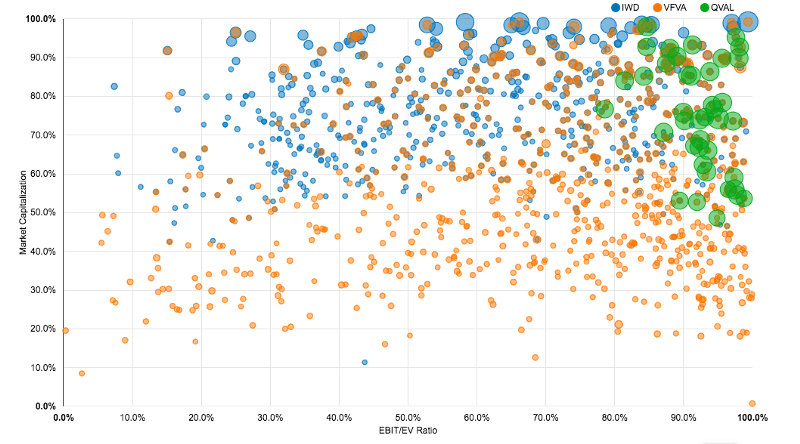

As you can see, QVAL only has 41 holdings compared to VFVA’s 783. But, QVAL doesn’t seem too value oriented on this measure. However, if we use a valuation measure other than price-to-book, the story changes. Below is the same plot as above, but the x-axis is Earnings Before Interest and Taxes over Enterprise Value (EBIT/EV):

Now it seems clear that QVAL is using a particular valuation measure (EBIT/EV) that VFVA was not using when selecting value stocks. Nevertheless, all of this begs the question:

Which one of these products is value investing?

The answer is: all of them! In fact, there are over 55 ETFs with “Value” in their name and even more mutual funds that are value oriented. While it is tempting to throw all of these products under the same label of “value investing”, you can’t commoditize them. Some are passive. Some are active. Some are more concentrated. Some are less concentrated. And I could go on. The point is that they are all different because the process they use to select their stocks is different.

Lastly, my goal here isn’t to pitch a particular kind of value product or value investing generally, but to emphasize that you should understand what investment products you buy. I have no clue which value stock selection process is better or worse, but I do understand that those products that are different from their benchmarks are more likely to outperform (or underperform) that benchmark. This is called having high “active share” and is what an active manager should be compensated for when making stock picks. However, even if you understand the process, this is just the beginning…

When Value Isn’t Value

With everything I have discussed above regarding process and value investing, this is just the tip of the iceberg. Travis Fairchild at O’Shaughnessy Asset Management recently wrote an incredible piece that illustrates how many companies systematically understate their book value, making them seem more expensive (based on price-to-book) than they actually are. His term for these stocks (“veiled value”) demonstrates how even value indices may not include all the true value stocks.

Think about how eye-opening this result is! There are value stock indices out there that are excluding “veiled value” stocks because they focus on price-to-book (P/B) as their main selection criteria. His research suggests that you need to utilize additional valuation measures (or adjust book values) before making value stock selections.

And Travis isn’t the first to challenge traditional valuation measures. Cliff Asness has discussed how the devil is in the details when it comes to the value factor, and Corey Hoffstein has also tackled this topic. Either way, all of these individuals have emphasized how much the process matters when it comes to creating an investment product. With that being said, I wish you all the best in your future investment selection endeavors and thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 70. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data