The racial wealth gap has long been an issue in the American economic landscape, shining a light on the intersection of wealth inequality and race relations within the United States. Fortunately, newly released data from the Federal Reserve suggests something hopeful—the racial wealth gap is shrinking.

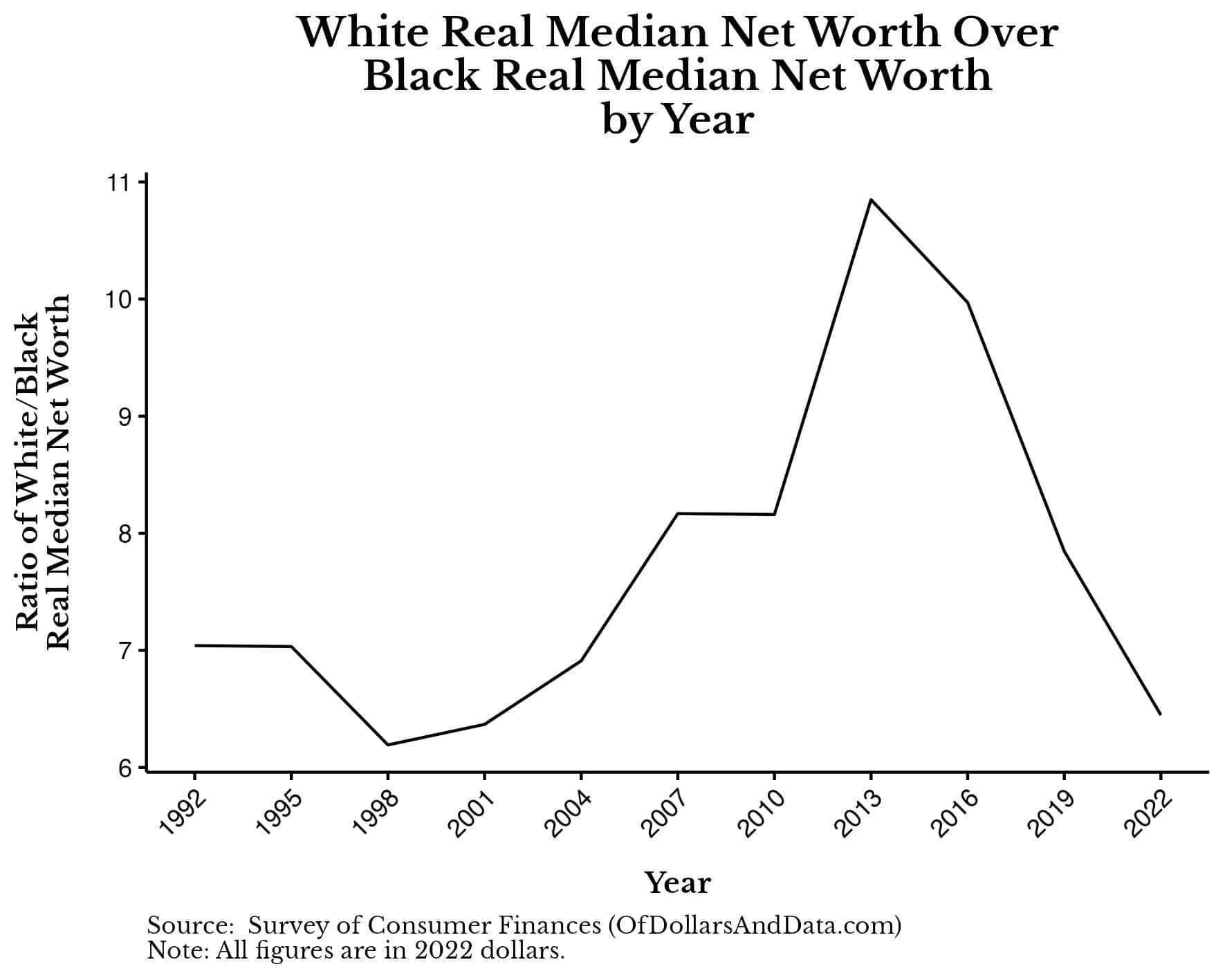

According to the Survey of Consumer Finances, from 2019 to 2022 the ratio of White median wealth to Black median wealth fell from a factor of 8 to a factor of 6.5. This means that the typical White household only had 6.5x as much wealth as the typical Black household in 2022, compared to 8x more in 2019. This is a positive sign that the wealth gap is shrinking.

Unfortunately, when we turn these ratios into actual dollar amounts, problems arise. The inflation-adjusted median net worth of White households increased from $219,000 in 2019 to $284,000 in 2022 (+$65,000). However, the inflation-adjusted median net worth of Black households only increased $28,000 in 2019 to $44,000 in 2022 (+$16,000). So, while the gap is shrinking, the inflation-adjusted dollar differences are getting larger.

The juxtaposition of the shrinking gap alongside increasing absolute differences raises a bigger question: What is the cause of the racial wealth gap and what might help to shrink it?

In this post, I’ll look to answer this question by using newly released data from the Federal Reserve.

A Very Brief History of the Racial Wealth Gap

Before we can look into what is causing the racial wealth gap, we should know a bit about its history. Thankfully, Ellora Derenoncourt and other researchers at the National Bureau of Economic Research published a paper that quantified the racial wealth gap going all the way back to 1860. Their paper states:

From a starting point of nearly 60 to 1 [in 1860], the white-to-Black per capita wealth ratio fell to 10 to 1 by 1920, and to 7 to 1 by the 1950s. 70 years later the wealth gap remains at a similar magnitude of 6 to 1.

This decline in the racial wealth gap corresponds with major social victories for Black Americans throughout U.S. history. For example, following the ratification of the 13th Amendment, which officially ended slavery in 1865, Black wealth exploded as more Black Americans were able to earn income and own property. Then, as many Black Americans migrated out of the southern United States to elsewhere in the country (via The Great Migration), the wealth gap continued to decline.

Unfortunately, this is where things started to stall. Though Black Americans made social strides with the Civil Rights Movement of the 1960s, the racial wealth gap has remained more or less unchanged. The most recent data on wealth and race (from the Federal Reserve) confirms this as well.

We can see this if we look at the chart below showing the median White over median Black inflation-adjusted net worth going back to 1992:

As you can see, while this gap has fluctuated over the years, it seems to get stuck at a ratio of 6-7, as Derenoncourt and her colleagues noted. The persistence of the racial wealth gap begs the question: what factors are at play in maintaining this gap?

One common explanation is the difference in educational attainment between Black and White Americans. But can this explain the racial wealth gap? Let’s find out.

Does Education Explain the Gap?

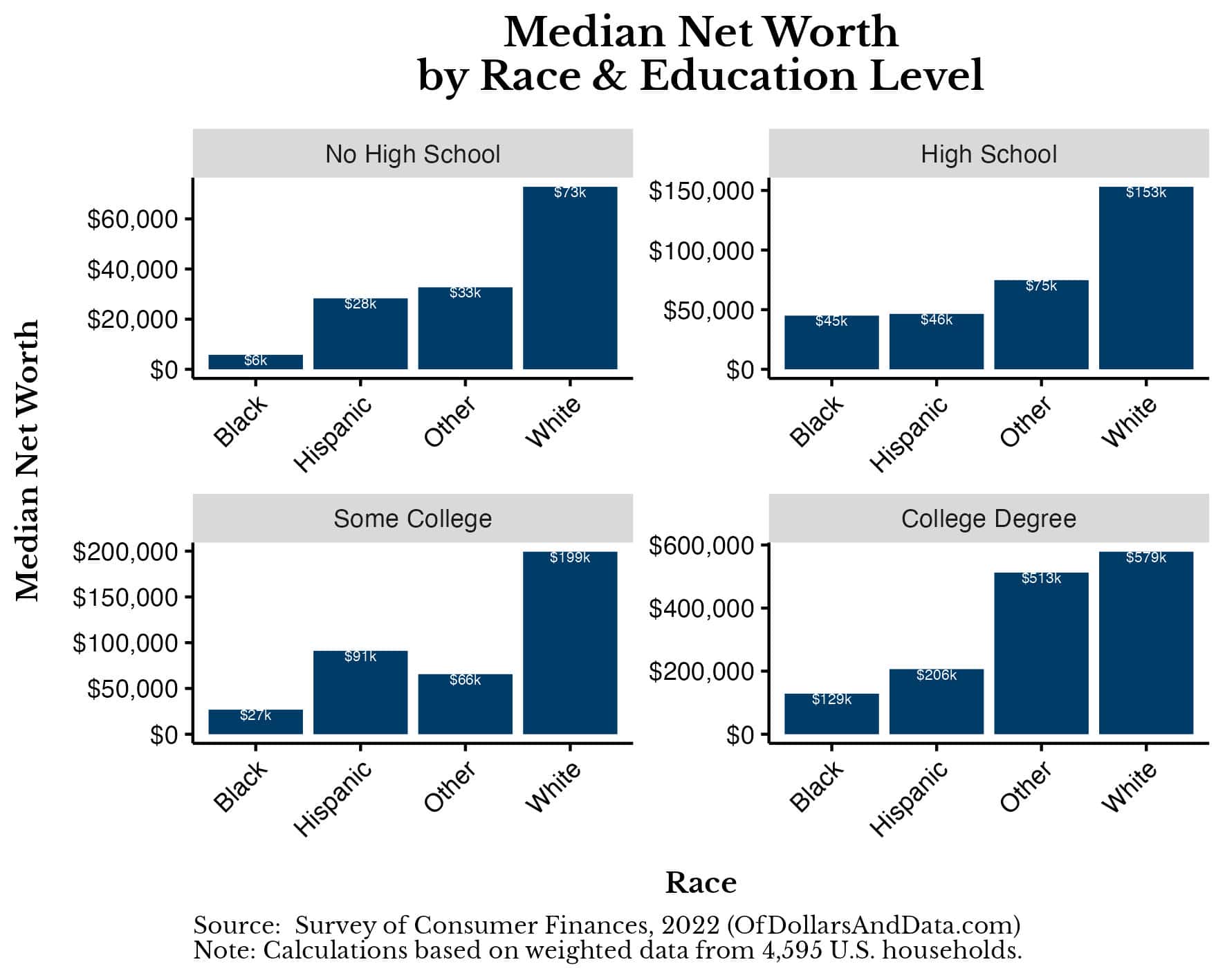

It’s often said that education is the great equalizer—a way to provide the same opportunities to everyone regardless of their identity. Given the historical context of the racial wealth gap, it’s tempting to wonder if education could be the solution to this problem.

Unfortunately, while the data does suggests that education helps to reduce the racial wealth gap, it doesn’t close it completely. In fact, based on the most recent 2022 data, the median Black household with a college degree has a net worth slightly below the median White household with a high school diploma.

As you can see, the typical Black household with a college degree has a net worth of $129,000 while the typical White household with a high school diploma has a net worth of around $153,000. This is a major improvement over 2019 where the median Black household with a college degree had similar net worth to the median White household without a high school diploma (~$84,000).

As you can see, the typical Black household with a college degree has a net worth of $129,000 while the typical White household with a high school diploma has a net worth of around $153,000. This is a major improvement over 2019 where the median Black household with a college degree had similar net worth to the median White household without a high school diploma (~$84,000).

Nevertheless, when comparing the median net worth of White households with a college degree vs. Black households with a college degree, the racial wealth gap is 4.5x (a bit smaller than the overall racial wealth gap of 6.5x). So while education does reduce the racial wealth gap, it doesn’t fully explain it away.

This suggests that focusing solely on educational initiatives, while important, won’t be enough to close the wealth gap, at least not initially. As a result, other factors, such as income must also be addressed.

Does Income Explain the Gap?

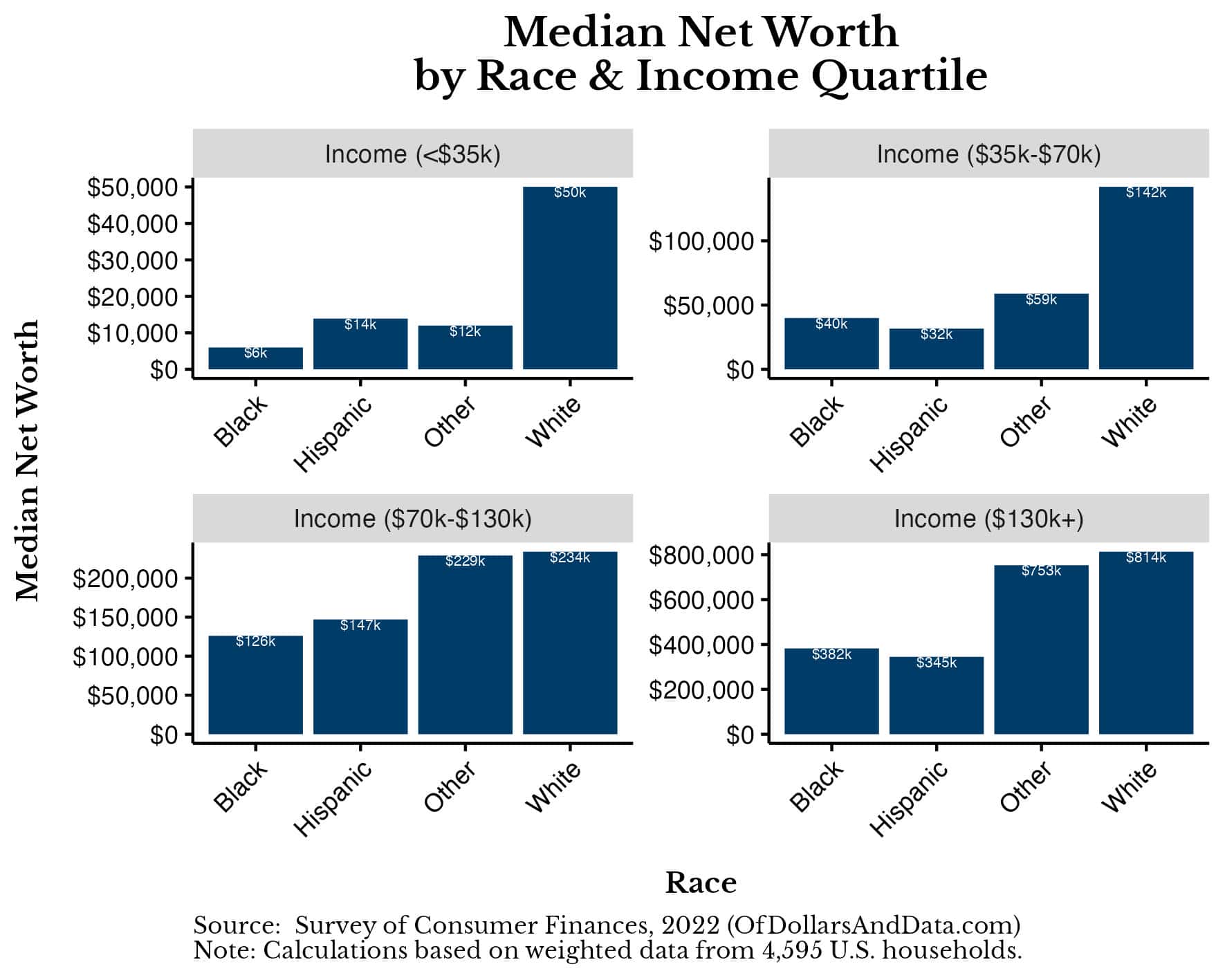

In the prior section, we tried to adjust for the racial wealth gap by controlling for the education level of a household. However, we don’t really care about the education level of households, but how that education level impacts a household’s income. Therefore, it makes more sense to adjust for income directly by comparing households within the same income brackets.

To do this, I segmented U.S. households into four income quartiles (based on the 2022 SCF data): <$35,000, $35,000 to $70,000, $70,000 to $130,000, and $130,000+. This means that roughly 25% of U.S. households earn <$35,000, 25% earn $35,000 to $70,000, and so forth. These quartiles serve as a rough approximation of the income distribution in America and help us understand how wealth accumulation varies across different levels of income.

After bucketing household income in this way and then looking at the median net worth by race, the wealth gap closes considerably more:

When looking at those households earning $70k-$130k or $130k+, the median net worth of White households is now only 2x-3x more than the median net worth of Black households. This is a great improvement over the racial wealth gap among households with a college degree (4.5x) and it’s a far cry from the overall racial wealth gap (6.5x).

While higher incomes do help to reduce the racial wealth gap, unfortunately, they don’t eliminate it. And while the gap is narrower at the higher income levels, it’s crucial to remember that a 2x-3x disparity in net worth still translates to substantial differences in quality of life, from homeownership opportunities to retirement and beyond.

But even if households with similar incomes still exhibit a racial wealth gap, what else could be causing it?

What Else Can Explain the Racial Wealth Gap?

When it comes to understanding wealth accumulation and how it varies across groups, there are only two factors that can create long-term differences:

- The flow of wealth: How much wealth you accumulate over time.

- The stock of wealth: How much wealth you start with.

And since we already tried controlling for the flow of wealth by controlling for income, any additional gap in wealth must be from differences in the initial stock of wealth. In other words, what remains of the racial wealth gap after controlling for education and income can likely be explained by differences in starting wealth (i.e. familial/generational wealth).

Researchers at the Federal Reserve Bank of Cleveland came to a similar conclusion when they studied the racial wealth gap as well. After analyzing prior studies that looked at the gap, the researchers stated:

Because the relationships between observable characteristics and wealth are estimated over short periods of time in those studies, they are likely underestimating the importance of initial conditions and income disparities for future wealth.

And guess what? The SCF data supports this as well.

So far we have broken out net worth by race, education, and income, but we haven’t looked at anything that involves time’s impact on wealth accumulation. Unfortunately, we don’t have the ability to follow each of the households in the SCF data over time, but we do have the age of each household.

So what if we try to compare young White households to similarly situated young Black households and then see how these households compare to older, similarly situated versions of themselves? The idea is to control for similar levels of starting wealth between Black and White households and see if it is predictive of future wealth.

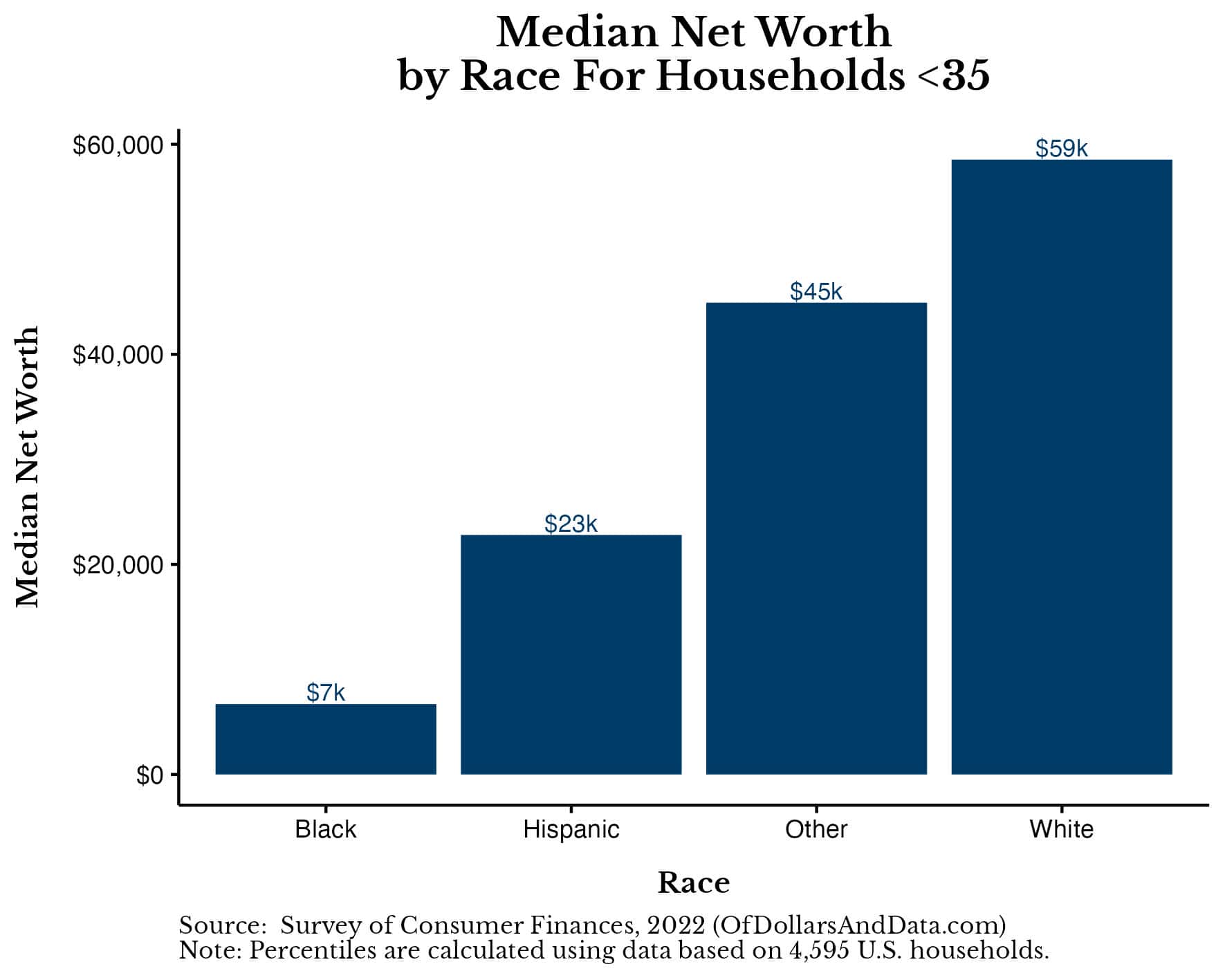

To begin, let’s look at the median net worth of all U.S. households under age 35 by race in 2022:

As you can see, Black households under 35 have a median net worth of $7,000 compared to $59,000 for their White counterparts.

If you wanted to find a Black household under 35 with a net worth around $59,000, you couldn’t use the median Black household under 35. Instead, you’d have to use the Black household at the 82nd percentile, or in the top 18% of Black households under 35, which would have a net worth of $64,000 (similar to the median White household’s net worth of $59,000).

Okay, now here is where the magic happens. Imagine these households (the median White and the 82nd percentile Black) in the future when they are 55-64 and on the verge of retirement. If we assume that they stayed in the same wealth percentile their whole life, the question is: how much wealth would they have at 55-64?

Of course, we can’t actually follow these households into the future, but we do have net worth data for the median White and 82nd percentile Black households aged 55-64 today. And this data shows that the median net worth of a White household aged 55-64 is $460,000 while the 82nd percentile net worth of a Black household 55-64 is $465,000.

$460,000 vs. $465,000!

We “closed” the racial wealth gap because we controlled for starting wealth.

This is important because it suggests that the racial wealth gap we see today has a lot to do with differences in starting conditions. So even if every American child had access to the same educational opportunities, because of differences in starting wealth between Black households and White households, the racial wealth gap would persist.

The analogy I like to think of is two cars traveling down the freeway. Even if we get the Black car to go the same speed as the White car, if the White car is 6.5 miles ahead of the Black car, the Black car will never catch it.

This is the issue at the heart of the racial wealth gap and there is no simple or easy solution. Even if the U.S. could pass reparations, which remain politically unpopular, there is no guarantee that this would be a long-term solution to the racial wealth gap.

After all, it’s not just the money that makes households better off, but the underlying factors that allowed them to accumulate that money in the first place. It may not be the wealth that matters, but what that wealth represents—higher income, better financial habits, a stronger network, etc. This is why direct cash transfers won’t necessarily solve the racial wealth gap in the long run.

Regardless, this thought experiment of adjusting for initial wealth misses the point. Because the actual wealth gap between a typical Black household and a typical White household stands at 6.5x today. We shouldn’t have to adjust for education or income to explain it away. This, in itself, is defeat.

Instead, we should ask ourselves why there is a massive gap in education and income between Black households and White households in the first place. Only then can we come up with ways to fix it.

The Bottom Line

We’ve examined the complexities of the racial wealth gap through the lens of education, income, and even initial wealth. From this analysis we determined that the gap isn’t just about what you earn or what you achieve, but also where you start from. And while the racial wealth gap has declined over the past three years, serious disparities remain.

All of this raises a bigger question of which policies we should consider to help reduce the racial wealth gap in the future. Should we expand educational opportunities? Do we need Universal Basic Income? What about reparations?

I don’t have the answers to these questions, but they are the questions that policymakers, economists, and activists should be actively thinking about. More importantly, they are the questions that we should be asking ourselves as a society that values fairness and the equality of opportunity.

In the end, reducing the racial wealth gap is about more than just numbers and charts. It’s about our values and how we define success and equality in our society. The gap didn’t emerge overnight and it won’t disappear overnight either.

Thank you for reading!

If you liked this post, consider signing up for my newsletter.

This is post 370. Any code I have related to this post can be found here with the same numbering: https://github.com/nmaggiulli/of-dollars-and-data